Sergii Zhmurchak/iStock Editorial by way of Getty Photographs

Expensive readers/followers,

Ask anybody who is aware of what Vestas Wind Techniques A/S is (OTCPK:VWDRY) and so they’ll probably have some robust opinions about whether or not you need to be investing within the enterprise or not. I’m no completely different. I feel Vestas Wind is a very good total enterprise, however I am uncertain of the near-term future, which makes me uncertain of how far the corporate will fall previous to recovering its momentum. The corporate additionally does not have one of the best present fundamentals or monitor file, additional impairing the conservative upside that I see for it.

Nonetheless, ought to this firm get well and see the revenue traits administration considers to be probably, your upside may very well be huge. Let me present you the 2 methods of viewing Vestas Wind Techniques.

Vestas Wind Techniques – Reviewing the corporate

Vestas is older than you suppose. The corporate was really based again in 1945, and presently operates amenities and manufacturing throughout the globe, with operations in most continents. It is the biggest Wind Turbine firm on this planet, and some years in the past, it reached a milestone of putting in nearly 70,000 generators in whole for a capability of over 100 GW in over 80 international locations.

The corporate’s roots return all the best way to 1898 – although on the time it had nothing to do with wind generators, as a substitute specializing in manufacturing home equipment, agricultural tools, intercoolers, and cranes. It didn’t enter the wind turbine business till 1979, and at first, it was a small a part of its operation.

In 2003, it merged with NEG Micon, which already on the time resulted within the largest wind energy producer on this planet. The corporate has been extra unstable than you would possibly anticipate for a market chief although, and went by way of a number of intervals of losses and recoveries.

Some primary information to start with right here.

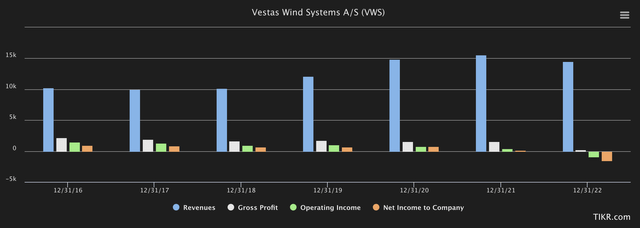

Vestas usually operates a enterprise that generates between €10-€15B price of revenues which usually comes by way of COGS to a Gross margin of round 10-18%, by way of OpEx to an OM of round 8-13% and settles at a internet earnings margin between 5-7%. This isn’t what has occurred in 2021 and 2022 although, which noticed the corporate undergo extreme declines in earnings, if not margins. Nonetheless, you already know what I take into consideration revenues with out strong margins – and that is just about precisely what Vestas presently has.

Vestas Margins (TIKR.com/S&P International)

So why this growth? In a phrase, macroeconomics. Or the strain, fairly from macro. The Ukraine/Russian conflict has not been sort to the corporate, and value inflation and SCM have pushed this firm’s prices up, whereas driving earnings into the bottom, fairly than as an ESG-driven setting may be anticipated to, see earnings develop.

As of the most recent yr of 2022, it has resulted in gross margins of 1.92%, with each different revenue margin destructive. This makes the corporate one of many least worthwhile companies in all the industrial house, which isn’t sort. It additionally implies that warning indicators are flashing throughout the spectrum, with OI at a loss, property rising quicker than revenues, a low security rating, and new issuances of debt. It additionally has a poor file of inventory buybacks, and rev/share in decline, and regardless of this, the worth for the inventory is comparatively excessive.

Are you beginning to see why I’m not as optimistic concerning the firm as another contributors on Searching for Alpha have been, and why I’m not “Pounding the desk” on the corporate right here?

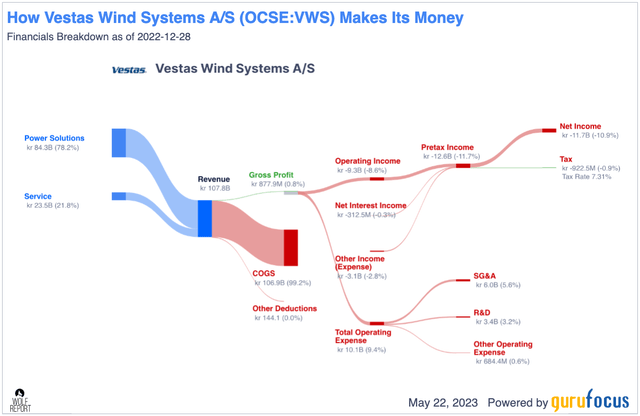

Vestas makes its cash from two segments.

- It builds turbines

- It providers its merchandise.

Fairly easy, proper? These come within the type of the Energy options and the service sector – sadly, that is all presently nearly within the destructive.

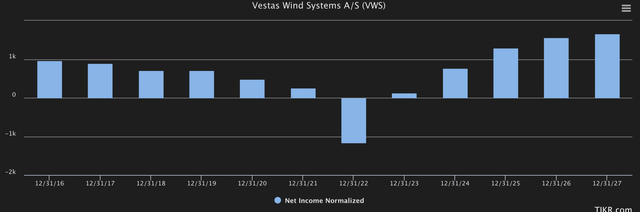

Vestas income/internet (GuruFocus)

Not precisely a flattering image, regardless of how “good” the corporate may be exterior of those traits. That is not one thing you wish to see, as a result of what it reveals you is an organization mainly fully unable to make a revenue from a 100B DKK income. ROIC internet of WACC went optimistic on the highest stage again in 2016. Since then it has been on a gentle decline. It went destructive in -19 and has stayed destructive since. The newest quantity for 2022 involves a destructive ROIC internet of WACC of -18%, which is, not mincing phrases, an abysmal consequence for a corporation like this.

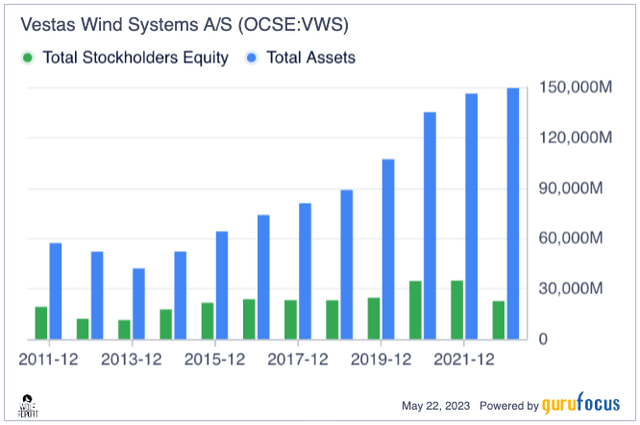

This has in flip taken deep bites out of shareholder fairness, the place the portion of stockholders’ fairness is now on the lowest stage for a lot of a few years, wanting on the whole % of firm property.

Vestas SE (GuruFocus)

All of this stuff are basically small worrying “blips” on the radar. Identical factor with the entire lack of insider exercise. Taken at face worth on their very own, their indicative worth is low. Taken collectively and checked out over time, I see an organization in critical decline. My query turns into “When and the way does it flip round?”

As a result of I consider it will possibly – or I might not be writing this text.

Vestas must exit Russia. It has operations there. It additionally must combat inflation, and people pressures have gotten more and more pervasive. Allowing can also be tougher on this setting, which implies that total, it is not a great set of situations for any sort of mission completion. That is, in fact, a major drawback for a enterprise like this one.

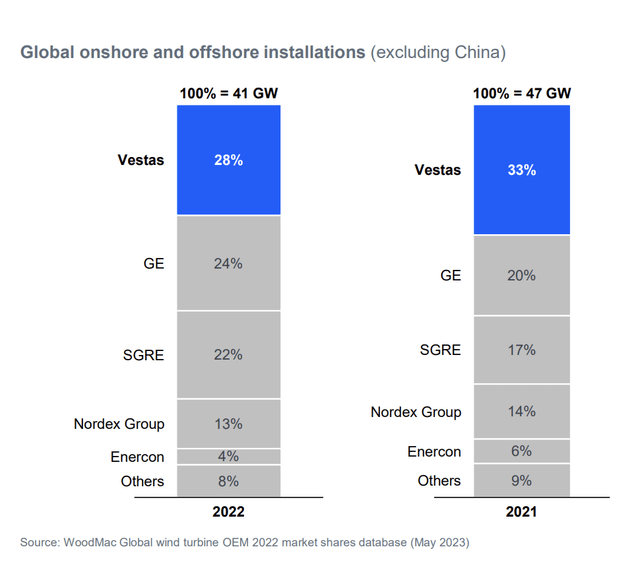

Nonetheless, Vestas remains to be the market chief – even when their market share is definitely shrinking at a fairly worrying tempo when whole installations for 2022.

Vestas IR (Vestas IR)

The service phase is seeing maybe the bottom quantity of strain, with a well-filled backlog of over €31B, and 147 GW below presently energetic contracts. Out of these, 136 are onshore, which makes for simpler servicing, with a mean contract length of 11 years. Nonetheless, so long as the corporate does not earn money on this stuff, their contracts and backlogs do not likely matter. A enterprise is barely a strong enterprise if it manages to squeeze sufficient internet revenue from its revenues to not solely pay its individuals but additionally its shareholders/traders – in any other case, what is the level? There isn’t a worth added.

Fortunately, 1Q23 is seeing important exercise in main power markets internationally. The corporate has seen an order consumption of fifty MW in the course of the quarter, with a complete mission pipeline of 32 GW. There’s nothing improper with the variety of orders the corporate has. The issue is the main points of the contracts, their adjustability for margins, and their points with legacy tasks like many firms presently have, aren’t extensively recognized.

The positives for the 1Q23 interval embody a income enhance of 14% YoY. The corporate is lastly rising costs, and these worth will increase are lastly discovering their manner from the highest line and downward. This has resulted in GM enhancements, however this 755% enchancment is from a stage of basically zero, so it actually does not depend. The corporate went EBIT-positive once more, however it actually ought to by no means have gone destructive within the first place – so once more, does not actually matter. Internet revenue is optimistic, however the level is that it is optimistic at €16M at a income of €2.8B. That corresponds to a quarterly internet revenue margin of 0.56%, which remains to be abysmal, and leaves Vestas with quite a bit to do.

Profitability enhancements solely make the corporate extra engaging if we will see it returning to a stage that is smart to put money into.

Let’s take a look at present valuations and forecasts.

Vestas Valuation – so-so, I am going to keep on with my choices

I did not undergo a lot of the minutia of the corporate right here, as a result of frankly, you don’t want particulars right here. All it’s good to know is that the corporate actually, from a basic monetary perspective, is not that investable as I see it. Far too usually we bathroom down in minutia as to what the corporate is predicted to do or get caught up in some romantic model of what the corporate does.

So in the intervening time, Vestas is a profitability-challenged wind turbine producer and repair enterprise. As for analysts, that is what they anticipate the corporate to do popping out of 2023.

TIKR.com Vestas (TIKR.com)

I am not too eager on this forecast. I take into account it a lot too exuberant, given the large restoration in 2024E. Both this comes from the corporate working by way of non-negotiable legacy contracts which in flip will revert margins, or it is mixed with a quantity enhance primarily based on new orders. I consider it presents a far too oversimplified image of the post-Ukraine power sector.

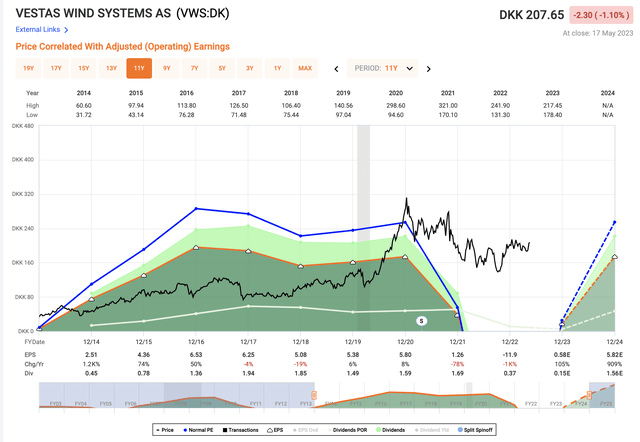

This image merely doesn’t make sense to me – and it is actually arduous to persuade me that an organization with this type of EPS development is price that type of, or any type of premium.

Vestas valuation (F.A.S.T. Graphs)

I do consider in normalization for Vestas – however I consider the normalization will come far slower, impeding progress within the firm. Vestas has been on a principally destructive trajectory since peaking in froth at over 300 DKK, leading to a destructive RoR of 33.35% since 2021. I don’t consider the corporate is finished falling.

That’s the reason I’ve been “backside fishing”. I discover the bottom potential workable cash-secured put choices, and I promote them at good costs to generate Alpha. A few of my earliest Places have been Vestas at strikes of 150-165 DKK/share, the place I might have been pretty content material shopping for the corporate as a longer-term guess.

Present analyst targets?

As frothy as ever – 22 analysts observe the corporate. Out of these 22, we have now a mean PT of 285 DKK from a variety of 188 DKK to 455 DKK. The unfold right here is completely insane. Out of these 22, solely 7 are at “BUY” regardless of what is actually a double-digit upside for the corporate. The remainder of the analysts are very cut up. Most are at “HOLD”, however a good quantity of 6 are both at “SELL” or underperform.

This could add some shade to the in any other case principally bullish image that is being offered right here. I am bullish on the proper worth – however I do not see that 188 DKK native goal as being conservative sufficient to provide me a great upside when the corporate is at destructive EBIT and internet, and I do not see a transparent, near-term catalyst for a important enchancment. Word important. I do consider it can climb, however the upside and bullish thesis relies on a important bounce again. That’s not one thing I presently see – although you are free to argue for it, in fact.

I consider the present macro presents a problematic view for a corporation like Vestas. At finest, I consider we’ll see restoration slowly or at a barely elevated tempo, with optimistic internet earnings trending upward after 2023.

Given the market in the present day, that’s not practically sufficient to make me optimistic on the inventory.

I start with a 165 DKK share worth goal, and name this inventory a “HOLD” right here.

Right here is my present thesis on Vestas.

Thesis

- Vestas Wind is a well-loved Wind Turbine firm that has captured the hearts and minds of many ESG traders. I like the corporate – however provided that it will possibly return to the profitability that we noticed years in the past. I don’t see this simply within the firm’s near-term future.

- I consider a mixture of pricing pressures and at the least momentary development shifts within the power markets will see Vestas proceed to be below strain from non-trivial inflation and working strain, particularly margins. It will stop the corporate from rising again up rapidly, fairly than turning this right into a slower course of in the intervening time.

- For that cause, I’m now at a “HOLD”, and I give the corporate a 165 DKK worth goal. That can also be, not coincidentally, the place I put my CSPs that I exploit to reveal to Vestas.

Keep in mind, I am all about:

- Shopping for undervalued – even when that undervaluation is slight and never mind-numbingly huge – firms at a reduction, permitting them to normalize over time and harvesting capital positive factors and dividends within the meantime.

- If the corporate goes effectively past normalization and goes into overvaluation, I harvest positive factors and rotate my place into different undervalued shares, repeating #1.

- If the corporate does not go into overvaluation however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

- I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them (italicized).

- This firm is total qualitative.

- This firm is essentially protected/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is presently low cost.

- This firm has a sensible upside that’s excessive sufficient, primarily based on earnings progress or a number of growth/reversion.

Not low cost, doesn’t have a excessive upside on a sensible foundation, and the dividend is a bit iffy at the moment. I am not offered on Vestas at the moment, and go “HOLD”.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.