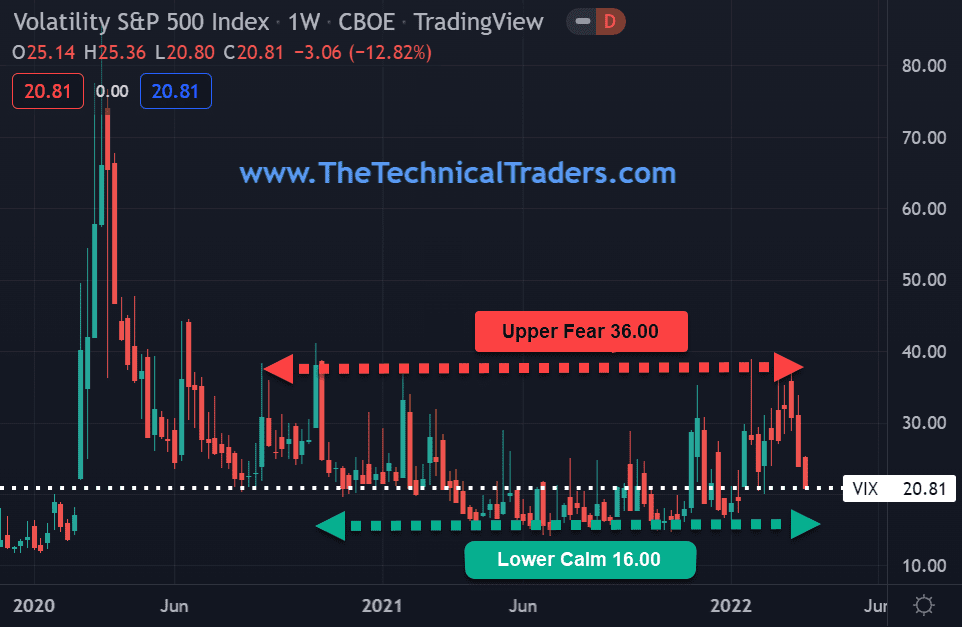

The (VIX) is a real-time index. It’s derived from the costs of index choices with near-term expiration dates which might be utilized to generate a 30-day ahead projection of volatility. The VIX permits us to gauge market sentiment or the diploma of concern amongst market individuals. Because the Volatility Index, VIX goes up, concern will increase, and because it goes down, concern dissipates.

Commodities and equities are each exhibiting renewed power on the heels of worldwide rate of interest will increase. Inflation exhibits no signal of abating as vitality, metals, meals merchandise, and housing continues their upward bias.

Over the last 18-months, the VIX has been buying and selling between its higher resistance of 36.00 and its decrease help of 16.00. Because the Volatility Index VIX falls, concern subsides, and cash flows again into shares.

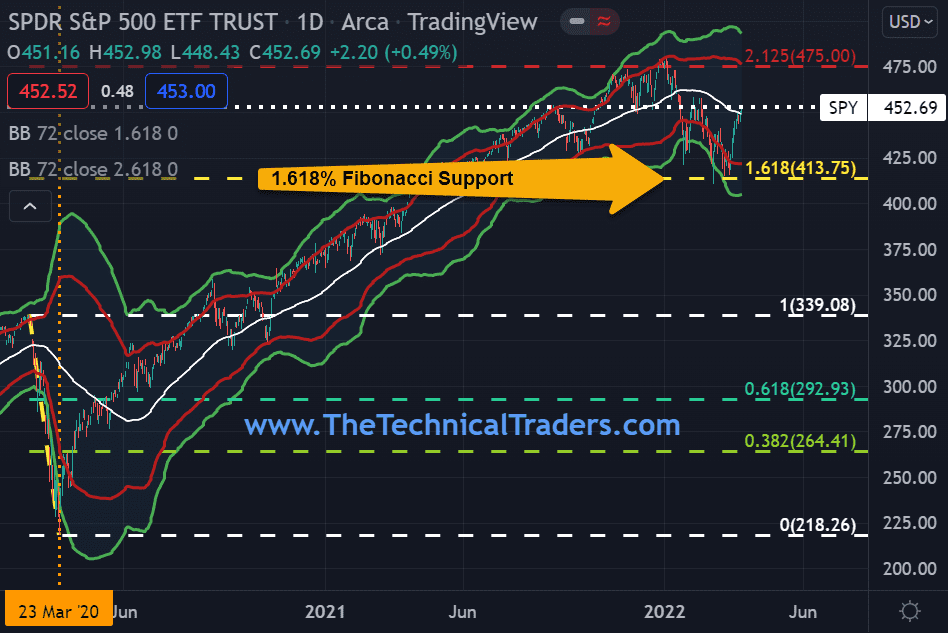

SPY Rallies +10%

The SPDR S&P 500 (NYSE:) has loved a pointy rally again up after touching its Fibonacci 1.618% help primarily based on its 2020 COVID worth drop. Cash has been flowing again into shares as buyers appear to be adapting to the present geopolitical surroundings and the change in world central financial institution lending charge coverage.

Resistance on the SPY is the early January excessive close to 475, whereas help stays solidly in place at 414. March marks the 2nd anniversary of the 2020 COVID low that SPY made at 218.26 on March 23, 2020.

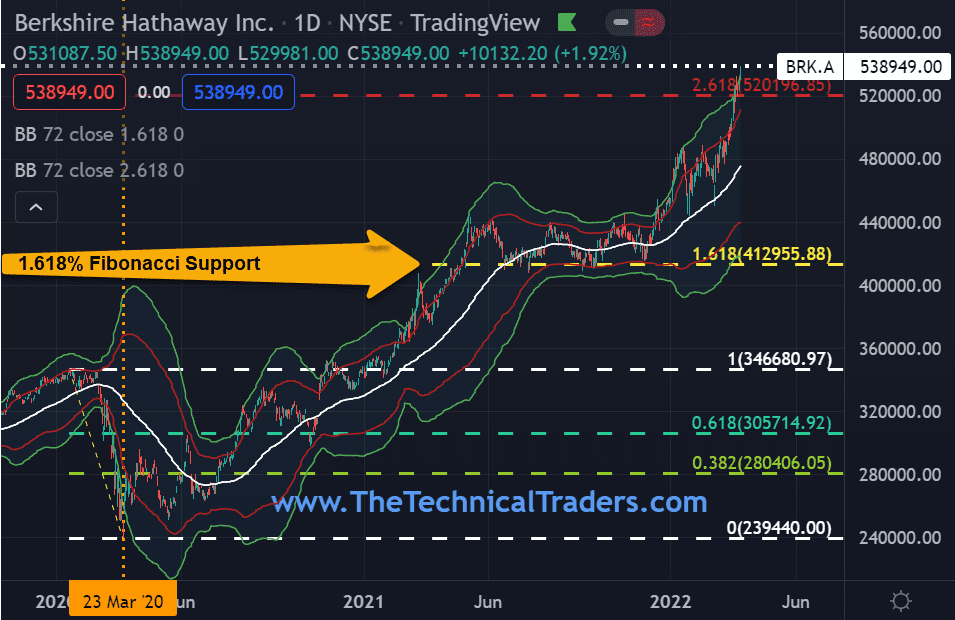

Berkshire Hathaway Hits Report-Excessive $538,949

Berkshire Hathaway (NYSE:)is up +20.01% yr thus far in comparison with the S&P 500 -4.68%. Berkshire’s Warren Buffet has additionally been on a purchasing spree, and buyers appear to be comforted that he’s shopping for shares once more. Buffet reached a deal to purchase insurer Alleghany (NYSE:) (y) for $11.6 billion and bought almost a 15% stake in Occidental Petroleum Company (NYSE:), price $8 billion.

These acquisitions appear to be well-timed as insurers and banks have a tendency to profit from rising rates of interest, and Occidental generates the majority of its money circulate from the manufacturing of .

As technical merchants, we glance completely on the worth motion to offer particular clues as to the present development or a possible change in development. With that mentioned, Berkshire is a traditional instance of not combating the market. As Berkshire continues to make new highs, its’ development is up!

Commodity Demand Stays Sturdy

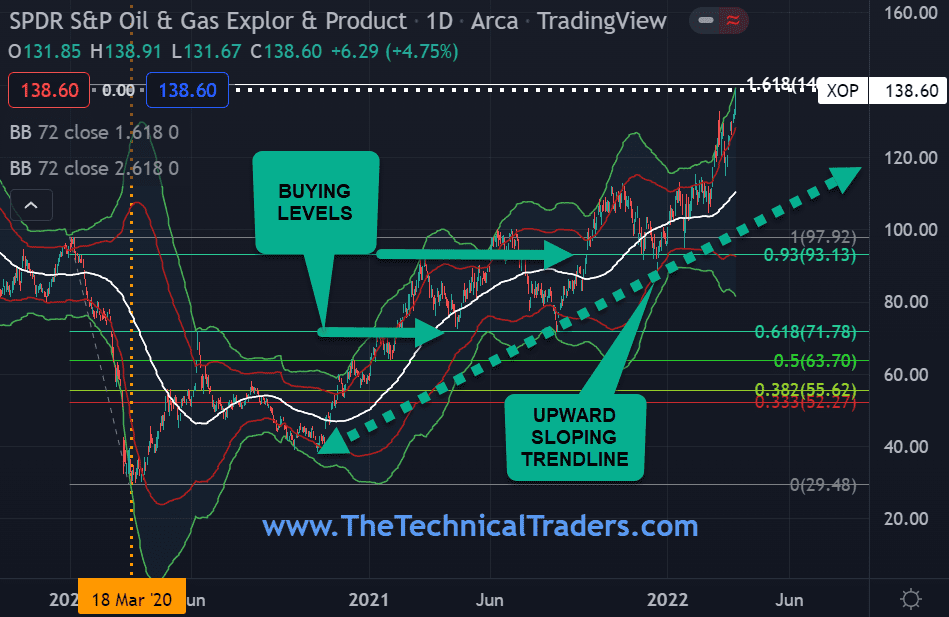

continues to run at 40-year highs, and it seems that it’ll take multiple FED charge hike to subdue costs. Since worth is King, we undoubtedly wish to experience this development and never battle it. It’s all the time good to purchase on a pullback, however the vitality markets at this level look like rising exponentially. The SPDR® S&P Oil & Gasoline Exploration & Manufacturing ETF (NYSE:) gave us some good shopping for alternatives earlier on the Fibonacci 0.618% $71.78 and the 0.93% $93.13 of the COVID 2020 vary high-low.

Bear in mind, the development is your buddy, as many a dealer has gone broke making an attempt to choose or promote a prime earlier than its time! Effectively-established uptrends just like the XOP are good examples of how using a trailing cease can maintain a dealer from getting out of the market too quickly however nonetheless supply safety in case of a sudden development reversal.