[ad_1]

US CPI KEY POINTS:

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to E-newsletter

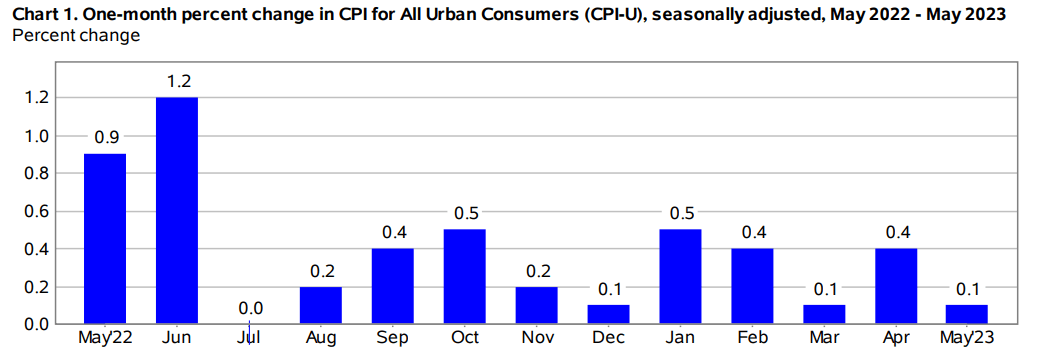

US headline inflation YoY in Could declined to 4% beating estimates round 4.1% whereas Core CPI YoY stays reasonably sticky popping out in step with estimates at 5.3%. The headline YoY inflation print is the bottom since March 2021 and concludes 12 consecutive months of declines. The Core CPI which excludes risky gadgets corresponding to meals and power has hit its lowest degree since November 2021 however does stay reasonably sticky.

Customise and filter dwell financial information through our DailyFX financial calendar

The most important contributors to the decline within the headline determine did come from the power index which declined 3.6 % in Could as the key power part indexes fell. Meals costs as talked about above stay an actual concern for the Federal Reserve with the index for meals away from dwelling up 8.3% over the previous yr and properly above a degree you’d really feel the Fed are comfy with.

Supply: US Bureau of Labor Statistics

FOMC MEETING TOMORROW AND THE OUTLOOK MOVING FORWARD

Heading into tomorrow’s assembly market pricing continues to lean towards a pause with as we speak’s information more likely to cement such a place. Core inflation stays sticky, nevertheless this could possibly be the primary indicators for the Fed that the battle in opposition to inflation could possibly be heading in the right direction.

If that is so the steering offered by the Fed could possibly be pivotal shifting ahead with market individuals already seeing a better likelihood of charge hikes on the July assembly. This got here within the quick aftermath of the assembly with charge hike chances rising as excessive 65% of a 25bps hike in July. After all, as we speak’s information is optimistic for the Federal Reserve of their battle in opposition to inflation, whether or not or not it will have any impression on tomorrow’s assembly and coverage outlook shifting ahead stays to be seen.

MARKET REACTION

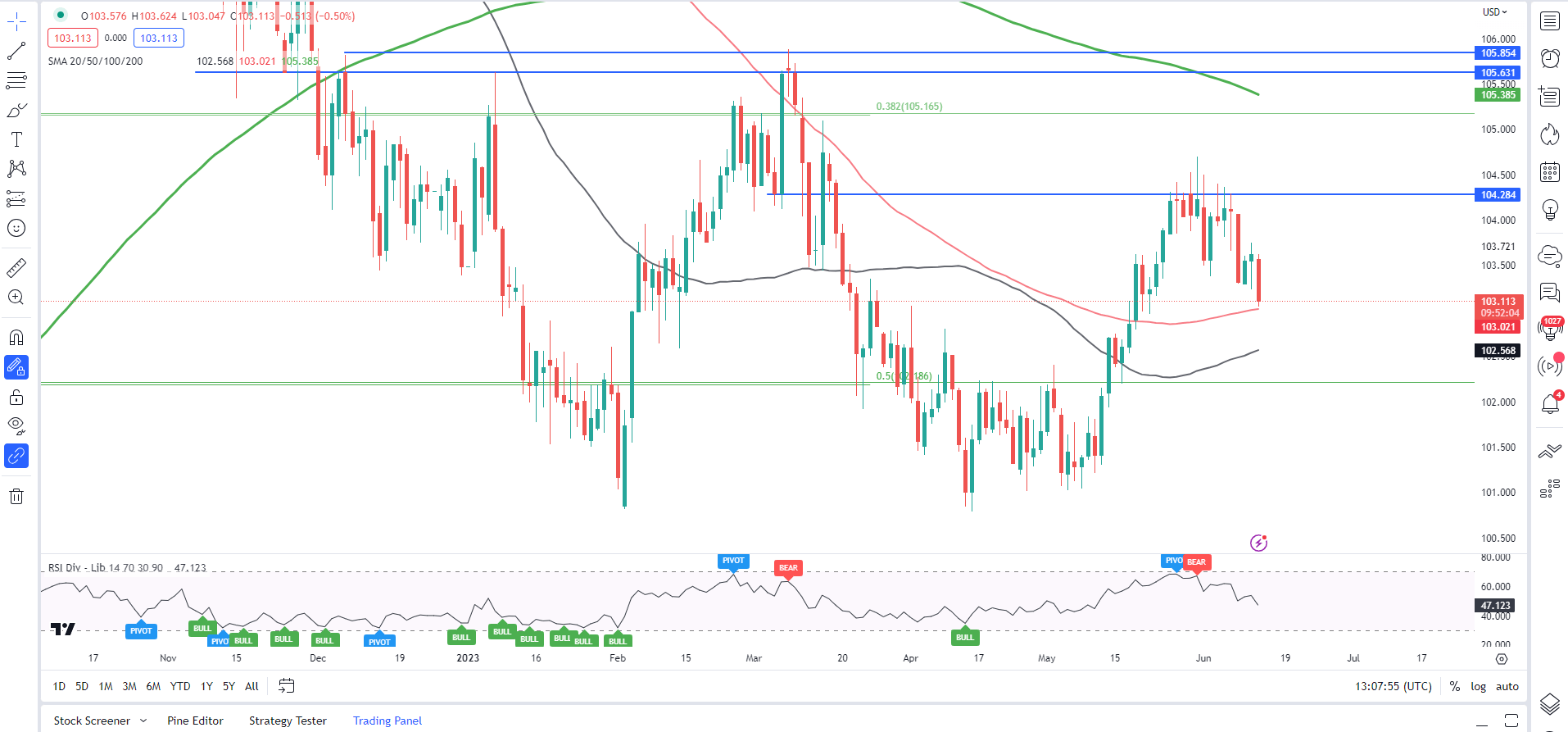

DXY Every day Chart

Supply: TradingView, ready by Zain Vawda

The DXY has been confined between the 103.30 and 104.30 handles because it appeared for a brand new catalyst to encourage a breakout. Wanting on the Greenback Index on the every day timeframe and we are able to see the important thing resistance space across the 104.30 which has held agency of late. Value has ticked larger on a number of events, however a every day candle shut above has up to now did not materialize.

Alternatively, a break beneath the 50 and 100-day MA may see a fast slide towards the 50-day MA and doubtlessly decrease. For now although the DXY stays in an general uptrend with no every day candle shut beneath the 101.00 deal with.

Key Intraday Ranges Value Watching:

Assist Areas

- 103.00 (100-day MA)

- 102.50 (50-day MA)

- 101.50

Resistance Areas

Really useful by Zain Vawda

High Buying and selling Classes

— Written by Zain Vawda for DailyFX.com

Contact and comply with Zain on Twitter: @zvawda

[ad_2]

Source link