[ad_1]

EJ_Rodriquez

Thesis

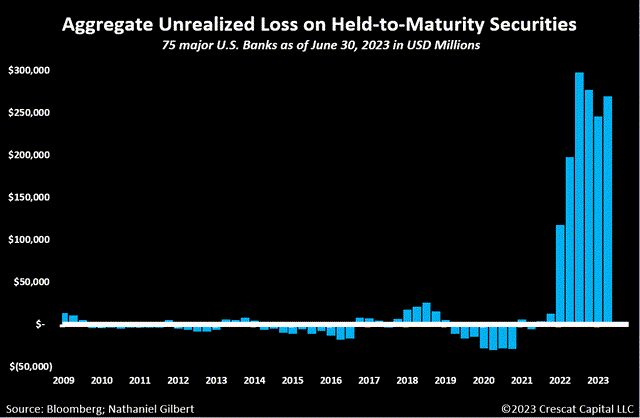

US regional banks have been beneath hearth for the final six months. Positive, some are overloaded with treasuries held to maturity, thus hiding unrealized losses on their steadiness sheets. The report tempo of rate of interest hikes and the financial institution’s portfolio weight of US treasuries created a dangerous state of affairs for regional banks. The chart beneath from Crescat Capital illustrates how critical that subject is:

Crescat Capital

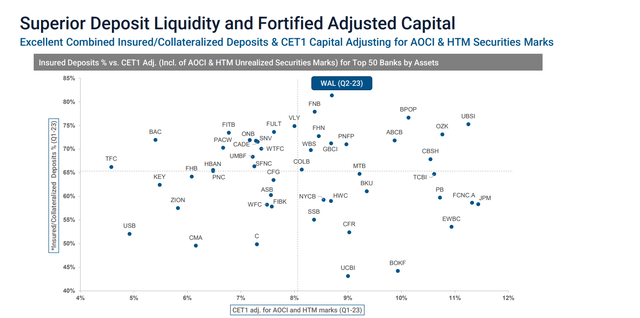

Nevertheless, not all banks are equal, even the regional ones. Western Alliance Financial institution Company is among the many safer regional banks. WAL has the very best price of insured deposits and achieved larger than common profitability. The enterprise is on the market at a worth barely protecting its e book worth. Nevertheless, the supply has just a few drawbacks, sufficient to present WAL a maintain ranking, a minimum of for now.

Firm Overview

Like most regional banks, WAL has had issue making up worth losses incurred in the course of the March turmoil. Regardless of that, Western Alliance is among the many interesting regional banks given the rising deposits and low variety of US treasuries held till maturity (HTM) in its steadiness sheet.

A major amount of deposits poured again to the group financial institution all through the second quarter, persevering with extremely encouraging patterns from the primary quarter and the next interval, in line with Western Alliance’s robust Q2’23 report.

The financial institution has a wholesome steadiness sheet composition. One of the best factor is its low publicity to HTM and US treasuries. The desk beneath represents WAL’s steadiness sheet dissected into items. The information is from the corporate’s final monetary report.

|

Asset ratios: property construction |

|

|

Money/Complete Property |

3.2 % |

|

Loans (ex., Bank cards)/Complete Property |

70 % |

|

Securities HTM/Complete Property |

1.9 % |

|

Securities AFS/Complete Property |

12.6 % |

|

MBS/Complete Property |

3.0 % |

|

US treasuries/ Complete Property |

3.3 % |

|

Legal responsibility ratios: capital construction |

|

|

Deposits/ Complete Liabilities |

82 % |

|

Different liabilities/ Complete Liabilities |

15 % |

|

Firm bonds/ Complete Liabilities |

12.9 % |

|

Fairness/ Complete Liabilities + Fairness |

8.3 % |

|

Solvency ratios: |

|

|

Loans /Deposits |

94 % |

|

Money/Deposits |

3.1 % |

|

Borrowings (inc. bonds)/ Complete Property |

12.9 % |

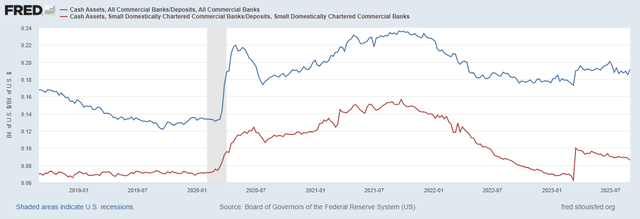

One crimson flag I want to level out is the low cash-to-deposit ratio. It’s decrease than the common for small banks. The picture beneath from the FRED database compares money property to deposits for small banks (crimson line) and all business banks (blue line).

FRED database

Small banks ratio is 8.5 %, whereas for all banking system is nineteen %. Within the case of one other financial downturn, WAL would possibly find yourself in a liquidity disaster. Money reserves will shortly dry up, and the financial institution has to liquidate different property.

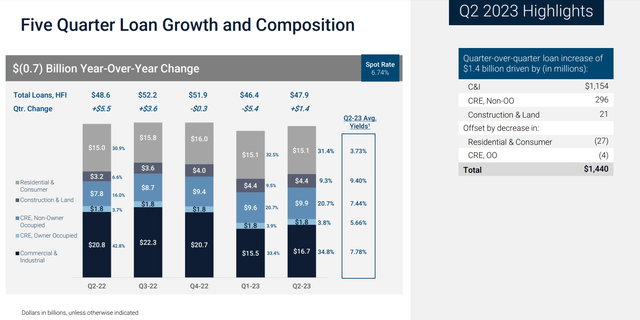

The mortgage composition is nicely diversified between C&I, mortgage shopper, and CRE loans. The picture beneath from the final presentation exhibits the mortgage development for the earlier 5 quarters.

Western Alliance presentation

Given March troubles within the final firm’s report for Q2, C&I noticed a wholesome development of 6%. The worth of the loans recorded on the corporate’s books elevated from $46.44 billion to $47.88 billion. The corporate’s publicity to loans for office-based actual property continues to be minimal. Solely 23% of its loans for business actual property, or 5% of all loans, are for places of work.

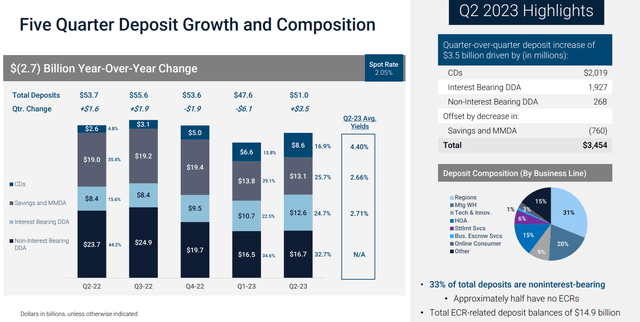

Let’s examine how is the suitable aspect of WAL’s steadiness sheet.

Western Alliance presentation

The deposits are adequately distributed by maturity. Nevertheless, given the low cash-to-deposit ratio, the demand deposits notably exceed money reserves. That mentioned, WAL has a excessive proportion of collateralized deposits, illustrated within the picture beneath:

Western Alliance presentation

WAL has greater than 80 % of its deposits insured. That reality compensates for the inadequate money reserves.

Basel III ratios are an environment friendly information to estimate a financial institution’s means to outlive. WAL’s numbers will not be spectacular at first look. The desk beneath illustrates the financial institution`s capital adequacy.

|

Basel III Ratios: |

|

|

Regulatory capital ratio (Capital adequacy ratio) |

12.6 % |

|

Tier 1 ratio |

10.9 % |

|

CET1 ratio |

10.1 % |

I’m not impressed with CET1. The ratio nonetheless exceeds Basel III pointers, however contemplating the macro setting. I want to be larger, a minimum of 12 %.

WAL’s profitability exceeds the trade’s common. The desk beneath illustrates the financial institution’s efficiency utilizing profitability metrics. The information is from the final monetary report for Q2 2023.

|

ROE |

17.2 % |

|

RoTE |

18 % |

|

RoCET 1 |

19.0 % |

|

ROA |

2.1 % |

These numbers are in step with the corporate’s five-year common. That reality has two-fold implications. First, the financial institution can preserve its sturdy efficiency whatever the circumstances. Second, it’d assist the financial institution enhance its liquidity in the long run. Counting on insurance coverage and collaterals to cowl an organization’s troubles is sweet at first sight. Finally, another person pays the invoice for administration’s incapacity to deal with their monetary affairs.

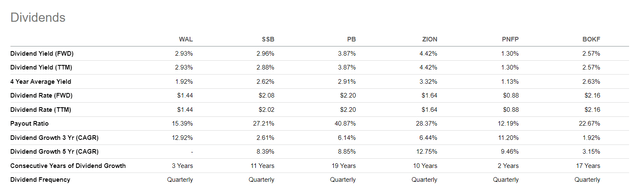

The corporate pays mediocre dividends in comparison with its friends. I think about any dividend mediocre, offering yield beneath US T payments. The latter pays you to attend whereas assuming nearly zero threat. That mentioned, if the principle incentive to spend money on any firm is the dividends, their yield has to exceed fixed-income ones. Beneath, I weigh up WAL with its opponents primarily based on dividend metrics.

Searching for Alpha

One optimistic factor about WAL is the dividend development is among the many greatest. For the final three years, CAGR has been 12.9%.

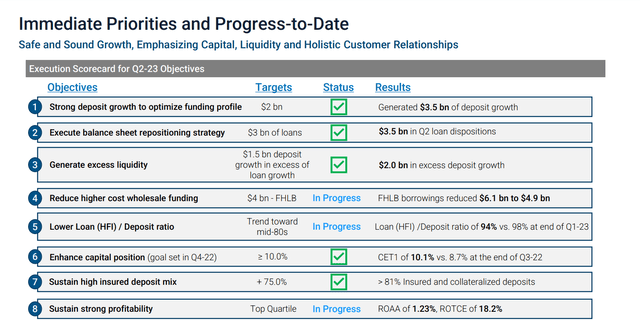

Q2 outcomes

Earlier than I proceed with the corporate valuation, let’s take a look at the efficiency for the final quarter. The desk beneath provides some numbers for Q2, 2023.

Western Alliance presentation

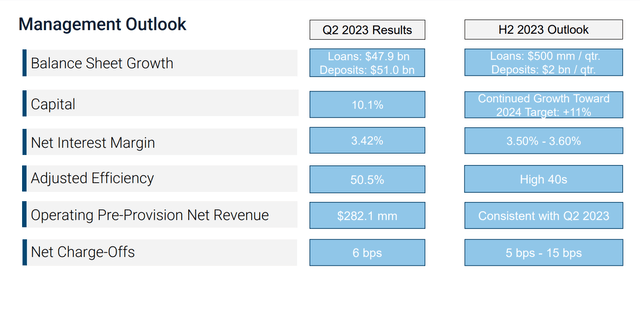

One of many key takeaways from WAL’s Q2’23 report was the achievement of wonderful deposit development, and I believe Western Alliance might be able to proceed increasing its deposit base. After the second quarter, complete deposits stood at $51.0 billion, a lower of $2.6 billion from the top of FY 2023.

A optimistic signal is how overtly the administration has mentioned their expectations for the rest of this yr. For the second half of this yr, they predict mortgage development of round $500 million per quarter. Moreover, deposits ought to enhance by nearly $2 billion every quarter all through the identical interval.

Western Alliance presentation

If the group can accomplish each of those targets, it’ll basically pressure people who’re hostile towards the corporate to change their opinions. Traders may additionally should be extra apprehensive concerning the web curiosity margin. Administration expects a web curiosity margin of between 3.5% and three.6% for the rest of this yr.

Firm Valuation

WAL has been paying insignificant dividends for the previous few years. To worth the corporate, I take advantage of the Extra Return Mannequin. I do comply with Professor Damodaran’s framework and its database.

Assumptions and inputs:

- Threat-free price equals the 5Y common of the USA long-term Authorities bond Fee, 2.2%.

- Development price, g, equals the 5Y common of the USA long-term Authorities bond Fee, 2.2%.

- USA’s fairness threat premium is 5.0 %.

- WAL’s e book worth per share is $49.13 (10/09/2023).

- WAL’ unlevered Beta 1.42

- WAL Debt/Fairness ratio 537 %.

- USA’s efficient tax price is 25 %.

- WAL ROE (TTM) 17.19 %

1. Calculate Levered Beta with the system beneath:

Levered Beta = Unlevered Beta * (1+D*(1-T)/E).

2. Calculate the low cost price (low cost price as the price of fairness) utilizing the ensuing worth for leveraged beta. The system I take advantage of is:

Value of Fairness = Threat-Free Fee + (Levered Beta * Fairness Threat Premium).

3. Calculate Extra Returns utilizing WAL’s ROE, Guide Worth, and Value of Fairness:

Extra fairness return = = (Secure Return on fairness – Value of fairness) x (Guide Worth of Fairness per share).

4. Calculate Extra Returns Terminal Worth assuming perpetual fixed development and steady value of fairness:

Extra Returns Terminal Worth = = Extra Returns / (Value of Fairness – Anticipated Development Fee).

6. Calculate the Worth of Fairness.

Worth of Fairness = Guide Worth per share + Terminal Worth of Extra Returns.

For WAL, I get the next outcomes:

Terminal Worth of Extra Returns Per Share = $56.65

Intrinsic worth per share = $106.28

Present market worth = $48.91 (09/15/2023)

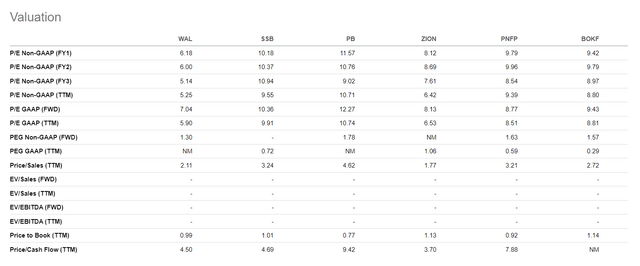

I examine WAL with different massive US regional banks. Prone to different regional banks, WAL trades near its e book worth. The picture beneath compares WAL with similar-sized regional banks.

Searching for Alpha

Utilizing P/E metrics, WAL is among the many least expensive regional banks.

Dangers

For all regional banks, the numerous threat is liquidity. WAL is a uncommon exception, with the very best proportion of insured deposits. Demand deposits considerably eclipsed the money reserves. In an emergency, the financial institution depends solely on its insurance coverage, which is a wonderful short-term benefit. Nevertheless, in the long run, WAL should enhance its cash-to-deposit ratio. Therefore, the financial institution will depend on its means to deal with future uncertainties.

However, the credit score threat is nicely diversified between numerous debtors. CRE publicity is minimized, notably within the workplace section.

The financial threat within the face of upper rates of interest is essential. The long-expected pivot would possibly come subsequent yr. Until then, we’d see one other hike to realize FED’s inflation goal. WAL has comparatively low publicity to HTM securities and US treasury bonds. Such steadiness sheet composition mitigates the chance of rising rates of interest.

Conclusion

Western Alliance is an efficient financial institution with development potential. It has notable benefits over its friends; nonetheless, they’re inadequate to present it a purchase ranking. The main downside is the money/deposit ratio beneath the US small banks’ common. After I spend money on banks, I like deposit ratios larger than the nation’s common for similar-sized enterprises. I stay up for seeing WAL’s progress to present it a purchase ranking.

[ad_2]

Source link