[ad_1]

US DOLLAR FORECAST – EUR/USD, USD/JPY, GBP/USD

- The U.S. greenback finishes the week reasonably decrease, easing off multi-month highs

- All eyes will on the March U.S. inflation report within the week forward

- This text discusses the technical outlook for EUR/USD, USD/JPY and GBP/USD

Most Learn: USD/JPY Tiptoes In the direction of Bullish Breakout after Sturdy US Jobs Information. What Now?

The U.S. greenback, as measured by the DXY index, misplaced floor over the previous 5 buying and selling classes, marking the tip of a three-week successful streak that had propelled costs to 5-month highs by Tuesday. When all was stated and carried out, the DXY retreated 0.24% to settle at 104.28, with the euro’s power being the first issue behind this motion.

Regardless of this subdued efficiency, the dollar shouldn’t be written off simply but, because it might be able to restart its advance and regain momentum quickly, particularly if the March U.S. inflation report, due for launch on Wednesday, beats projections and confirms Wall Avenue’s worst nightmare: progress on disinflation has hit a roadblock.

Consensus estimates recommend headline CPI climbed 0.3% on a seasonally adjusted foundation final month, lifting the annual charge to three.4% from 3.2% beforehand. The core gauge can be seen rising 0.3% month-on-month, however the 12-month studying is projected to have slowed to three.7% from 3.8% in February, a constructive however tiny step in the best course.

Supply: DailyFX Financial Calendar

RECENT FEDSPEAK

Fed Chair Powell, in a speech on the Stanford Enterprise, Authorities, and Society Discussion board earlier this week, acknowledged that nothing has modified for the FOMC by way of its coverage outlook outlined within the newest Abstract of Financial Projections, signaling that 75 foundation factors of easing stays on the desk for the yr. His feedback appeared to deflate the U.S. greenback as we moved in the direction of the latter a part of the week.

Though Powell is a very powerful voice on the Federal Reserve, different officers are starting to precise reservations about committing to a preset course. Fed Governor Michelle Bowman, as an example, has indicated that headway in disinflation efforts has stalled and that she wouldn’t be comfy reducing charges till renewed value pressures abate. She additionally talked about that mountain climbing charges once more is feasible, although not going.

Entry our Q2 buying and selling forecast to get an in depth evaluation of the U.S. greenback’s medium-term outlook. Obtain it totally free at the moment & do not miss out on key methods!

Advisable by Diego Colman

Get Your Free USD Forecast

Fed Dallas President Lorie Logan additionally appeared to have embraced a extra aggressive posture, emphasizing that it is too early to contemplate easing measures. In assist of her viewpoint, she cited hotter-than-expected CPI readings currently and indicators that elevated borrowing prices might not be restraining combination demand as a lot as initially thought.

All issues thought-about, if the inflation outlook continues to evolve unfavorably, the U.S. central financial institution could haven’t any different alternative however to start out coalescing round a extra hawkish place, with the robustness of the labor market giving policymakers loads of wiggle room to be affected person earlier than pivoting to a looser stance. This might imply delayed rate of interest reductions and shallow cuts this yr as soon as the method lastly will get underway.

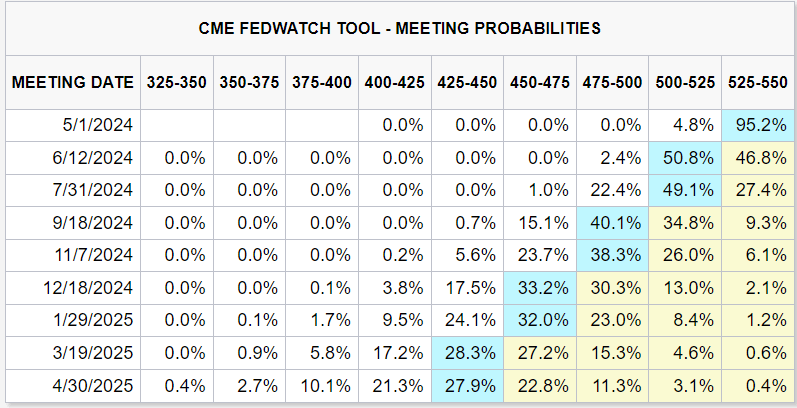

The next desk reveals the possibilities of Fed motion at varied FOMC conferences.

Supply: CME Group

In mild of the aforementioned factors, merchants ought to intently watch the upcoming inflation numbers and brace for volatility. That stated, an upside shock within the knowledge, significantly within the core metric, may reinforce the upswing in U.S. Treasury yields seen within the first days of April, permitting the U.S. greenback to renew its upward journey and command management within the FX area.

In the meantime, a lower-than-anticipated print on the all-items and core indices may have the alternative results on markets, leading to decrease authorities charges and a softer U.S. greenback. Nonetheless, for this situation to play out, the divergence of the ultimate knowledge from expectations would must be substantial; in any other case, the affect on bonds and the U.S. foreign money could be extra measured.

For an entire overview of the EUR/USD’s technical and elementary outlook for the approaching months, be certain that to obtain our complimentary Q2 forecast!

Advisable by Diego Colman

Get Your Free EUR Forecast

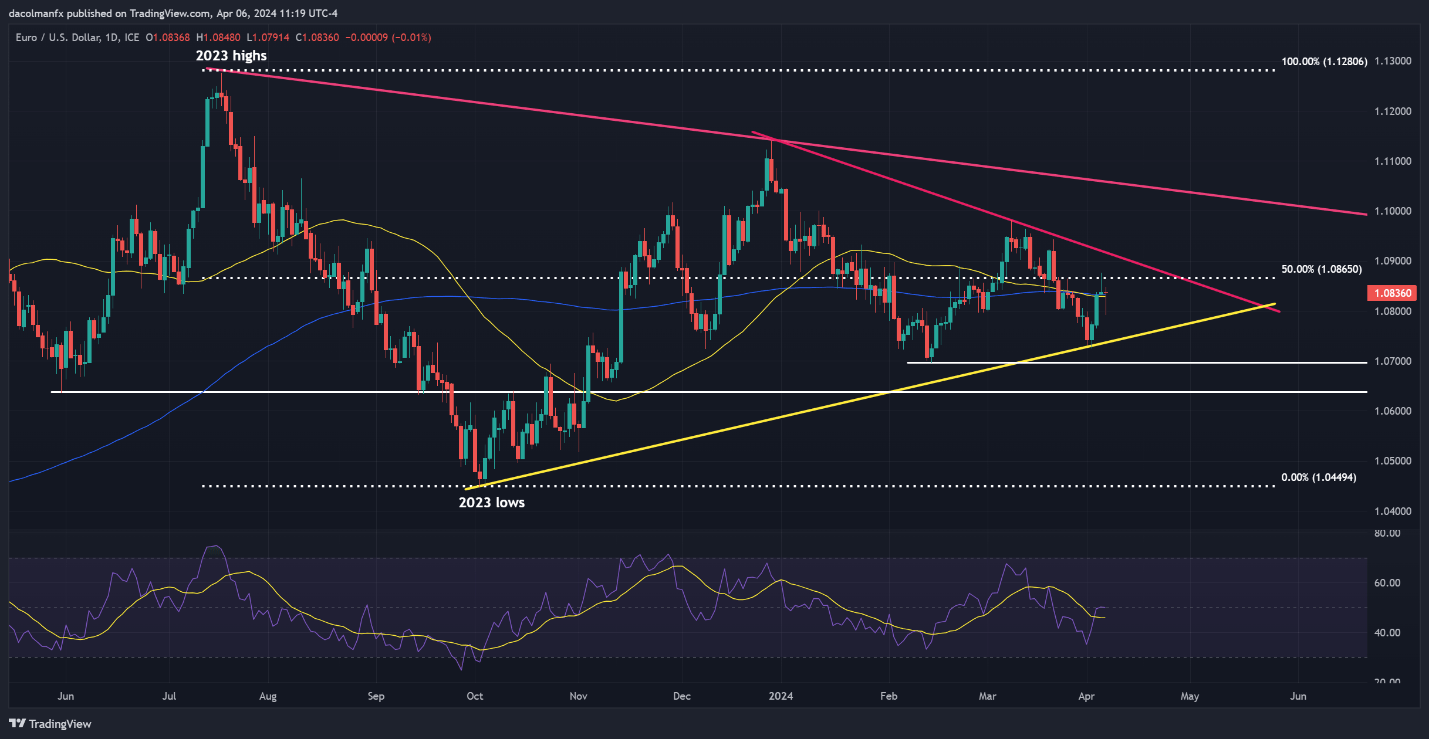

EUR/USD TECHNICAL ANALYSIS

EUR/USD dipped to multi-week lows at first of the week, solely to rebound from trendline assist round 1.0725, with this bounce propelling costs above each the 50-day and 200-day easy shifting averages. Ought to the pair construct upon its latest restoration over the approaching classes, Fibonacci resistance emerges at 1.0865. On additional power, all eyes can be on 1.0915.

Alternatively, ought to sellers regain management and drive costs under the important thing shifting averages talked about earlier, a retreat in the direction of 1.0840 may ensue. Bulls should vigorously defend this technical ground; a failure to take action may exacerbate destructive sentiment in the direction of the euro, doubtlessly triggering a drop in the direction of the 1.0700 deal with. Under this space, consideration ought to gravitate in the direction of 1.0625.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Utilizing TradingView

Questioning about USD/JPY’s medium-term prospects? Acquire readability with our newest forecast. Obtain it now!

Advisable by Diego Colman

Get Your Free JPY Forecast

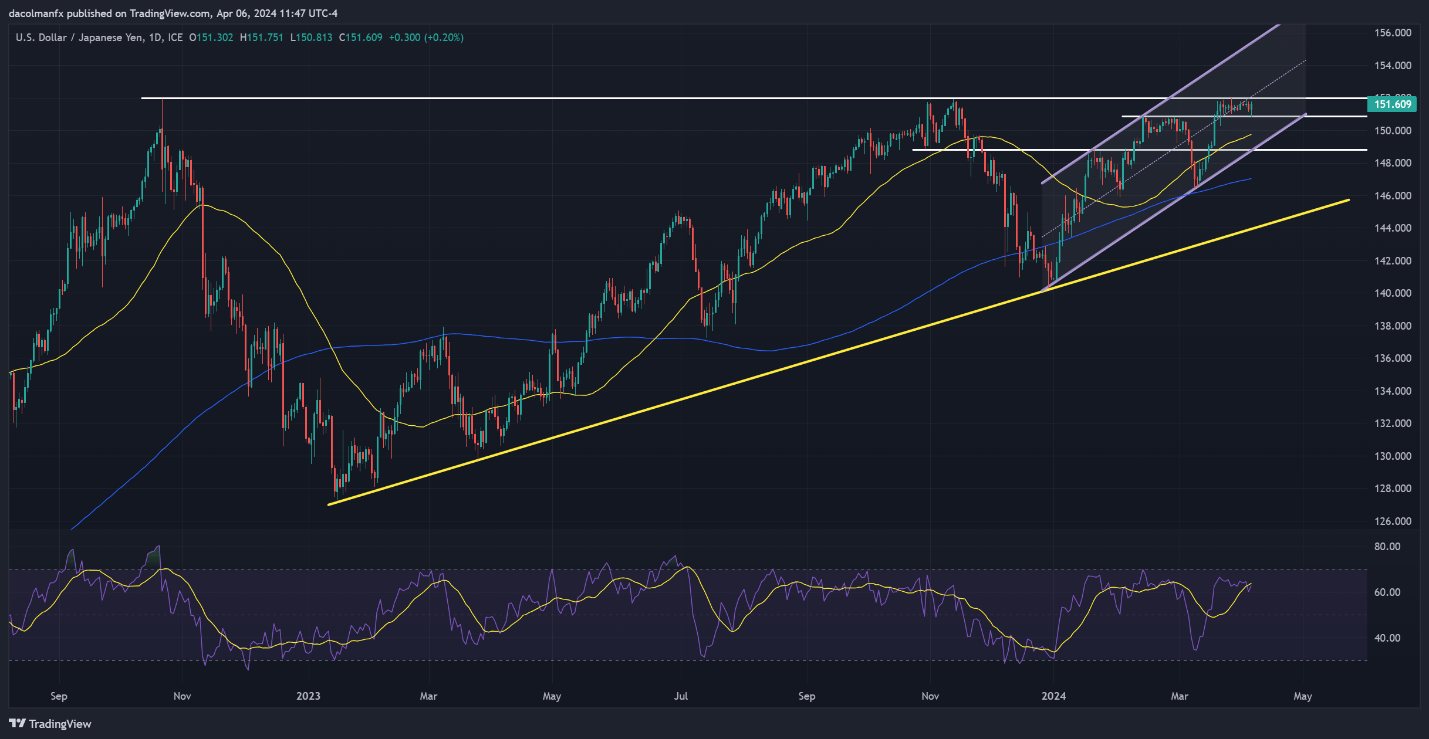

USD/JPY TECHNICAL ANALYSIS

USD/JPY has exhibited range-bound conduct over the previous two weeks, oscillating between resistance close to 152.00 and assist at 150.90. This implies a consolidation interval is underway. With that in thoughts, merchants needs to be looking out for both a breakout (152.00) or a breakdown at (150.90) for steerage on the near-term outlook.

Within the occasion of bullish breakout, a rally in the direction of the higher boundary of a short-term ascending channel at 155.25 could observe, offered Tokyo stays on the sidelines and refrains from intervening within the FX area to assist the yen. Conversely, in case of a breakdown, sellers may start to trickle again into the market, setting the stage for a drop in the direction of 149.75 (50-day SMA), adopted by 148.85.

USD/JPY PRICE ACTION CHART

USD/JPY Chart Created Utilizing TradingView

Eager to know how FX retail positioning can provide hints concerning the short-term course of main pairs akin to GBP/USD? Our sentiment information holds invaluable insights on this subject. Obtain it at the moment!

| Change in | Longs | Shorts | OI |

| Every day | 6% | -17% | -5% |

| Weekly | -10% | 4% | -5% |

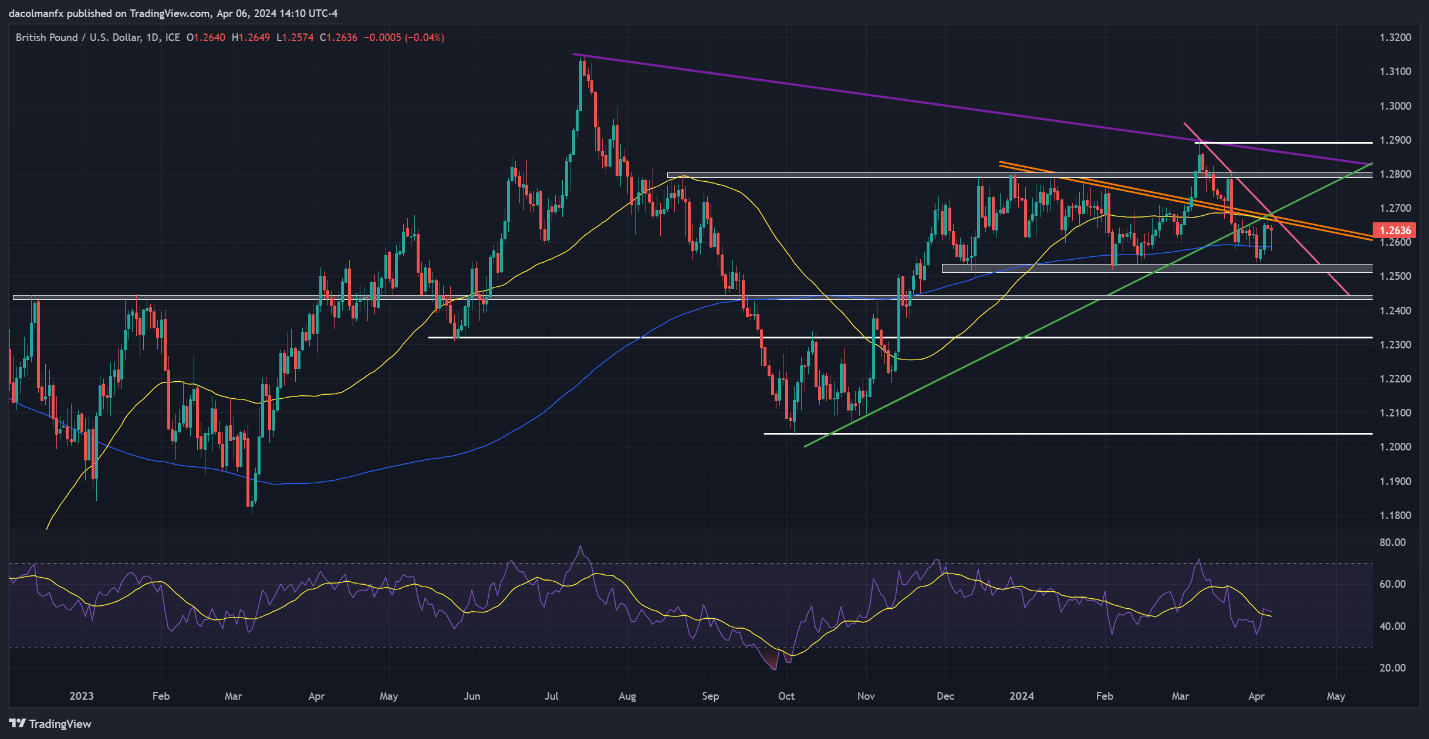

GBP/USD TECHNICAL ANALYSIS

GBP/USD fell early within the week however bounced again within the following days, in the end reclaiming its 200-day SMA. Nonetheless, the upward impulse light when costs didn’t clear cluster resistance at 1.2670, close to the intersection of three key trendlines. Merchants ought to monitor this space intently, conserving in thoughts {that a} bearish rejection may ship cable tumbling again in the direction of 1.2590 and presumably even 1.2520.

Then again, if the bulls achieve pushing the change charge above 1.2670 in a decisive trend, shopping for curiosity may choose up traction within the upcoming buying and selling classes, fostering situations for a possible climb in the direction of the 1.2800 deal with. Additional upside development past this juncture may open the door to a retest of final month’s excessive within the neighborhood of 1.2895.

GBP/USD PRICE ACTION CHART

GBP/USD Chart Created Utilizing TradingView

[ad_2]

Source link