[ad_1]

DXY, GBP/USD PRICE, CHARTS AND ANALYSIS:

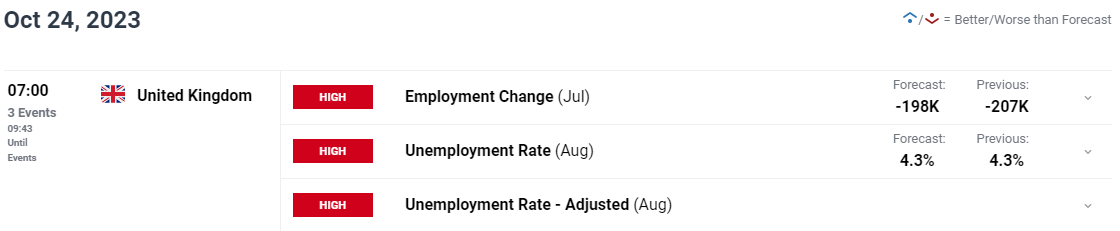

- GBP/USD Seems to be to Get well with a Trendline Break Pending and UK Labor Information Forward Tomorrow.

- US Greenback Index Retreat a Welcome for Cable Bulls as Geopolitical Issues Linger.

- IG Consumer Sentiment Reveals Retail Merchants are Web Lengthy on Cable. As We Take a Contrarian View to Consumer Sentiment at DailyFX, Are We in for Additional Draw back?

- To Study Extra About Worth Motion, Chart Patterns and Shifting Averages, Take a look at the DailyFX Schooling Part.

Learn Extra: Bitcoin Breaks Psychological 30k Stage as Spot ETF Approval Hopes Develop

Elevate your buying and selling abilities and achieve a aggressive edge. Get your arms on the US Greenback This autumn outlook in the present day for unique insights into key market catalysts that ought to be on each dealer’s radar.

Really helpful by Zain Vawda

Get Your Free USD Forecast

DOLLAR INDEX (DXY)

The Greenback index has had an intriguing begin to the week holding regular in early commerce as long-term US Yields helped underpin the US Greenback. Nonetheless, a big retreat in US Yields because the begin of the US session has seen the DXY make a big transfer decrease serving to threat property and all greenback denominated asset lessons.

Greenback Index (DXY) Every day Chart

Supply: TradingView, Chart Created by Zain Vawda

The transfer within the DXY shouldn’t come as an entire shock provided that final week’s threats of escalation within the Center East did not encourage a break above the 107.00 mark. This might’ve been seen as an indication that DXY bulls could also be rising stressed, and a deeper retracement could also be wanted. The query now’s whether or not this can stay sustainable transferring ahead?

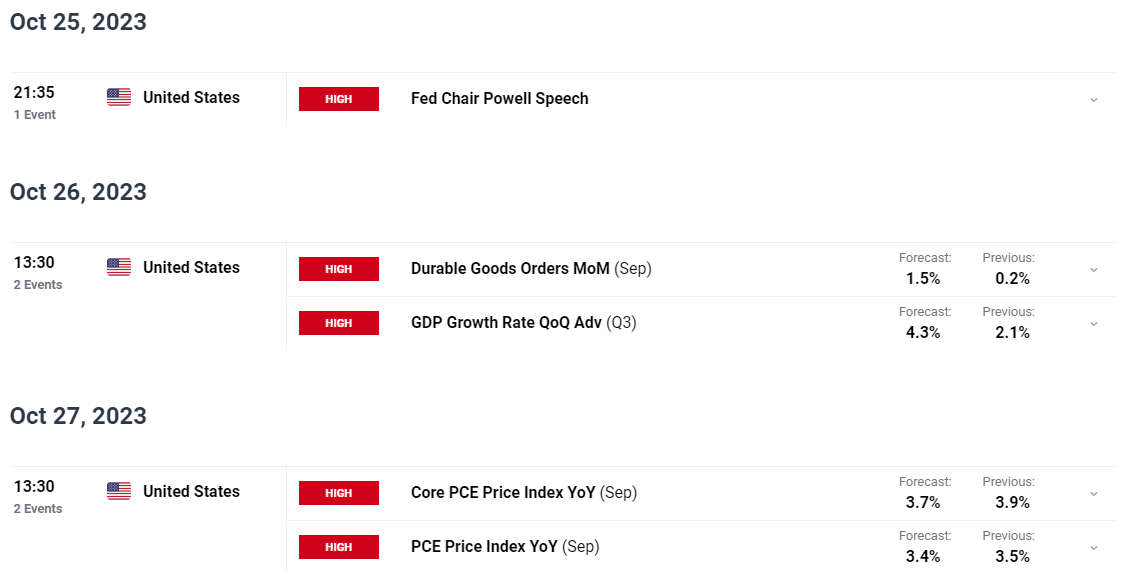

Taking a look at the remainder of the week and it may show to a tough one for the DXY as we do have some excessive influence knowledge occasions which may present assist for the Greenback. US Q3 GDP is anticipated to be optimistic and sturdy whereas US PCE Information (Feds most popular inflation gauge) is anticipated to stay sizzling. If so, we might be in for per week of two halves, with DXY weak point until Wednesday earlier than a notable restoration to finish the week. Positively value listening to.

Searching for Suggestions, Tips and Perception to GBPUSD, Obtain the The way to Commerce Information Under Now!!

Really helpful by Zain Vawda

The way to Commerce GBP/USD

GBPUSD EYEING A TRENDLINE BREAK WITH LABOR DATA AHEAD

Cable has been on the backfoot for fairly a while with a latest try at a rally met with fierce promoting stress on October 12. Now lots of the stress on GBPUSD in latest occasions has been Greenback based mostly and with Greenback weak point in the present day we’re seeing a rally in the meanwhile with GBPUSD up round 100-pips on the time of writing.

Tomorrow does deliver some UK labor knowledge with optimistic numbers possible to assist Cable proceed posting features. A weak print right here may depart the GBP uncovered, with a return of USD power prone to wipe out features fairly rapidly.

The USD nonetheless has a key position right here as I’m not but satisfied {that a} DXY retracement will final via the week with the US knowledge already mentioned. My different concern stays the Geopolitical state of affairs within the Center East which continues to vary each couple of hours. The US have been vocal of army intervention and such a transfer may give the DXY renewed impetus on safe-haven demand. Please hold a detailed eye on the developments within the Center East because it may lead to fast adjustments in threat urge for food.

For all market-moving financial releases and occasions, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

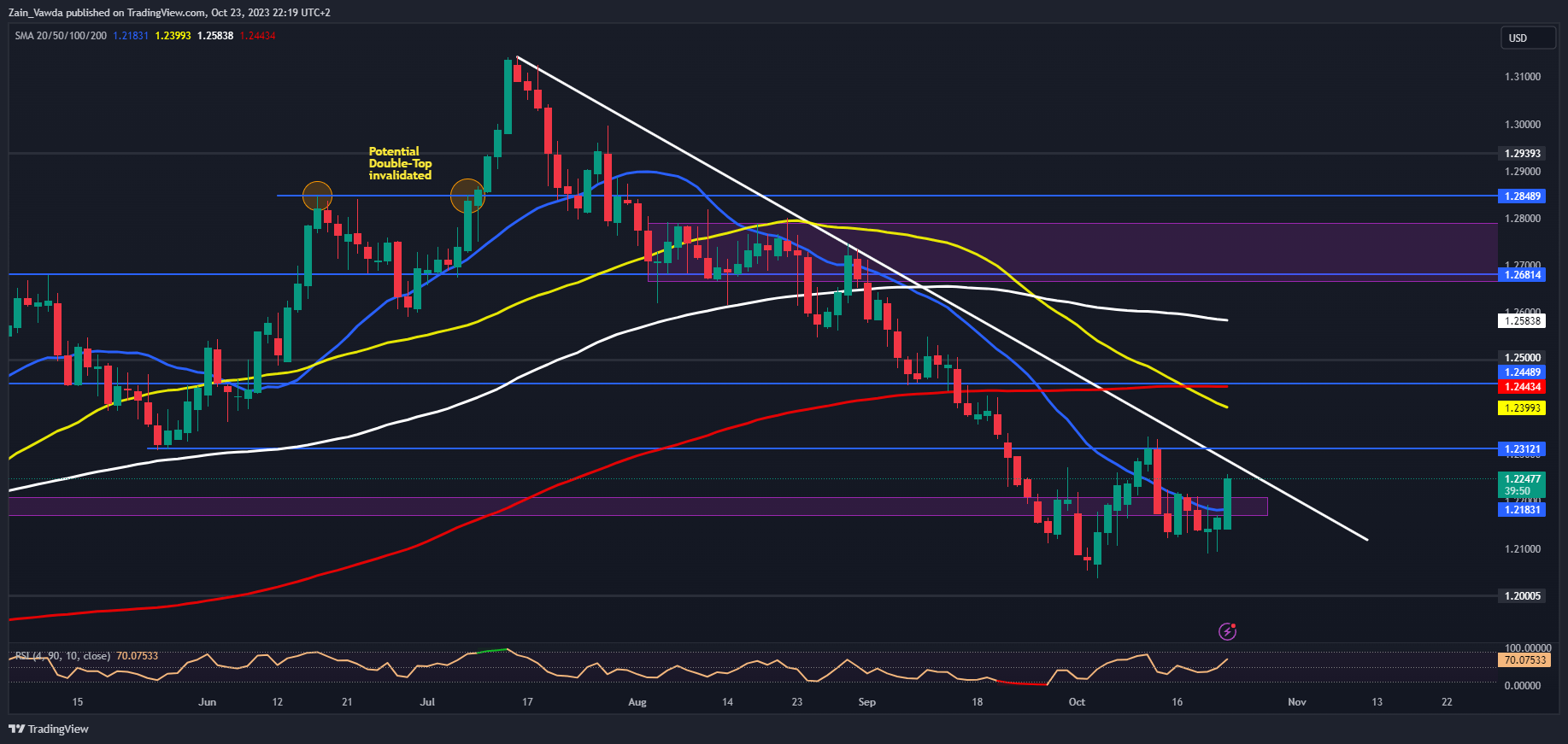

GBPUSD is lastly approaching the long-term trendline which has been in play since July 14 with Cable having decline about 1000 pips since. It seems the October 4 low might have been a backside as we now have since modified construction by printing the next excessive and better low with in the present day’s rally trying like the start of a brand new greater excessive leg from a worth motion standpoint.

If Cable is ready to break above the trendline there may be the 1.2300 stage which may show sticky with the 50 and 200-day MAs resting simply above at 1.2399 and 1.2443 respectively. A break above these two areas may see the long-awaited return to the 1.2500 psychological stage.

Alternatively, trying on the potential for a break to the draw back and the primary hurdle is the latest resistance turned assist on the 1.2200 stage earlier than the latest greater low on the 1,2100 stage turns into an space of curiosity forward of the 1.2000 deal with. Heaps to unpack given the ever-changing market circumstances, however alternatives might show aplenty.

Key Ranges to Preserve an Eye On:

Assist ranges:

- 1.2200

- 1.2100 (Current Swing Low)

- 1.2000 (Psychological Stage)

Resistance ranges:

- 1.2300

- 1.2399 (50-day MA)

- 1.2500

GBP/USD Every day Chart, October 23, 2023

Supply: TradingView, Created by Zain Vawda

IG CLIENT SENTIMENT DATA

IG Retail Dealer Sentiment reveals that 63% of merchants are at the moment NET LONG on GBPUSD. Given the contrarian view to Consumer Sentiment knowledge at DailyFX, Is GBPUSD to renew its slide this week?

For a extra in-depth take a look at GBP/USD sentiment and the adjustments in lengthy and quick positioning, obtain the free information beneath.

| Change in | Longs | Shorts | OI |

| Every day | -6% | 21% | 2% |

| Weekly | -10% | 12% | -3% |

— Written by Zain Vawda for DailyFX.com

Contact and observe Zain on Twitter: @zvawda

[ad_2]

Source link