[ad_1]

Bitcoin, BTC/USD, Ethereum, ETH/USD – Outlook:

- Bitcoin rally fizzles forward of a significant hurdle.

- ETH/USD falters at key resistance.

- What’s the outlook and what are the important thing ranges to look at?

Advisable by Manish Jaradi

Get Your Free Introduction To Cryptocurrency Buying and selling

BITCOIN: Lacks upward momentum

Bitcoin’s lack of ability to retest a significant ceiling on the end-August excessive of 28150 underscores the broader weak spot – BTC/USD simply doesn’t have sufficient upward momentum required to embark on a significant uptrend. Consequently, the Bitcoin rally final week proved to be short-lived. See the earlier replace that highlighted the opportunity of a rebound “Have Bitcoin & Ethereum Capitulated? BTC/USD & ETH/USD Value Setups,” printed September 18.

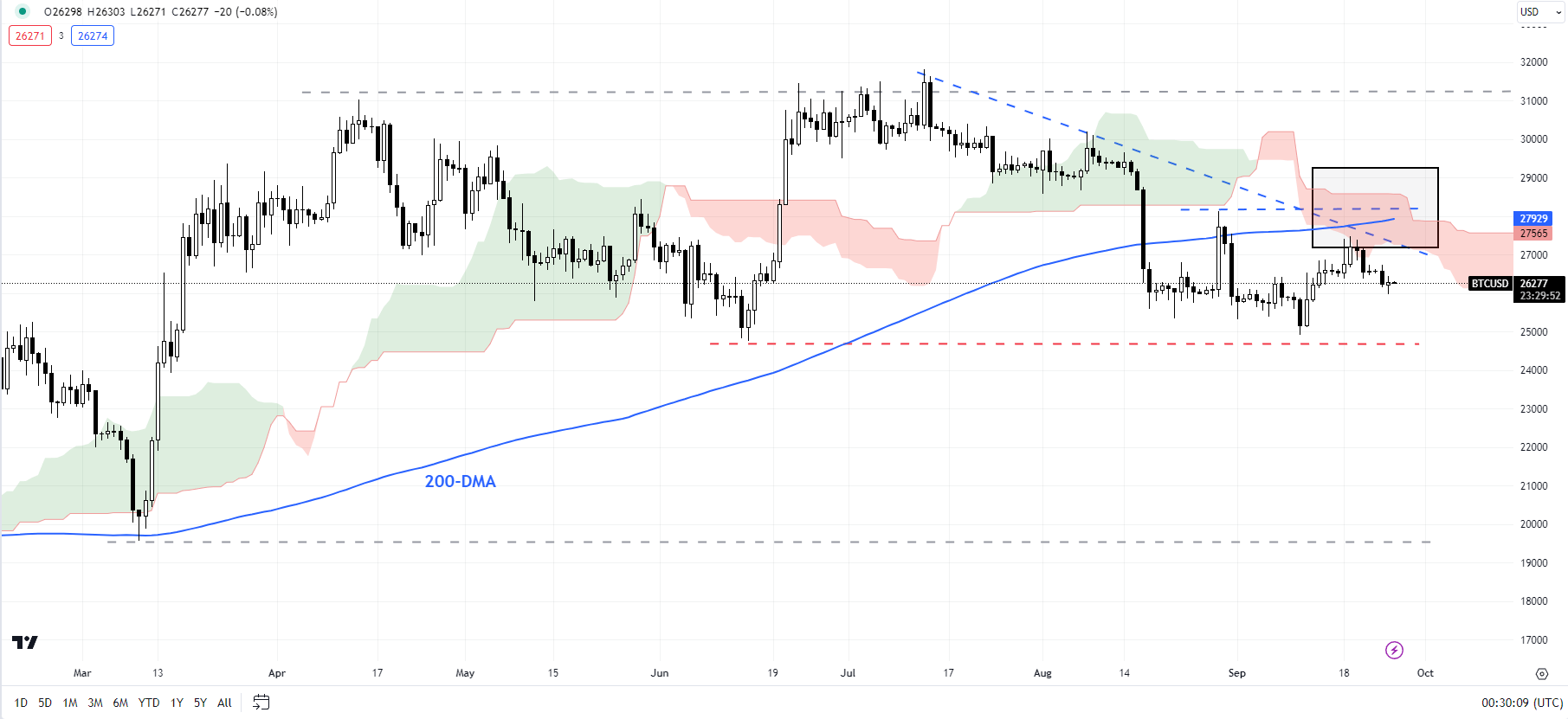

BTC/USD 240-Minute Chart

Chart Created by Manish Jaradi Utilizing TradingView

The following fall under essential converged assist on the September 15 low of 26250, coinciding with the decrease fringe of the Ichimoku cloud and the 89-period transferring common on the 240-minute charts confirms that the upward stress has pale. The break under assist has opened up the opportunity of two situations. BTC/USD may settle in a 24750-27500 vary; the second state of affairs includes a retest of the June low of 24750.

BTC/USD Each day Chart

Chart Created by Manish Jaradi Utilizing TradingView

On the upside, until Bitcoin is ready to cross above the end-August excessive of 28150, the trail of least resistance stays sideways to down. From a big-picture perspective, any break under 24750 may spell additional weak spot towards the March low of 19500.

ETHEREUM: Falters at key resistance

Ethereum charts most likely stand out and make clear the shortcoming of Bitcoin to rise towards the August excessive. Ethereum has succumbed to robust resistance on the 200-period transferring common, coinciding with the early-September excessive of 1660, and a downtrend line from August.

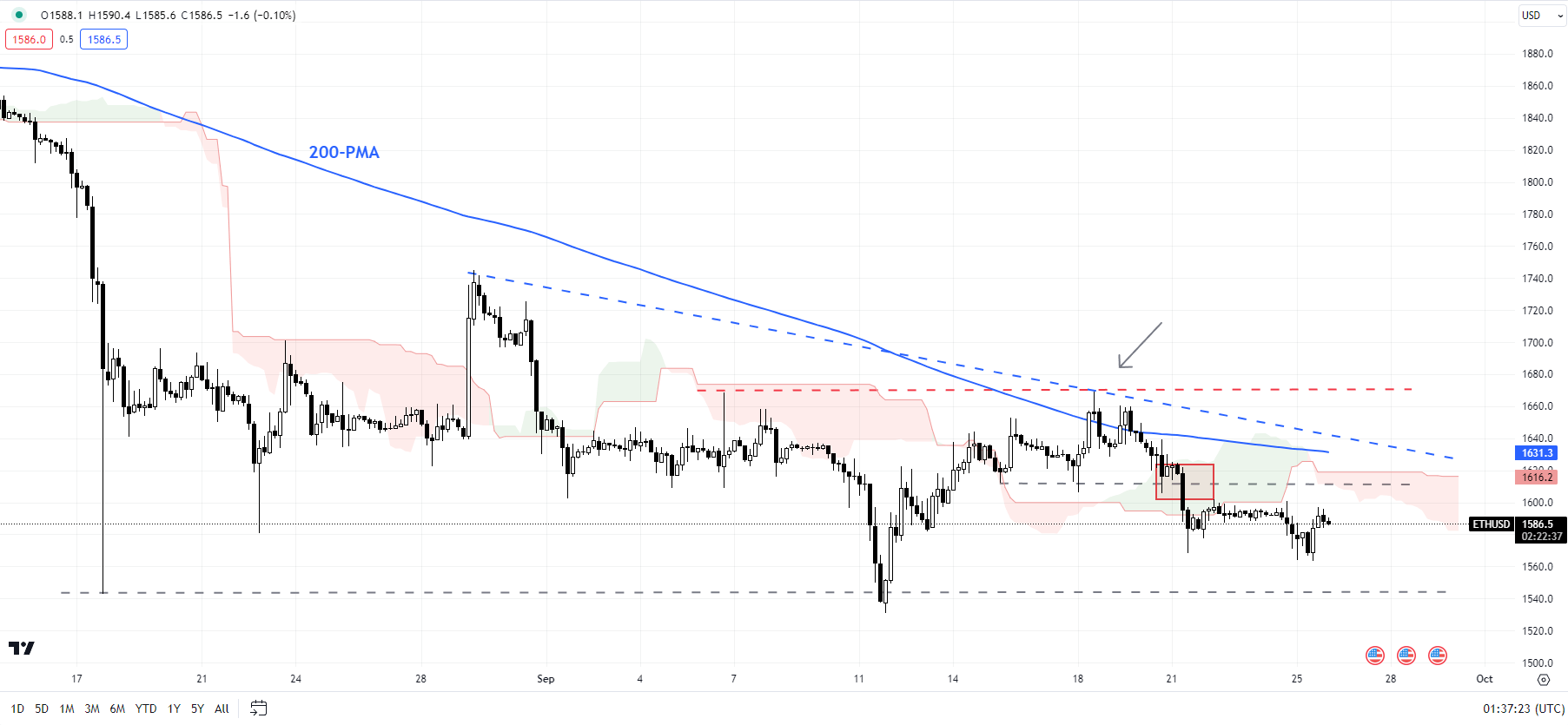

ETH/USD 240-Minute Chart

Chart Created by Manish Jaradi Utilizing TradingView

The retreat from key resistance coupled with the next fall under a horizontal trendline assist at 1600 retains the bearish bias intact –as highlighted within the earlier replace. ETH/USD dangers a retest of the August low of 1550. Under the August low, the following assist is on the decrease fringe of a downtrend channel since April (now at about 1485). A break under the 1475-1550 area may pave the best way towards the October low of 1370.

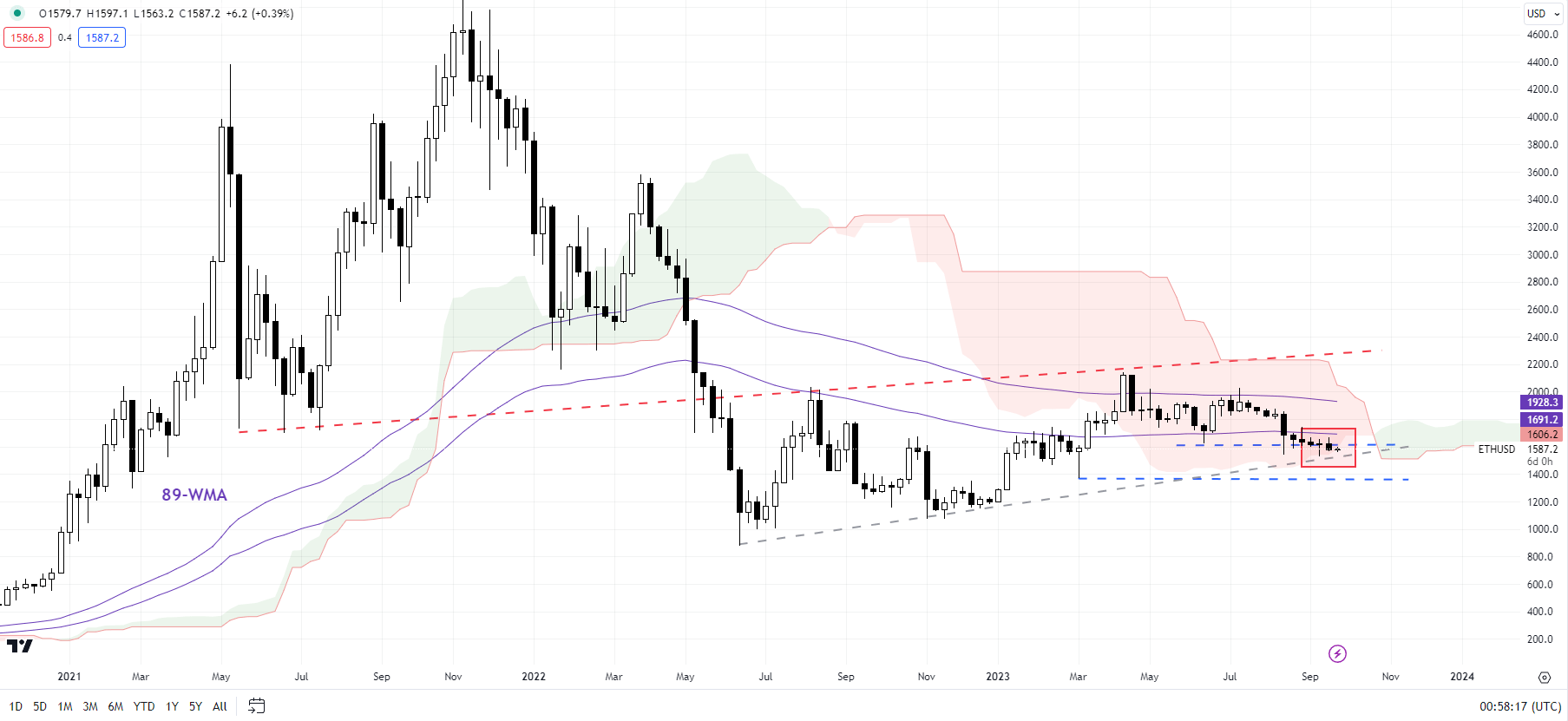

ETH/USD Weekly Chart

Chart Created by Manish Jaradi Utilizing TradingView

As famous earlier this month, ETH/USD has been underneath the affect of the bearish Ichimoku cloud cowl on the weekly charts. Moreover, in latest weeks, ETH/USD has been snowed underneath the Ichimoku cloud on the each day charts. On the upside, Ethereum must surpass 1660 on the very least for the downward stress to start easing.

Advisable by Manish Jaradi

Enhance your buying and selling with IG Shopper Sentiment Information

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and observe Jaradi on Twitter: @JaradiManish

[ad_2]

Source link