[ad_1]

US DOLLAR FORECAST – EUR/USD, USD/JPY, GBP/USD

- U.S. greenback shows rangebound conduct forward of high-impact occasions on Friday

- US PCE knowledge and Powell’s speech on Friday shall be key for markets

- Thinner liquidity situations are anticipated later within the week due to a financial institution vacation

Most Learn: Japanese Yen Outlook – Market Sentiment Alerts for EUR/JPY, GBP/JPY, AUD/JPY

The U.S. greenback, as measured by the DXY index, moved inside a slim vary on Tuesday, displaying a scarcity of clear path, however finally managed to eke out tiny positive aspects. Blended U.S. Treasury yields and a way of warning amongst market contributors contributed to the muted worth motion, with merchants adopting a wait-and-see method forward of high-impact occasions on the U.S. financial calendar later this week.

Supply: TradingView

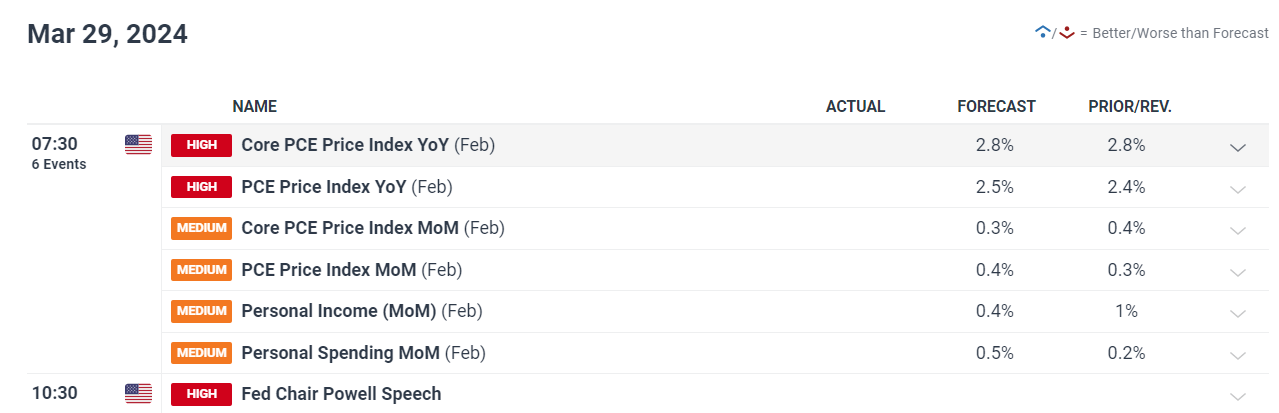

The discharge of core PCE knowledge on Friday, the FOMC’s most well-liked inflation gauge, holds explicit significance. This knowledge level will present recent insights into the trajectory of client costs, which policymakers are watching rigorously to information their subsequent transfer. Moreover, a speech by Fed Chair Powell on the identical day shall be carefully scrutinized for any clues in regards to the timing of the primary fee minimize of 2024.

Nevertheless, this is the wrinkle: Friday falls on a financial institution vacation. As well as, some international locations in Europe observe Easter Monday. This implies the true market response to those occasions is likely to be delayed till the next week. This prolonged interval of anticipation may additional add to a way of hesitancy amongst buyers, dissuading many from making giant directional bets till a clearer image emerges.

Whereas Foreign currency trading will proceed, nevertheless it will not be enterprise as typical. Decreased liquidity, a trademark of holidays, can amplify worth swings at instances. Even seemingly routine trades can upset the fragile stability between provide and demand, with fewer merchants round to soak up purchase and promote orders. Therefore, exercising warning is very advisable for these planning to commerce within the upcoming days.

Fundamentals apart now, the following portion of this text will revolve round inspecting the technical outlook for 3 key forex pairs: EUR/USD, USD/JPY and GBP/USD. Right here, we’ll dissect important worth thresholds that may act as assist or resistance within the upcoming classes – ranges that may supply beneficial insights for danger administration and strategic decision-making when constructing positions.

Supply: DailyFX Financial Calendar

Need to know the place the euro could also be headed over a longer-term horizon? Discover key insights in our quarterly forecast. Request your complimentary information right this moment!

Really useful by Diego Colman

Get Your Free EUR Forecast

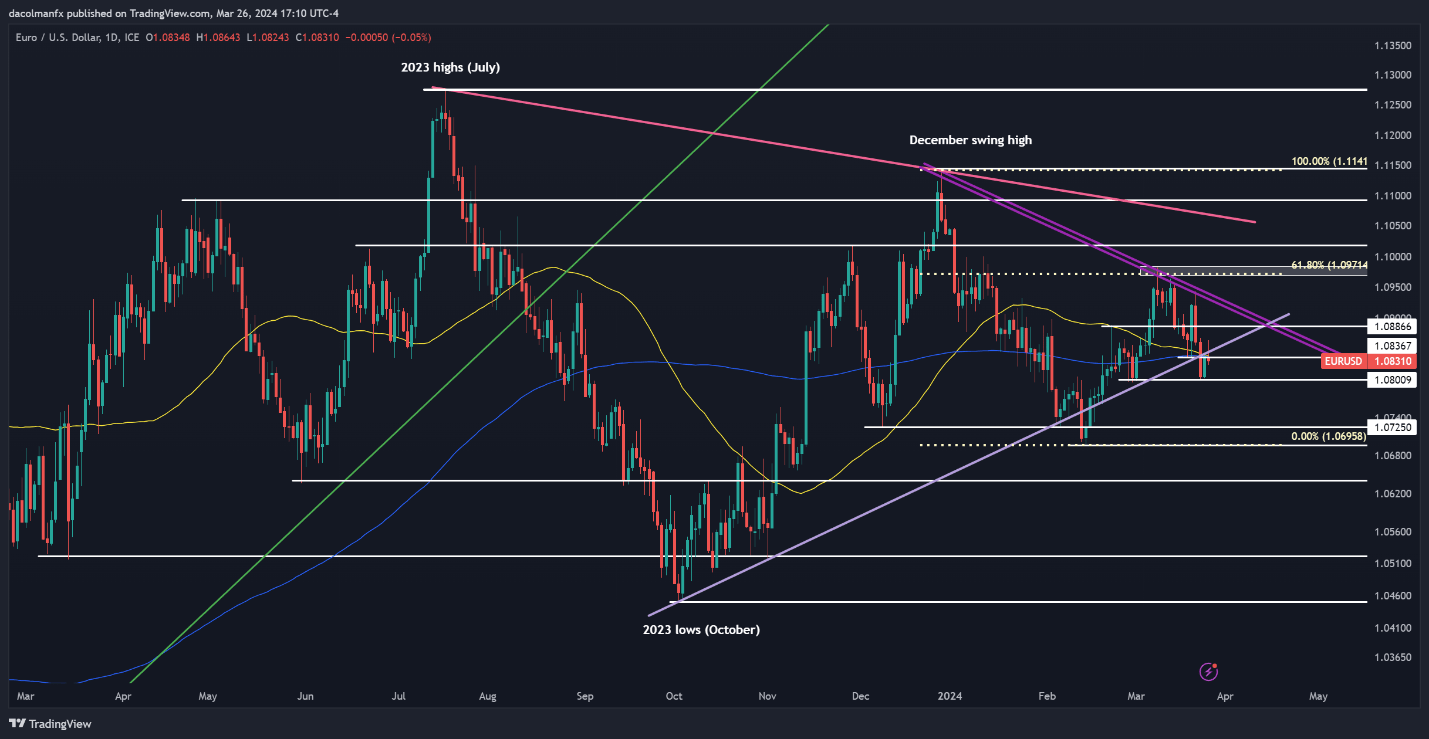

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD remained comparatively unchanged on Tuesday, failing to capitalize on the earlier session’s rebound and stalling at confluence resistance at 1.0835-1.0850. Ought to costs face rejection at present ranges, a retracement in direction of the 1.0800 mark is likely to be anticipated. On continued weak point, the main focus shall be on 1.0725.

On the flip aspect, if EUR/USD resumes its advance and efficiently takes out the 1.0835-1.0850 vary, bullish sentiment may make a comeback, ushering a transfer in direction of 1.0890 within the close to time period. Extra positive aspects past this juncture may reinforce shopping for curiosity, paving the best way for a climb in direction of trendline resistance at 1.0925.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Utilizing TradingView

Delve into how crowd psychology might affect FX market dynamics. Request our sentiment evaluation information to know the function of retail positioning in predicting USD/JPY’s near-term path.

| Change in | Longs | Shorts | OI |

| Each day | 5% | -1% | 0% |

| Weekly | -3% | 13% | 10% |

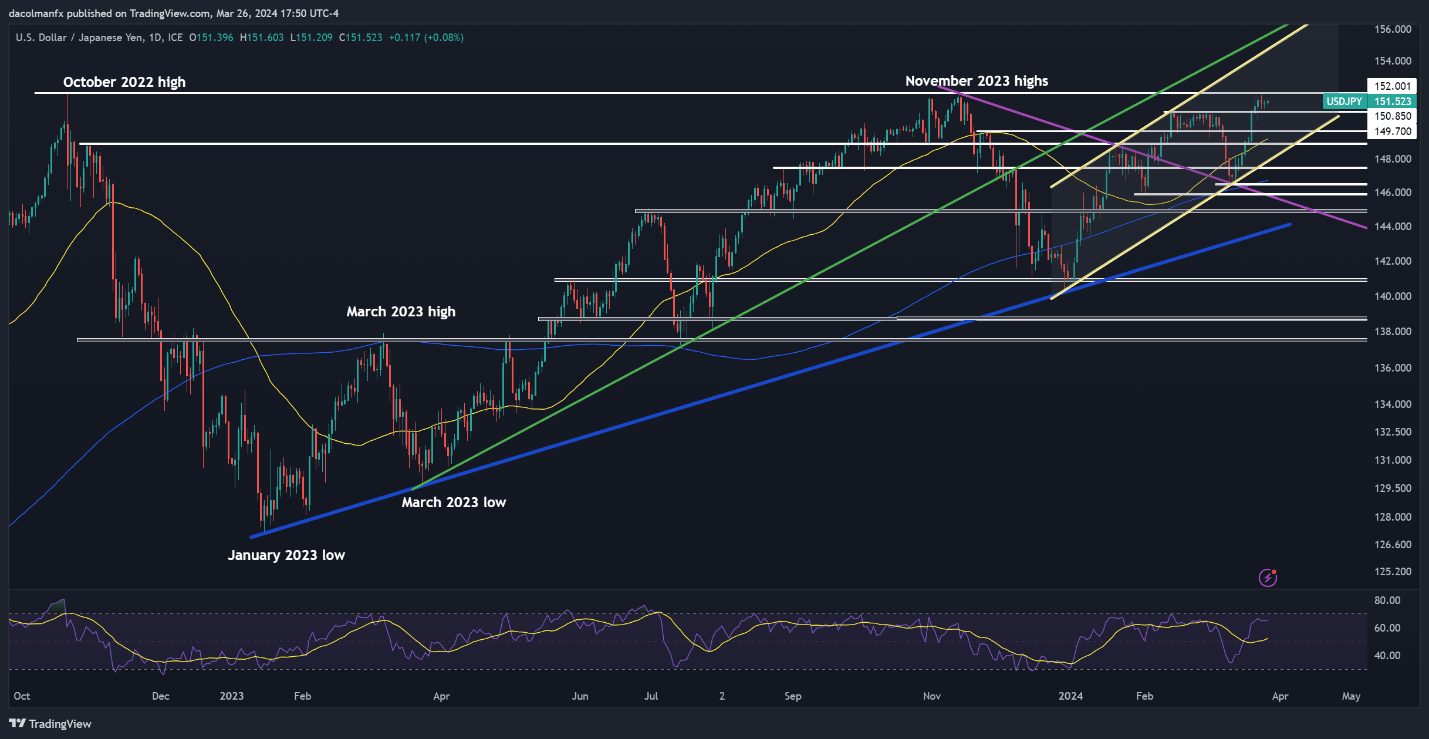

USD/JPY FORECAST – TECHNICAL ANALYSIS

USD/JPY displayed rangebound conduct on Tuesday, consolidating after final week’s rally and hovering beneath important resistance at 152.00. This key stage warrants shut consideration as a breakout may immediate the Japanese authorities to step in to assist the yen. On this state of affairs, we may see a pullback in direction of 150.90, adopted by 149.75. On additional losses, all eyes shall be on the 50-day easy transferring common.

Within the occasion that USD/JPY breaches the 152.00 mark and Tokyo refrains from intervening to let markets discover a new stability, bulls might really feel emboldened to provoke a bullish assault on 154.50, a key barrier outlined by the higher boundary of an ascending channel that has been in place since December of the earlier 12 months.

USD/JPY PRICE ACTION CHART

USD/JPY Chart Created Utilizing TradingView

Inquisitive about what lies forward for the British pound? Discover all of the insights in our quarterly forecast. Request your free copy now!

Really useful by Diego Colman

Get Your Free GBP Forecast

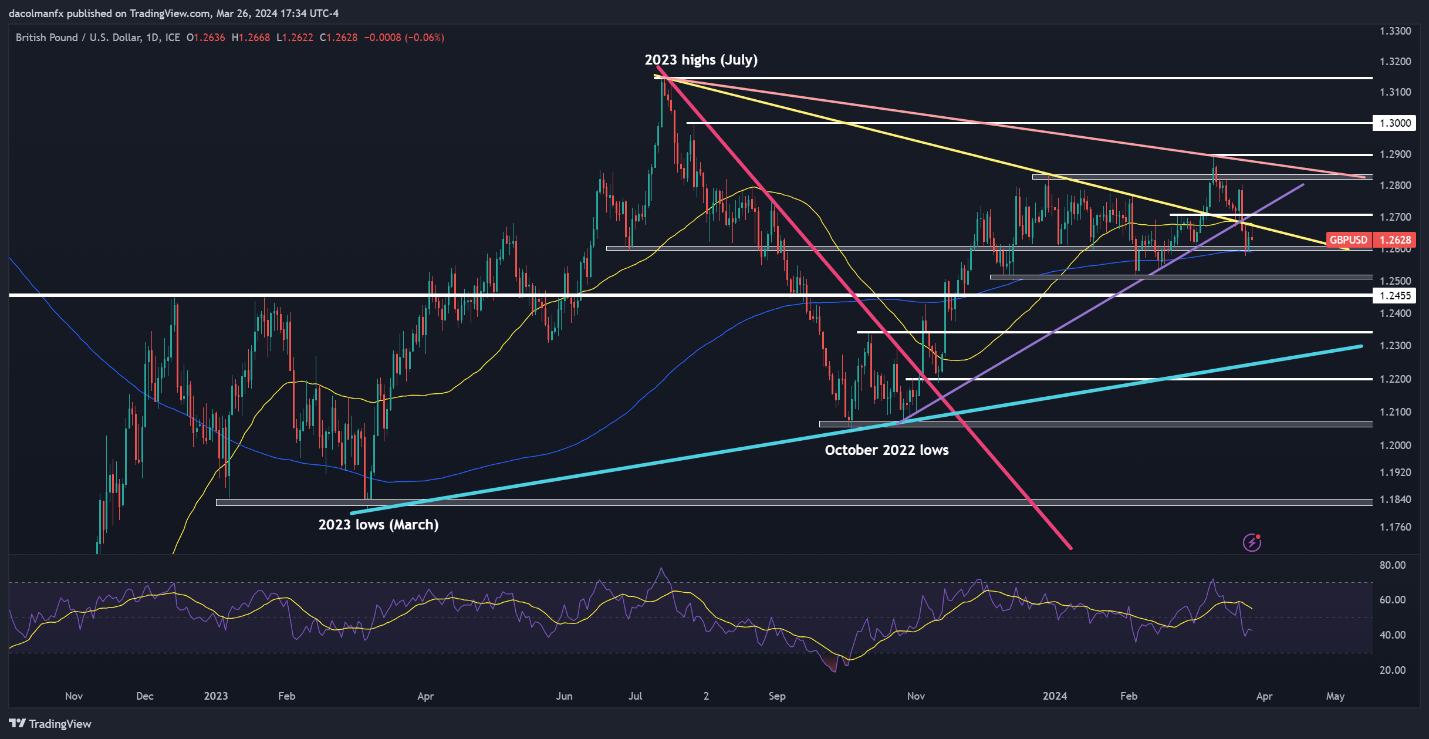

GBP/USD FORECAST – TECHNICAL ANALYSIS

GBP/USD additionally did not construct on Monday’s rebound, edging downwards after an unsuccessful push above each trendline resistance and the 50-day easy transferring common at 1.2675. Ought to this rejection be validated within the upcoming days, a retest of the 1.2600 stage could also be imminent. Additional losses from this level onward may immediate a descent in direction of 1.2510.

Conversely, if consumers return and propel cable larger, confluence resistance looms at 1.2675 after which at 1.2700, a key psychological threshold. Overcoming this technical ceiling is likely to be tough and will current challenges; nonetheless, a decisive breakout may reinforce upward impetus, doubtlessly setting the stage for a rally in direction of 1.2830.

GBP/USD PRICE ACTION CHART

GBP/USD Chart Created Utilizing TradingView

[ad_2]

Source link