[ad_1]

US Core PCE Key Factors:

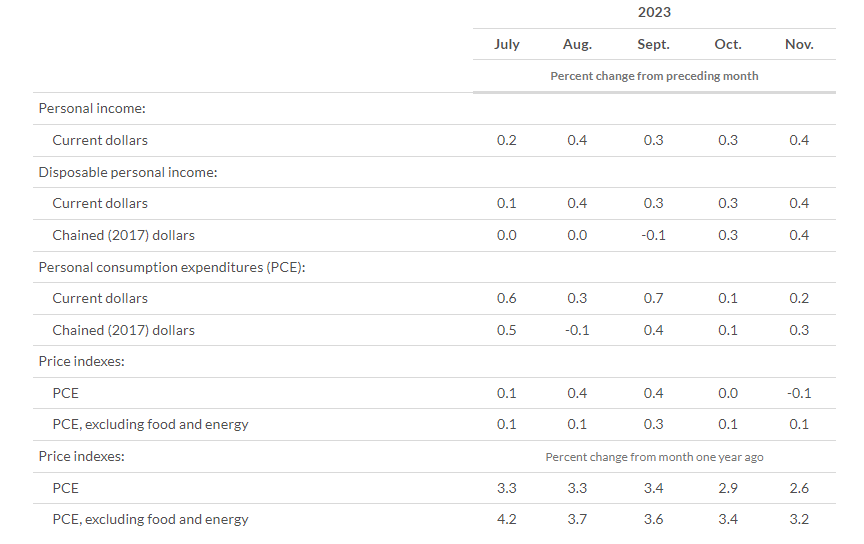

- Core PCE Value Index YoY(NOV) Precise 3.2% Vs 3.5% Earlier.

- PCE Value Index YoY(NOV) Precise 2.6% Vs 2.9% Earlier (Revised Down).

- The Information At this time Will Solely Additional Gasoline the Fireplace Relating to Price Cuts in 2024.

- To Study Extra AboutValue Motion,Chart PatternsandShifting Averages, Try theDailyFX Schooling Part.

MOST READ: USD/JPY Value Forecast: USD/JPY Could Battle to Discover Acceptance Beneath the 142.00 mark

Elevate your buying and selling abilities and achieve a aggressive edge. Get your arms on the Information Buying and selling Information at the moment for unique insights on tips on how to navigate information occasions.

Really helpful by Zain Vawda

Introduction to Foreign exchange Information Buying and selling

The PCE costs MoM declined in November coming in at -0.1percentfollowing final month’s flat studying. The COREPCE worth index MoMcame in at 0.1% down from the 0.2% print from final month in what can be a welcome print for the US Federal Reserve.

The annual CORE PCE price cooled to three.2% from 3.5%, afresh low since mid-2021.

In the meantime, annual core PCE inflation which excludes meals and vitality, slowed to three.5% from 3.7%, a contemporary low since mid-2021. In the meantime, month-to-month core PCE inflation which excludes meals and vitality and is most popular Fed inflation measure, was regular at 0.1%, after a downwardly revised studying in October.

Customise and filter stay financial knowledge by way of our DailyFX financial calendar

Private incomeincreased $81.6 billion (0.4 % at a month-to-month price) in November, in line with estimates launched at the moment by the Bureau of Financial Evaluation

From the previous month, thePCE worth indexfor November decreased 0.1 %. Costs for items decreased 0.7 % and costs for providers elevated 0.2 %. Meals costs decreased 0.1 % and vitality costs decreased 2.7 %. Excluding meals and vitality, the PCE worth index elevated 0.1 %.

Supply: US Bureau of Financial Evaluation

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to E-newsletter

IMPLICATIONS FOR THE US ECONOMY

The US GDP knowledge added an extra feather within the ca for market individuals punting for 150bps of price cuts in 2024. At this time’s knowledge will solely add gas to that fireplace because the PCE inflation stays the Fed’s most popular inflation metric. The November figures confirmed once more inflationary pressures proceed to average at a gradual tempo. The Federal Reserve predicts PCE inflation to be 2.8%, and core PCE inflation at 3.2% in 2023, each reducing to 2.4% within the following 12 months.

MARKET REACTION

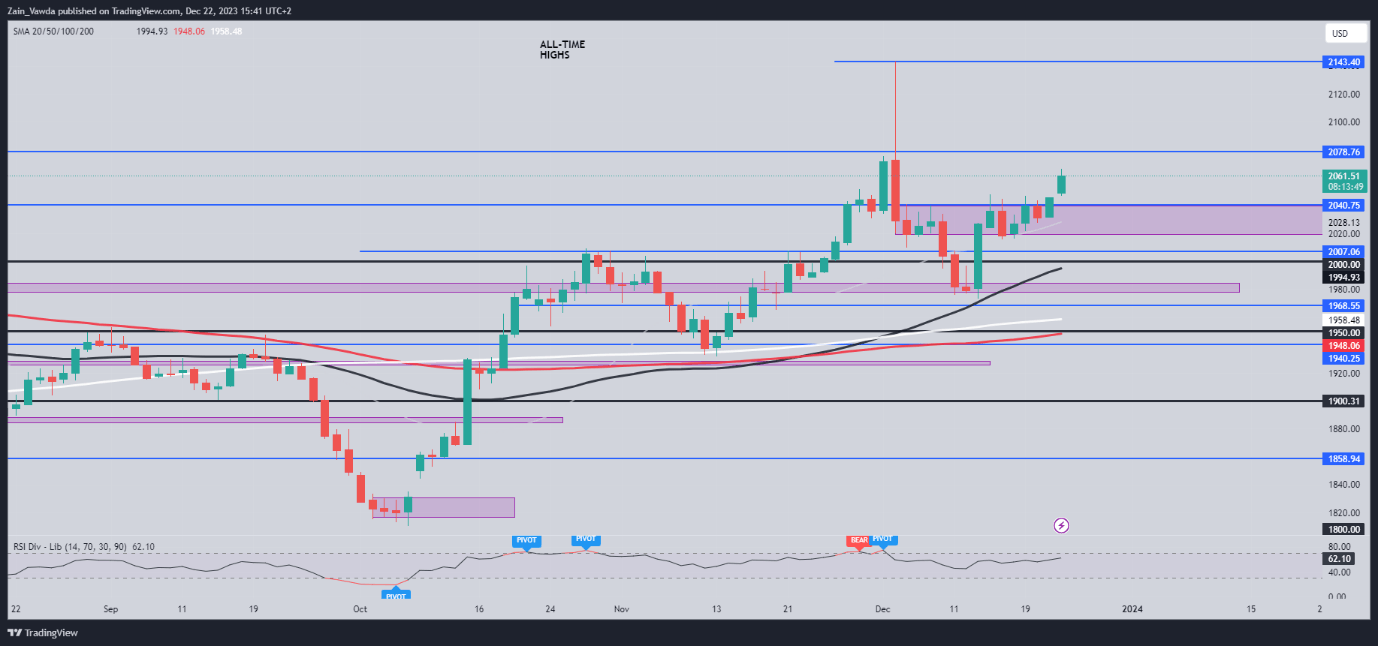

Following the information launch the greenback index prolonged its slide with Gold proving to be a beneficiary. Gold costs spiked to a direct excessive across the $2066-$2068/OZ space earlier than some pullback.

Earlier within the week I had mentioned how a possible breakout could require a catalyst and US knowledge during the last two days have lastly supplied a shot within the arm. Rapid resistance above the $2068 space rests within the $1978-$1983 space and this might show a sticky level if we do arrive there later at the moment.

Key Ranges to Maintain an Eye On:

Resistance ranges:

Help ranges:

Gold (XAU/USD) Each day Chart- December 22, 2023

Supply: TradingView, ready by Zain Vawda

| Change in | Longs | Shorts | OI |

| Each day | -6% | 2% | -3% |

| Weekly | 2% | 6% | 3% |

— Written by Zain Vawda for DailyFX.com

Contact and comply with Zain on Twitter: @zvawda

[ad_2]

Source link