- The greenback is being supported by robust financial information from the US, in addition to the continuing rate of interest hike cycle.

- The euro is being weighed down by considerations concerning the European Central Financial institution’s skill to boost rates of interest.

- In the meantime, the Chinese language yuan is being weakened by China’s financial slowdown, and sanctions are weighing on the ruble

Sustaining its upward trajectory since July, the entered the 105 vary this week and started testing the March peak.

A number of components driving demand for the greenback are contributing to its international strengthening, reversing a year-long downtrend. Foremost amongst these components is powerful financial information from the US.

Furthermore, a seasonal impact is presently favoring the greenback, as historic information signifies that demand for the greenback tends to surge throughout September.

This enhance in demand, mixed with the continuing rate of interest hike cycle within the latter half of 2023 in a macroeconomically unsure atmosphere, has made the greenback notably enticing.

Whereas the greenback continues to understand in opposition to the currencies of developed nations comprising the index, additionally it is gaining worth in opposition to the currencies of different main economies, equivalent to China and Russia.

US Greenback Exams March Peak: Can it Break By?

The DXY has strengthened throughout the bearish channel after stabilizing across the 100 degree earlier this 12 months.

The DXY is presently testing the important resistance level at 105, which corresponds to the Fib 0.382 degree, primarily based on the latest downtrend.

This degree additionally aligns with the height noticed throughout the restoration efforts in March. If the DXY can shut the week above 105, it might sign a possible goal of 108.

Moreover, within the quick and medium time period, EMA values have begun to assist this upward development as of this week. The one technical concern at this juncture is the Stochastic RSI indicator, which is approaching the overbought zone.

This indicator, which beforehand signaled a return to the March and June peaks, is presently positioned above these peaks.

Contemplating the basic components, it is potential that the DXY might face short-term resistance at its present ranges and expertise a brief pullback in the direction of the 103 degree.

Such a transfer would additionally entail a retest of the higher boundary of the descending channel.

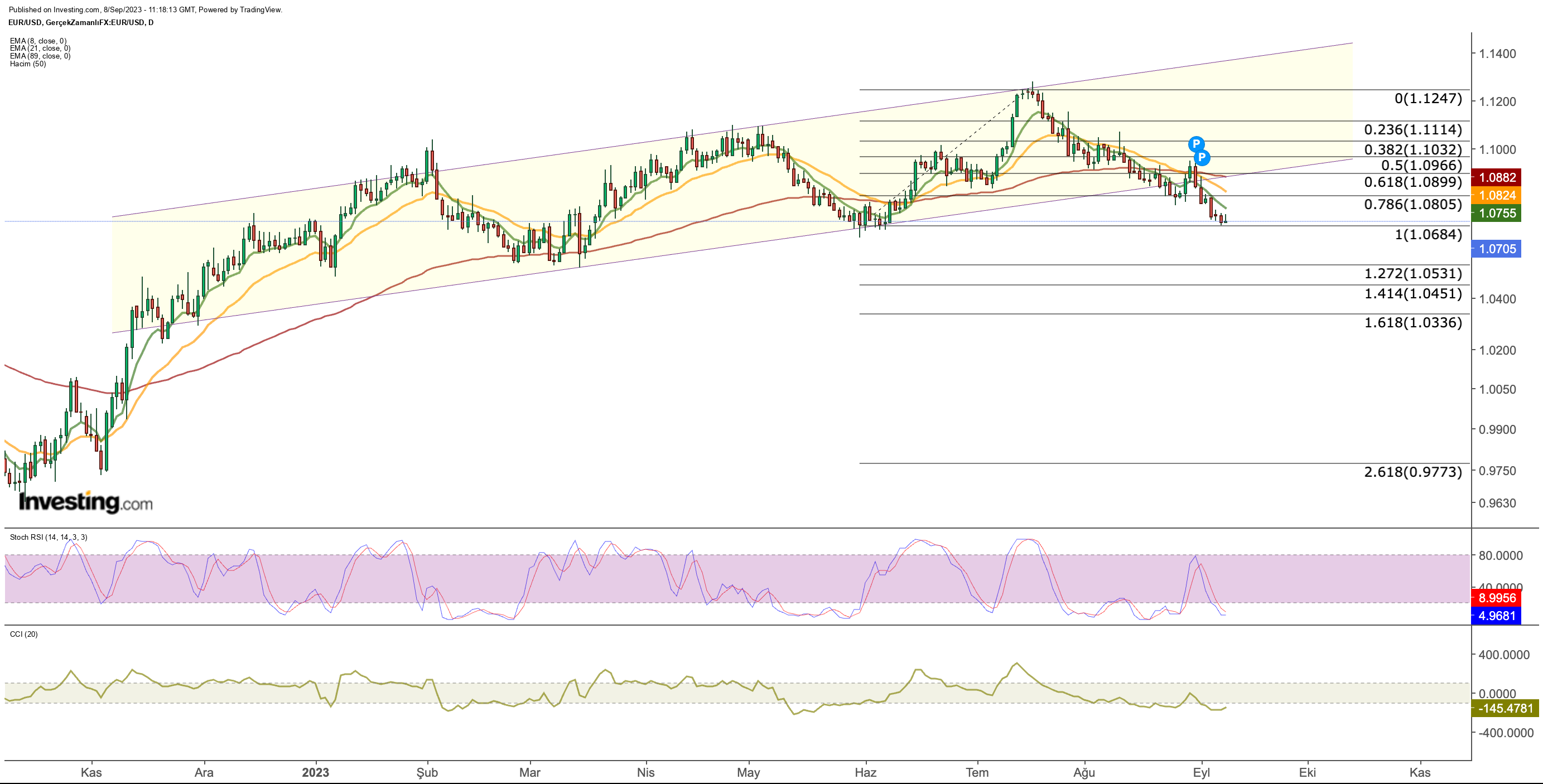

EUR/USD: Euro Continues to Weaken In opposition to the Greenback

The pair has not too long ago breached the decrease boundary of its bullish channel as of September. With the euro exhibiting indicators of weak spot, the pair has descended this week to roughly $1.06, a degree the place it discovered assist again in Could.

Contemplating the restoration noticed between June and July, it is believable that the retreat could persist, doubtlessly bringing the EUR/USD pair all the way down to the $1.03 – $1.05 vary after the lack of the $1.06 degree.

If there is a rebound from the present ranges, the $1.08 area will develop into a major level to observe.

Nevertheless, ought to a possible partial restoration in the direction of the $1.08 area fail to materialize, it might act as a set off for a extra pronounced retracement of the EUR/USD pair.

USD/CNY: Yuan Falls on China’s Financial Woes

The yuan continues to be among the many worst-performing currencies within the Far East as China loses momentum on its post-pandemic restoration path.

Whereas the yuan has remained partially resilient in opposition to the greenback within the final two weeks, it closed the week at 7.33 with a 1% depreciation this week. Thus, parity recorded a brand new excessive after October 2022.

Whereas the present outlook exhibits that the potential for a restoration within the quick time period is weak, the upward motion of USD/CNY could proceed. Technically, after exceeding the final peak, the pair could proceed its motion in the direction of the 7.5 band so long as it stays above 7.33.

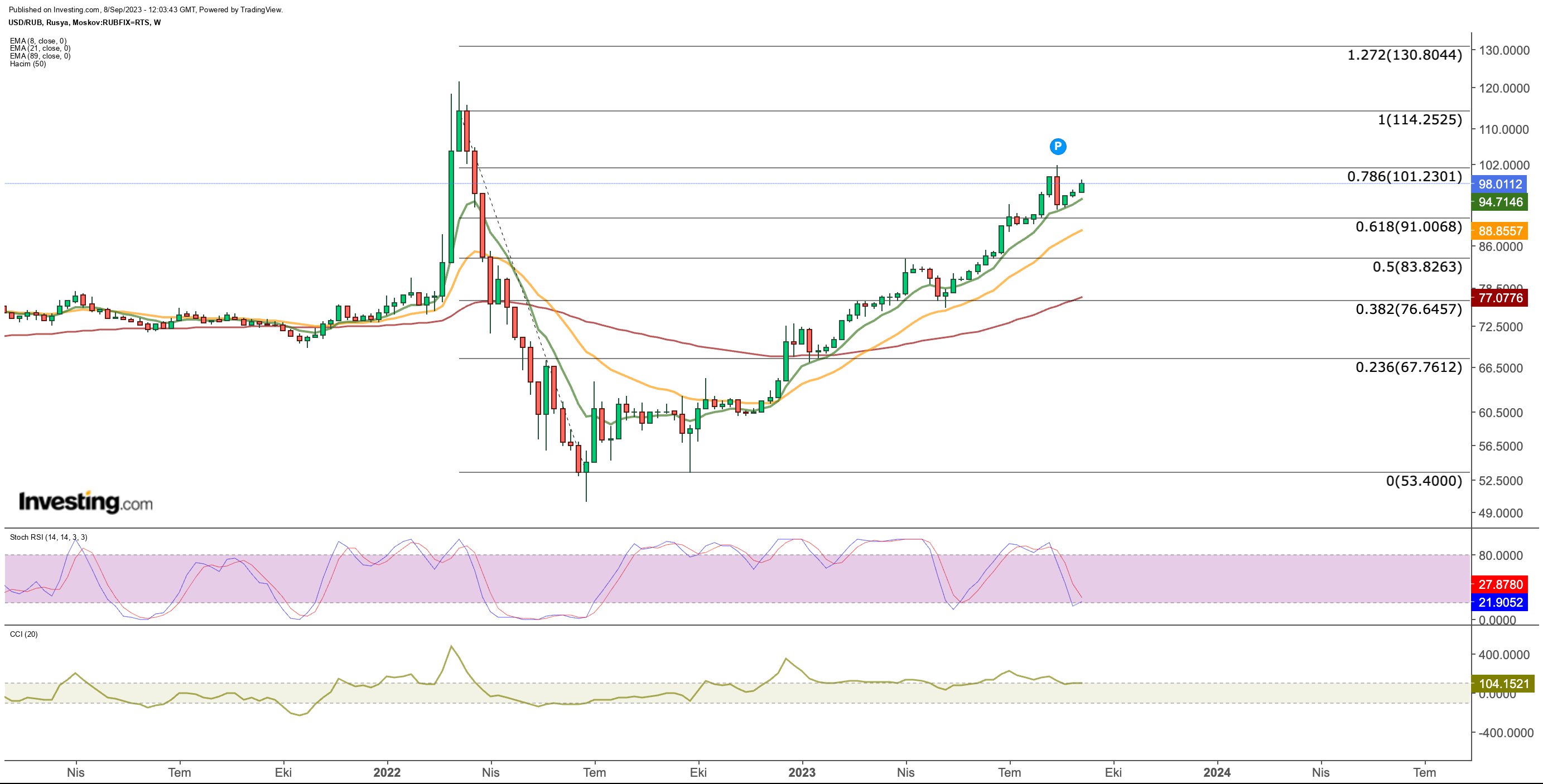

USD/RUB: Ruble Set to Soar?

The pair has been beneath shut scrutiny not too long ago attributable to a number of key components. Russia’s ongoing battle with Ukraine, its determination to restrict oil exports in collaboration with Saudi Arabia till the top of the 12 months (anticipated to affect power costs), and discussions with Turkey concerning a grain hall have stored Russia within the international highlight.

Concurrently, Russia is grappling with a difficult financial scenario attributable to sanctions, trying to successfully handle its assets, notably its oil reserves, in an effort to steadiness its funds.

As commerce interactions between the European Union and Russia proceed to say no and Russia’s international reserves erode attributable to sanctions, the continuing international strengthening of the US greenback seems to make an increase within the USD/RUB pair nearly inevitable.

From a technical perspective, USD/RUB skilled a partial decline to the 92 degree after reaching 101 inside a long-term uptrend. Nevertheless, within the final three weeks, the pair has rebounded and moved again in the direction of the 100 degree.

Contemplating the continuing points in Russia and the robust place of the US greenback, it’s believable that the USD/RUB pair’s upward momentum could persist, with the potential for the pair to achieve the March 2022 peak at 115 after breaking the resistance at 101 (Fib 0.786).

Nevertheless, if there’s a signal of greenback weak spot following a potential intervention across the 100-101 degree, a retracement of USD/RUB in the direction of the 88-91 degree could develop into potential.

However, from a technical standpoint, the prevailing development suggests an upward motion is extra probably than a correction.

***

Discover All of the Information you Want on InvestingPro!

Disclosure: The writer holds no place in any of the devices talked about on this report.