USD/ZAR PRICE FORECAST:

Advisable by Zain Vawda

Get Your Free USD Forecast

MOST READ: USD/ZAR Rises as SA Reserve Financial institution (SARB) Pauses After 10 Consecutive Hikes

The South African Reserve Banks (SARB) current pause within the climbing cycle was little question met with cheers by many customers domestically, but the Central Financial institution and a few economists feared additional depreciation for the ZAR could also be within the offing. Following an preliminary selloff nonetheless, the ZAR has held agency with USDZAR struggling to reclaim the 18.0000 mark.

US FOMC AND MONETARY POLICY MOVING FORWARD

Trying forward into subsequent week and USDZAR value motion is prone to be pushed by USD elements over the short-term. Usually information releases from South Africa except rate of interest choices don’t have a tendency to maneuver the needle on USDZAR all that a lot.

The FOMC assembly this week had many analysts divided as market members appear to be of the opinion that the Federal Reserve are completed climbing charges for 2023, regardless of Fed Chair Powell leaving the door open for additional tightening.

Fed Funds Chance

Supply: Refinitiv

Earlier as we speak US Core PCE information got here in beneath estimates and falling 0.5% from the Might print of 4.6%. This can clearly be one other win for the Federal Reserve in addition to market members hoping the height charge is in. This clearly follows on from optimistic Q2 GDP information as effectively and with the robustness of the labor market speak of a tender touchdown is prone to speed up.

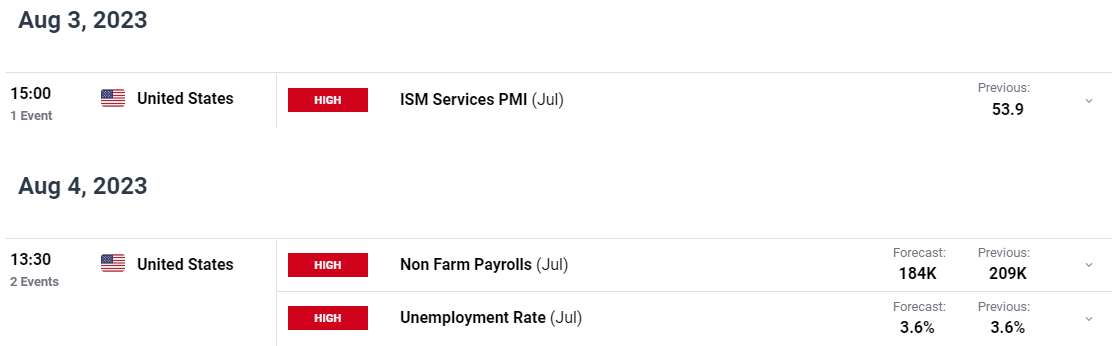

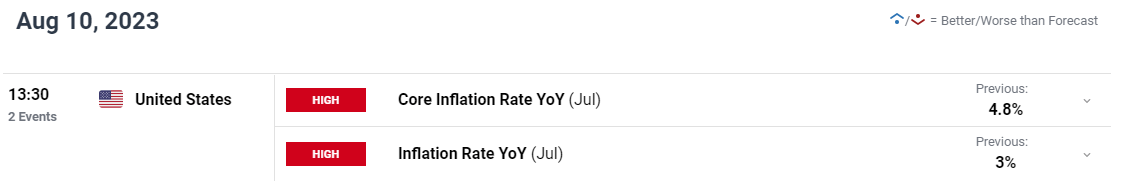

Over the following two weeks US information may maintain the important thing with ISM service PMI adopted the NFP jobs report after which after all the newest US inflation numbers on August 10. These occasions will doubtless be a key driving pressure for the US Greenback over the following 2 weeks and will have an enormous say within the course of USDZAR.

For all market-moving financial releases and occasions, see the DailyFX Calendar

SOUTH AFRICA AND THE RAND MOVING FORWARD

Trying forward for South Africa and the current bout of chilly temperatures has resulted in an uptick in loadshedding. This clearly may weigh on the ZAR and the SA Reserve Financial institution outlook transferring ahead with loadshedding cited as a key space of concern with regard to financial development prospects for the remainder of the 12 months. Eskom having spent a loopy quantity over the previous three months on diesel provides to be able to decrease the phases of loadshedding, nonetheless this isn’t sustainable over the long run because it threatens to additional destabilize the facility utilities monetary place. This might imply as winter attracts to an in depth, larger phases of loadshedding could return on a extra everlasting foundation.

Advisable by Zain Vawda

Get Your Free Prime Buying and selling Alternatives Forecast

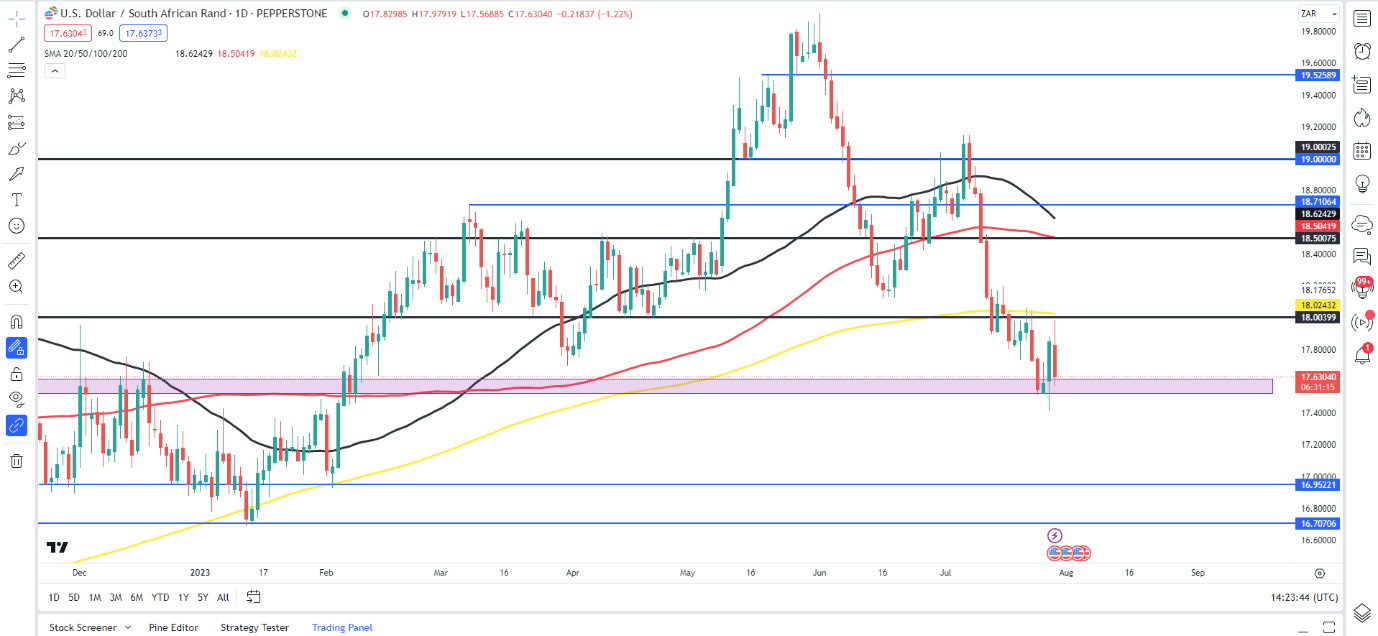

FINAL THOUGHTS AND TECHNICAL OUTLOOK

USDZAR from a technical standpoint has all the time fascinated me as we are inclined to development for a sustained time frame. Trying again traditionally and developments appear to run for 3-4 months at a time earlier than we see a major change within the general development of the pair. That is one thing which has continued this 12 months with the upside rally starting on February 2 from the lows across the 16.9200 mark all the way in which to the 19.9200 mark on June 1.

Since then, we’ve got seen USDZAR staircase its approach decrease towards the 17.5000 deal with which is holding agency on the minute. The vary between the 17.5000-18.0000 mark has been holding for the previous 2 weeks regardless of a number of financial occasion threat for each the ZAR and the USD.

Trying forward and as we speak’s rejection of the 18.0000 mark as soon as extra wants acceptance with a each day candle shut beneath the 17.5000 space (highlighted in pink on the chart) for additional draw back to achieve traction. Such a transfer would carry the February swing low at 16.9200 into focus earlier than a check of the YTD low across the 16.7000 deal with comes into focus. Alternatively, given the pace of the current selloff we may very well be in for a short-term retracement notably if US information stays sturdy with first space of resistance the 18.0000 mark which strains up with the 200-day MA. A break larger right here may carry a retest of 18.5000 into focus which is a key confluence space as we’ve got the 100-day MA resting there as effectively.

USD/ZAR Every day Chart, July 28, 2023

Supply: TradingView, Ready by Zain Vawda

Introduction to Technical Evaluation

Shifting Averages

Advisable by Zain Vawda

— Written by Zain Vawda for DailyFX.com

Contact and comply with Zain on Twitter: @zvawda