[ad_1]

US DOLLAR OUTLOOK:

- U.S. greenback ended the day decrease regardless of the Fed’s hawkish financial coverage outlook

- The FOMC held charges regular on the finish of its June assembly, however signaled the tightening cycle just isn’t over

- The U.S. greenback’s bearish response suggests markets are skeptical of the Fed’s plans to renew mountain climbing later this 12 months

Really useful by Diego Colman

Get Your Free USD Forecast

Most Learn: Fed Pauses for Now however Alerts Greater Peak Price, Gold Costs Shift into Reverse

The U.S. greenback, as measured by the DXY index, weakened on Wednesday regardless of the Federal Reserve’s aggressive stance. Whereas the buck initially superior following at the moment’s financial coverage announcement, it was unable to carry positive aspects for lengthy, an indication of a insecurity within the central financial institution’s outlook.

For context, the FOMC held borrowing prices regular in a variety of 5.00% to five.25% on the finish of its June assembly, however indicated that extra work is required to defeat inflation, with policymakers projecting a terminal charge of 5.6% for 2023, up from 5.1% beforehand. This might symbolize two further 25 bp hikes over the subsequent six months. By corollary, this implies the “pause” can be short-lived.

The greenback’s counterintuitive response means that markets usually are not satisfied that the Fed will comply with by with its plans to renew tightening later this 12 months. If merchants believed within the steeper normalization path and the message of “greater for longer”, implied yields on 2023 Fed fund futures would have repriced greater and stayed at these ranges. The chart beneath reveals that didn’t occur.

2023 FED FUNDS FUTURES IMPLIED YIELDS

Supply: TradingView

For rate of interest expectations to shift in a extra hawkish path, the macro panorama must validate the view that the economic system stays in good condition to resist a extra restrictive financial coverage setting geared toward curbing inflation. To get a greater understanding of the evolving outlook, merchants ought to hold an in depth eye on upcoming financial stories, akin to U.S. retail gross sales, unemployment claims and the buyer confidence survey.

If incoming statistics affirm that financial exercise stays resilient, traders will probably be much less hesitant to low cost a extra aggressive coverage outlook. This might rekindle the united statesdollar’s restoration. Conversely, if information begins to deteriorate, the market skepticism could possibly be supported, reinforcing the U.S. greenback’s subdued tone.

Really useful by Diego Colman

Foreign exchange for Rookies

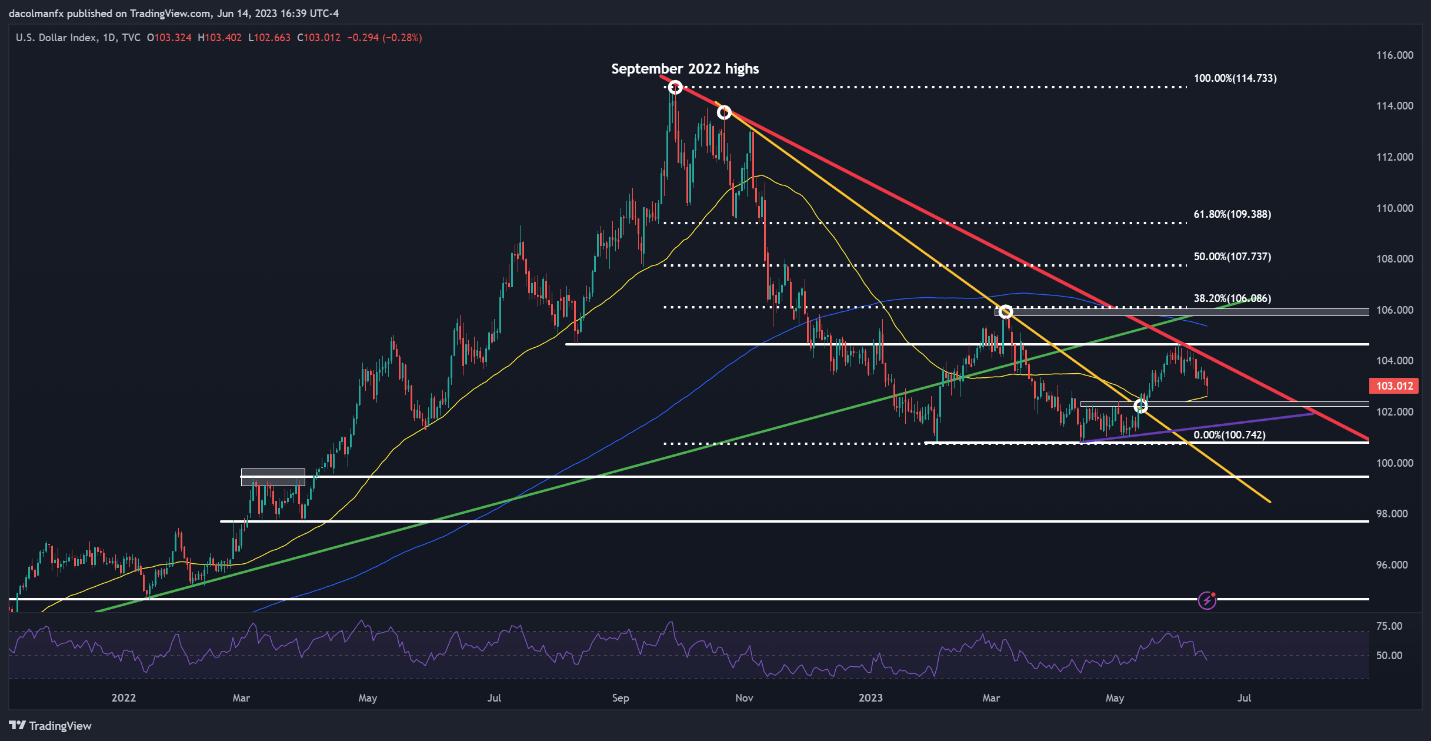

US DOLLAR TECHNICAL ANALYSIS

When it comes to technical evaluation, the U.S. greenback index has been trending decrease because the starting of the June following an unsuccessful try to clear trendline resistance at 104.55. That mentioned, if costs retain their bearish bias and push decrease, preliminary assist stretches from 102.40 to 102.15. If this flooring is taken out, we might see a transfer in the direction of 101.50.

On the flip aspect, if consumers regain management of the market and spark a bullish reversal, the primary ceiling to remember rests on the psychological 104.00 stage (additionally trendline resistance). If this barrier is breached, DXY can have fewer obstacles to reclaim 104.70, after which the 200-day SMA.

US DOLLAR (DXY) TECHNICAL CHART

US Greenback (DXY) Chart Ready Utilizing TradingView

[ad_2]

Source link