Up to date on March fifteenth, 2022 by Nikolaos Sismanis

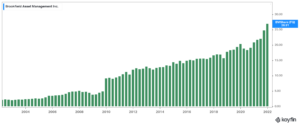

Viking International Buyers is a Connecticut-based hedge fund, specializing each in early-stage firms and mature equities, with round $34.4 billion of Belongings underneath Administration (AUMs).

The corporate was based by Norwegian-born Andreas Halverson who turned a billionaire rising the fund since its inception in 1999. Andreas nonetheless manages the fund as of as we speak, with the vast majority of the funds being allotted in customary particular person equities.

Buyers following the corporate’s 13F filings during the last 3 years (from mid-February 2019 by way of mid-November 2022) would have generated annualized whole returns of 17.24%. For comparability, the S&P 500 ETF (SPY) generated annualized whole returns of 18.17% over the identical time interval.

Be aware: 13F submitting efficiency is completely different than fund efficiency. See how we calculate 13F submitting efficiency right here.

You’ll be able to obtain an Excel spreadsheet (with metrics that matter) of Viking International Buyers by clicking on the hyperlink beneath:

Hold studying this text to study extra about Viking International Buyers.

Desk Of Contents

Viking International Buyers’ Funding Technique

All through the years, Viking has stayed constant in making use of a research-intensive, long-term centered funding strategy. On the core of its funding choice course of is key evaluation to make sure that its equities are resilient and in a position to ship strong long-term returns.

Throughout this course of, Viking will typically assess a enterprise’s mannequin and financials, its administration caliber, and the general business development of its sector.

Moreover, Viking’s funding analysis and decision-making processes are decentralized. Nonetheless, threat administration is centralized. In different phrases, Viking is ready to capitalize on a number of distinctive concepts introduced in by its analysts, whereas the fund’s prime administration is to make sure that stated concepts stay balanced, risk-adjusted, and accountable.

This distinctive operational mannequin permits the fund’s skilled managers to navigate Viking’s portfolio and capital allocation in direction of market-beating returns. On the similar time, its investing professionals can solely concentrate on figuring out distinctive funding concepts with out worrying about coping with points akin to hedging, threat administration, and general efficiency.

Contemplating the fund’s previous 3-year efficiency, its funding technique has been paying off nicely, even when it has barely underperformed the general market. Traditionally, Viking’s goal of delivering best-in-class efficiency for its traders has been principally profitable.

Viking’s High 10 Most Important Investments

Viking’s public-equity portfolio is comprised of a number of 68 particular person equities. Whereas that is fairly a diversified portfolio, its prime 10 holdings make up simply over 42.1% of its whole weight. The fund’s largest holding is T-Cellular U.S. (TMUS), during which the corporate has allotted round 7.3% of its whole capital.

Supply: Viking’s 13F submitting, Creator

T-Cellular US, Inc. (TMUS)

T-Cellular has had a spot in Viking’s portfolio since early 2020. With T-Cellular buying Dash final 12 months, the corporate ought to be capable to actively compete with AT&T (T) and Verizon (VZ). Because of the synergies to be unlocked, the corporate ought to endure a progress part over the following few quarters. Revenues rose by 2.2% to $20.8 billion in the latest quarter, with service revenues rising to $15 billion.

Administration raised its merger synergy forecasts following the continuing integration progress. Round 50% of Dash’s buyer site visitors is now carried on the T-Cellular community, whereas roughly 20% of Dash clients have been moved over.

The corporate introduced that the merger synergies amounted to $3.8 billion in full-year 2021, almost 3x larger year-over-year, exceeding administration’s steerage. On account of elevated investor expectations, the inventory’s valuation a number of has expanded, at the moment at a ahead EV/EBITDA a number of of 8.7.

The inventory at the moment occupies round 7.3% of Viking’s portfolio. The fund elevated within the firm by 28% through the earlier quarter. T-Cellular is now the fund’s largest holding.

Humana Inc. (HUM)

Humana provides medical and supplemental profit plans to people. The corporate additionally has a contract with Facilities for Medicare and Medicaid Providers to manage the Restricted Revenue Newly Eligible Transition prescription drug plan program in addition to contracts with quite a few states to supply Medicaid, twin eligible, and long-term assist providers advantages.

The corporate has been rising its prime and backside line constantly through the years. Buyers should be cautious, nevertheless, of the corporate’s low-margin enterprise mannequin, as is the case with nearly all of its business friends.

Humana is Viking’s second-largest holding, accounting for round 4.9% of its whole public-equity portfolio.

Brookfield Asset Administration (BAM)

Brookfield Asset Administration (BAM) is a number one international various asset supervisor and one of many largest international traders in actual belongings – which incorporates actual property, renewable energy, infrastructure, and personal fairness. The corporate is headquartered in Toronto, Canada, and manages a portfolio of private and non-private funding merchandise for each institutional and retail purchasers.

BAM additionally manages 4 publicly traded listed partnerships: Brookfield Property Companions (BPY), Brookfield Infrastructure Companions (BIP), Brookfield Renewable Companions (BEP), and Brookfield Enterprise Companions (BBU). Brookfield turns into extra helpful over time because it will increase the earnings from its asset administration actions and the worth of its invested capital.

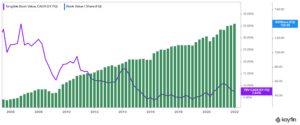

Brookfield’s long-term progress has been nothing wanting exceptional, based mostly on the next compounded progress metrics from 1999 to 2021: guide worth, 11%; FFO per share, 16%; belongings underneath administration, 18%; stability sheet belongings, 15%; shareholders’ fairness, 18%; charges and annualized carry, 24%. Importantly, this progress has been achieved with little or no dilution.

Brookfield Asset Administration is Viking’s third-largest holding, comprising 4.4% of its public fairness portfolio.

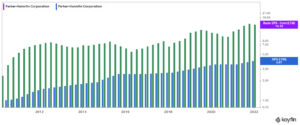

Parker-Hannifin Company (PH)

Parker-Hannifin is a diversified industrial producer specializing in movement and management applied sciences. The corporate was based in 1917 and has grown to a market capitalization of $35.9 billion with annual revenues of over $14 billion.

Parker-Hannifin has paid a dividend for 71 years and has elevated that dividend for a exceptional 65 consecutive years.

The corporate is on the unique Dividend Kings record.

Since 2010, Parker-Hannifin has greater than tripled its earnings-per-share. The expansion trajectory of the corporate slowed final 12 months because of the international pandemic. Nonetheless, Parker-Hannifin has recovered fairly swiftly.

Parker-Hannifin is Viking’s fourth-largest holding, comprising 3.9% of its public fairness portfolio.

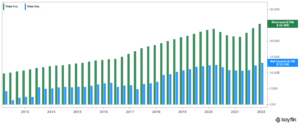

Visa (V)

Visa is the world’s chief in digital funds, with exercise in additional than 200 nations. The inventory went public in 2008 and its IPO has confirmed to be probably the most profitable in U.S. historical past. The corporate’s international processing community supplies safe and dependable funds around the globe and is able to dealing with greater than 65,000 transactions a second. Within the fiscal 12 months 2021, the corporate generated almost $12.3 billion in revenue.

On January twenty seventh, 2022, Visa reported Q1 fiscal 12 months 2022 outcomes for the interval ending December thirty first, 2021. (Visa’s fiscal 12 months ends September thirtieth.) For the quarter, Visa generated income of $7.1 billion, adjusted web revenue of $3.9 billion, and adjusted earnings-per-share of $1.81, marking will increase of 24%, 25%, and 27% respectively.

These outcomes had been pushed by a 20% achieve in Funds Quantity, a 40% achieve in Cross-Border Quantity, and a 21% achieve in Processed Transactions. Throughout the quarter Visa returned $4.9 billion to shareholders by way of dividends and share repurchases. As well as, in December of 2021, the board of administrators licensed a brand new $12.0 billion share repurchase program.

Visa is Viking’s fifth-largest place. It accounts for 3.8% of its whole holdings.

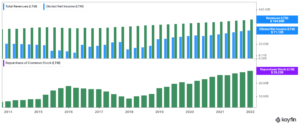

Microsoft (MSFT):

Discovered amongst the highest holdings of the vast majority of the funds we’ve got lined, Microsoft is Viking’s sixth-largest holding, occupying ~3.8% of its portfolio. The fund trimmed its place by 19% through the quarter.

Microsoft is a mega-cap inventory with a market capitalization of $2.07 trillion.

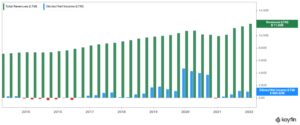

Supported by the corporate’s robust profitability, administration has been constantly elevating buybacks over the previous decade to additional reward its shareholders. The quantity allotted to inventory repurchases has reached new all-time highs over the previous 4 quarters, at almost $29.2 billion.

Income progress stays within the double-digits, so it’s prone to see capital returns accelerating shifting ahead. The corporate can be rising the dividend at a double-digit fee, although on the present yield, which stands beneath 1%, traders ought to count on the vast majority of their future returns within the type of capital positive factors.

Regardless of that, Microsoft’s money place has been rising regularly, with the corporate at the moment sitting on prime of an enormous $125.3 billion money pile.

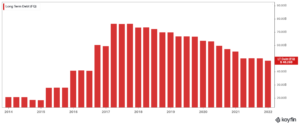

Additional, whereas many firms have chosen to make the most of the present ultra-low rates of interest to lift low cost debt and purchase again inventory, Microsoft’s strategy has been prudent and considerate. Not solely are present earnings extensively masking buybacks (~60% buyback “payout ratio”), however long-term debt has been considerably decreased from $76 billion in mid-2017 to round $48.2 billion as of its final report.

It’s spectacular {that a} inventory with a market capitalization of $2.07 trillion nonetheless has such a robust progress momentum. Shares are additionally buying and selling a P/E ratio of round 34.6, which can be wealthy. Nonetheless, resulting from Microsoft’s strong progress and financials, it’s doubtless that traders will proceed pricing shares at a premium going ahead.

Amazon.com Inc. (AMZN)

Amazon is Viking’s seventh-largest holding, comprising 3.8% of its whole portfolio. The fund boosted its place by 37% over the past quarter.

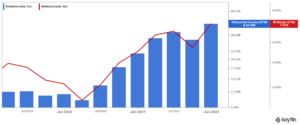

Amazon delivered one other strong quarter lately, with This autumn AWS web gross sales up 40% YoY to $17.78 billion, topping the $17.23 billion consensus estimate. Revenues grew to $137.4 billion, a 9.4% enhance YoY, contributing to all-time excessive LTM (final twelve months) gross sales of $469.8 billion.

On account of scaling its operations, the corporate’s web revenue margins reached 7.1% through the previous twelve months, turning Amazon into an more and more worthwhile firm. The inventory is at the moment buying and selling at a P/E of 60.3 based mostly on this 12 months’s projected web revenue, however contemplating its EPS progress, the corporate will doubtless develop into its valuation.

The inventory has had a spot in Viking’s portfolio since Q2-2015.

Boston Scientific Corp (BSX):

Boston Scientific is Viking’s eighth-largest holding, accounting for round 3.6% of its public fairness portfolio. It’s a comparatively new place for the fund, initiated throughout Q3 of 2018. The corporate continues to generate strong outcomes through the present occasions stuffed with uncertainty. Final 12 months, the corporate generated all-time excessive revenues of $11.89 billion.

Shares are at the moment buying and selling a ahead P/E of 23.7 at the moment. Whereas the inventory is certainly not low cost, analysts count on robust EPS progress within the subsequent couple of years.

Viking boosted its place in Boston Scientific by 176% through the newest quarter.

Chubb Ltd. (CB)

Chubb Ltd is a world supplier of insurance coverage and reinsurance providers headquartered in Zurich, Switzerland. The corporate supplies insurance coverage providers together with property & casualty insurance coverage, accident & medical health insurance, life insurance coverage, and reinsurance. The present model of Chubb was created in 2016, when Ace Restricted acquired the ‘previous’ Chubb and adopted its identify. American traders can provoke an possession place in Chubb by way of shares listed on the New York Inventory Alternate, the place they’re traded with the ticker image CB.

Chubb reported its fourth-quarter earnings outcomes on February 1. The corporate reported that its revenues totaled $9.3 billion through the quarter, which was 11% greater than the revenues that Chubb generated through the earlier 12 months’s quarter. Web written premiums had been up 10% year-over-year in Chubb’s P&C phase, which was consistent with progress recorded within the earlier quarter. Chubb was in a position to generate a web funding revenue of $900 million through the quarter, which was down barely on a sequential foundation.

Chubb generated earnings-per-share of $3.81 through the fourth quarter, which was simply forward of what the analyst neighborhood had forecasted. Chubb’s strong profitability through the quarter may be defined by a really wholesome mixed ratio, regardless of some pure disasters that impacted Chubb’s disaster losses. Due to written premium progress and tailwinds from share repurchases, Chubb’s earnings might be robust within the coming quarters as nicely, except the corporate feels an influence from above-average disaster losses, which typically aren’t predictable. Chubb’s guide worth was up significantly through the interval, ending the quarter at $140.00.

Viking elevated its place in Chubb by 21% through the earlier quarter.

Centene Company (CNC)

Centene has been in Viking’s portfolio for just a few years now. The fund initiated its place throughout Q2-2018. Centene capabilities as a multi-national healthcare firm that implements applications and providers to under-insured and uninsured people in america. The corporate’s reasonably priced providers have helped it develop its revenues quickly through the years.

Be aware, nevertheless, that whereas the inventory appears fairly low cost at a ahead P/E of simply 15.5, the enterprise mannequin’s margins are extraordinarily skinny. Web margins hover within the very low single digits. Due to this fact, profitability might be damage if bills had been to rise.

Centene is Viking’s tenth-largest holding. The fund trimmed its place by round 12% through the earlier quarter.

Closing Ideas

Viking’s 68-stock portfolio is well-diversified, with a robust capital allocation in direction of healthcare.

Supply: Viking’s 13F submitting, Creator

The corporate’s research-intense philosophy and distinctive separation of its opportunity-identification and execution groups have been in a position to yield near-market returns over the previous few years.

As a result of a big proportion of the corporate’s AUMs are allotted in direction of particular person equities, Viking is likely one of the easier-to-replicate funds by retail traders. Nonetheless, Viking’s stock-picking requires extra due diligence, because the fund’s investments may symbolize hedging methods or different non-profit-targeting positions.

Having stated that, Viking’s prime 10 investments are product of reliable, long-term funding companies, most of which have demonstrated many years of shareholder worth creation.

Extra Sources

See the articles beneath for evaluation on different main funding companies/asset managers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].