[ad_1]

- Walt Disney is about to reportQ3 earnings on Wednesday after market shut

- The long-term outlook for the inventory appears promising

- Technically, the inventory is testing a long-term backside presently

Walt Disney (NYSE:) is all set to launch its fiscal Q3 earnings proper after the market closes tomorrow, August ninth. Again in Could, the

Now, issues have settled a bit, and although expectations have been adjusted since that final quarterly report, we’re nonetheless curious to see if the home of Mikey has any surprises up its sleeve this time round. In keeping with InvestingPro, earnings per share (EPS) may very well be round $0.99 for the quarter, with income forecasts hovering at roughly $22.53 billion.

This is the twist: those self same analysts who beforehand had larger expectations have now lowered their HBK from $1.44 and introduced down the income estimates from $22.97 billion.

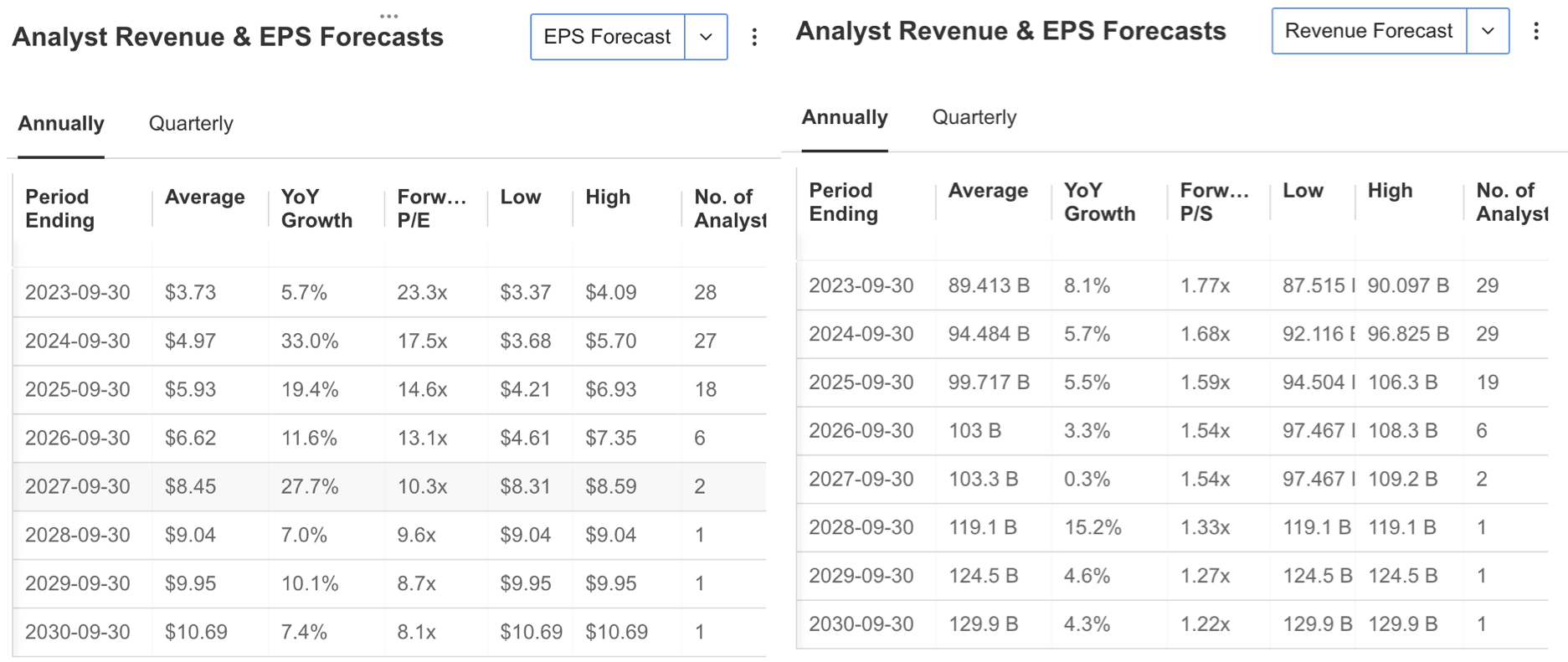

Supply: InvestingPro

Forecasts for the remainder of the 12 months recommend that Disney may attain a median HBK of three.73 and a value/earnings ratio of 23.3X by the tip of the 12 months. Yr-end income expectations are estimated at $89.41 billion, up 8%. In the long term expectations, Disney’s income is anticipated to achieve $100 billion by 2026. Earnings per share expectations come within the type of a median of $5, with a rise of 33% by the tip of subsequent 12 months.

Supply: InvestingPro

Disney’s Prowess: A Deep Dive Into Key Monetary Ratios

With a considerable market capitalization reaching nearly $158 billion, Walt Disney stands as a cornerstone within the leisure trade, making waves throughout two distinct sectors. Past its famend amusement parks and product gross sales, Disney’s affect extends to the media realm, encompassing digital platforms and the movie trade. Working below the banner of Disney Plus, its digital platform efforts in media are noteworthy, whereas its cinematic prowess is highlighted by heavyweight studios like Walt Disney Footage, Marvel Studios, and Lucasfilm.

This esteemed stature within the trade instructions appreciable consideration from institutional traders, with giant companies lately underscoring their confidence in Disney by rising publicity to DIS shares inside their portfolios. What deserves consideration is the truth that hedge funds and institutional traders show their belief in Disney from a long-term perspective, controlling over 60% of the possession in DIS shares. This issue may probably encourage particular person traders to understand the latest downtrend in DIS inventory as a promising shopping for alternative.

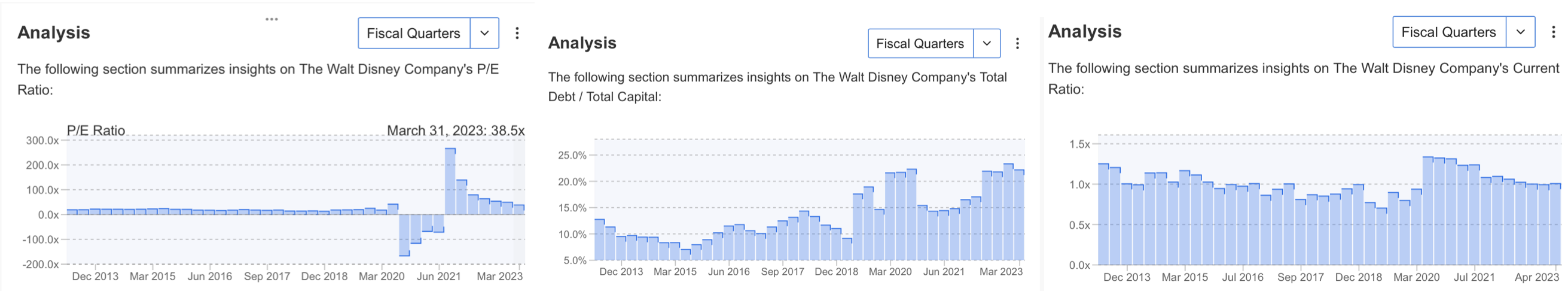

Now, let’s delve into a couple of pivotal ratios regarding the firm, main as much as the upcoming announcement of earnings this week. Firstly, the value/earnings (P/E) ratio at 38.5x highlights that regardless of a notable decline over the previous two years, the inventory stays positioned at a premium stage. With a gradual complete debt-to-capital ratio of twenty-two%, Disney’s monetary stability is obvious, mirroring sector averages and indicating comparatively decrease monetary threat. Notably, Disney’s present ratio is at 1, suggesting its capability to satisfy short-term obligations successfully.

Supply: InvestingPro

Consequently, the constant upward trajectory in earnings per share is favorable for the corporate, amplifying its attract for traders eyeing long-term commitments. The added attract of constant dividend disbursements enhances the inventory’s attraction, particularly to these with a long-term funding horizon. InvestingPro’s complete evaluation of the corporate aligns with this sentiment, figuring out one other encouraging facet: the corporate maintains a low F/Okay ratio, regardless of the latest surge in short-term earnings.

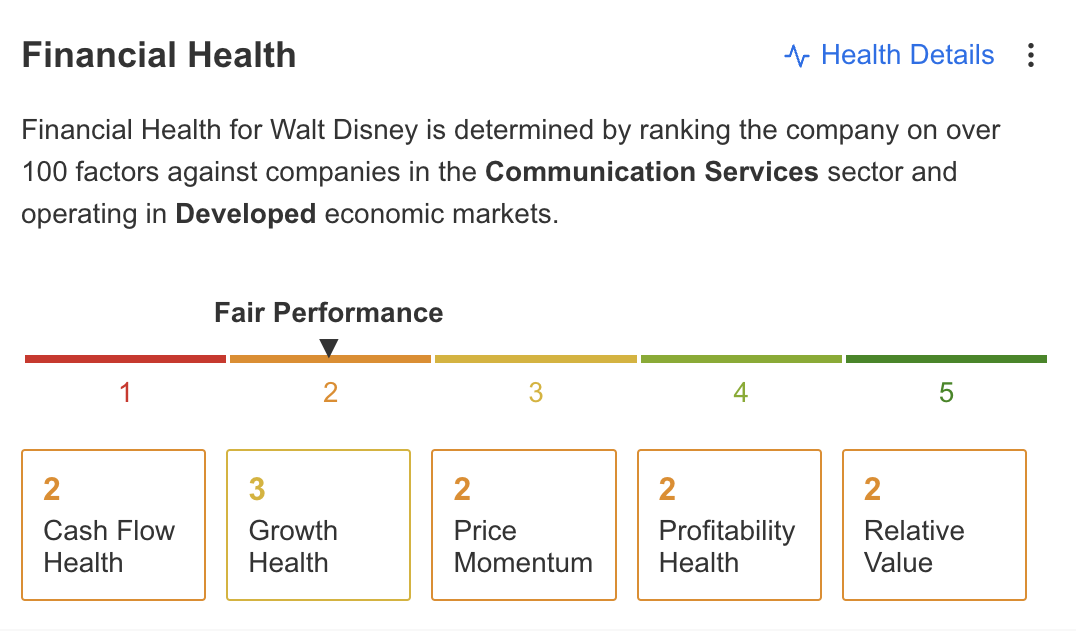

Analyzing the present knowledge obtainable on the InvestingPro platform, Disney’s monetary well being falls in need of the common benchmark. Whereas the corporate’s development is pegged at median ranges, features like profitability, money circulation, relative worth, and value momentum require consideration and enchancment. In consequence, the outlook validates analysts’ downward revisions of their short-term expectations for the corporate.

Supply: InvestingPro

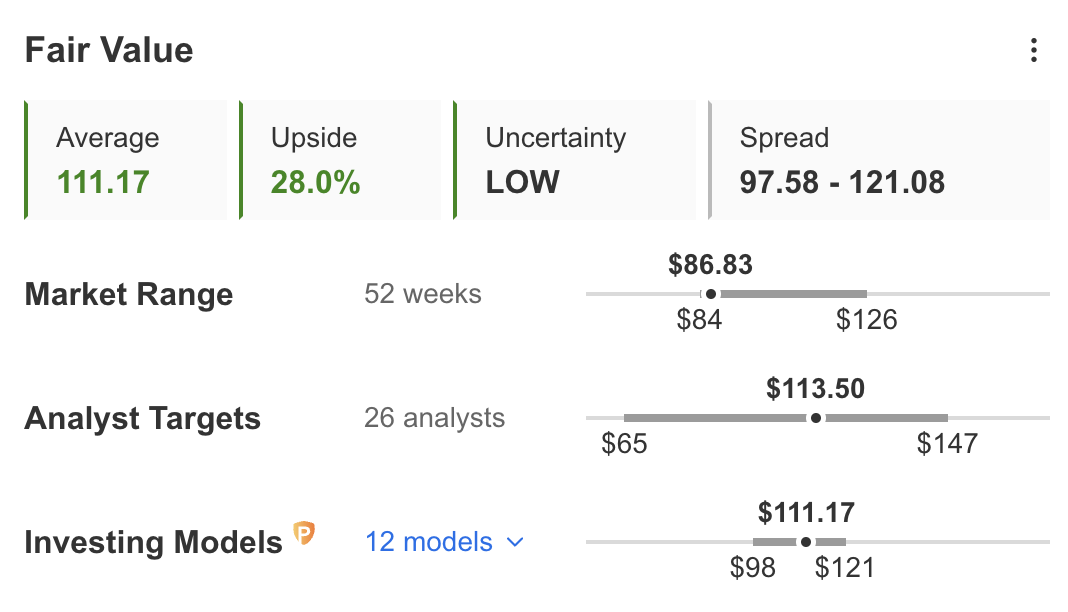

Regardless of the corporate’s monetary well being being beneath common, the outlook for its inventory value seems promising. The truth is, in keeping with InvestingPro’s calculations primarily based on 12 monetary fashions, the honest worth for the inventory immediately is $111. Analysts have related expectations, with their targets hovering round $113.

Apparently, these estimates point out that the DIS inventory is presently buying and selling at a reduction of round 28% in comparison with its present value. This implies that the inventory may be undervalued primarily based on these assessments.

Supply: InvestingPro

One other putting criterion about DIS inventory is that its beta is at 1.28. This ratio implies that the inventory reacts larger than the overall market pattern. Accordingly, DIS share, which has a beta above 1 from potential value fluctuations, might be anticipated to maneuver extra risky.

Supply: InvestingPro

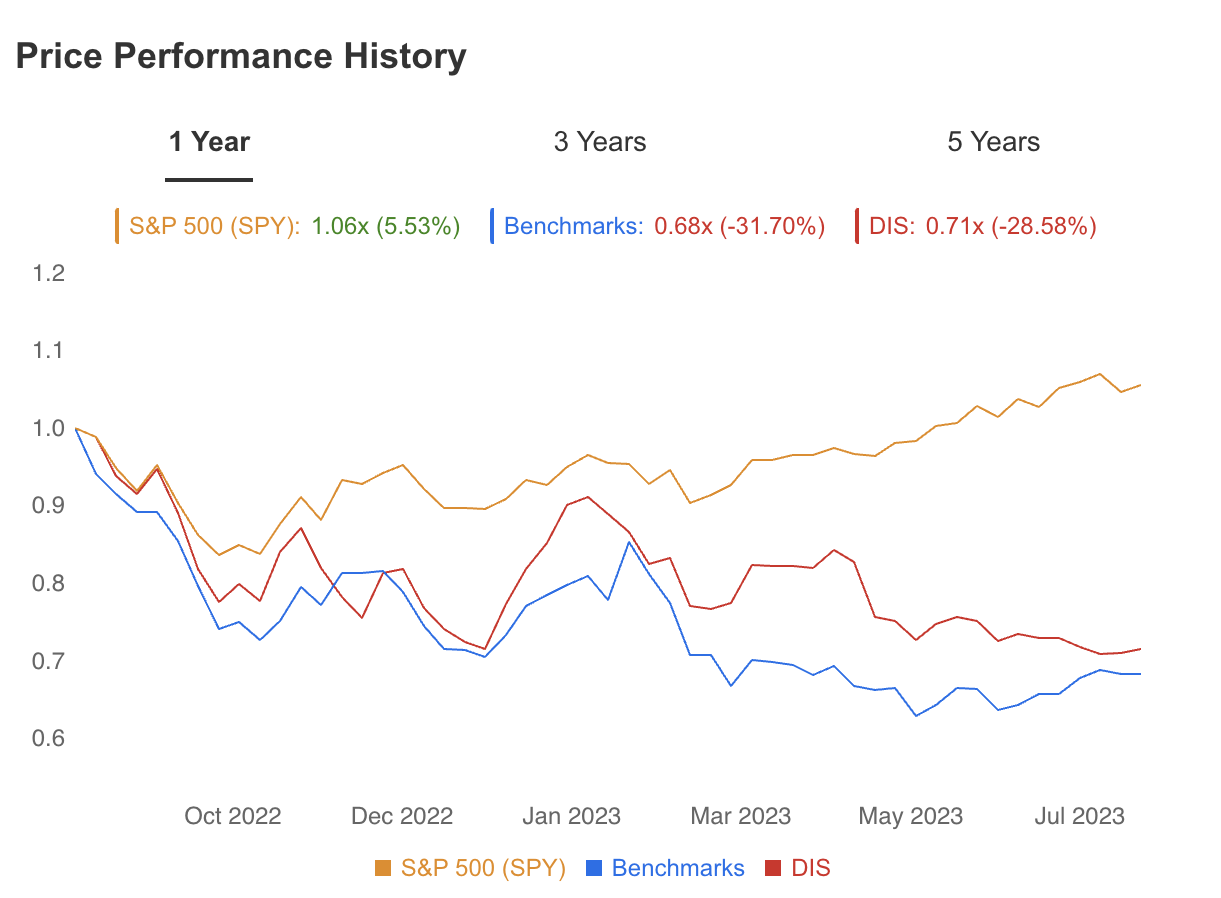

Inspecting the inventory’s value efficiency over the previous 12 months, we observe a decline that is barely above the sector common however beneath the for this timeframe. A extra detailed evaluation of DIS’s value motion reveals that whereas the damaging pattern has been legitimate all through 2023, the tempo of the downward momentum is easing, exhibiting a slight sideways shift.

Disney: Technical View

Over the previous two years, DIS inventory has skilled a constant downtrend. Regardless of exhibiting some indicators of restoration within the earlier 12 months, as indicated by the weekly chart, the pattern reversal hasn’t totally materialized but. However, the present outlook means that the inventory has reached some extent the place it has traditionally encountered shopping for curiosity, forming a possible backside.

DIS inventory is presently present process a check of its long-term help at $85. Apparently, this zone has beforehand triggered a fast uptrend after its final check on the shut of 2022. Nevertheless, it is value noting that these upward strikes have been in response to sharp declines. Regardless, the present scenario may very well be seen as a chance for traders to contemplate re-entry.

On this context, DIS wants to attain a weekly shut above $95 with the intention to break away from its downtrend. As soon as this milestone is reached, the preliminary goal may very well be across the $113 mark. Wanting additional down the road, medium and long-term objectives past that stage lie at $128, $141, and $155.

It is value listening to the Stochastic RSI indicator on the weekly chart as effectively. Positioned within the oversold zone, it may probably sign an upward motion past the $95 mark.

Conclusion

To sum it up, whereas Disney’s conservative monetary outlook may result in short-term hurdles, the long-term outlook appears promising, notably with the sustained curiosity from institutional traders.

But, it is essential to focus on that though expectations for the present quarter have been revised downward, the upcoming announcement of the monetary outcomes on August ninth may probably spark an uptrend within the inventory value.

***

Discover All of the Data you Want on InvestingPro!

Disclaimer: The writer doesn’t personal any of those shares. This content material, which is ready for purely academic functions, can’t be thought of funding recommendation.

[ad_2]

Source link