Japanese Yen (USD/JPY) Evaluation

- Yen picks up late bid as markets digest Ueda’s feedback

- Rising Japanese Authorities bonds spur on the yen someday after BoJ assembly

- USD/JPY turns away from the 150 mark as 146.50 emerges as speedy assist

- For knowledgeable perception into concerns for the Japanese Yen in Q1, obtain the forecast under:

Really helpful by Richard Snow

Get Your Free JPY Forecast

Yen Picks up a Late Bid as Markets Digest Ueda’s Feedback

The principle takeaway from yesterday’s Financial institution of Japan (BoJ) assembly was that Ueda nonetheless has his eye on an eventual exit from detrimental charges regardless of inflation exhibiting indicators of slowing down. Ueda described the chance of reaching the two% goal as “rising” and even mentioned an exit from detrimental charges is feasible within the absence of addressing the present, sub-optimal output hole (distinction between potential output and present output).

Markets see April as a stay assembly for the BoJ however at present value in a full 10 foundation factors (bps) by the June assembly. The BoJ is primarily searching for the continuation of what it refers to because the virtuous cycle between inflation and wages. The wage negotiation course of is more likely to roundup in March, which has led markets to naturally look to the April assembly for any motion within the rate of interest.

Implied Foundation Factors Priced in by Charge Markets

Supply: Refinitiv, ready by Richard Snow

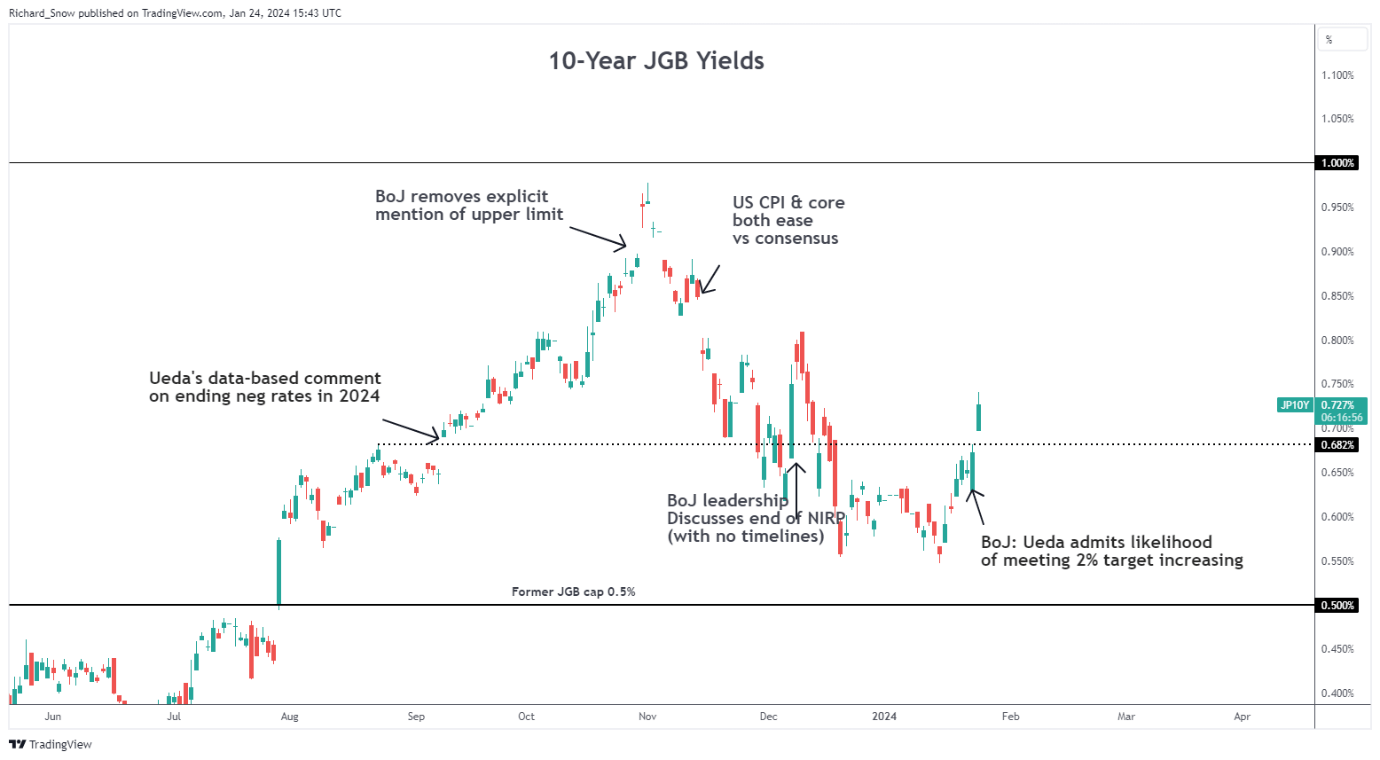

Rising Japanese Bond Yields Spur on The Japanese Yen

Japanese Authorities bond yields (10-year) continued to rise at the moment, within the aftermath of the BoJ assembly. Yields are nonetheless a great distance off the early November peak earlier than inflation pressures revealed indicators of slowing and markets cooled expectations round any imminent price modifications. The upper yield boosts the attractiveness of the yen and sometimes sees an increase within the native forex.

Japanese Authorities Bond Yields (10-year)

Supply: TradingView, ready by Richard Snow

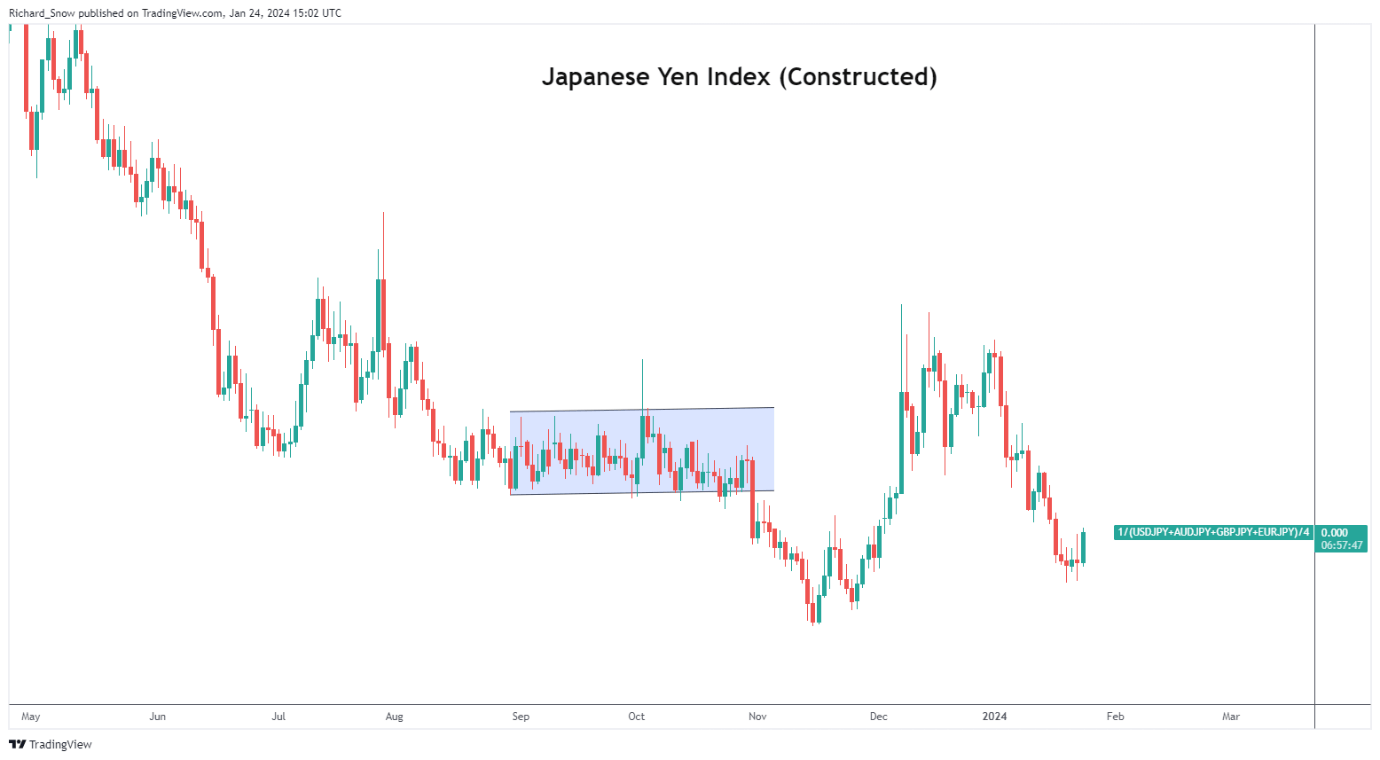

The Yen has broadly risen towards numerous main FX currencies (GBP, AUD, EUR, USD) as could be seen under in an equal-weighted index comprising of the above-mentioned currencies:

Supply: TradingView, ready by Richard Snow

Really helpful by Richard Snow

The way to Commerce USD/JPY

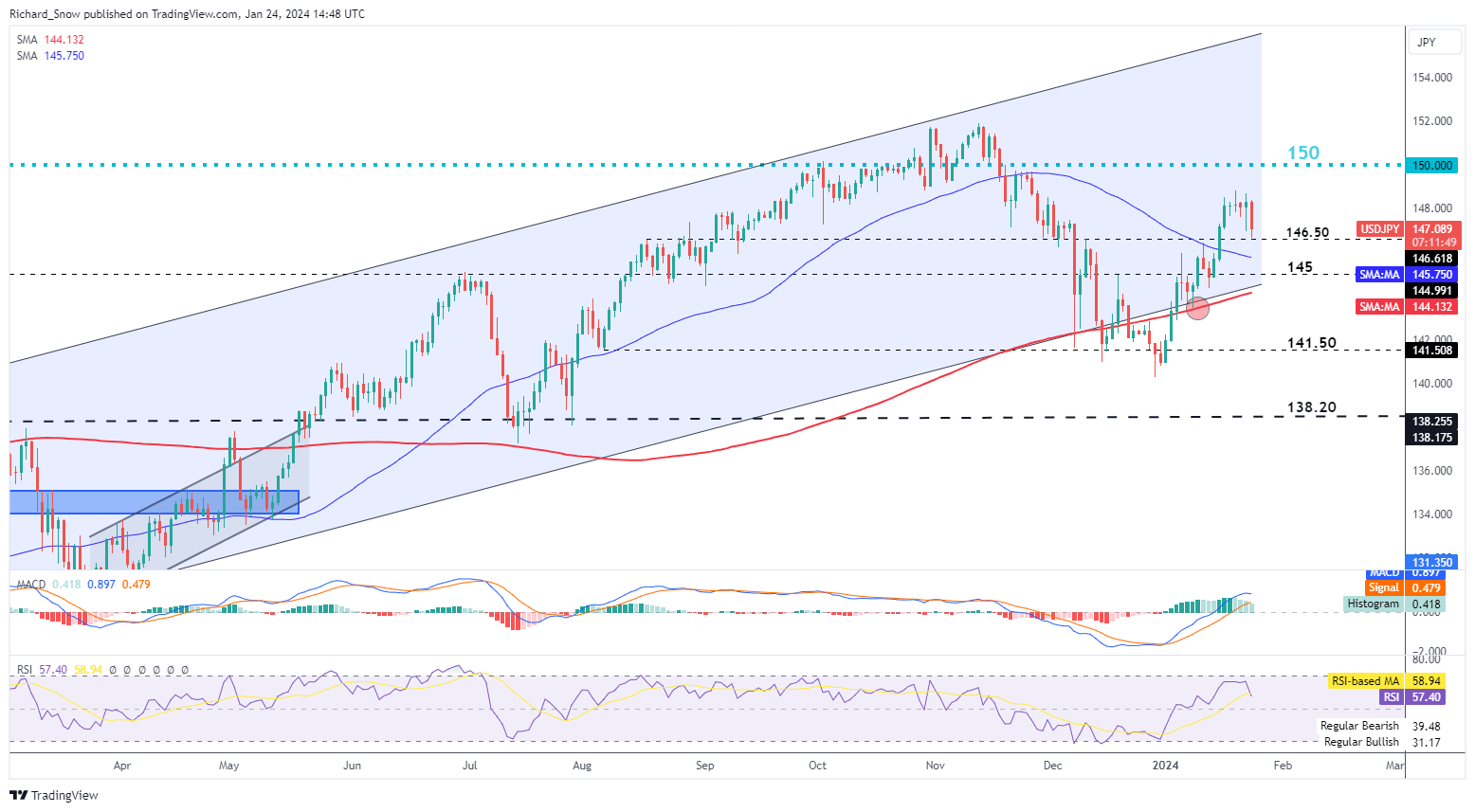

USD/JPY Turns Away from the 150 Mark as 146.50 Emerges as Instant Assist

USD/JPY discovered resistance forward of the 150 marker however failed to succeed in the psychological stage after the BoJ head pointed in direction of an eventual exit from detrimental charges with rising likelihood.

The quick to medium time period uptrend has not damaged down as of but, with 146.50 essentially the most speedy stage of assist, adopted by 145.00 and the underside of the longer-term rising channel (highlighted in blue). Nonetheless, the US greenback could pose a problem to the yen tomorrow and Friday with US This fall GDP and PCE information on faucet.

Robust PMI information earlier at the moment factors to an financial system that’s rising at a good tempo and this might preserve USD supported if inflation considerations construct within the upcoming information prints with the resilient December CPI print nonetheless recent within the minds of merchants.

USD/JPY Every day Chart

Supply: TradingView, ready by Richard Snow

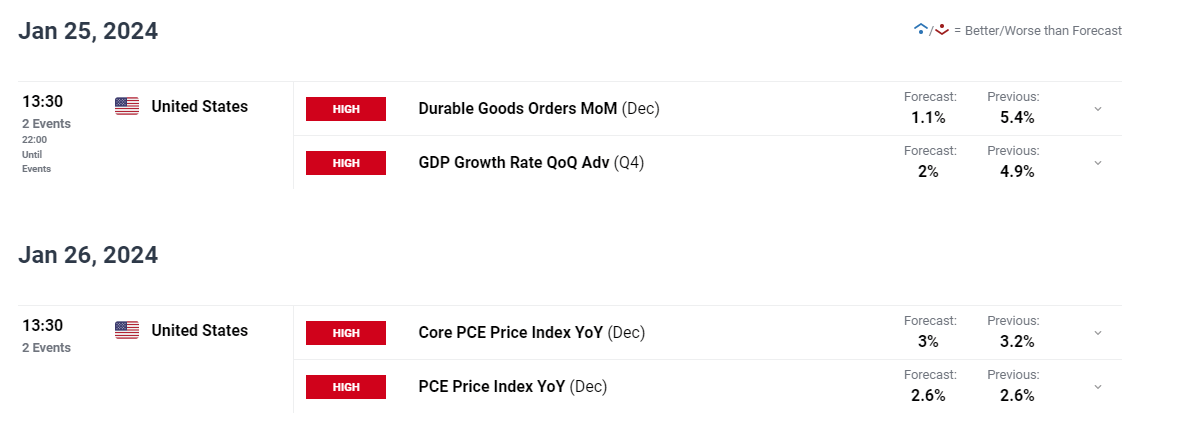

After the BoJ assembly, Japan particular information is fairly scarce however US This fall GD and PCE information on Thursday and Friday ought to offer a carry for intra-day volatility earlier than the weekend.

Higher-than-expected PMI information for the month of January suggests the US financial system is shifting alongside at a good canter however markets shall be extra centered on backward trying information in tomorrow’s This fall development print.

USD/JPY can even keep loads of curiosity subsequent week when the FOMC meet to debate financial coverage. Earlier than then, US PCE information for December is anticipated to disclose cussed headline pressures stay, with one other welcome drop within the core measure of inflation.

Customise and filter stay financial information through our DailyFX financial calendar

Really helpful by Richard Snow

Really helpful by Richard Snow

How To Commerce The Prime Three Most Liquid Foreign exchange Pairs

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX