[ad_1]

Following Saudi Arabia’s Power Ministry announcement, that it’ll lengthen its voluntary manufacturing lower by a million barrels per day till September, with the prospect of extra cuts and additional extensions, oil futures costs rebounded in Thursday’s buying and selling (03/08). The Saudi manufacturing lower retains its crude output at round 9 million barrels per day, the bottom stage in years. Additionally, OPEC crude manufacturing in July fell by -900k bpd to a 1-year low of 27.79m bpd. The OPEC+ Joint Ministerial Monitoring Committee will maintain a web-based evaluation on Friday to gauge the affect of the group’s provide cuts.

As well as, Russia introduced that it’ll scale back oil shipments by 300,000 barrels per day, till September. Beforehand, Russia pledged to chop its crude oil manufacturing by 500,000 barrels per day in August. In the meantime, the US skilled a dramatic decline in shares that brought about the general stage of nationwide oil shares to succeed in the bottom stage since January 2023. US crude oil manufacturing was properly under the February 2020 record excessive of 13.1 million barrels per day.

Apart from the oil manufacturing lower, additionally contributing to the value enhance was the rise in China’s oil imports which was revealed by authorities commerce statistics to have risen +4.6% m/m in June, to 12.72 million barrels per day, the very best in three years.

Technical Overview

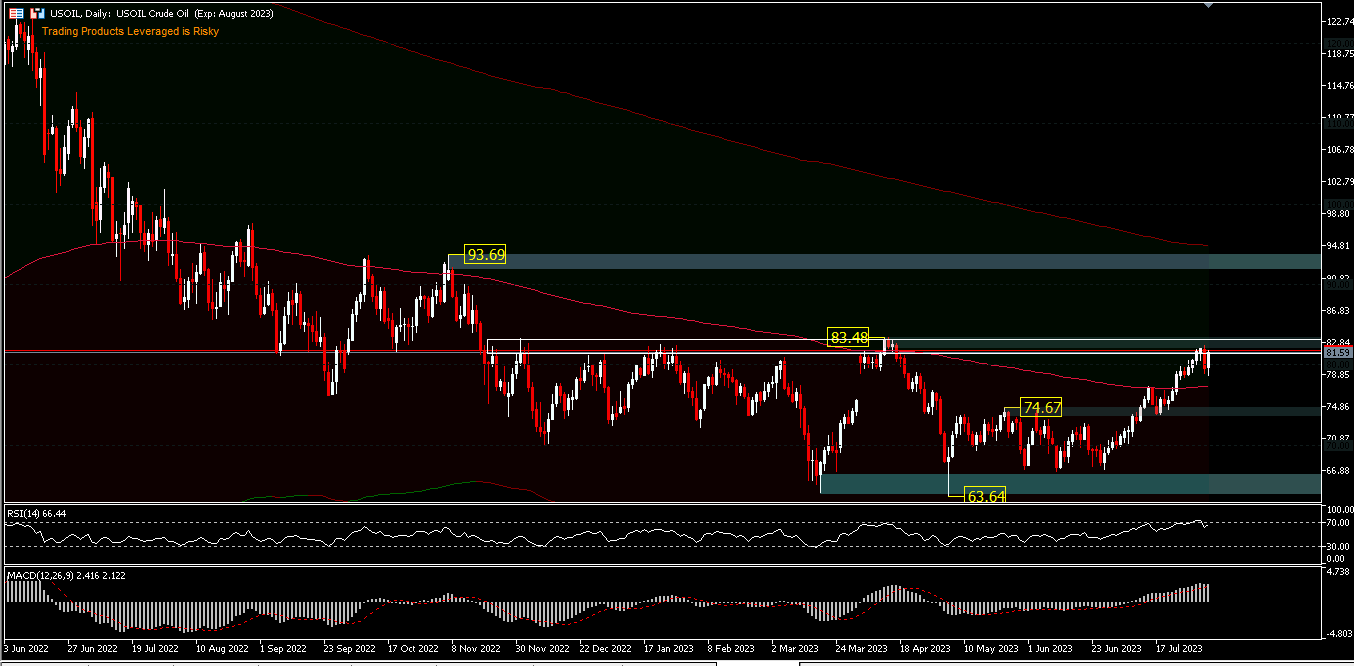

USOIL, D1 rallied over 2% in Thursday’s buying and selling (03/08), after falling on Wednesday. The value is at the moment nonetheless buying and selling above $80.00 with the important thing resistance being at $83.48 which was the very best worth in April. The truth that the extension of manufacturing cuts introduced costs as much as $80.00 doesn’t but point out a big enhance, amid falling Indian crude oil imports. In June Indian imports had been reported down -1.3% y/y to 19.7 MMT, the bottom in 7 months. Whereas the value is at the moment sitting above the 200-day EMA, the RSI has proven shopping for saturation.

MACD continues to be within the purchase zone validating the current rally. A break of the important thing resistance of $83.48 may probably convey an upside to check the resistance of $93.69, however it’s more likely to be matched by elevated demand. Under the 200-day EMA, $74.67 assist or at the least $75.00 could possibly be the maintain that market individuals are eyeing.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Academic Workplace – Indonesia

Disclaimer: This materials is offered as a basic advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link