[ad_1]

ksushsh/iStock via Getty Images

Main Thesis & Background

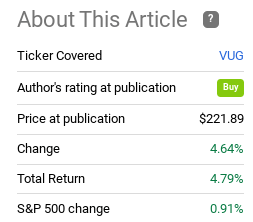

The purpose of this article is to evaluate the Vanguard Growth ETF (NYSEARCA:VUG) as an investment option at its current market price. This is a fund I cover when I am considering buying in to the “growth” theme, and I have owned it from time to time. In fact, when I covered the fund last quarter, I had a “buy” rating on it. I saw a high likelihood for out-performance, and that outlook as certainly been vindicated:

Fund Performance (Seeking Alpha)

While this gain near 5% easily outpaces the S&P 500, the reason for my updated review this time around has to do with more recent performance. If we consider a 5% gain over three months, things look pretty stable. But the truth is VUG was performing much better than that until very recently. Unfortunately those gains could not be held, and VUG has dropped by double-digits over the past month alone:

1-Month Performance (Seeking Alpha)

It is because of this unsettling chart that I wanted to take another look at VUG. Given that this performance is driven by macro-factors that I do not see abating in the short-term, I believe a more neutral outlook on the fund is warranted at the moment. Therefore, I am downgrading my rating to “hold”, and will explain why in more detail below.

Tech Stocks Are Leading Market Declines

To begin, I want to focus on why I see amplified risk in growth funds right now. The reality is that growth isn’t “bad” right now – or for the long-term. But I want to manage expectations by illustrating investors who buy into it now are setting themselves up for a more risk-on positioning. That leaves the opportunity for outsized gains – but also amplified losses.

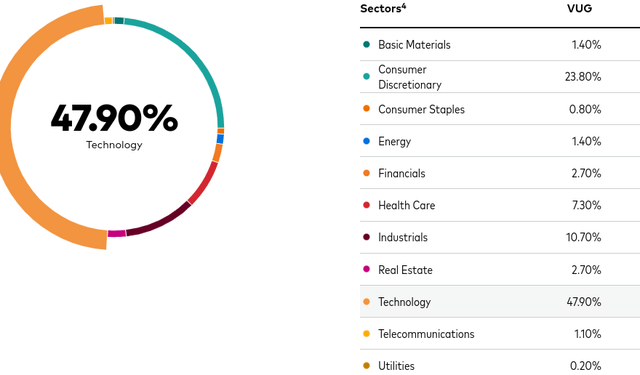

The reason is that growth funds (VUG and others) are heavily Tech-weighted. In fact the Tech sectors represents almost half of total fund assets, as shown below:

VUG’s Sector Weightings (Vanguard)

Again, I am not saying that readers need to flee the sector, but we have to be realistic about what this entails. Specifically, Tech and “growth” options are getting disproportionately hit when inflation readings come in hot. This is because higher than expected inflation leads markets to anticipate a more hawkish Fed. This is generally bad for growth themes.

As an example, when August’s CPI figure came in above expectations, the NASDAQ 100 Index led the market’s declines with a drop near 5%:

NASDAQ 100 Performance (Bloomberg)

Inflation and a re-set of interest rate expectations (to the upside) has been taking its toll on VUG. This is why the fund’s strong gain since my last article has dwindled. The past month has been an experiment in what happens when market expectations are not met, and the result has not been pretty.

Of course, if one expects inflation to moderate and the Fed to shift more dovish, that VUG is precisely the fund you want to be buying. It has seen a sharp drop and a correction to the upside would be in the cards. But my outlook for inflation is that it will remain high for the next few months, and probably longer. I don’t see a great catalyst to shift the Fed’s action through 2022, and that makes me more cautious on VUG as a result.

The Market Believes Tough Times Are Ahead

Beyond just recent market performance, there are other factors at play that make me a little nervous on getting too risk-on at this juncture. A play on U.S. Tech/Growth shares basically means one is optimistic about economic growth in the U.S. and corporate profits. When markets are bullish, VUG will perform well because the “growth” expectations are predicted to translate into real gains in the future. When markets are bearish, suddenly those growth opportunities are not as attractive. In the latter environment, investors tend to favor companies with more stable revenue streams and that hurts the multiples investors are willing to place on the underlying shares in VUG’s portfolio.

The concern now is that credit markets suggest challenging times ahead. A common indicator to monitor is a yield curve inversion, which often acts as a predictor of either a recession or general economic distress. While the gap between the 2-year Treasury and the 10-year Treasury is the most common barometer, there are also other yield spreads we should focus on. Of note right now is the gap between the 2-year Treasury against the 30-year Treasury. This yield curve inverted last week, to a level not seen since 2000:

Inversion of 2-Year to 30-Year Treasury (Yahoo Finance)

This is another signal that caution should be the rule for the time being. The market clearly is anticipating a weaker macro-economic environment going forward. If that sentiment continues and/or if declining growth materializes, then funds like VUG are almost certain to under-perform.

Inflation Is The Thorn – Who Knows When It Will End

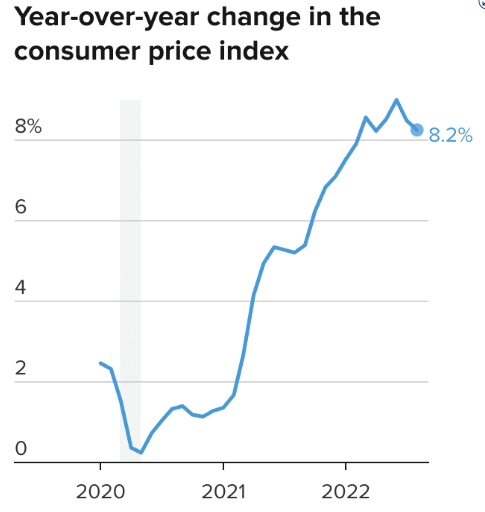

As the famous Guns N’ Roses song goes “Every Rose Has Its Thorn”, and that has been the case with growth funds in the past month. This “thorn” is inflation. This is critical because the concerns about economic growth, the yield curve inversion, and a more hawkish Fed are all the after effects from inflation. If inflation cools, the picture for equities is much brighter. But that has not been the case of late.

In fact, August’s CPI reading showed us that inflation is not a thing of the past. It remains as red hot as ever, continuing a consistent trend in 2022:

CPI Annual Change (CNBC)

My takeaway from this is that the “thorn” (inflation) impacting growth funds is as relevant today as it was earlier this year. Is relief in sight? Possibly. But we have to remember that for a while energy prices were the main driver of inflation. But in August’s report the energy index fell 5.0% from July, led by declines in gasoline. However, food prices rose, and also energy inputs, such as electricity and natural gas, saw increases. The simple reality is this thorn is one that will be with us through 2022, and that supports my downgrade of VUG.

The Story Isn’t All Bad, Retail Investors Stand Ready To Buy

Through this review I have probably sounded quite bearish. But let us remember I placed a “hold” rating on this fund, not a “sell”. So there has to be some reasons for optimism too, right?

The answer to this is yes. I do not see an extremely weak macro-picture that suggests investors need to flee en masse. Do I have concerns, especially when it comes to VUG? That should be clear. But I don’t want to paint an overly bleak picture either. Further gains could absolutely be ahead, so it would be wise for investors to keep at least some exposure to risk-on assets.

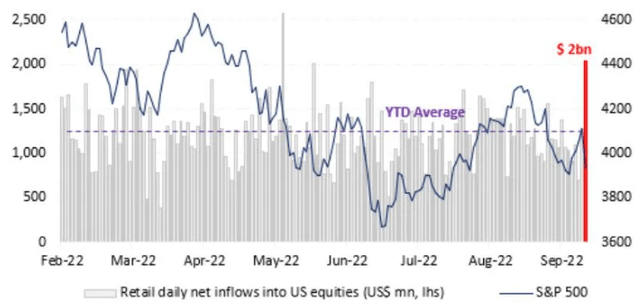

One reason why has to do with retail investor activity that I have been seeing lately. On down days, individual investors are stepping up in a big way. They must be sitting on some cash and, even more importantly, are willing to put it to work when they see big down days. Case in point is last week, when the major indices saw their worst day since March 2020. Despite the uncertainty that probably played on sentiment, retail investors stepped up big. They plowed cash in to Tech and large-cap ETFs at an aggressive pace:

Retail Investor Inflows (net) (Bank of America)

The conclusion I draw here is that we may be reaching some support levels in the market. The major indices are well off their highs, but there seems to be plenty of investor interest to pick up shares when the market has large drops. That can bode well in the coming months if we have indeed found a bottom in stock prices, so it makes sense to keep a fair level of exposure for the time being.

Wages Support Consumer Discretionary

My final point looks at the Consumer Discretionary sector, which is VUG’s second largest by weighting. While Tech does dominate this fund, consumer-oriented plays make up over a quarter of assets – so this is still a critical focus area for investors in this fund.

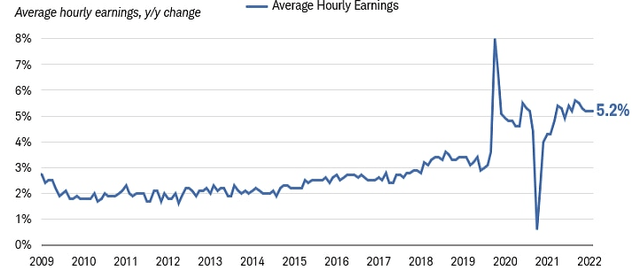

On this note, there are some reasons for optimism too. Inflation again has been a sore point here, dampening consumer and household sentiment and forcing a decline in retail sales in real terms. However, wages have been rising for American workers. The pace of the increase is not keeping up with inflation, but the gain of 5% is still healthy:

American Wages (Charles Schwab)

What this suggests is that if inflation does moderate or even decline, Americans are going to be in a very good position. Wages are up and labor participation has been rising as well. This dynamic is supportive of the consumer sector, and that is a positive for VUG.

Bottom-line

VUG had seen a large, short-term gain only to come under pressure as inflation came in red hot and the Fed reiterated a hawkish stance. While the fund is still up 5% since my last review, I am cautious now going forward. Inflation, Fed rate hikes, and yield curve inversions are all forcing me to downgrade my outlook for growth funds. Yes, there are some bright spots to be found, especially among the American consumers. But I’m not sure that will be enough to wrap up 2022. As a result, I believe a move to “hold” is warranted for this fund, and I suggest investors approach any new positions cautiously at this time.

[ad_2]

Source link