WTI crude oil witnessed a discernible retreat, influenced by a number of converging elements that underscore the intricate dynamics shaping the oil market. The appreciating worth of the Greenback, a perennial pressure in commodity markets, performed a big position, casting a shadow over oil costs. Concurrently, the upcoming menace of a US authorities shutdown, contingent on the passage of the stopgap spending invoice by November 17, launched a further layer of uncertainty to the oil market.

Compounding the value dip was the sudden surge in crude inventories, a revelation from the US Power Info Administration (EIA) that resonated all through the market. Nonetheless, essentially the most pronounced influence got here from the announcement by the Iraqi oil minister. The revelation that Iraq and Turkey had reached an settlement to renew oil exports within the north despatched ripples via the oil panorama. This settlement basically paved the way in which for oil firms to recommence manufacturing within the Kurdistan area inside a mere three days, injecting a further 400,000 barrels of crude into the day by day provide chain.

Whereas the general pattern displayed a sure weak spot, it wasn’t characterised by an outright freefall. As an alternative, the costs exhibited a sample of fluctuation, reflecting the nuanced dynamics at play.

The latest fragility in oil costs as soon as once more locations OPEC+ below the highlight. Regardless of their concerted efforts all year long, the tenuous steadiness within the oil market appears to elude them. The pullback in costs provides stress on OPEC+ as they face the problem of sustaining stability. The market sentiment, main as much as the following assembly, is unlikely to lean in the direction of anticipations of an output lower decision. It seems the fragile equilibrium achieved by OPEC+ hangs within the steadiness.

Analyzing the stock report launched just lately, crude oil inventories registered a noticeable uptick. Nonetheless, the complexities of the market had been highlighted by concurrent oil de-stocking, notably evident within the decline of US strategic oil reserves. The combination information paints an image of neutrality, with the draw back momentum showing considerably restrained within the quick time period.

The US EIA’s revealed that crude oil inventories surged by 3.6 million barrels for the week of November 10, surpassing the anticipated improve of 1.793 million barrels, added an additional layer of intricacy. Cushing, Oklahoma crude shares elevated by 1.9 million barrels. On the refined oil entrance, shares skilled a lower of 1.4 million barrels, opposite to expectations. Gasoline shares mirrored the sudden pattern by declining by 1.5 million barrels, defying the projected improve of 622,000 barrels. Notably, US industrial crude oil imports, excluding strategic reserves, dipped to six.373 million barrels per day within the week of November 10, marking a lower of 21,000 barrels per day from the earlier week.

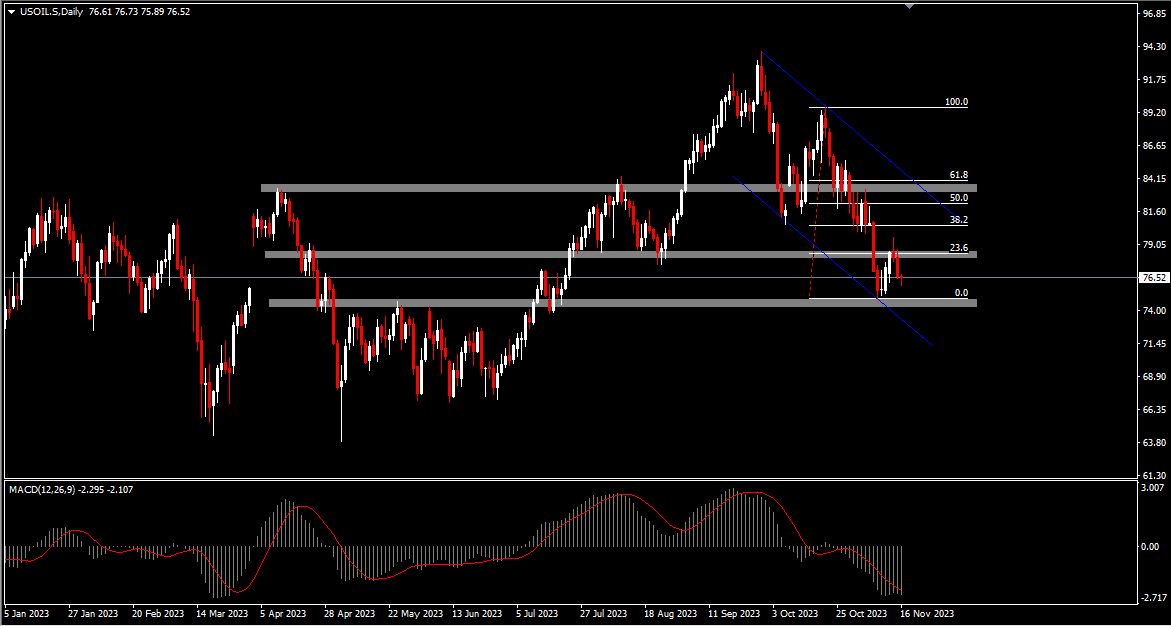

Analyzing WTI crude oil’s present standing from a technical perspective, it’s evident that it’s buying and selling inside a descending channel on the day by day timeframe. The worth, hovering round $76.3 per barrel, prompts concerns about its potential strikes.

There are two doable situations. If the assist at $74.9 holds, there’s an opportunity of an upward transfer in the direction of the 23.6% Fibonacci stage at $78.3 per barrel. Conversely, a break under $74.5 may result in a decline to $72.3 per barrel, signaling a possible shift in market sentiment favoring the bears.

The MACD indicator on the day by day timeframe helps a bearish outlook, being under the zero line and beneath the sign line. This means further bearish momentum.

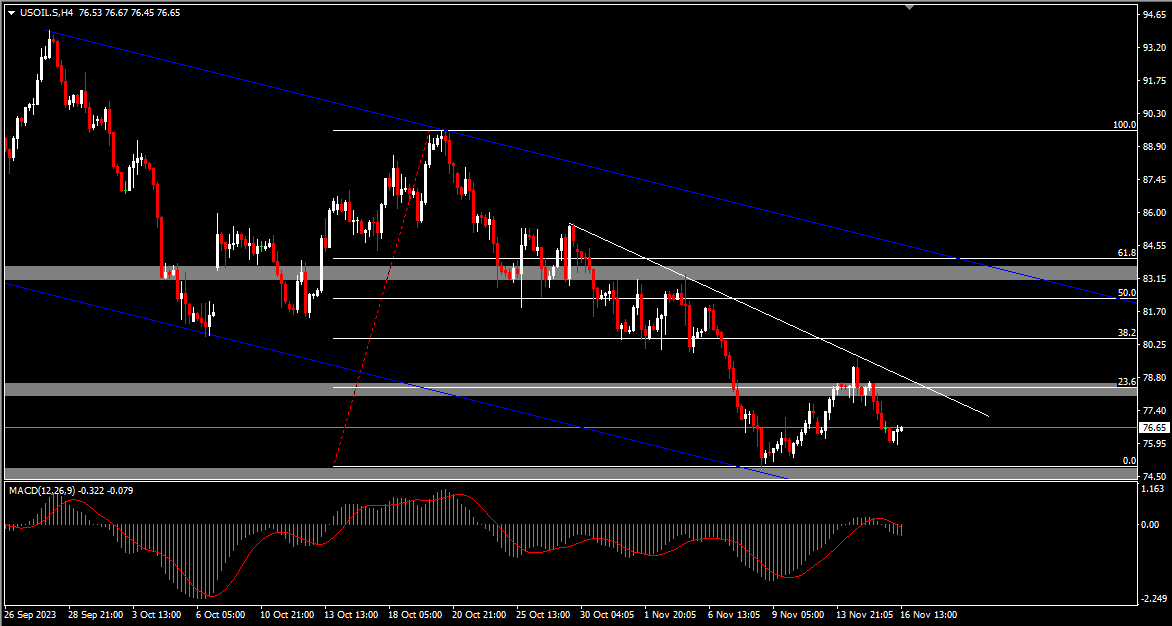

This sentiment is confirmed on the 4-hour timeframe, with the MACD indicator additionally positioned under the zero line and below the sign line, emphasizing sustained bearish stress.

Click on right here to entry our Financial Calendar

Francois du Plessis

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.