AnthonyRosenberg/iStock Unreleased via Getty Images

I’ve never bought into the allure of the S&P 500 index (SPY) as a primary holding, as I prefer to invest in companies that generate more meaningful income. Despite the recent downturn, the S&P 500 index still yields a paltry 1.5%. This means that even if a retiree were to accumulate a respectable $2 million retirement balance, they would only receive $30K per year from the index fund. That’s hardly enough to everyday living expenses in today’s world.

This brings me to V.F. Corporation (NYSE:VFC), which is an S&P Dividend Aristocrat that’s now trading at prices that were once previously unimagined. This article highlights what makes VFC a quality income buy at present, so let’s get started.

Why VFC?

V.F. Corp. is a global leader in branded lifestyle apparel, footwear and accessories with 40,000 employees worldwide and annual sales of $11.8B. VFC’s product offerings span multiple channels including retail, wholesale and e-commerce. The company’s portfolio of iconic lifestyle brands includes Vans, The North Face and Timberland, which combine to make 80% of its sales.

Despite a challenging operating environment, VFC was able to cast some doubts aside, with revenue up 9% YoY (up 12% on a constant currency basis) to $12.8 billion in its fourth fiscal quarter (ended April 2, 2022). This was driven by encouraging results from VFC’s The North Face brand (27% of total sales), which saw an impressive 24% sales growth (26% constant currency) during the quarter, and 32% sales growth for the full fiscal year 2022. Notably, The North Face’s gross margin is now above pre-pandemic levels on the back of positive operating leverage.

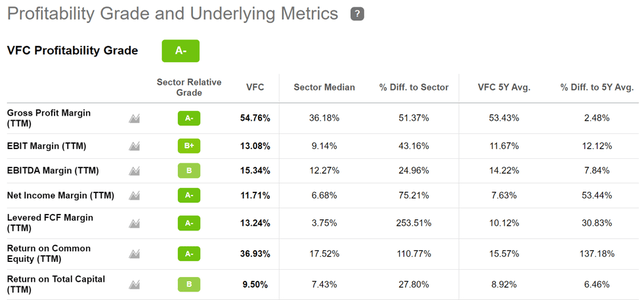

Moreover, VFC is demonstrating strong margins through strong pricing power, with adjusted operating margin up 510 basis points to 13.1% for the full fiscal year 2022. As shown below, VFC scores an A- grade for profitability with a net income margin of 11.7%, sitting well above the 6.7% sector median.

VFC Profitability (Seeking Alpha)

VFC is also notable for its shareholder returns, having returned $1.1B to shareholders during FY22 alone, through $773 million in cash dividends, and $350 million of shares repurchased. VFC is well on its way to becoming a Dividend King after having raised its dividend for 48 consecutive years. Recent price weakness has pushed the yield to 4.2%, and the dividend comes with a safe payout ratio of 64%, all while maintaining an A- rated balance sheet. As shown below, VFC’s dividend yield now sits close to its highest level in over a decade.

VFC Dividend Yield (YCharts)

Risks to the thesis include the potential for a recession, which could result in a pullback in consumer spending. In addition, weakness in consumer spending in China due to the shutdown there may carry over into the current quarter. This was reflected by Vans sales being down in the region in the latest quarter.

Looking forward, management appears confident for FY23, as it’s guided for a 7% revenue increase in constant dollars, to be driven primarily by its larger brands and from emerging brands such as Icebreaker, which generated record revenue in FY’22, and Smartwool, which saw 40% sales growth last year. VFC is also adapting to changing consumer preferences with its omnichannel strategy, as outlined during the recent conference call:

We continue to invest in enhancing the consumer omnichannel experience by adding intelligence to the way we collect, connect, manage and govern cross-channel consumer profiles that provide dynamic segmentation capabilities that serve all direct-to-consumer channels and marketing solutions at the brands.

This has enabled us to provide a true seamless omnichannel experience, allowing brands to build stronger connections and personalize the way we communicate with our consumers, which in turn increases satisfaction, engagement and conversion. Our click to delivery in the U.S. has improved further to just over 2 business days. Investing in our transformation will continue to be a key strategic priority as we look to the future.

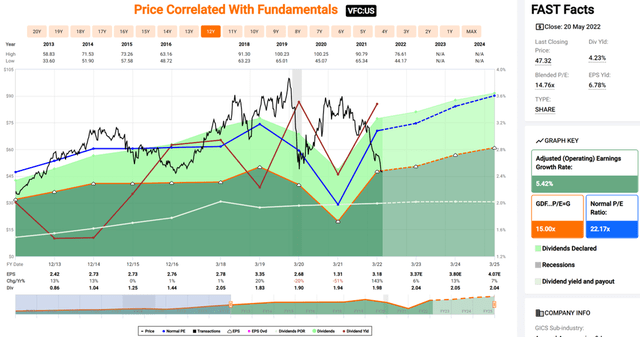

I see VFC as now trading in deep value territory at the current price of $47.32 with a forward PE of just 13.9, sitting far below its normal PE of 22.2 over the past decade. Sell side analysts have a consensus Buy rating with an average price target of $59 and Morningstar has a fair value estimate of $68, implying a potential one year 29-48% total return.

VFC Valuation (FAST Graphs)

Investor Takeaway

VFC is a high-quality company that’s well positioned for the long term. It has strong brands, a diversified portfolio, and a solid balance sheet. It’s also returning cash to shareholders through dividends and share repurchases, and is on its way to becoming a Dividend King. The recent sell-off provides an attractive entry point for long-term value investors.