[ad_1]

South African Rand, Greenback Newest:

- SARB (South African Reserve Financial institution) raises the repo charge by 25-basis factors to 7.25% (under expectations of seven.5%).

- USD/ZAR digests commentary from the MPC (financial coverage committee) – load shedding and the extraordinary power-cuts dampen sentiment as productiveness declines.

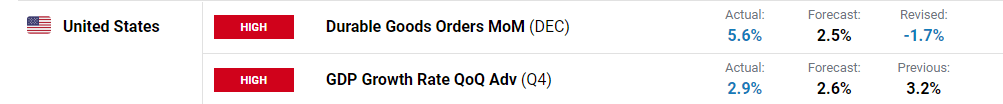

- US GDP and sturdy items beat estimates highlighting a resilient US financial system

Advisable by Tammy Da Costa

Get Your Free High Buying and selling Alternatives Forecast

SARB Raises Charges by 0.25%, Progress Forecasts Sink

The SARB (the South African Reserve Financial institution) has introduced one other 25 basis-point charge hike, under market expectations for a 50-basis level hike. With the repo charge now rising to 7.25% (up from 7%), the MPC (financial coverage committee) assembly supplied a dismal outlook for the power-stricken nation.

DailyFX Financial Calendar

In anticipation of subsequent week’s FOMC, the discharge of US financial knowledge might pose a further risk to the risky Rand. Though Greenback weak spot has restricted USD/ZAR positive factors, the rising market (EM) foreign money stays weak to investor’s urge for food for threat.

Be taught extra about how central banks affect the foreign exchange market and the consequences of central financial institution intervention within the foreign exchange market.

Not solely is the nation experiencing the worst power-cuts in historical past, corruption, poor upkeep and lack of accountability has precipitated the inequality hole to widen. With the primary energy utility, Eskom, at the moment growing the length of the blackouts (known as load shedding), energy cuts quantity to roughly eight – ten hours with out electrical energy.

Advisable by Tammy Da Costa

Buying and selling Foreign exchange Information: The Technique

Because the vitality part stays the primary contributor to inflation, Eskom has proposed one other 18.5% enhance within the value of electrical energy (a choice that’s at the moment on maintain).

Which means that enterprise house owners must rely of different sources of vitality whereas protecting rising prices of manufacturing. n the MPC committee assembly earlier at the moment, the ability disaster remained on the forefront of development prospects which has deteriorated additional.

In the meantime, the discharge of US GDP and sturdy items orders highlighted a resilient financial system with each readings exceeding expectations.

Customise and filter dwell financial knowledge by way of our DailyFX financial calendar

USD/ZAR Technical Evaluation

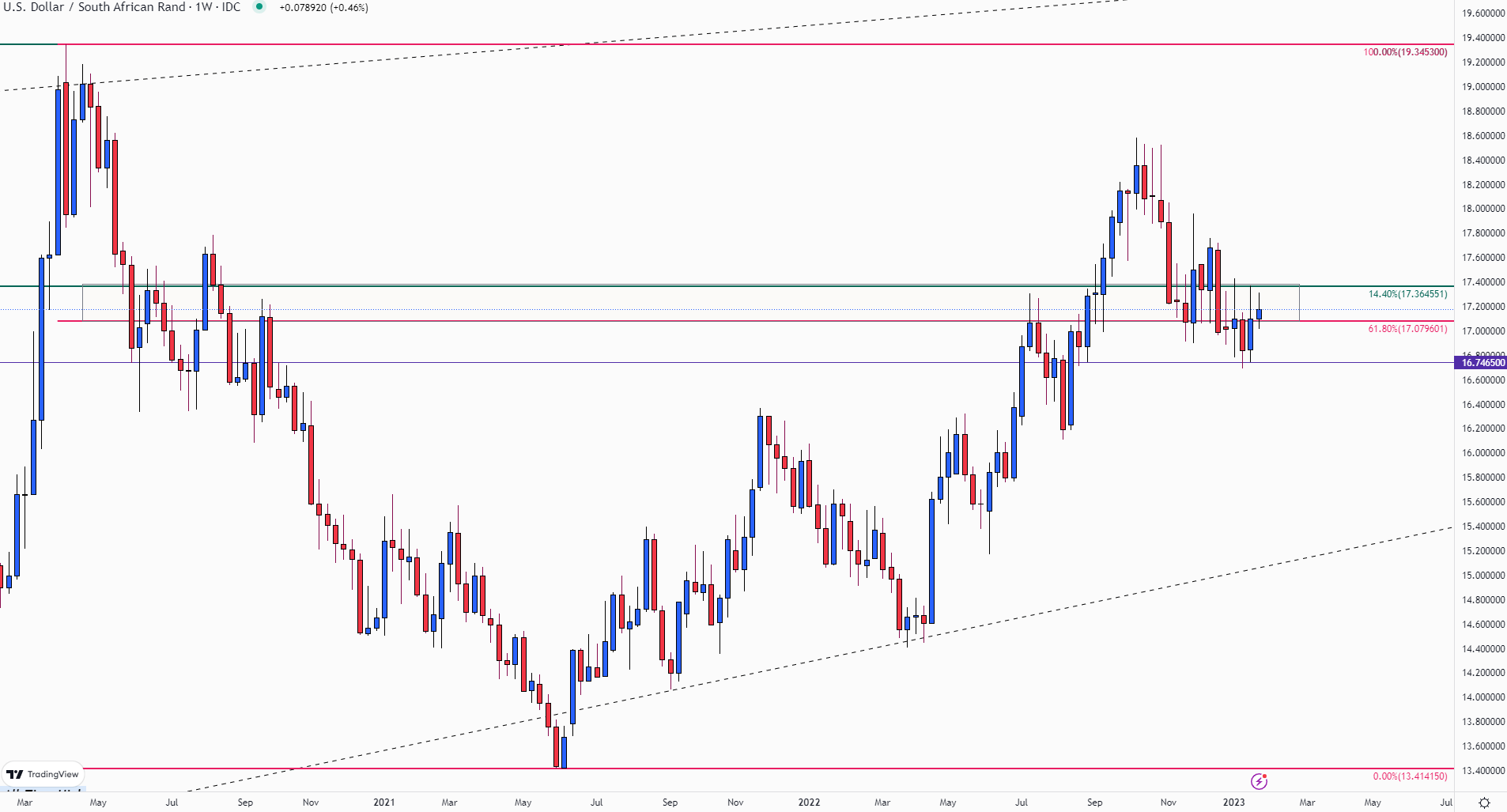

After rising to a excessive of 18.579 in October final yr, expectations of the Fed slowing the tempo of tightening buoyed USD weak spot, driving the pair decrease. Because the transfer gained traction, costs continued to fall, driving costs to a five-month low of 16.694 earlier this month. With a broader vary of help and resistance forming between key Fibonacci ranges from prior strikes.

USD/ZAR Weekly Chart

Chart ready by Tammy Da Costa utilizing TradingView

With final week’s candle erasing the prior week’s losses, a break of 17.00 and of 17.079 (61.8% Fibonacci of the 2020 – 2021 transfer) drove costs in direction of the 14.4% Fibonacci of the 2004 – 2020 transfer at 17.364.

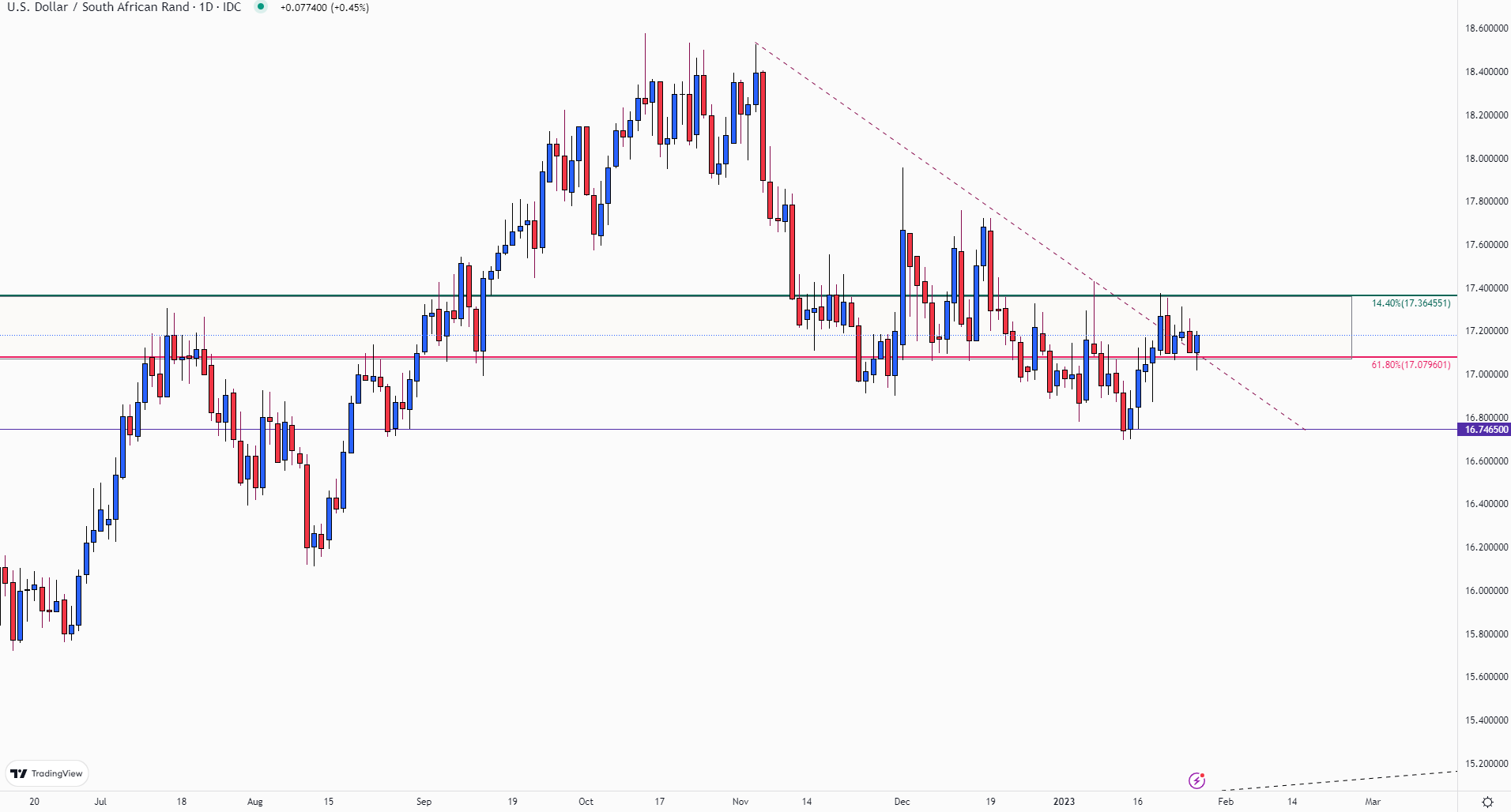

Whereas the each day chart additional highlights the vary that has developed in latest weeks, the descending trendline from the Oct – Jan transfer has shaped a further zone of help at prior resistance (17.000).

USD/ZAR Every day Chart

Chart ready by Tammy Da Costa utilizing TradingView

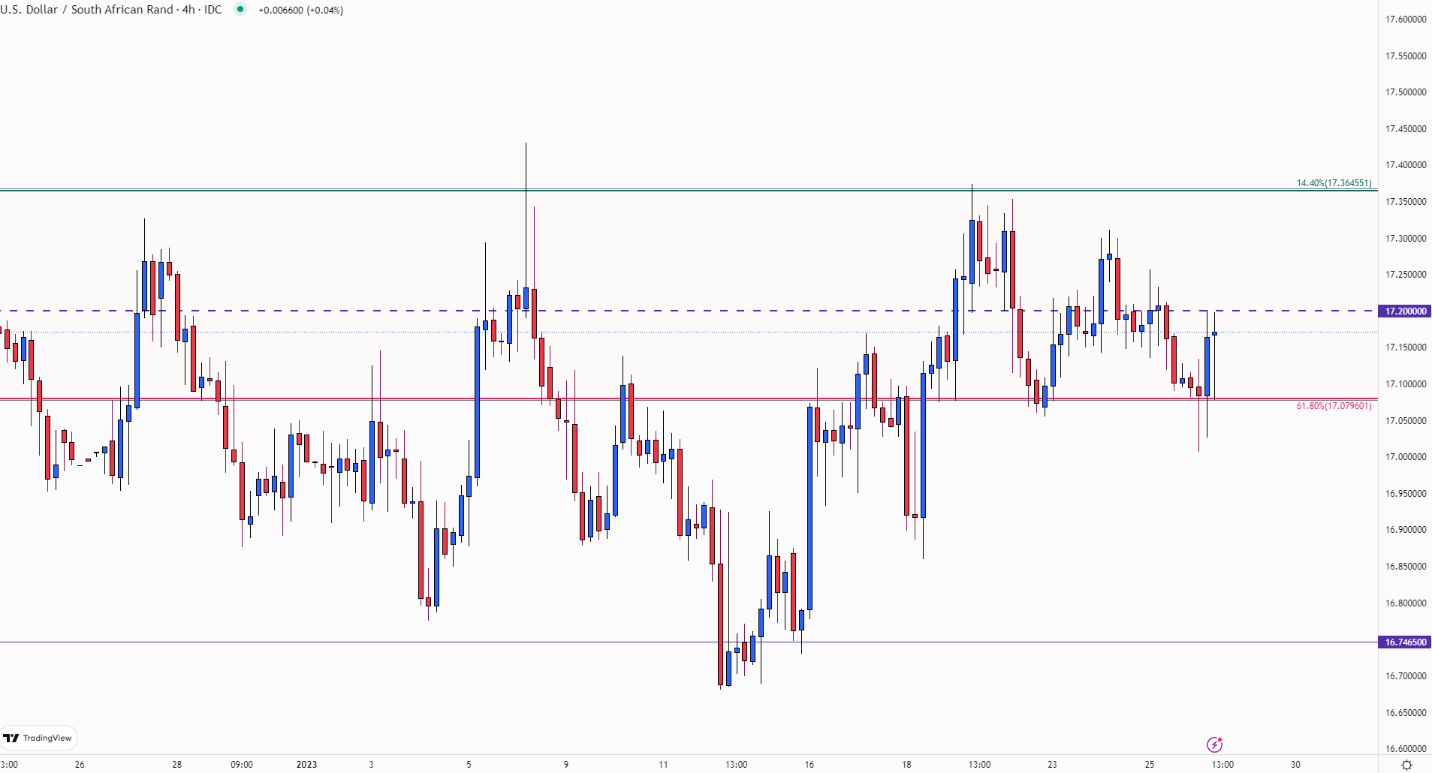

In the meantime, on the four-hour chart, the17.200 deal with has supplied one other hurdle whereas the lengthy lower-wicks under 17.00 symbolize a powerful retaliation from consumers which lifts costs increased.

USD/ZAR 4-Hour Chart

Chart ready by Tammy Da Costa utilizing TradingView

For the uptrend to carry, costs might want to acquire traction above 17.200 to retest 17.300. Above that, the 17.365 Fib looms bringing 17.500 again into play.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to E-newsletter

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and comply with Tammy on Twitter: @Tams707

[ad_2]

Source link