[ad_1]

On Friday, the US Greenback hit an nearly two-month low in opposition to the Euro. This was largely as a consequence of rising expectations that the Federal Reserve could be placing the brakes on rate of interest hikes, as a consequence of a weak employment report. All eyes are actually on US central financial institution officers, as merchants search for hints about future rate of interest insurance policies.

Federal Reserve Chairman Jerome Powell is ready to talk on Wednesday and Thursday. Powell’s phrases may have a big impression on the markets and form future developments. These speeches are intently watched by merchants as they typically include essential hints for forex markets.

Nonetheless, it’s important to contemplate the opposite facet of the equation. European Central Financial institution (ECB) President Christine Lagarde made waves together with her hawkish feedback over the weekend. Her assertive stance might act as a buffer for the EURUSD pair, stopping a serious drop. Lagarde’s robust phrases spotlight the facility of central financial institution officers in influencing market sentiment.

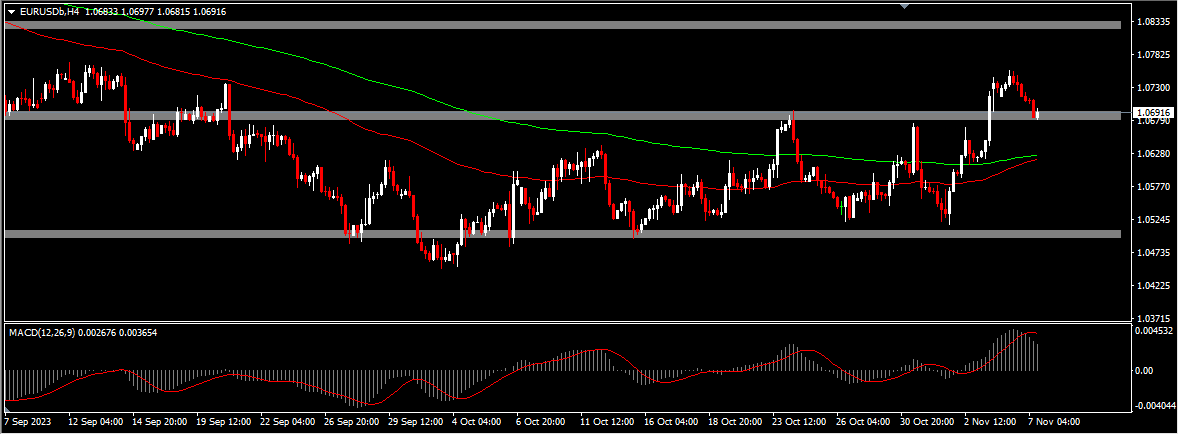

Wanting on the technical facet, the short-term outlook on the 4-hour timeframe exhibits some key help ranges. If the EURUSD pair breaks under 1.0670, it may sign additional declines, presumably all the way down to the 200-period EMA at 1.0620 and even the 61.8% Fibonacci retracement stage at 1.0607. The MACD indicator, at the moment under the sign line, signifies a leaning towards bearish momentum.

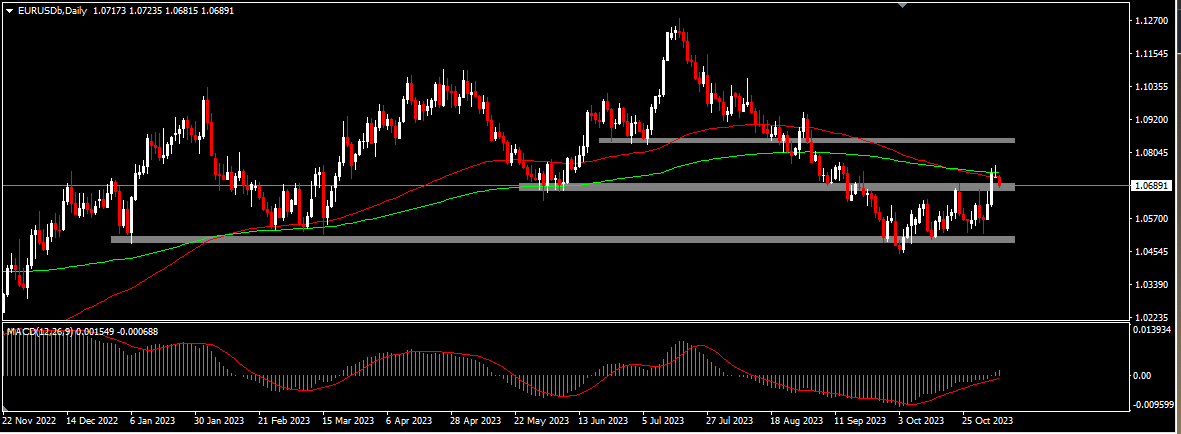

Zooming out to a each day perspective, the 100- and 200-period EMA have shaped a “demise cross,” usually signalling a bearish development. Nonetheless, the MACD, which has crossed above the zero line, hints at a bullish sentiment.

Given these combined indicators, it’s essential for merchants to train endurance and warning. Earlier than leaping into new lengthy positions, a transparent break above 1.0740 would sign a possible shift in momentum, right into a bullish one.

Click on right here to entry our Financial Calendar

Francois du Plessis

Market Analyst

Disclaimer: This materials is supplied as a common advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link