[ad_1]

US DOLLAR OUTLOOK – EUR/USD, GBP/USD, USD/JPY

- The U.S. greenback retreated sharply this previous week, pressured by falling U.S. Treasury yields

- Nevertheless, the tide might flip within the dollar’s favor if upcoming U.S. CPI information tops estimates

- February’s U.S. inflation numbers shall be launched on Tuesday morning

Most Learn: USD/JPY Sinks on Bets BoJ Will Finish Destructive Charges Quickly, US Inflation in Focus

The U.S. greenback fell sharply final week, pressured by falling U.S. Treasury yields on rising expectations that the Federal Reserve might quickly start to scale back borrowing prices for the US financial system. By the top of the week after all of the twists and turns, the DXY index had plummeted by 1.10%, marking its worst weekly efficiency since early December.

US DOLLAR INDEX VS US BOND YIELDS

Supply: TradingView

Though Fed Chairman Powell indicated that the central financial institution just isn’t but sufficiently assured that client costs are on a sustained path towards convergence to the two.0% goal to slash rates of interest imminently, he additionally urged that policymakers are “not far” from gaining better confidence within the inflation outlook to lastly pull the set off.

Keen to find what the long run might have in retailer for the U.S. greenback? Discover complete solutions in our quarterly forecast! Get it right now!

Really helpful by Diego Colman

Get Your Free USD Forecast

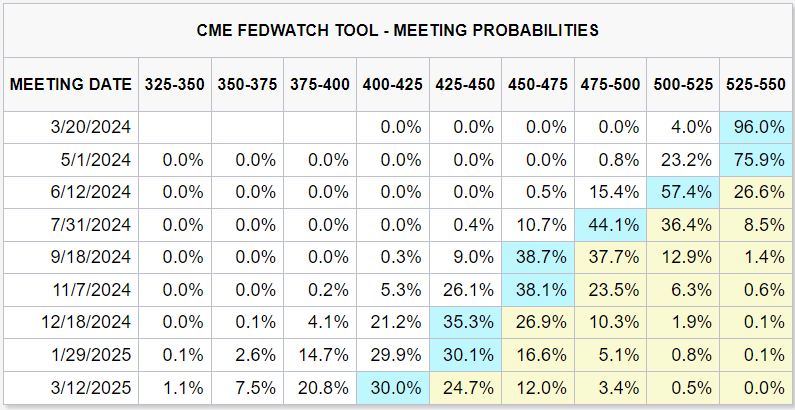

Powell’s remarks to Congress, coupled with combined U.S. employment figures that exposed an sudden uptick within the jobless charge to three.9% in February, bolstered bets that the Fed might ship its first lower of the cycle in June, elevating the percentages of this occasion to 57% on Friday from 52% two days earlier. The chart under reveals present Fed assembly chances.

Supply: CME Group

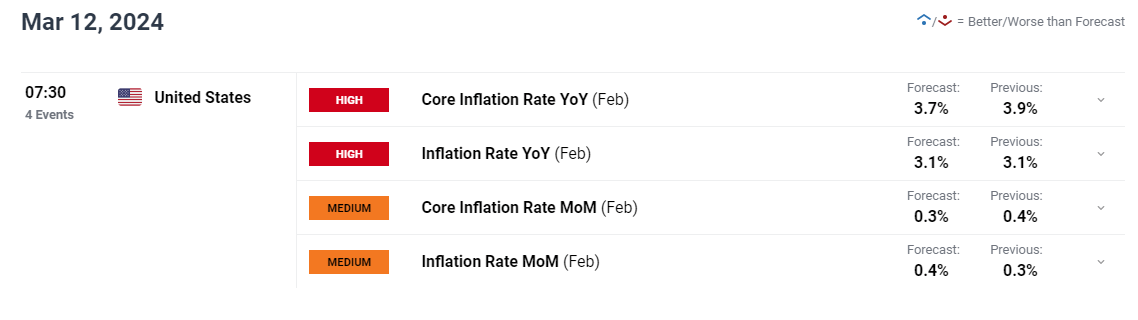

Trying forward, whereas U.S. greenback bears have regained the higher hand, the tables might flip within the coming days. For instance, if February’s US inflation information, to be launched on Tuesday, beats consensus estimates by a large margin, mirroring January’s upside shock, the temper might change on the drop of a hat, permitting bulls to mount a comeback.

The next desk gives an summary of Wall Avenue CPI forecasts as of Friday.

UPCOMING US INFLATION REPORT

Supply: DailyFX Financial Calendar

CPI numbers indicating minimal progress on disinflation needs to be bullish for the U.S. greenback, because it might spark a hawkish repricing of the Fed’s roadmap. It is because, in such a state of affairs, traders would count on the Fed to maintain rates of interest larger for longer, which might imply a delay in financial coverage easing.

In the meantime, a subdued inflation report under consensus estimates needs to be bearish for the dollar. This is able to validate Wall Avenue’s dovish outlook, resulting in an extension of the latest pullback in yields. Given the potential market impression of the upcoming client value index survey, merchants ought to comply with its launch carefully, paying explicit consideration to the pattern in core metrics.

Wish to know the place EUR/USD is headed over the approaching months? Discover all of the insights accessible in our quarterly forecast. Request your complimentary information right now!

Really helpful by Diego Colman

Get Your Free EUR Forecast

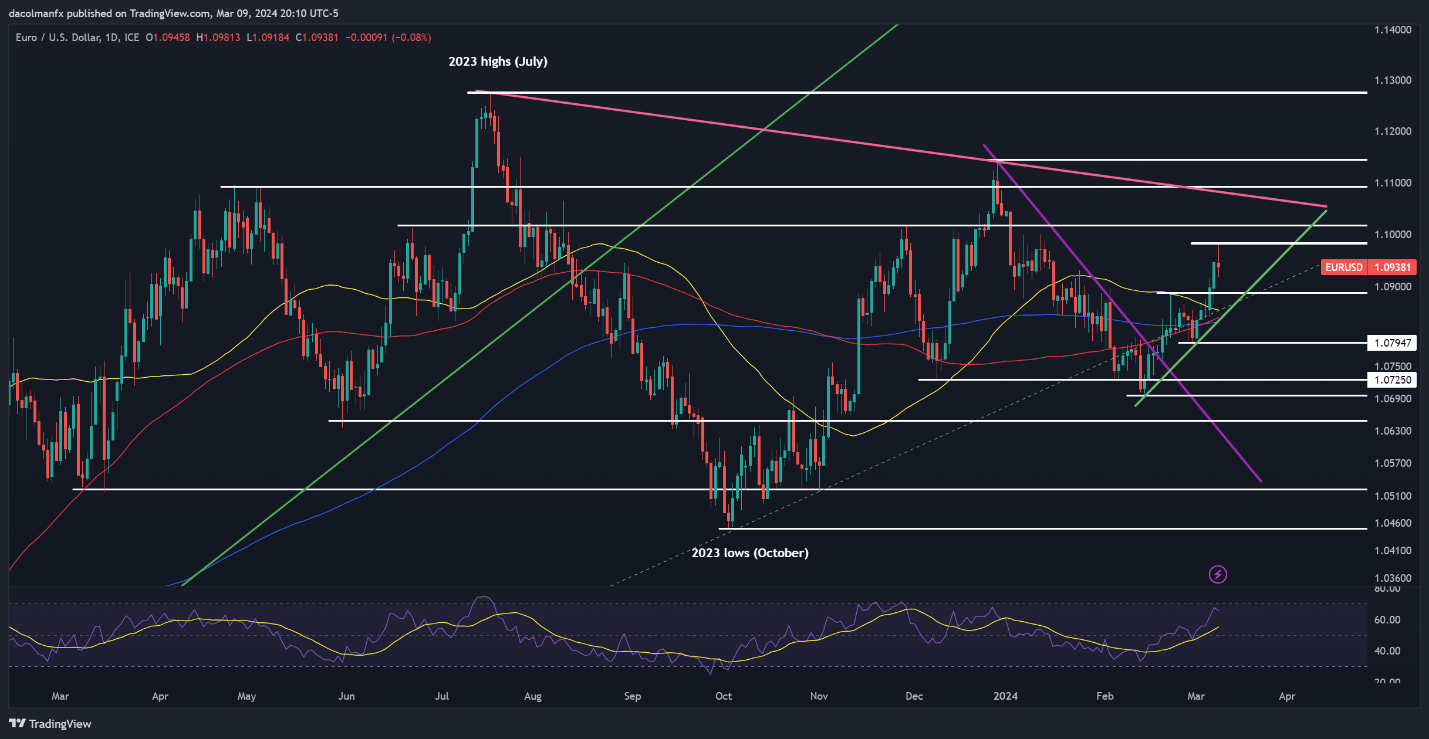

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD has rallied sharply in latest days, pushing previous a number of essential thresholds through the upswing. If positive aspects choose up traction over the approaching week, a key ceiling to observe emerges at 1.0980, adopted by 1.1020. Subsequent energy would then shift focus to trendline resistance at 1.1075.

Conversely, if sellers unexpectedly stage a comeback and drive costs decrease, the primary technical ground to keep watch over is positioned at 1.0890. Within the occasion of additional losses past this level, the highlight shall be on confluence assist at 1.0850 and 1.0790 thereafter.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Utilizing TradingView

Inquisitive about what lies forward for the Japanese yen? Discover complete solutions in our quarterly outlook. Declare your free copy now!

Really helpful by Diego Colman

Get Your Free JPY Forecast

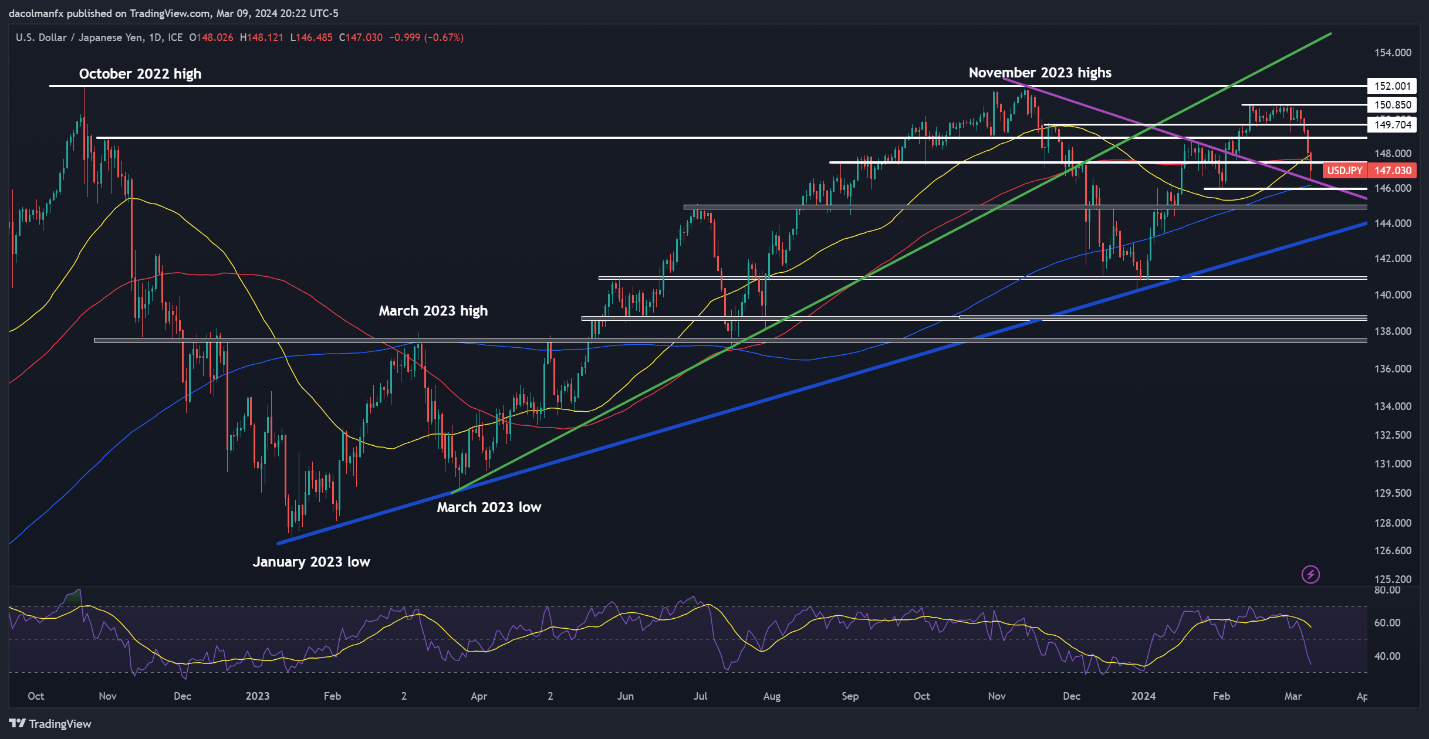

USD/JPY FORECAST – TECHNICAL ANALYSIS

USD/JPY plummeted this week, slipping under 147.50 and shutting at its lowest level since early February. If losses proceed over the approaching buying and selling classes, preliminary assist seems at 146.50. Beneath this degree, consideration shall be on the 200-day easy transferring common barely above the 146.00 mark.

Alternatively, if U.S. greenback bulls handle to set off a rebound, resistance is anticipated round 147.50. Past that threshold, all eyes shall be on 148.90. Trying larger, an extra transfer to the upside might see market curiosity shift in direction of 149.70, adopted by 150.90.

USD/JPY PRICE ACTION CHART

USD/JPY Chart Created Utilizing TradingView

Involved in studying how retail positioning can provide clues about GBP/USD’s directional bias? Our sentiment information incorporates useful insights into market psychology as a pattern indicator. Obtain it now!

| Change in | Longs | Shorts | OI |

| Every day | -7% | 3% | -1% |

| Weekly | -25% | 42% | 11% |

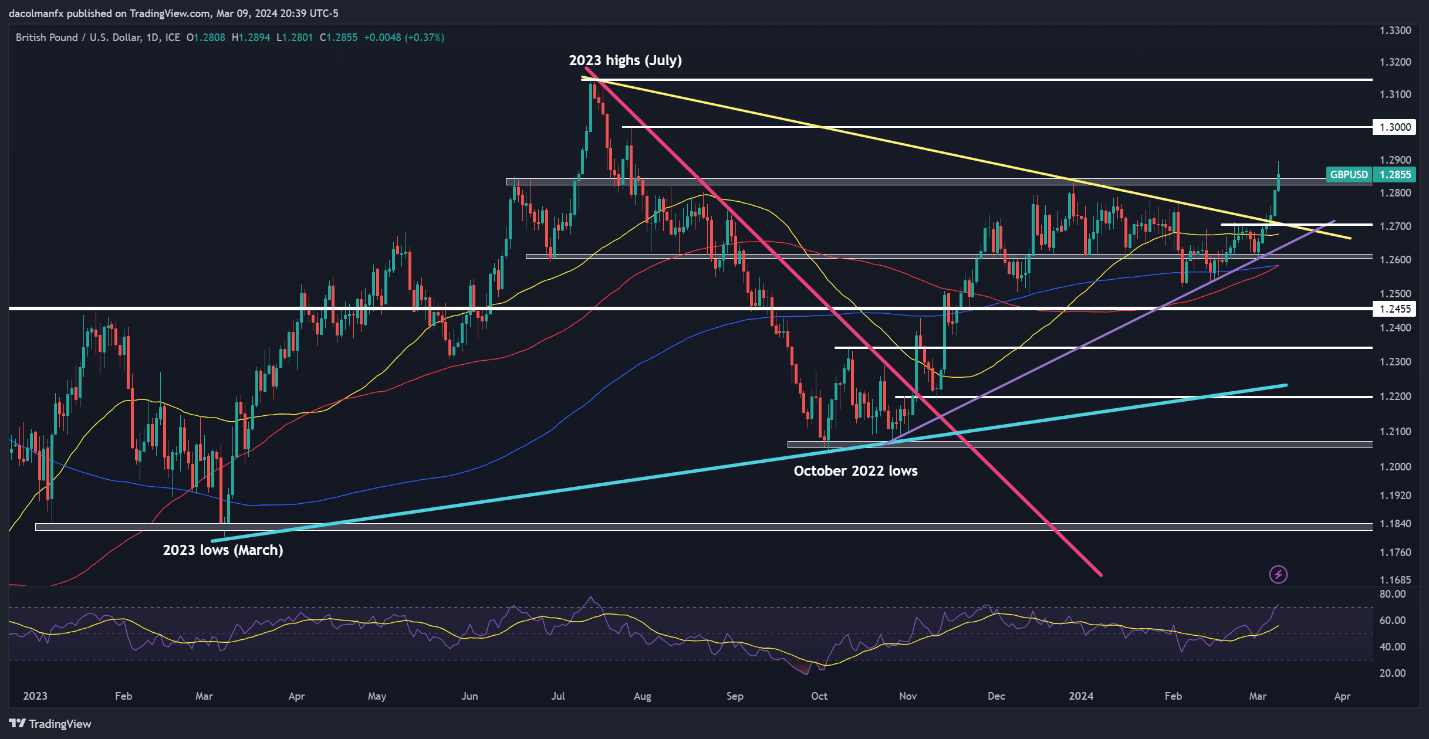

GBP/USD FORECAST – TECHNICAL ANALYSIS

GBP/USD soared this week, clearing a significant resistance close to 1.2830 simply earlier than the weekend. If this bullish breakout is sustained within the days forward, consumers might really feel emboldened to provoke an assault on the psychological 1.3000 degree. Above this level, further positive aspects will deliver 1.3140 into view.

On the flip aspect, if sentiment turns bearish rapidly and costs begin transferring downwards, assist lies at 1.2830, adopted by 1.2715. Transferring decrease, consideration shall be on the 50-day easy transferring common hovering round 1.2675.

GBP/USD PRICE ACTION CHART

GBP/USD Chart Created Utilizing TradingView

[ad_2]

Source link