[ad_1]

Considerations over the US financial system weighed on shares on Tuesday [26/09], after new house gross sales in August fell greater than anticipated to the bottom stage in 5 months. New house gross sales within the US in August fell -8.7% m/m to 675,000, weaker than expectations of 698,000. In the meantime, the US Convention Board Client Confidence for September took successful, falling from the earlier studying of 108.7 to 103.0, lacking the forecast of 105.9. Though the Present State of affairs Index registered a slight improve from 146.7 to 147.1, the Expectations Index skilled a extra vital decline, falling from 83.3 to 73.7. This drop introduced the Expectations Index under 80, a stage historically seen as an early warning of a recession within the following yr.

https://www.conference-board.org/matters/consumer-confidence/press/CCI-Sept-2023

Shares prolonged their losses on rising bond yields. The yield on 10-year T-notes on Tuesday rose to a recent 16-year excessive of 4.56% and ended up +2.1 bp at 4.55%. The USA500 index fell -1.47%, the USA30 fell -1.14%, and the USA100 closed down -1.51%.

Giant cap know-how shares had been weaker and weighed on the general market, amid considerations that world central banks must hold rates of interest larger for an extended time period with the intention to fight inflation. Amazon -4%, Apple over -2%, Alphabet over -2%, Microsoft and Meta down over -1%. The worsening property debt disaster in China stays a problem for world inventory markets, as a consequence of considerations that the debt disaster will derail the nation’s progress prospects and drag down the worldwide financial system.

Technical Assessment

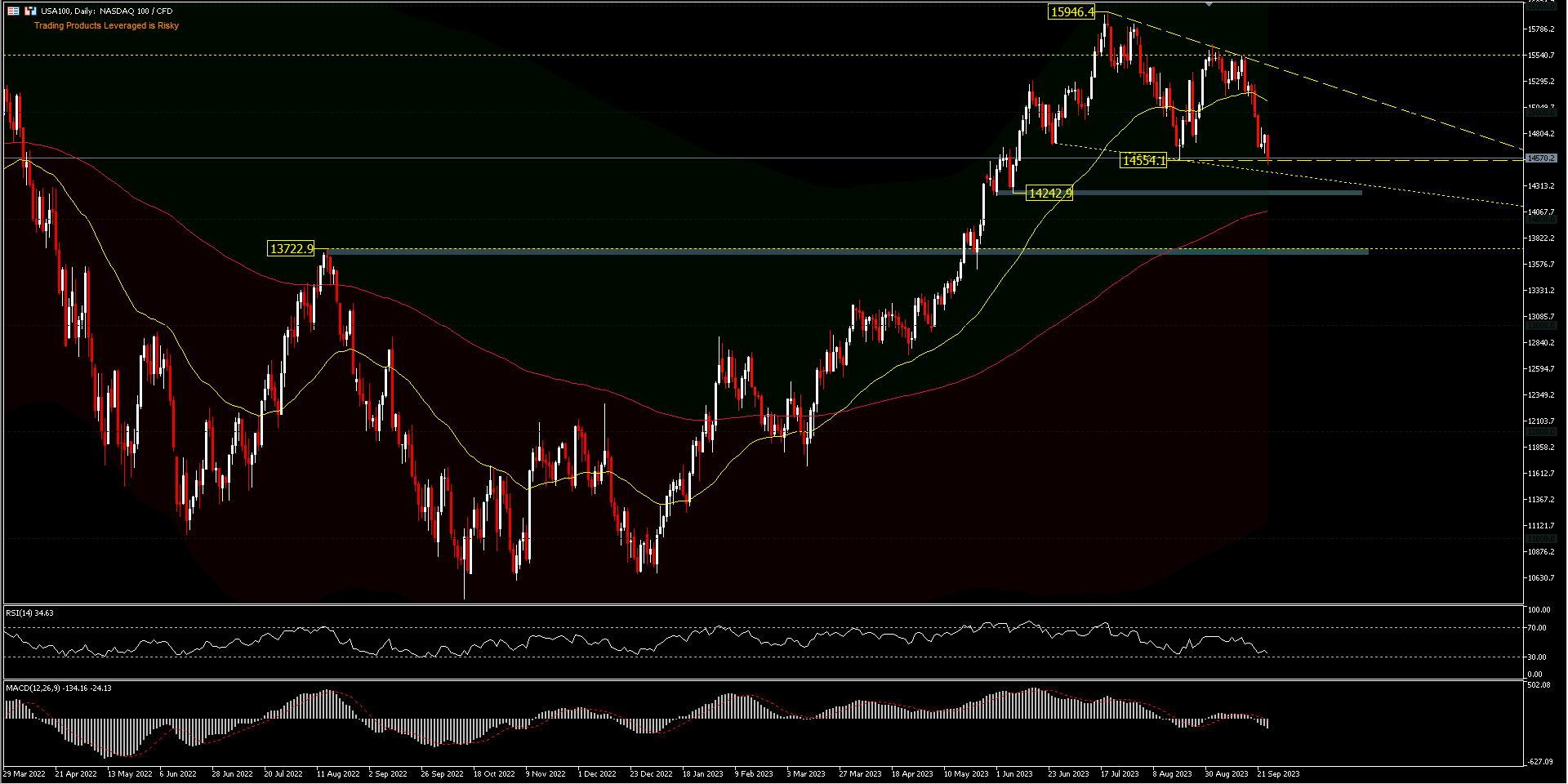

USA100 – Prolonged its 3-week decline this week. In Tuesday’s buying and selling, the index was seen making an attempt to surpass the structural help of 14,554. A transfer under this help would open the door for a take a look at of the 14,242 help and even the resistance which is the help at 13,722. Nevertheless, if the 14,554 help holds, it may result in a brief rebound which might cloud the outlook. RSI is approaching oversold ranges and MACD is poised within the promote zone, validating the latest decline. At present, the worth is shifting under the 50-day common, midway to the 200-day EMA or over 3% away from the present place.

Jamie Dimon, chairman and chief government of JPMorgan Chase & Co. floated the concept US rates of interest may attain 7%, a worst-case situation that might catch customers and companies off guard. Merchants stay targeted on the end-of-month deadline forward of a attainable US authorities shutdown. Supply: Bloomberg.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is offered as a basic advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link