US Greenback, Singapore Greenback, Thai Baht, Indonesian Rupiah, Philippine Peso, ASEAN, Elementary Evaluation – Speaking Factors

- US Greenback stabilizes in opposition to Rising Market currencies

- Merchants intently eyeing the FOMC assembly minutes forward

- Philippine and Thailand CPI additionally in focus for PHP & THD

US Greenback ASEAN Weekly Recap

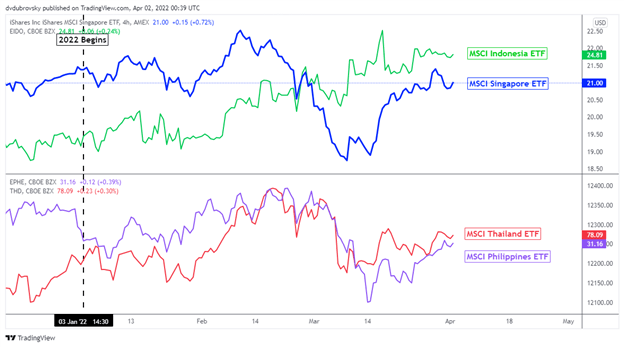

This previous week, the US Greenback continued to stabilize in opposition to ASEAN currencies such because the Singapore Greenback, Thai Baht, Indonesian Rupiah and Philippine Peso. Broadly talking, the Dollar stays decrease in opposition to Rising Asia currencies for the reason that March Federal Reserve rate of interest resolution. This follows broad beneficial properties in ASEAN indices, signaling that investor confidence has been enhancing – see chart under.

MSCI ASEAN Indices 4-Hour Chart

Chart Created Utilizing TradingView

Exterior Occasion Danger – Ukraine, Yield Curve, FOMC Minutes

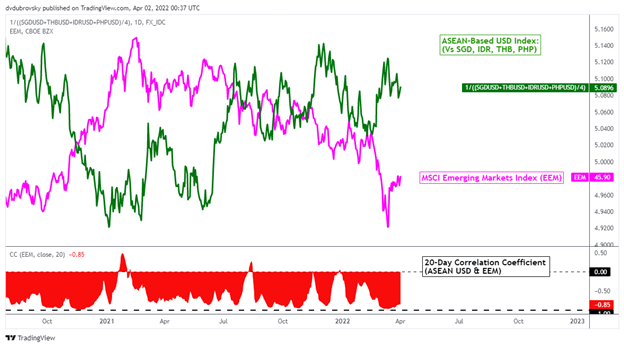

Rising Market currencies are typically fairly delicate to international danger tendencies when evaluating them in opposition to the US Greenback – see chart under. As such, the stream of capital into and out of the creating world might be essential to comply with. A gauge of this from Bloomberg is sitting at its highest since early February after discovering a backside on March 14th.

Russia’s assault on Ukraine has been taking part in a key position. It appears that evidently merchants have materially repriced their expectations of the warfare impacting normal danger urge for food. Having a look on the Russian Ruble, USD/RUB has fallen from a excessive of 154.25 after the assault, to final week’s shut of 85.00. RUB is now buying and selling round ranges seen previous to the invasion and the native inventory market appears to have averted a complete meltdown.

The scenario nonetheless stays risky, however merchants could shift again to the underlying problem putting Rising Markets in danger, the Federal Reserve’s tightening cycle. Geopolitical tensions in Europe could bolster meals and vitality costs, maybe pushing to a extra hawkish central financial institution. The markets are additionally beginning to worth in a recession given {that a} key gauge of the US yield curve has inverted.

With that in thoughts, merchants are going to be eyeing the FOMC assembly minutes on Wednesday. Merchants might be awaiting what will be in retailer for tapering the Fed stability sheet. The S&P 500 ended flat in per week when the central financial institution reduced its asset holdings. This might spell hassle for danger urge for food within the coming months, leaving the US Greenback ready to capitalize in opposition to Rising Market currencies.

ASEAN Occasion Danger – Philippine and Thailand CPI, Singapore Retail Gross sales

Turning in the direction of the ASEAN financial docket, there are a few prints to maintain an eye fixed out for. These embrace March Philippine and Thailand CPI information for USD/PHP and USD/THB respectively. These are anticipated to cross the wires at 3.9% y/y and 5.6% y/y respectively. Singapore may even launch retail gross sales, that are anticipated to extend 4.8% y/y in February.

Take a look at the DailyFX Financial Calendar for ASEAN and international information updates!

On April 1st, the 20-day rolling correlation coefficient between my ASEAN-based US Greenback index and the MSCI Rising Markets Index modified to -0.85 from -0.91 one week in the past. Values nearer to –1 point out an more and more inverse relationship, although you will need to acknowledge that correlation doesn’t suggest causation.

ASEAN-Based mostly USD Index Versus EEM Index – Every day Chart

Chart Created Utilizing TradingView

*ASEAN-Based mostly US Greenback Index averages USD/SGD, USD/IDR, USD/THB and USD/PHP

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the feedback part under or @ddubrovskyFX on Twitter