Richard Drury

Liberty All-Star Fairness (NYSE:USA) is a compelling investing car for traders that wish to mix tech publicity with a excessive dividend yield.

USA is a closed-end fairness fund that owns a number of the largest names within the tech business in its portfolio and that has achieved engaging, double-digit returns within the final decade. The closed-end fairness fund offers traders with a ten% dividend yield because it distributes capital good points dividends and is a compelling funding choice, in my opinion, for traders that wish to be uncovered to the synthetic intelligence theme.

Diversification, excessive passive revenue, and tech publicity are the three foremost the reason why traders would possibly wish to take into account the Liberty All-Star Fairness Fund for his or her passive revenue portfolios.

Portfolio And Funding Goal

The Liberty All-Star Fairness Fund invests in each development and worth shares in giant corporations, principally within the U.S. Info Expertise sector. The fund’s foremost targets are capital appreciation and revenue distribution to USA’s shareholders.

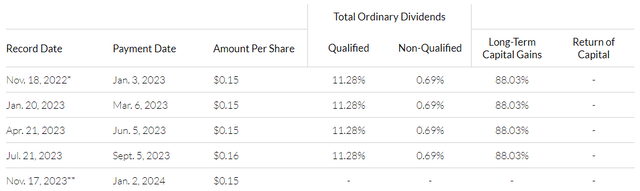

The Liberty All-Star Fairness Fund particularly seeks to pay distributions on its shares equal to roughly 10% of its web asset worth each year, which makes USA primarily a passive revenue car for traders. The fund’s distributions are primarily paid out of realized long-term capital good points, and the fund’s quarterly dividends are taxed as bizarre dividends.

Lengthy-Time period Capital Good points (Liberty All-Star Fairness Fund)

The newest distribution is $0.18 per share per quarter, which equates to a ten.4% main dividend yield. The Liberty All-Star Fairness Fund is, like I mentioned, predominantly comprised of huge cap U.S. investments and manages roughly $2.0 billion in property. The fund’s present expense ratio sits at 0.93%.

The attention-grabbing factor about Liberty All-Star Fairness Fund is that the closed-end fund combines tech publicity and diversification with recurring dividend revenue. The fund presently pays traders a ten% yield, paid quarterly, and traders might doubtlessly revenue from the fund’s express concentrate on the synthetic intelligence theme.

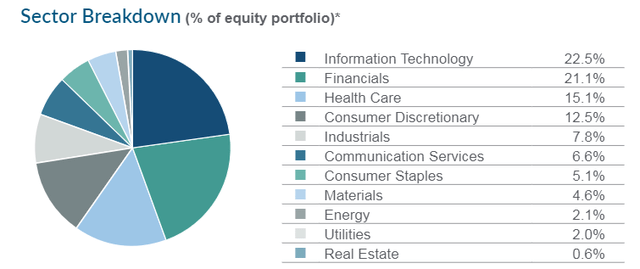

The vast majority of investments within the firm’s portfolio are a part of the Info Expertise sector which had a portfolio weighting of twenty-two.5% which incorporates quite a lot of shares which might be poised to revenue from rising AI investments. The second-biggest sector was Financials (21.1%), adopted by Well being Care (15.1%).

Sector Breakdown (Liberty All-Star Fairness Fund)

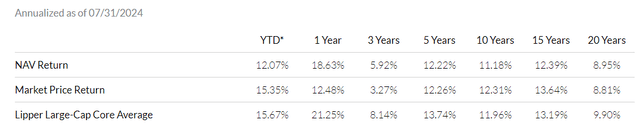

Efficiency Historical past

Liberty All-Star Fairness Fund profited within the final 12 months from a robust efficiency report of know-how investments, leading to an 18.6% return on web asset worth.

The long-term return can also be engaging, because the fund achieved 11.2% NAV returns within the final decade. The benchmark for the Liberty All-Star Fairness Fund is the Lipper Giant-Cap Core Mutual Fund Common.

NAV Return (Liberty All-Star Fairness Fund)

High Holdings Breakdown And AI Focus

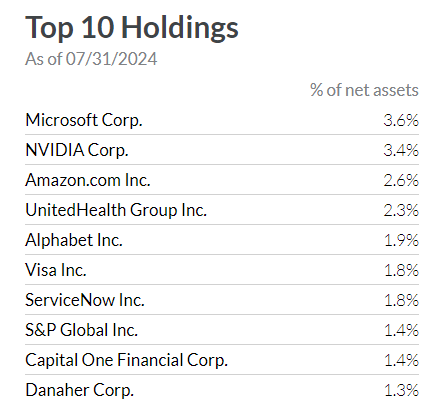

Liberty All-Star Fairness Fund is primarily centered on the data know-how business, as I simply highlighted. NVIDIA Corp. (NVDA), Microsoft Corp. (MSFT), Amazon.com (AMZN) and Alphabet Inc. (GOOG) are high holdings for the closed-end fund and Microsoft was USA’s largest holding with a portfolio weighting of three.6% as of July 31, 2024.

The Liberty All-Star Fairness Fund accommodates a substantial variety of investments which have publicity to the synthetic intelligence theme. Firms like Nvidia and Alphabet have been large winners final 12 months as they profited from the company sector’s spending spree on GPUs which might be particularly geared in the direction of AI functions.

Nvidia lately clarified, to call only one instance, that it expects its newest Blackwell chips to ship out to clients on the finish of the 12 months and that it expects billions of gross sales from its newest GPU.

Since Nvidia has a 3.4% weighting in Liberty All-Star Fairness Fund’s portfolio, an ongoing outperformance of AI shares might assist the fund’s web asset worth development shifting ahead.

High 10 Holdings (Liberty All-Star Fairness Fund)

Low cost To NAV

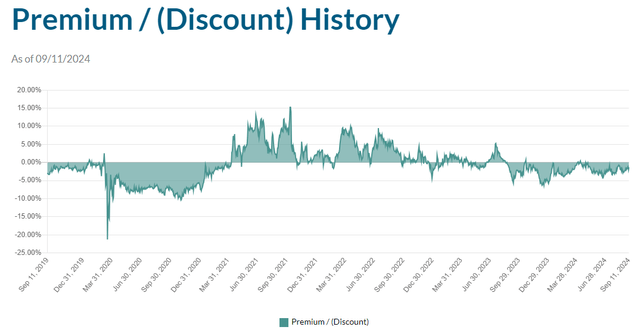

The Liberty All-Star Fairness Fund, as of 09/11/2024, was $6.96 whereas the fund’s market value was $6.87 which means a reduction to web asset worth of 1.29%.

The Liberty All-Star Fairness Fund has traditionally offered each at a premium and at a reduction to web asset worth, at various instances, making it onerous to make a generalized assertion concerning the fund’s valuation historical past.

Within the long-run, I anticipate the Liberty All-Star Fairness Fund’s web asset worth to develop and to promote at or close to web asset worth because the portfolio is made up of extremely liquid inventory investments within the giant cap market. The prospects for NAV development are superb, in my opinion, as the corporate owns market leaders within the dominant Info Expertise sector.

Low cost To NAV (Liberty All-Star Fairness Fund)

What Dangers Do Traders Have To Account For

Clearly, the Liberty All-Star Fairness Fund is targeted on know-how corporations and contains a number of the most infamous names within the know-how world, Nvidia, Microsoft and Alphabet. Thus, traders should acknowledge that the USA closed-end fairness fund is primarily allocating funding funds to the cyclical know-how sector which exposes traders to appreciable dangers in case investor capital rotates into different sectors, for example in case tech strikes out of favor with traders.

Moreover, the Liberty All-Star Fairness Fund is invested primarily in procyclical corporations, so USA might be not going to be an incredible selection for traders throughout a recession.

My Conclusion

Liberty All-Star Fairness Fund is a compelling selection for passive revenue traders as a result of it combines diversification, revenue and appreciation potential associated to probably the most dominant names within the know-how business.

As well as, the Liberty All-Star Fairness Fund has produced engaging, double-digit returns within the long-term whereas it expense ratio is beneath 1%.

The Liberty All-Star Fairness Fund could also be a gorgeous funding choice for passive revenue traders that wish to achieve publicity to the quickly evolving info know-how business, significantly as a result of it contains express leaders comparable to Alphabet or Nvidia.

As well as, Liberty All-Star Fairness Fund is a compelling funding car for traders that wish to ramp up their publicity to the synthetic intelligence theme, which has captured the creativeness of traders within the final 12 months. Purchase.