On Monday night time Moody’s reduce the credit standing of a bunch of small and mid-sized banks whereas inserting a number of massive Wall Avenue names underneath assessment. Amongst these latter ones there may be BNY, US Bancorp, State Avenue and Belief Monetary.

The ranking company cited the continual rate of interest and asset-liability administration dangers with implications for liquidity and capital ‘’because the wind-down of unconventional financial coverage drains systemwide deposits and larger rates of interest depress the worth of fixed-rate property”. Banks’ Q2 outcomes additionally confirmed rising profitability pressures which might be decreasing their capability to generate inner capital. Whereas the final Stress Take a look at outcomes confirmed pretty comfy capital ratios among the many greatest gamers of the sector, Moody’s is warning that substantial unrealized losses could also be not captured by these regulatory capital ratios and sudden losses of market or client confidence in a excessive rate of interest setting will depart weaker banks struggling with a worsening high quality of their property. The company is anticipating charges to remain larger for longer and a gentle recession in early 2024.

Technical Evaluation – Financial institution of New York Mellon (BNY)

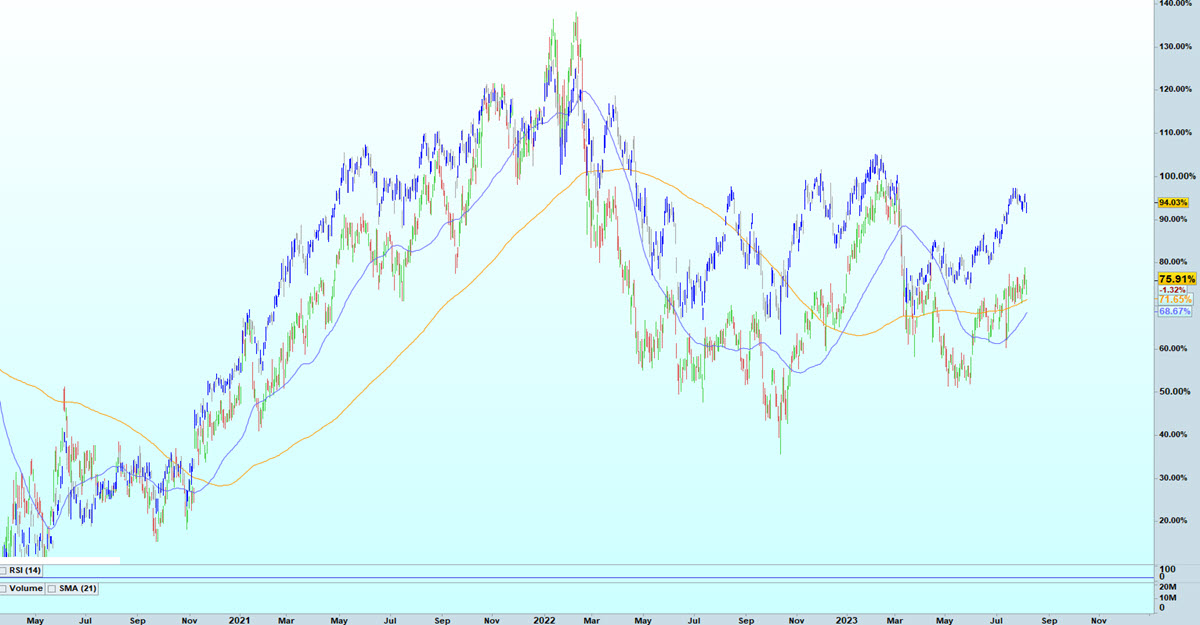

BNY has been underperforming the broader XLF, the Monetary Choose Sector SPDR Fund, for years now and the state of affairs has probably not improved: because the put up Covid disaster backside in late March 2020 the inventory is +75.91% versus a sectorial fund efficiency of +94.03%.

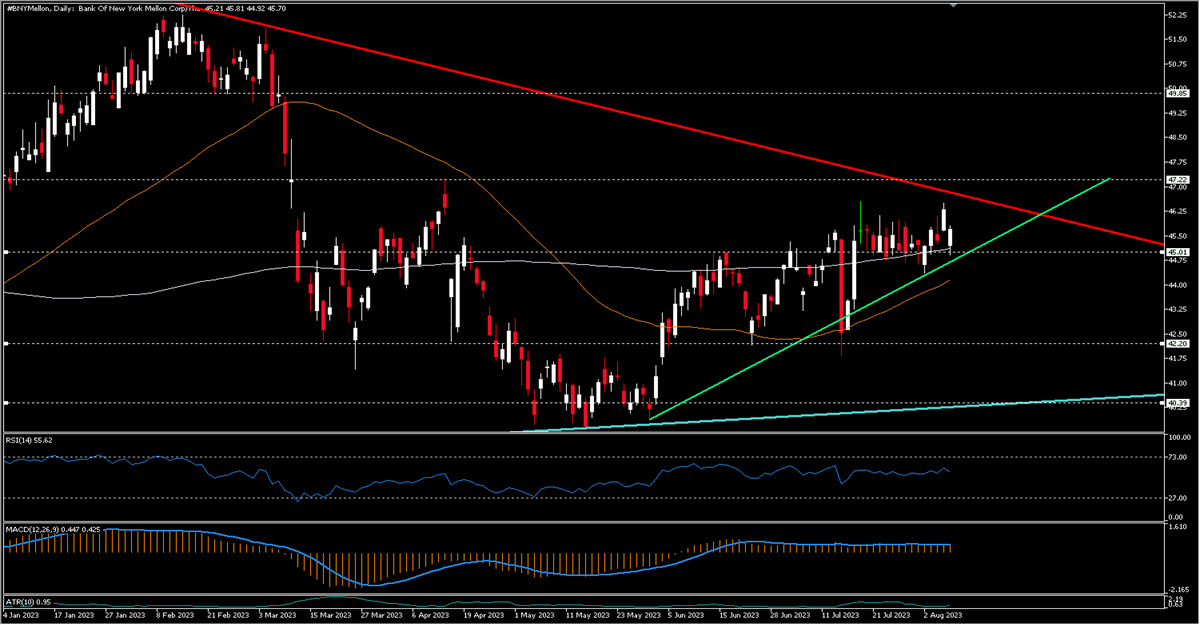

Proper now the inventory is in a quite attention-grabbing state of affairs: to start with, we see that now we have really had ascending lows during the last three years. However what we need to pay extra consideration to is the truth that it has simply examined the bearish trendline – additionally long-term – which is obtained by becoming a member of the highs of December 21 with these of February this 12 months. The value can also be simply above the MA200 (and likewise the MA50) Neither the RSI nor MACD indicators give us a lot info, being basically flat. What we will likely be observing over the following few days would be the holding of the 2 trendlines, i.e. round $46.54 upwards and $45 downwards: it’s a very slim vary which, within the occasion of an upward break-out, would first lead toa check of $47.20 after which open up room for a lengthening as much as round $49.80. A downward break of the more moderen development (mild inexperienced) and of the 2 MAs ought to as an alternative result in a retest of the $42.20 space and maybe even one thing decrease, in direction of $40.40.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a normal advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.