[ad_1]

US CPI Key Factors

- US CPI is predicted to fall to 2.9% y/y, with the “Core” (ex-food and -energy) studying coming in at 3.8% y/y.

- The current surge within the “Costs” part of the ISM PMI surveys hints that inflation may reaccelerate this Spring.

- USD/JPY is testing key resistance at 149.40 forward of the report – a scorching studying may result in one other leg larger within the pair.

When is the US CPI Report?

The January US CPI report will likely be launched at 8:30am ET on Tuesday, February 13, 2024.

What Are the US CPI Report Expectations?

Merchants and economists count on the US CPI report fall to 2.9% y/y on a headline foundation, with the “Core” (ex-food and -energy) studying anticipated at 3.8% y/y.

If these expectations are realized, it could mark the bottom year-over-year readings for the 2 measures in practically three years.

US CPI Forecast

Heading into the 12 months, there was a transparent “script” that merchants and economists had been anticipating the US economic system to comply with:

- Job development would proceed to gradual and…

- Inflation would progressively recede again to the Federal Reserve’s 2% goal, prompting

- The central financial institution to chop rates of interest repeatedly, beginning in March.

There’s been only one downside with this: The economic system didn’t get the memo. As a substitute of following that script, we’ve seen blowout employment figures, inflation seemingly reaccelerating, and the Fed pushing again on expectations for rate of interest cuts in March. Tomorrow’s US CPI report is the following massive check to see if the nascent pattern of US financial exceptionalism in 2024 continues.

Digging into the information, headline CPI has clearly seen its decline stall during the last couple of quarters, with the year-over-year measure truly rising from 3.0% to three.4% during the last six months. That stated, the Fed is extra involved with the “Core” CPI studying, which is seen as extra indicative of underlying worth pressures and has continued to edge decrease in current months.

Among the best main indicators for inflation is the “Costs” part of the Manufacturing and Non-Manufacturing PMI surveys. Traditionally, a easy common of those two parts has been a comparatively dependable predictor of CPI readings 3-6 months into the longer term, because the chart under reveals:

Supply: TradingView, StoneX

Whereas it gained’t essentially impression CPI dramatically this month, the newest spherical of PMI surveys confirmed costs rising for 58.5% of respondents throughout the 2 surveys, suggesting that inflation may properly tick up as we transfer into the Spring. That is little question a priority for the Fed and should result in a smaller-than-expected response even when this week’s (lagging) CPI studying is available in under expectations.

Notably, merchants usually are not essentially anticipating an enormous transfer on the again of this month’s CPI report. Measures of implied volatility within the FX market are hovering close to 2-year lows amidst the continuing Lunar New 12 months vacation, and in keeping with Reuters, choices merchants are pricing in a median of a 38-pip transfer in and 58-pip transfer in forward of the information. That stated, with fewer merchants at their desks than normal, there’s definitely the potential for an outsized transfer if the information actually surprises relative to expectations.

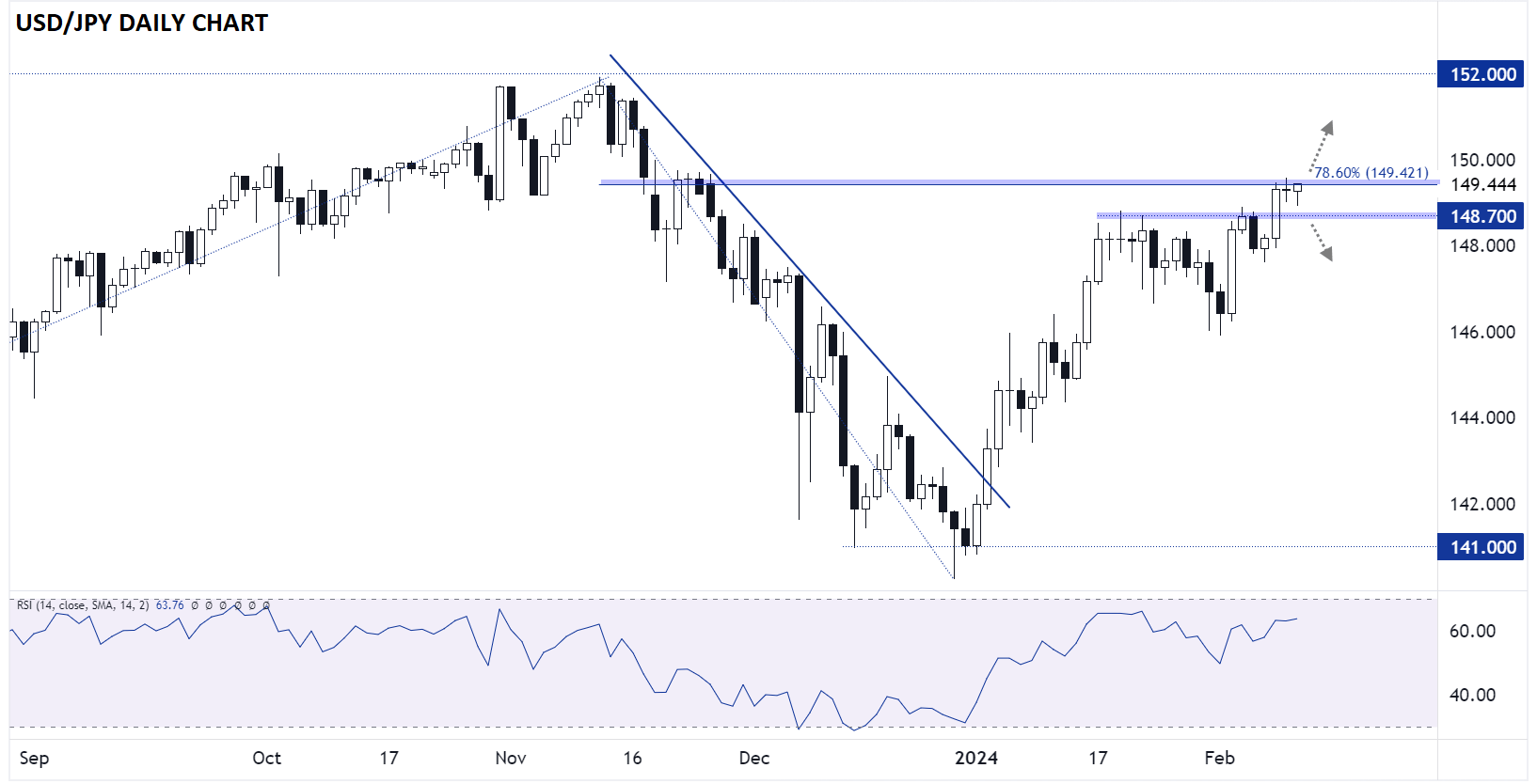

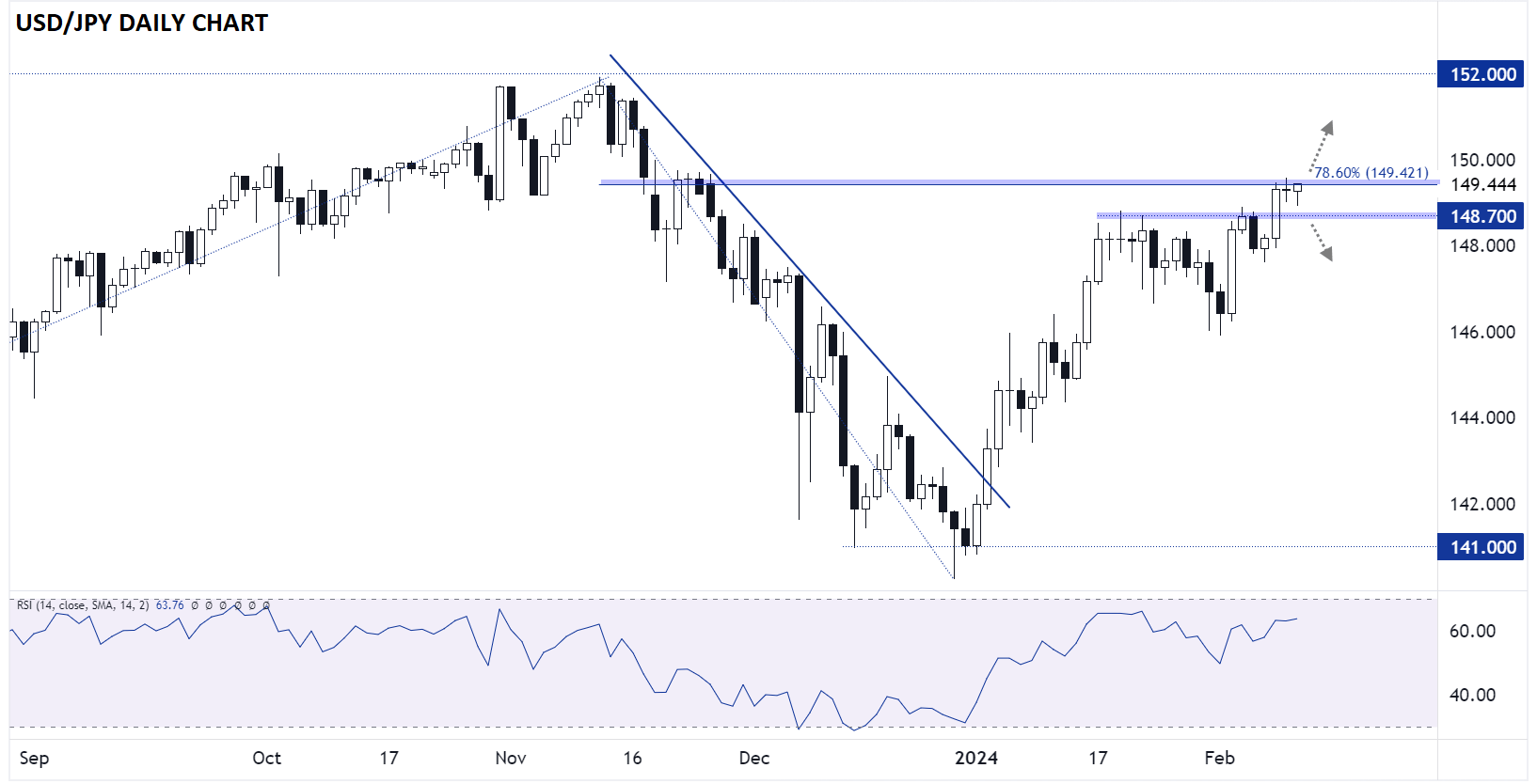

Japanese Yen Technical Evaluation – USD/JPY Each day Chart

Supply: TradingView, StoneX

As is usually the case with US information, USD/JPY could have the “cleanest,” most reasonable response to this month’s CPI information. Trying on the chart above, USD/JPY is consolidating after its breakout above 148.70 resistance final week.

For this week, the important thing resistance degree to look at would be the 78.6% Fibonacci retracement of the November-December drop close to 149.40. If bulls are capable of overcome that resistance degree (probably on the again of a hotter-than-expected US CPI report), the pair has little in the way in which of technical resistance till nearer to 152.00. In the meantime, a smooth inflation studying and bearish response in USD/JPY may take charges under previous-resistance-turned-support at 148.70, opening the door for a deeper retracement under 148.00.

Unique Publish

[ad_2]

Source link