This text focuses totally on the technical outlook for the yen. For a deeper understanding of the basic components driving the Japanese foreign money’s trajectory within the second quarter, be happy to obtain our complete Q2 forecast. It is complimentary!

Advisable by Diego Colman

Get Your Free JPY Forecast

USD/JPY TECHNICAL OUTLOOK

USD/JPY soared in the course of the first three months of 2024, advancing greater than 7% earlier than the top of the primary quarter. Following this upswing, the pair was buying and selling barely under its 2022 and 2023 highs, situated close to the psychological 152.00 stage on March 22, an necessary resistance threshold that merchants ought to carry on their radar within the close to time period.

When it comes to potential eventualities, a push past 152.00 might theoretically reinforce upward momentum and provides technique to a rally in the direction of 154.00. Nonetheless, any bullish breakout could not maintain for lengthy, because the Japanese authorities could shortly step in to assist the yen. For that reason, an increase above the 152.00 space might be seen as a chance to fade power. Nonetheless, within the absence of FX intervention, bulls might really feel emboldened to launch an assault on 158.50, adopted by 160.00, the April 1990 excessive.

However, if USD/JPY is rejected from its present place and pivots to the draw back, assist emerges at 146.50 close to the March swing low and the 200-day easy shifting common. Under this, subsequent ranges of assist materialize at 145.00, 143.50, and 140.45, the latter marking the 23.6% Fibonacci retracement derived from the upward section spanning 2021 to 2022. Extra losses past this juncture would shift focus in the direction of 137.00 and subsequently to 133.25.

USD/JPY Weekly Chart

Supply: TradingView, Ready by Diego Colman

Enthusiastic about studying how retail positioning can supply clues about EUR/JPY‘s directional bias? Our sentiment information accommodates precious insights into market psychology as a development indicator. Obtain it now!

| Change in | Longs | Shorts | OI |

| Every day | -13% | 2% | -2% |

| Weekly | 33% | -9% | -2% |

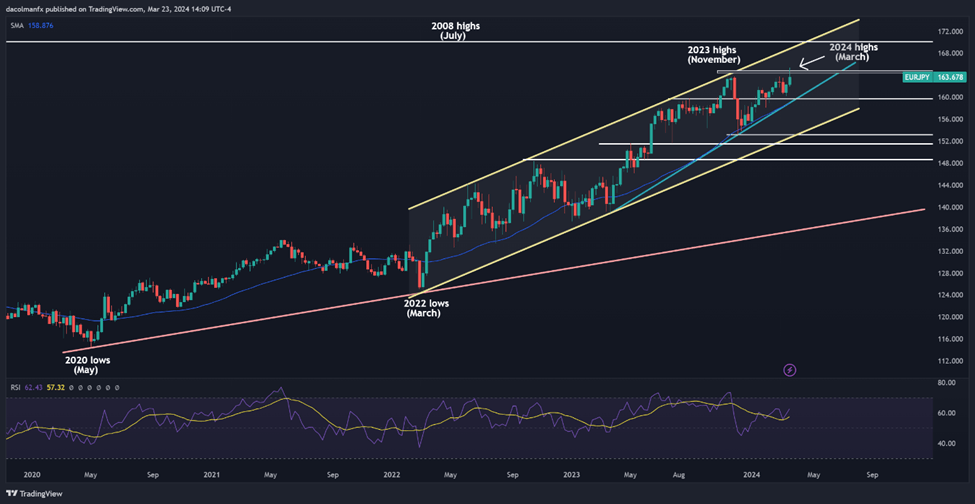

EUR/JPY TECHNICAL OUTLOOK

EUR/JPY additionally superior sharply within the first quarter of the yr, briefly topping the 165.00 threshold, and hitting its strongest mark in practically 16 years. Whereas bulls seem like answerable for the steering wheel, we’re unlikely to see a sustained transfer above 165.00 as a result of Japanese authorities, who search to stop substantial depreciation of the yen, could step in to include the bleeding.

Within the surprising case that EUR/JPY manages to interrupt previous 165.00 decisively and Tokyo stays on the sidelines, consumers could really feel emboldened to launch an assault on the higher boundary of a long-term ascending channel at 168.75. If euro’s momentum continues to construct unchecked, the market might set its sights on the 2008 highs close to the psychological 170.00 stage.

Alternatively, if upward impetus begins fading and costs shift downwards over the approaching weeks, sellers could muster the braveness to problem trendline assist and the 200-day easy shifting common close to 159.70. The pair could try to backside out on this space earlier than rebounding, however ought to a breakdown materialize, bulls could head for the hills, paving the best way for a retracement in the direction of channel assist at 153.10. Subsequent losses from this level might precipitate a drop in the direction of 151.60, adopted by 148.70.

EUR/JPY Weekly Chart

Supply: TradingView, Ready by Diego Colman

Uncover out prime 3 buying and selling alternatives for the second quarter. Request the information now!

Advisable by Diego Colman

Get Your Free High Buying and selling Alternatives Forecast

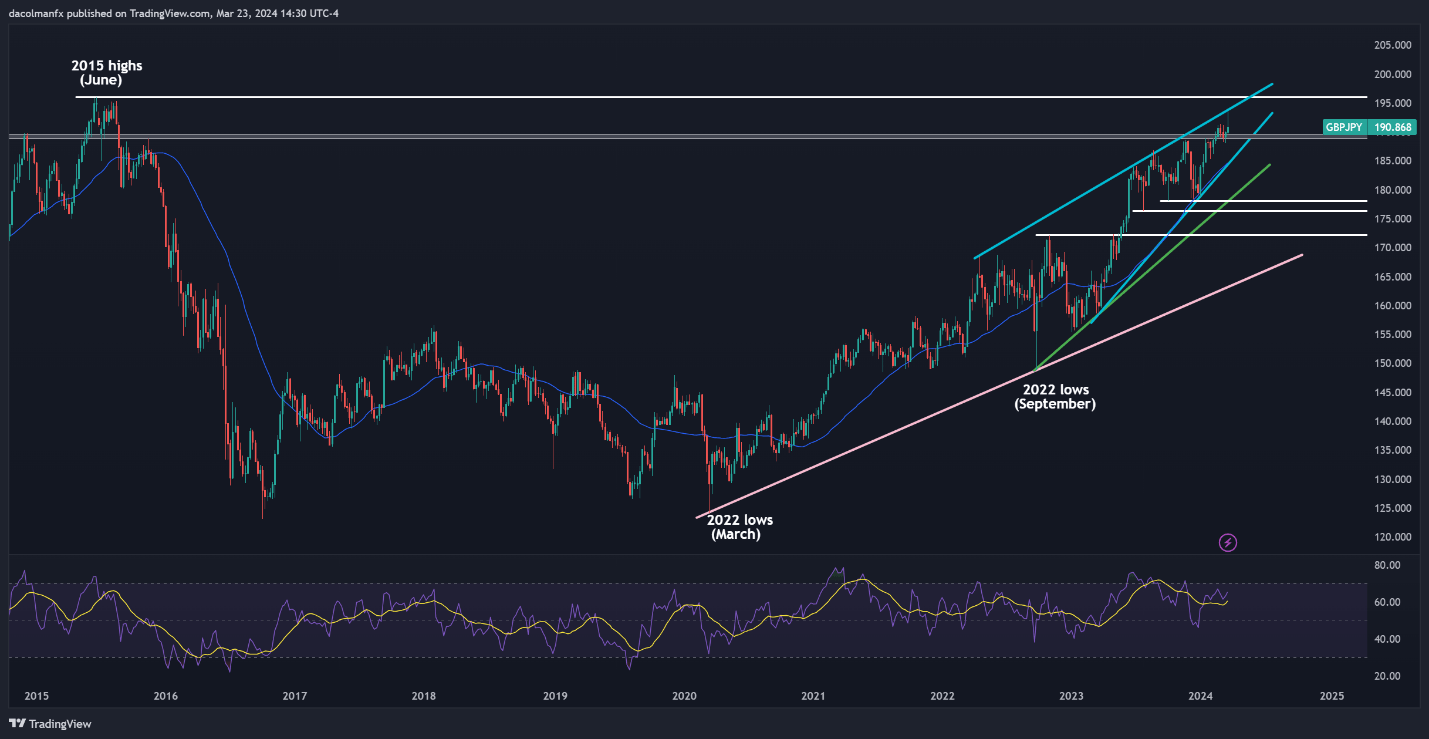

GBP/JPY TECHNICAL OUTLOOK

The British pound was no exception and likewise strengthened dramatically in opposition to the Japanese yen within the first quarter, with GBP/JPY rising above the 190.00 deal with to ranges not examined since August 2015. With merchants positioning for a price reduce from the Financial institution of England within the second quarter and the Financial institution of Japan lastly normalizing its stance, the trail of least resistance could also be decrease for the pair within the medium time period regardless of its constructive technical outlook.

Within the occasion of a bearish reversal, GBP/JPY could encounter assist round 189.00 and 184.75 thereafter, the place the 200-day easy shifting common meets a medium-term ascending trendline on the time of writing. Subsequent losses past the aforementioned thresholds might draw consideration in the direction of 178.00 – key swing lows of December and October final yr. The pair could set up a foothold within the area; nonetheless, a drop under it might immediate a transfer in the direction of 176.50, adopted by 172.25.

However, if bulls preserve their grip in the marketplace and propel the trade greater, resistance emerges at 193.50, this yr’s peak. Drawing from previous patterns, bears could resist one other bullish advance at this juncture. Nonetheless, within the occasion of a clear and decisive breakout, a rally in the direction of the 2015 highs close to 196.00 might be on the horizon.

GBP/JPY Weekly Chart

Supply: TradingView, Ready by Diego Colman