[ad_1]

The Walt Disney Co., a diversified worldwide household leisure and media enterprise based since 1923, shall launch its Q1 2024 earnings end result on 7th February (Wednesday), after market shut. The corporate operates by way of two fundamental segments: Disney Media and Leisure Distribution (DMED) and Disney Parks, Experiences and Merchandise (DPEP). The previous covers the corporate’s world movie, tv content material manufacturing and distribution actions, whereas the latter encompasses parks and experiences and client merchandise.

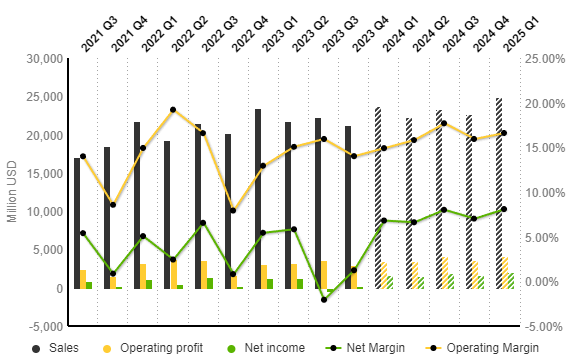

Walt Disney generated $21.2B income in This fall 2023, down -4.88% from the earlier quarter, however up 5.41% from the identical interval final 12 months. In accordance with the official report, income generated from the Disney Parks section was up 13% (y/y) to $8.2B (boosted by positive factors in worldwide parks buoyed by elevated attendance and visitor spending progress, however barely offset by decrease outcomes at home parks and resorts). Nonetheless, section working earnings was up 31% (y/y) to $1.76B.

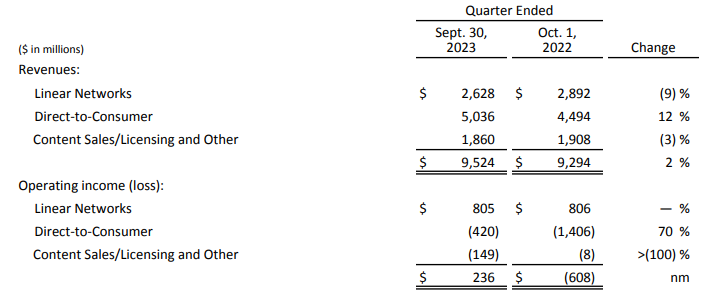

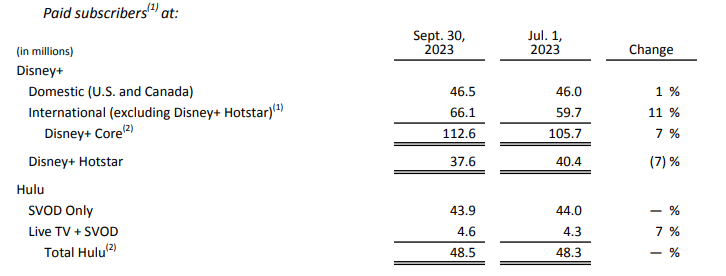

Quite the opposite, the corporate’s Media and Leisure Distribution was up 2% (y/y) in income to $9.5B. Each home and worldwide channels reported losses, resulting in Linear Networks down -9% (y/y) to $2.6B. Working earnings for the section have been down -5% (y/y) and -3% (y/y) for home and worldwide part, to $528 million and $115 million, respectively. Income for Content material Gross sales/Licensing and Different was down -3% (y/y) to $1.86B. The losses of the 2 segments have been barely offset by positive factors within the Direct-to-Client section, which was up 12% (y/y) to $5.04B. Its working losses narrowed to -$0.42B (was -$1.41B in the identical interval final 12 months), following larger subscription income (from Disney+ Core and Hulu), in addition to lowered value in advertising and marketing, know-how and distribution.

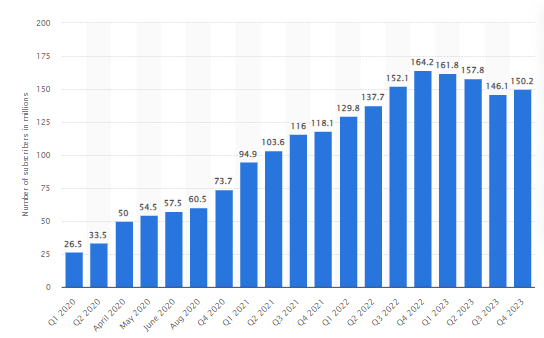

The corporate reported an enchancment in world Disney+ subscribers, to 150.2 million, marking the tip of the falling development for 3 consecutive quarters. By common month-to-month income per paid subscriber (ARPU), home Disney+ reported a rise of $0.19 from the earlier quarter to $7.50, whereas Worldwide Disney+ reported a rise of $0.09 to $6.10. The previous was attributed to larger promoting income, whereas the latter was attributed to a rise in common retail pricing, however partially offset by a better mixture of subscribers to promotional choices.

All in all, the administration stays optimistic over the outlook within the close to time period:

“As we glance ahead, there are 4 key constructing alternatives that shall be central to our success: reaching important and sustained profitability in our streaming enterprise, constructing ESPN into the preeminent digital sports activities platform, bettering the output and economics of our movie studios, and turbocharging progress in our parks and experiences enterprise,” – CEO Bob Iger

Along with that, key focus shall be on the corporate’s streaming enterprise profitability and subscriber progress, client demand in addition to its value administration method.

In accordance with projections by S&P International Market Intelligence, gross sales income is anticipated to succeed in $23.8B within the coming quarter, up 12% from the earlier quarter, and up 1.2% from the identical interval final 12 months. Working revenue and internet earnings ought to see important enchancment, at $3.5B and $1.62B respectively. This could deliver internet margin and working margin up by 5.56% and 0.9% from the earlier quarter, to 6.80% and 14.91%, barely higher than the ends in the identical interval final 12 months.

Technical Evaluation:

The #Disney share value stays clearly above its 52-week low ($78.73). The extent along with $75.30 projected from Fibonacci Enlargement, type a powerful help zone. The most recent inventory value closed above FE 61.8%, or $91.55, and approaching 100-week SMA. A bullish breakout above this dynamic resistance could deliver $105.60 (FR 78.6%, prolonged from the lows in March 2020 to the highs in March 2021) into focus, adopted by $126.40 (FR 61.8%).

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link