USD/JPY, FOMC, BoJ Information and Evaluation

- FOMC and Financial institution of Japan central financial institution preview

- Federal Reserve Financial institution because of hike tomorrow however by how a lot?

- USD/JPY technical evaluation forward of central financial institution conferences

FOMC Preview: Inflation and Geopolitical Uncertainty to Affect Fee Hike

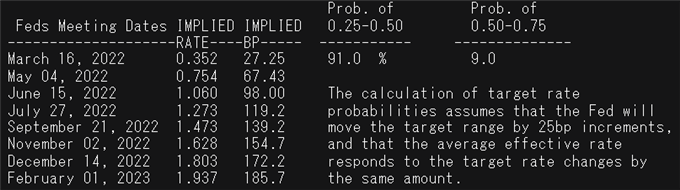

Tomorrow marks a slightly vital day in monetary markets because the Federal Reserve Financial institution is scheduled to announce its first price hike for the reason that pandemic. Previous to the invasion of Ukraine, distinguished FOMC members, significantly James Bullard, advocated for a slightly aggressive method to price hikes, supporting a 50 foundation level hike in March. Since then, market expectations appear to have settled on a extra conservative 25 foundation level hike (91% chance in response to charges markets).

Implied Possibilities Derived from Fed Funds Futures

Supply: Refinitiv, ready by Richard Snow

Along with the rate of interest hike, quarterly financial projections will probably be launched. One factor to notice is that the projections are prone to have been finalized earlier than the invasion of Ukraine and should already be outdated. Keep watch over the press convention for clarification on the dates the projections – all the data is on the DailyFX financial calendar.

Financial institution of Japan Preview (BoJ): Yen Depreciation Tolerated for Now

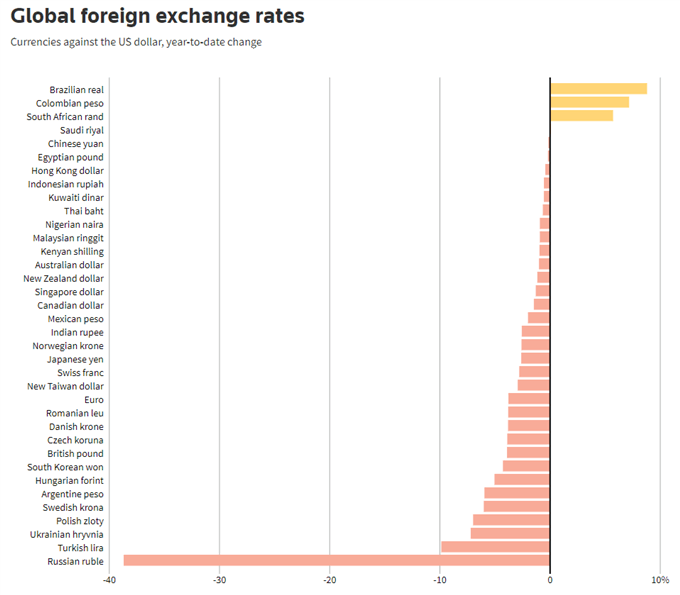

The Yen has depreciated for the reason that Ukraine invasion which got here as fairly a shock contemplating its standing as a protected haven. Nonetheless, upon nearer inspectionJapan imports round 80% of its oil consumption, rising oil prices will additional elevate import prices, putting downward stress on the Yen. Japan joins a complete host of currencies that commerce decrease to the US greenback year-to-date.

A Reuters report citing somebody near the BoJ’s considering talked about that Japan is prepared to tolerate a sluggish Yen depreciation however sooner charges of depreciation are prone to demand nearer consideration to the difficulty.

Supply: Refinitiv, ready by Richard Snow

The US greenback has truly acquired a safe-haven bid and has remained elevated ever for the reason that FOMC began speaking up the chance of a March 2022 price hike in response to multi-decade ranges of inflation.

USD/JPY Key Technical Ranges

The USD/JPY has gained momentum since its topside breakout however has now reached the primary degree of resistance on the longer-term trendline resistance. The RSI rose to overbought ranges, a doable sign of short-term exhaustion nonetheless, the greenback reveals little signal of weak point.

A 25 foundation level hike would come as no shock and will see sustained help for the buck. A 50 foundation level hike would elevate the attractiveness of the greenback and will lead to a transfer in USD/JPY in the direction of 120.00.

Ought to we see a sizeable USD/JPY retracement, 116.30 can be the closest degree of help the place bulls could also be tempted to enter the bullish development.

USD/JPY Every day Chart

Supply: IG, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX