[ad_1]

US Greenback, DXY Index, USD, SVB, Treasury Yields, Fed, Kashkari, Credit score – Speaking Factors

- US Greenback languishes as Treasury yields wrestle to carry their floor

- The banking scenario may do a number of the Fed’s work on monetary tightening

- If Core PCE information later within the week is powerful, what is going to it imply for DXY (USD) Index?

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to Publication

The US Greenback softened once more right this moment after a selloff to finish final week with the uncertainty surrounding the banking sector persevering with to be assessed by markets.

It’s being reported that First Citizen Financial institution closed a deal to amass SVB Monetary.

The announcement on the Federal Deposit Insurance coverage Company (FDIC) web site says, “The 17 former branches of Silicon Valley Bridge Financial institution, Nationwide Affiliation, will open as First–Residents Financial institution & Belief Firm on Monday, March 27, 2023.”

The information might assist to alleviate some worries, however the market will likely be eyeing Deutsche Financial institution’s share value right this moment after taking a hammering on Friday on issues that they too could possibly be susceptible to tightening monetary circumstances.

Treasury yields are little moved throughout many of the curve after a push decrease on Friday. The benchmark 2-year notice is buying and selling close to 3.80%, having yielded shut to five.10% a number of weeks in the past. It’s value retaining in thoughts that it was beneath 2.40% at the moment final 12 months.

The 1-year bond managed so as to add some foundation factors right this moment as markets vacillate concerning the trajectory of the Fed’s charge path.

The general slide decrease in Treasury yields seems to have undermined the DXY (USD) index.

DXY (USD) INDEX AGAINST 2- AND 10-YEAR TREASURY YIELDS

Chart created in TradingView

Over the weekend, Minneapolis Fed President Neel Kashkari stated {that a} credit score crunch may gradual the financial system and it’s one thing that the Fed is watching intently.

After a whippy couple of weeks, crude oil has had a quiet begin on Monday with the WTI futures contract a contact above US$ 69 bbl whereas the Brent contract is close to US$ 75 bbl on the time of going to print.

Spot gold had an early look under USD 1,970 an oz. however moved again above there. The Aussie Greenback has been the best-performing main foreign money going into the European session.

Hong Kong’s Dangle Seng Index (HSI) is a notable underperformer of APAC fairness indices with earnings and the general weak point within the housing sector weighing it down. Futures are pointing to an excellent to start out the European and North American fairness periods.

The spotlight of right this moment’s financial calendar will likely be Germany’s IFO numbers. Later this week will see a slew of European CPI figures whereas the US will get GDP, Core PCE and jobs information.

The complete financial calendar may be considered right here.

Really helpful by Daniel McCarthy

Foreign exchange for Newbies

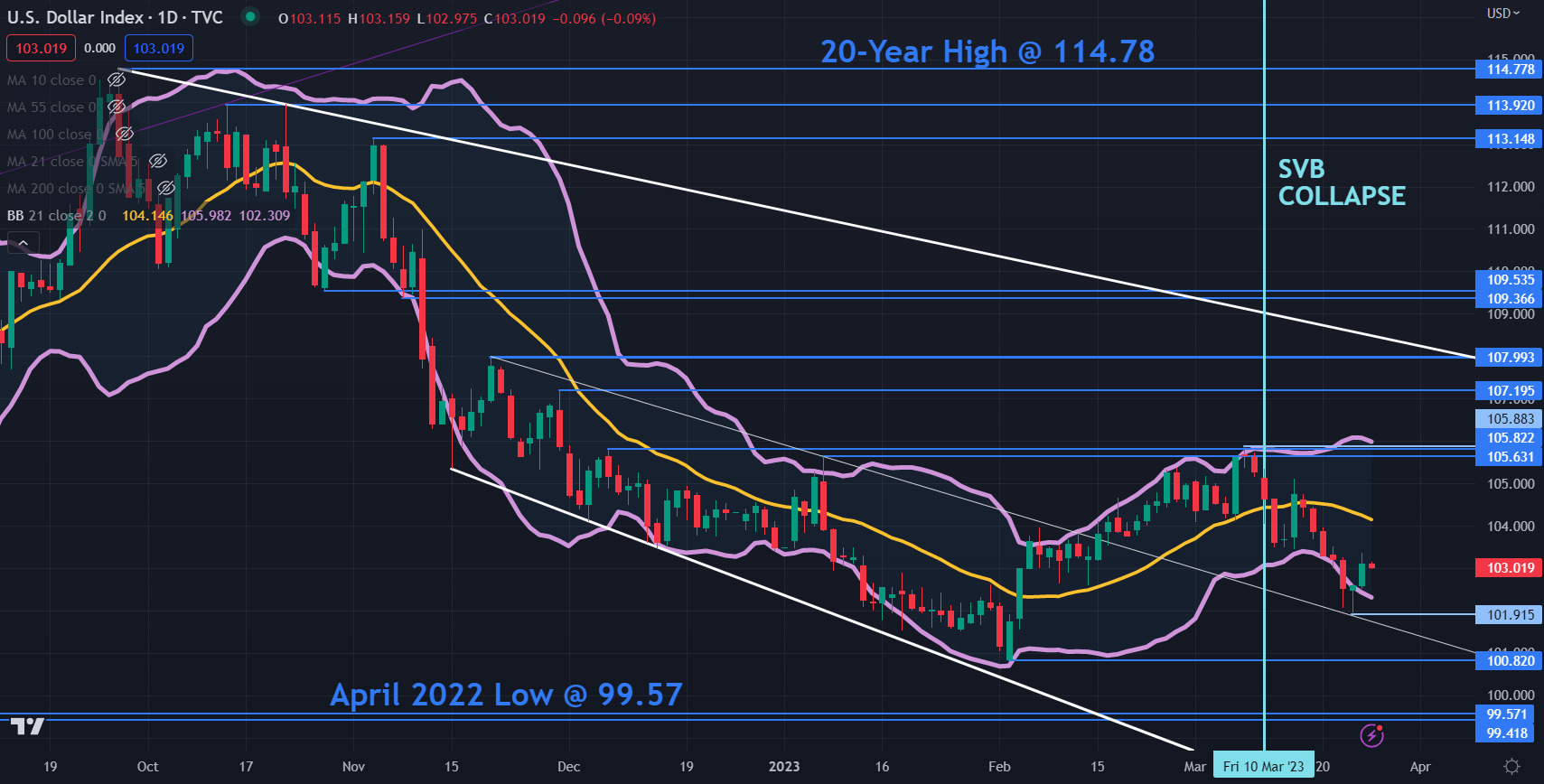

DXY (USD) INDEX TECHNICAL ANALYSIS

The DXY index stays in a broad long-term descending development channel.

The current sell-off broke under the decrease band of the 21-day easy transferring common (SMA) based mostly Bollinger Band. Towards the top of final week, it closed again contained in the band and that value motion may sign a pause within the bearish run or a possible reversal.

Help is perhaps on the current lows of 101.93, 100.82, 99.57 and 99.42.

On the topside, the triple tops seen within the 105.63 – 105.88 space might present a resistance zone. The earlier peaks 107.70 and 1.08.00 may provide resistance forward of the breakpoints at 109.37 and 109.54.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel through @DanMcCathyFX on Twitter

[ad_2]

Source link