[ad_1]

US Greenback Vs Euro, British Pound, Japanese Yen – Worth Setups:

Really useful by Manish Jaradi

Get Your Free Prime Buying and selling Alternatives Forecast

Developments on the technical charts point out that the US greenback’s rally is starting to point out tentative indicators of fatigue, pointing to a minor pause within the close to time period. Nonetheless, there aren’t any indicators of reversal but, suggesting that it could be untimely to conclude that the uptrend is over.

DXY Index: Upward stress might be easing a bit

The DXY Index’s (US greenback index) fall beneath minor assist finally week’s excessive of 106.85 signifies that the upward stress has pale a bit. Nonetheless, this wouldn’t indicate that the uptrend is reversing – certainly, the index would want to interrupt beneath fairly robust assist at Friday’s low of 105.65, coinciding with the decrease fringe of the Ichimoku cloud on the 240-minute charts.

DXY Index (USD index) 240-minute Chart

Chart Created by Manish Jaradi Utilizing TradingView

Because the accompanying chart reveals, on earlier events, the index has rebounded from related assist, so it wouldn’t be shocking if it does so once more. Solely a break beneath the 200-period shifting common (now at 105.00) on the 240-minute chart would pose a menace to the broader uptrend.

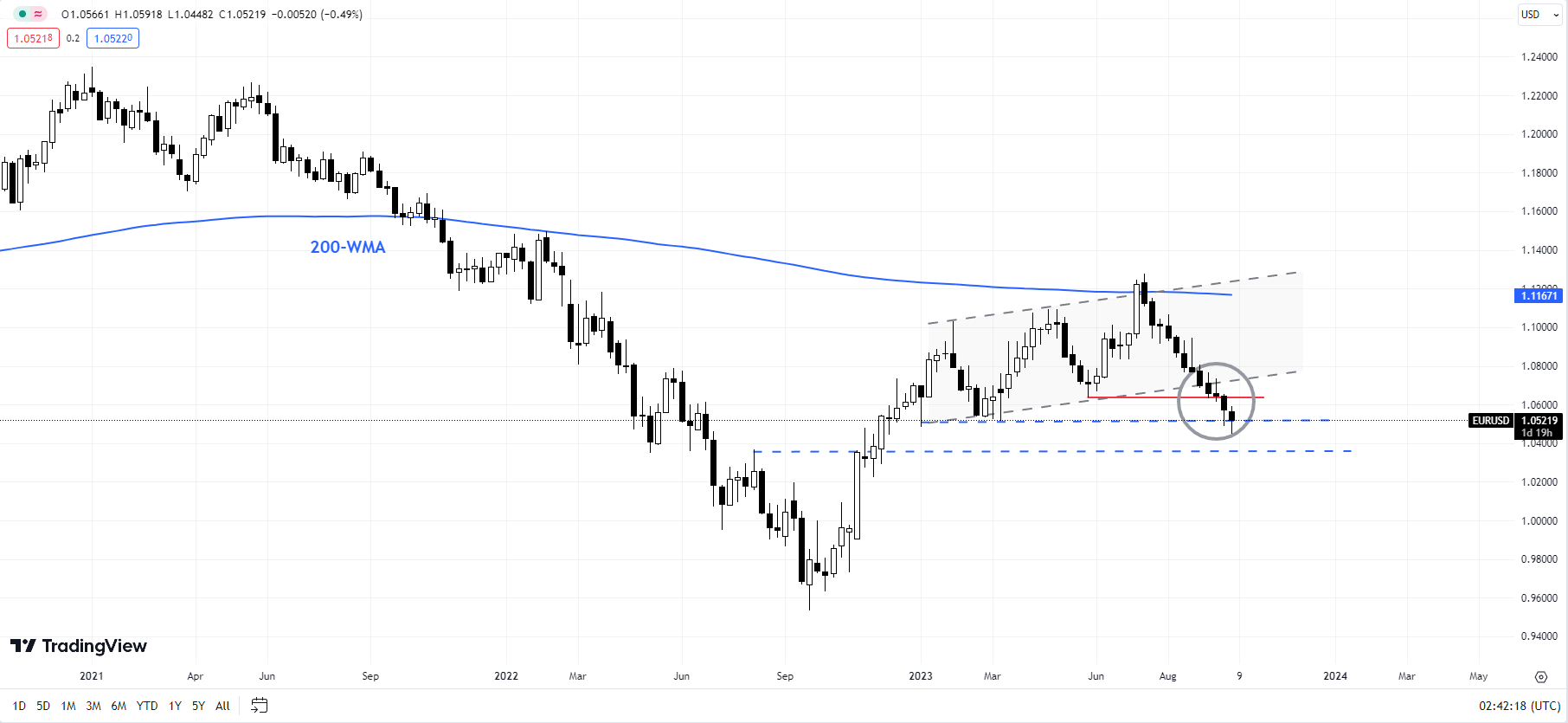

EUR/USD Weekly Chart

Chart Created by Manish Jaradi Utilizing TradingView

EUR/USD: Upward channel breaks

EUR/USD’s fall beneath the Might low of 1.0635 is an indication that the broader upward stress has pale. This coincides with a crack beneath the decrease fringe of a rising channel from early 2023. The pair is wanting deeply oversold because it assessments one other important flooring on the January low of 1.0480, not too removed from the decrease fringe of the Ichimoku cloud on the weekly charts (at about 1.0315). A break beneath 1.0315-1.0515 would pose a extreme threat to the uptrend that started in late 2022. Loads of resistance on the upside to cap corrective rallies, together with 1.0650, 1.0735, and 1.0825.

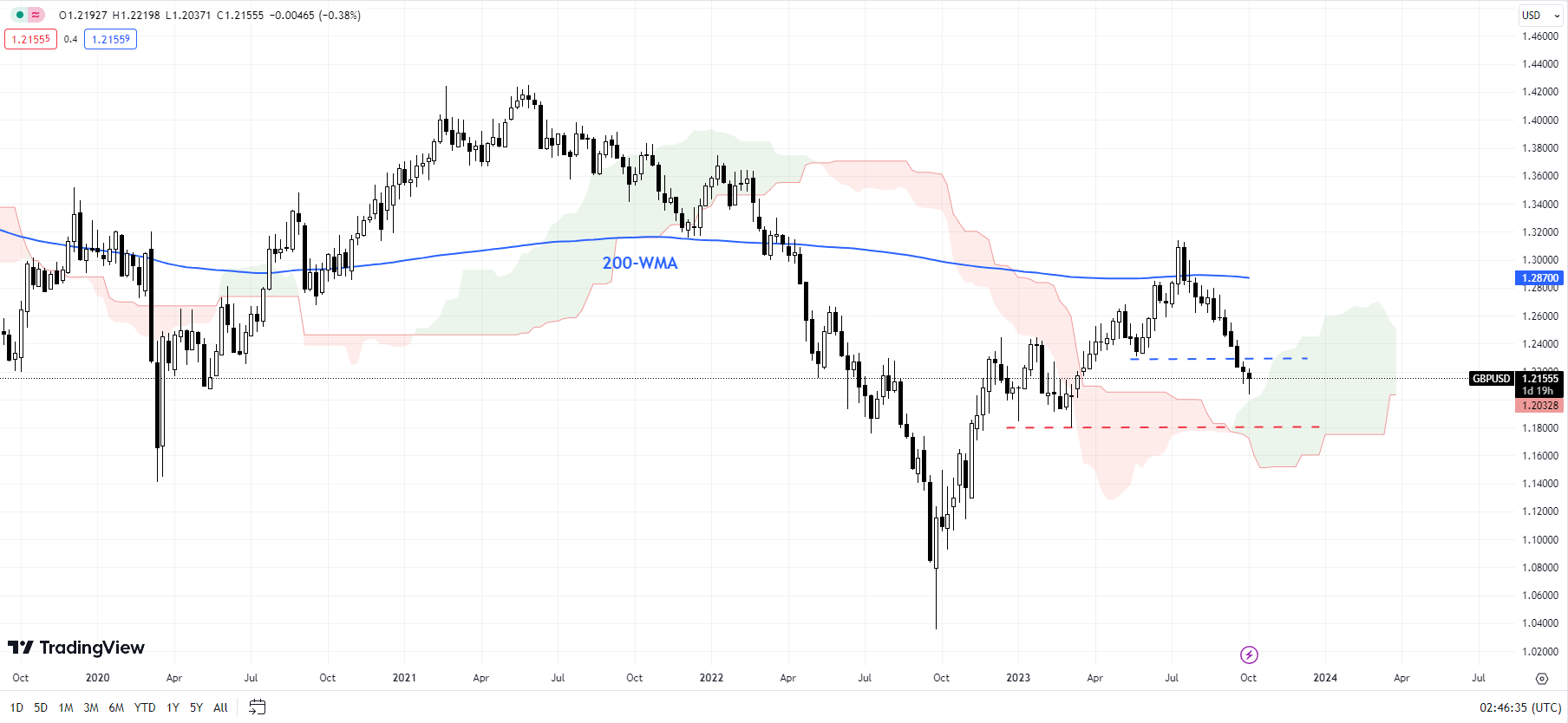

GBP/USD Weekly Chart

Chart Created by Manish Jaradi Utilizing TradingView

GBPUSD: Weak bias because it approaches assist

GBP/USD’s break beneath assist on the Might low of 1.2300 has opened the best way towards a significant cushion on the March low of 1.1800, across the decrease fringe of the Ichimoku cloud on the weekly charts (at about 1.1600). A fall beneath 1.1600-1.1800 would pose a threat to the broader restoration, disrupting the higher-top-higher-bottom sequence since late 2022.

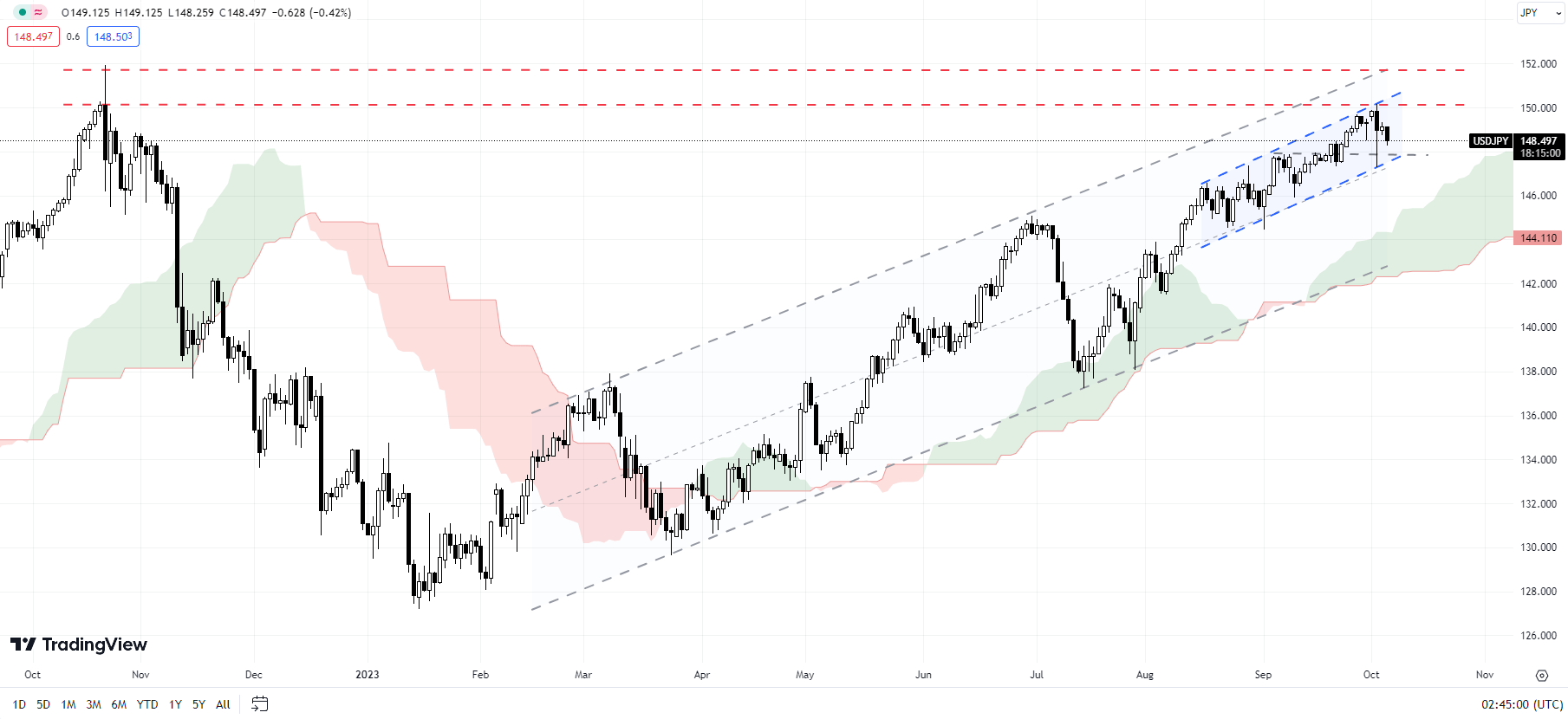

USD/JPY Day by day Chart

Chart Created by Manish Jaradi Utilizing TradingView

USD/JPY: Sharp retreat from a troublesome hurdle

USD/JPY has retreated from the psychological barrier at 150, not too removed from the 2022 excessive of 152.00. The bearish reversal created this week might be early indicators of fatigue within the rally. Nonetheless, until USD/JPY falls beneath assist at Tuesday’s low of 147.25, coinciding with the 200-period shifting common on the 240-minute chart, together with the decrease fringe of a rising channel since September, the trail of least resistance stays sideways to up. Any break beneath 147.00-147.25 may open the best way towards the early-September low of 144.50.

Really useful by Manish Jaradi

Prime Buying and selling Classes

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and comply with Jaradi on Twitter: @JaradiManish

[ad_2]

Source link