As a substitute of falling after the Fed lowered charges, the and yields have risen.

This appears incongruous given the dovish Fed discuss.

Nevertheless, lots of the cuts had been baked into the bonds forward of the announcement.

What number of instances have we merchants seen a “promote the occasion” scenario?

Nevertheless, what issues extra is what occurs from right here.

We proceed to see “gentle” financial information hinting at a slowdown.

On the similar time, many commodities are rallying with information of the China stimulus, geopolitical strife, and climate disturbances.

Plus, we are actually listening to talks of extra price cuts on the best way this 12 months.

First, I doubt that the 10-year yields will rise way more from present ranges.

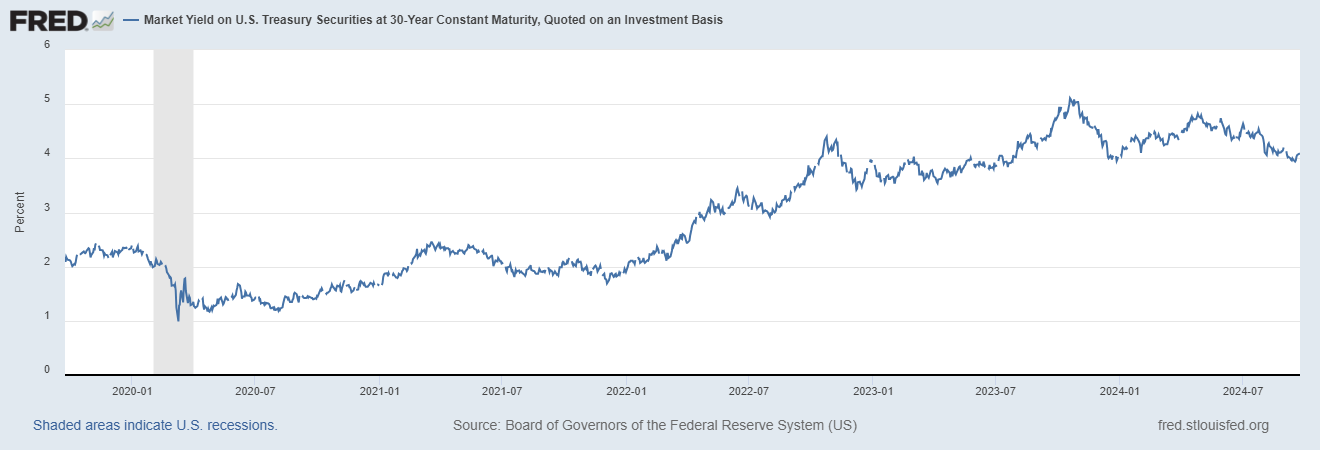

On this chart you possibly can see the rise in charges on the bonds.

Extra importantly, you possibly can observe the yields to see if this rise for the reason that Fed minimize, reverses or continues.

With nonetheless above the 23-month transferring common and sitting on each day chart assist, what ought to we look ahead to?

First, we should watch to see if the 50-day transferring common holds up.

The value is close to sufficient to think about that stage our predominant assist (97.20).

Secondly, TLT had an inside day, which implies it traded at the moment contained in the buying and selling vary of yesterday. A transfer over 98.89 can be bullish.

Third, momentum weakened some displaying a bearish divergence. Therefore a break of 97.85 can take it all the way down to the 50-DMA.

TLT is at the moment underperforming , which is nice for the market and threat on.

Because of this it’s so vital to look at these lengthy bonds.

A rally in TLT and a possible outperformance of the benchmark may very well be damaging for the and equities, whereas optimistic for rising markets and commodities.

ETF Abstract

(Pivotal means short-term bullish above that stage and bearish beneath)

- S&P 500 (SPY) 565 pivotal assist

- Russell 2000 (IWM) Vary 215-225

- Dow (DIA) Appears like topping motion

- Nasdaq (QQQ) 475 assist 485 resistance

- Regional banks (KRE) 52-55 assist zone

- Semiconductors (SMH) 240 pivotal

- Transportation (IYT) 67.00 assist 69 resistance

- Biotechnology (IBB) 140-142 assist zone

- Retail (XRT) 73.50 assist 77 resistance

- iShares iBoxx Hello Yd Cor Bond ETF (HYG) Nonetheless buying and selling above the 200-WMA-healthy