US Greenback Speaking Factors

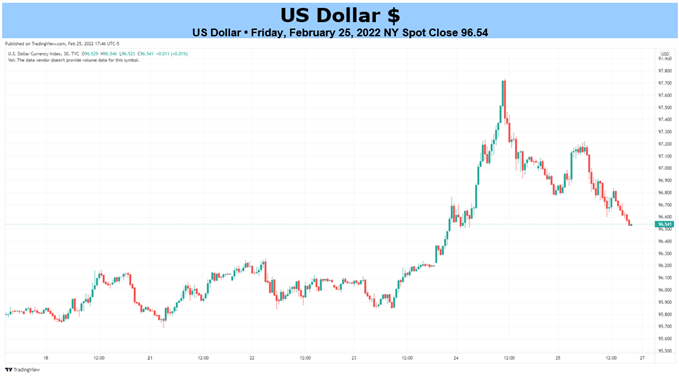

The US Greenback Index (DXY) climbed to a recent yearly excessive (97.74) as heightening Russia-Ukraine tensions seem like spurring a flight to security, and recent information prints popping out of the US could preserve the Dollar afloat because the Non-Farm Payrolls (NFP) report is anticipated to point out an extra enchancment within the labor market.

Basic Forecast for US Greenback: Bullish

The US Greenback Index (DXY) has damaged out of a slim vary as the specter of warfare in Europe drags on investor confidence, and swings in threat urge for food could proceed to sway the Dollar because the US and its allies implement further sanctions on Russia.

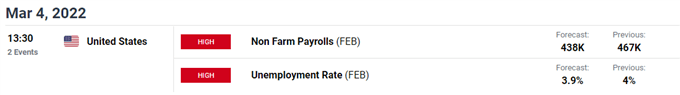

On the similar time, the replace to the US Non-Farm Payrolls (NFP) report could affect the near-term outlook for the Greenback because the economic system is anticipated so as to add 438K jobs in February, and one other uptick in employment could generate a bullish response within the Dollar as the event places stress on the Federal Reserve to normalize financial coverage sooner fairly than later.

In flip, the DXY could resume the bullish development carried over from the earlier 12 months because the Federal Open Market Committee (FOMC) prepares to change gears, and it stays to be seen if the central financial institution will regulate its exit technique as Chairman Jerome Powell and Co. are slated to launch the up to date Abstract of Financial Projections (SEP) on the subsequent rate of interest determination on March 16.

Till then, recent information prints popping out of the US could sway the Greenback as Fed Governor Christopher Waller emphasizes that “the Fed must act promptly to start tightening financial coverage,” and an extra enchancment within the labor market could push the FOMC to projected a steeper path for the Fed Funds charge because the official acknowledges that “a robust case might be made for a 50-basis-point hike in March” whereas talking at an occasion held on the College of California.

With that mentioned, an extra deterioration in threat urge for food could preserve the US Greenback Index (DXY) afloat over the approaching days, and one other uptick in employment could push the Dollar to recent yearly highs because it places stress on the FOMC to regulate its exit technique.

— Written by David Tune, Forex Strategist

Comply with me on Twitter at @DavidJSong