The struggle between Russia and Ukraine has raised nerves world wide, and understandably so. It has additionally spooked buyers, each for the unpredictable impacts it might need and coming inside a local weather of already elevated inflation and macro headwinds. The S&P 500 dropped 5% from the start of February to March 4th, as an indication of those nerves.

Whereas the state of the world is unsure, the outlook for long-term buyers will not be as bleak because it seems at first blush. It appears counterintuitive and unthinkable, and but: investing in occasions of struggle tends to repay!

Actually, the psychological error we regularly make is to imagine struggle causes markets to go down and buyers to lose cash.

Realizing the historical past and dynamics of the market might help us to not fall into these generalizations which, in the long run solely harm us greater than if we ignored the state of affairs.

A Look Again At Historical past: The Graph

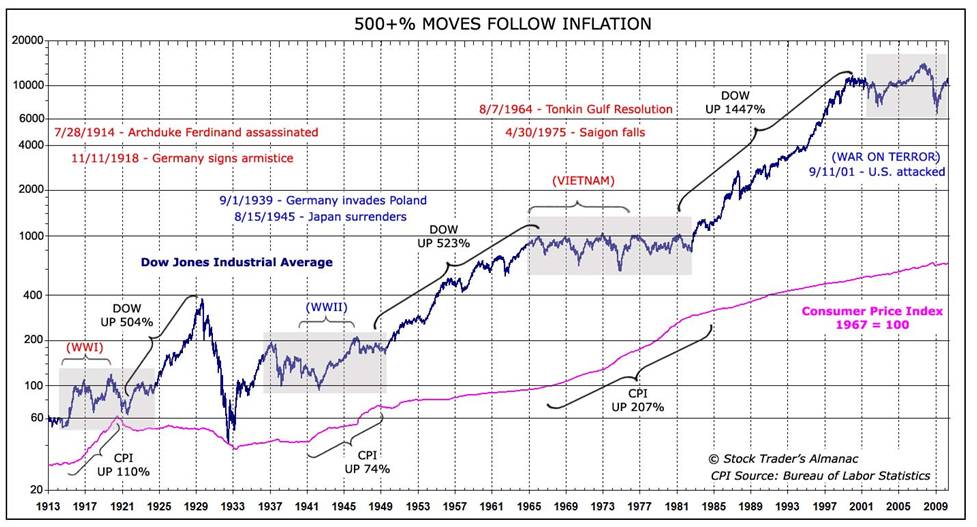

What you see within the picture beneath, is the chart of the in occasions of struggle. Specifically, we give attention to three crucial occasions which, hopefully, will show to be extra intensive wars than the Russia-Ukraine battle:

- World Battle I

- World Battle II

- Vietnam Battle

Supply: Bureau of Labor Statistics

Even simply trying on the graph, with the struggle durations highlighted in grey, we will see how the values on the finish of the struggle had been in keeping with and sometimes increased than at first, and that this holds for every of the three events talked about above.

The numbers

Let’s examine the precise numbers in every of the three conflicts….

First World Battle

Within the 6 months following the outbreak of World Battle I, the Dow Jones Industrial Common misplaced 30%. At the moment, for the reason that struggle had severely affected the monetary world, it was determined to shut the inventory change (an echo of which we hear right now within the closing of the Russian inventory change).

Six months later, when it totally reopened getting into 1915, the Dow Jones scored its highest ever enhance in a single yr: +88%!

On the finish of the battle, which lasted from 1914 to 1918, the American index gained a complete of 43%, or an annualized 8.7%.

World Battle II

When Hitler invaded Poland on September 1, 1939, the market rose 10% within the following session on September 5, 1939. With the assault on Pearl Harbor (December 1941), shares opened down (by simply 2.9%, nonetheless) however recovered in lower than a month. When the Allied Forces invaded France in 1944, the Dow Jones Industrial Common registered a 5% enhance within the following month.

As with World Battle I, on the finish of the battle, which lasted from 1939 to 1945, the Dow Jones gained 50% total, or 7% annualized.

Vietnam Battle

Though a extra circumscribed battle (and maybe just like the one between Russia and Ukraine), the Vietnam Battle additionally had related traits for inventory markets. In 1965, when American troops arrived in Vietnam, the Dow Jones closed the yr with a ten% acquire. On the finish of the battle, in 1973, the market realized an total efficiency of 43%, or 5% annualized.

Contemplating subsequently all 3 durations, we will say that the inventory market has realized a median of 45% total and about 7% annualized.

Conclusion

Now, as at all times, we should always not take the information of the previous and suppose that the long run shall be precisely the identical. What we will say nonetheless, is that historical past and numbers present that it’s mistaken to say that in occasions of struggle you lose cash. If something, the other has borne out.

The actual query that we should ask ourselves, nonetheless, whether or not reflecting on the +88% rebound from World Battle I, or perhaps a time just like the April 2020 post-Covid rebound, is that this: was I available in the market at the moment or was I out of it out of concern?

These are moments for which we can’t afford, if we actually wish to obtain vital targets by way of outcomes, to remain out of the markets.

Investing can at all times be worthwhile with the best time horizon, and maybe in occasions of struggle, with the mis-perception of dangers by different buyers, there are extra alternatives to emerge.

Disclaimer

This text has been written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation or suggestion to take a position as such it isn’t supposed to encourage in any method the acquisition of any asset. Any sort of asset is evaluated from a number of factors of view and is very dangerous and subsequently, any funding choice and the danger stay the duty of the investor.