Most Learn: US Greenback Falls Additional After US NFP Beat however January Quantity Revised Sharply Decrease

USD/JPY prolonged losses and sank to its lowest degree since early February on Friday, supported by speculations that the Fed could also be nearer to getting better confidence that inflation is on a sustained path in the direction of the two.0% goal to start out decreasing borrowing prices.

The greenback’s lackluster efficiency earlier than the weekend was compounded by the February employment report, which revealed a spike within the unemployment fee to its highest degree in two years. This raised issues about potential cracks showing within the U.S. labor market.

Nevertheless, the principle issue behind USD/JPY’s retreat was seemingly the media leak that the Financial institution of Japan is warming as much as the concept of ending detrimental charges at its March assembly, spurred by expectations of considerable pay raises on this 12 months’s annual wage discussions between unions and large companies.

Interested by what lies forward for the Japanese yen? Discover complete solutions in our quarterly buying and selling forecast. Declare your free copy now!

Beneficial by Diego Colman

Get Your Free JPY Forecast

Beforehand, we contended {that a} lasting yen restoration appeared unlikely and never imminent, at the very least till the BoJ lastly pulled the set off and relinquished its extraordinarily accommodative place. With that second drawing nearer, the Japanese forex may very well be getting ready to a sturdy comeback.

Whereas the outlook for USD/JPY is beginning to dim, its near-term destiny isn’t but determined. For instance, if subsequent week’s U.S. CPI report surprises to the upside as within the earlier month, there might be room for a quick rebound earlier than a extra sustained pullback later within the 12 months. Because of this, merchants ought to carefully watch the inflation launch.

UPCOMING US CPI DATA

Supply: DailyFX Financial Calendar

Interested by understanding how FX retail positioning might affect USD/JPY’s trajectory? Uncover key insights in our sentiment information. Obtain it now!

| Change in | Longs | Shorts | OI |

| Day by day | -7% | -7% | -7% |

| Weekly | 24% | -19% | -10% |

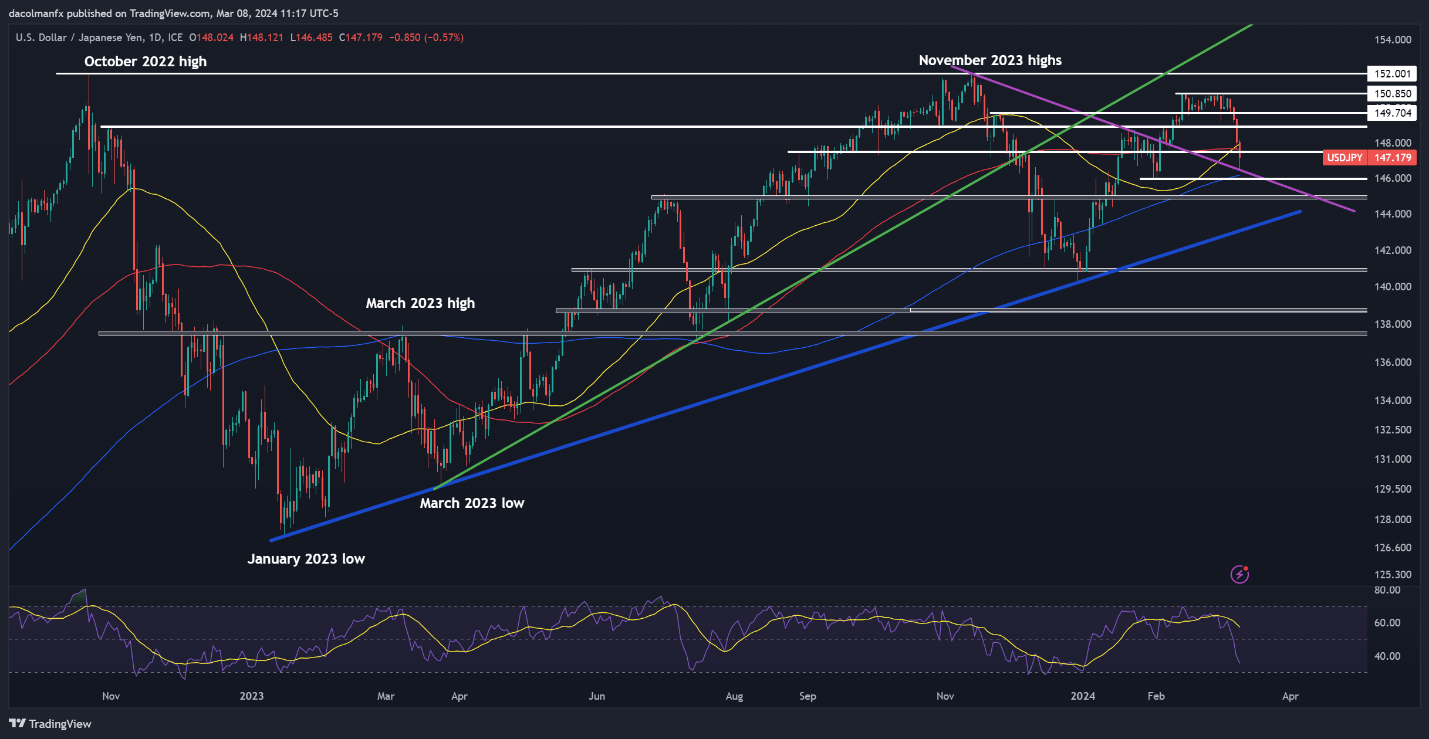

USD/JPY FORECAST – TECHNICAL ANALYSIS

USD/JPY retreated additional on Friday, sinking beneath assist at 147.85/147.50 and hitting its lowest mark in additional than a month. If this breakdown is sustained, the following key flooring to look at emerges at 146.60, adopted by 146.10, the 200-day easy shifting common. Under this space, all eyes shall be on 145.00.

On the flip aspect, if consumers mount a comeback and spark a bullish reversal unexpectedly, resistance looms at 147.50/147.85 and 148.90 thereafter. On continued energy, market consideration is prone to transition in the direction of 149.70, adopted by 150.90.

USD/JPY PRICE ACTION CHART

USD/JPY Chart Created Utilizing TradingView