[ad_1]

Gold has entered a outstanding rally mode for the reason that starting of February, surpassing earlier report highs regardless of the sturdy US Greenback and Treasury yields. Up to now in April, the gold worth has continued to set new report highs and briefly touched a excessive of $2365 per ounce.

What are the driving components? Why does gold worth ignore Central Banks’ potential easing? Why are market correlations weak in Q2?

The gold’s unprecedented surge will be attributed to varied components, with central financial institution insurance policies, geopolitical tensions, Chinese language demand, and inflation hedging methods taking part in important roles.

Central Banks coverage

Up to now in April, the gold worth has continued to set new report highs and briefly touched a excessive of $2365 per ounce. Confidence within the Fed’s easing cycle could have eroded considerably, however protected haven demand and central financial institution shopping for have continued to maintain costs underpinned.

Do not forget that the market opened this yr with expectations for 150 bps in easing starting in March. Nevertheless at present Fed funds futures had been hammered on March US Inflation information, repricing for fewer fee cuts this yr and a later begin date.

The Fed has lengthy warned that the cooling in inflation won’t be on a linear path and the report mirrored the stubbornness of worth pressures. And whereas power and housing contributed over half of the power, there have been modest good points in lots of different elements, suggesting a broadening. Certainly, Powell’s “supercore” fee which additionally takes out housing, rose 0.65% on the month, after good points of 0.47% in February and 0.85% in January, in accordance with Bloomberg.

Implied charges replicate negligible threat for the June fee reduce, put July unsure and recommend fewer than the three reductions posited by the Fed’s median dot for 2024. Certainly, it’s now the case that the market is September for the preliminary transfer. It’s uncertain the FOMC would act in November. Regardless that Chair Powell has confused the Fed is apolitical, the assembly comes the day after the elections. And apparently, the December contract exhibits solely 44 bps in cuts versus the 75 bps within the dots, however the latter was a really shut name. We now anticipate the FOMC to make its first reduce in September and comply with it up with a second in December.

Central Banks Gold reserves

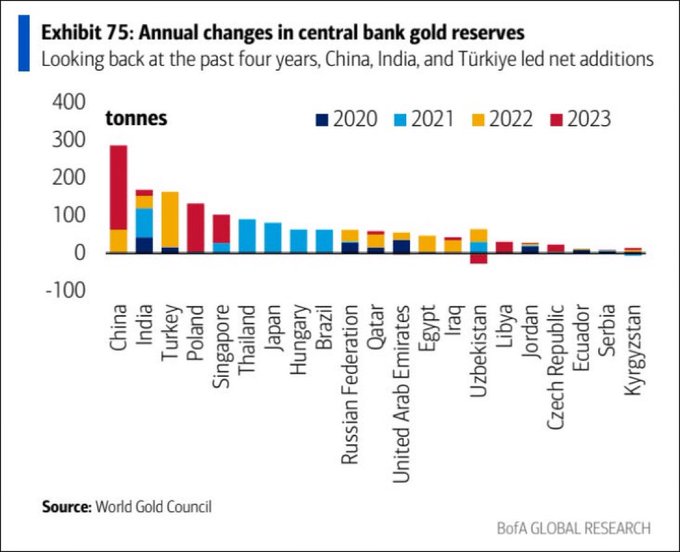

Central financial institution purchases exert a stronger affect on the gold market worldwide, as demonstrated by the constant excessive demand seen over the previous three years.

Extra exactly, the Folks’s Financial institution of China bought gold for its reserves for a seventeenth straight month in March, whereas final month Bullion held by the Folks’s Financial institution of China rose by about 390,000 troy ounces. That takes complete holdings to 72.58 million troy ounces, equal to about 2,257 tons, which is China’s central financial institution’s largest annual buy in 2023 since 1977.

The World Gold Council flagged that China isn’t the one nation buying Gold. Russia, Turkey and India additionally ramping up its gold purchases.

This surge in gold buying is partly attributed to lowered confidence in rapid rate of interest cuts from Central banks, positioning gold as an funding for stability and a possible hedge towards inflation.

In response to The Kobeissi Letter, this important rise in central financial institution gold acquisitions since early 2022 which continues to strongly help Gold reaching new highs, is a diversification technique from Central banks in response to international financial pressures.

Notably in China, the rise of gold reserves at unprecedented charges, is an try to minimize reliance on the US Greenback and the US debt disaster, to face financial challenges, notably within the property market.

Nevertheless, this rising choice for bodily gold over paper claims and derivatives signifies a return to gold’s historic position as an important monetary asset. This transition is additional underscored by BRICS international locations regularly transferring away from the greenback in worldwide commerce, suggesting a resurgence of gold as a impartial reserve asset for balancing commerce imbalances.

The switch of gold from the West to the East signifies not solely a wealth switch but additionally a big second within the monetary panorama. As Jap nations accumulate gold, they safeguard their economies towards foreign money devaluation and problem the longstanding monetary supremacy of the West.

Protected-haven demand

Geopolitical tensions, akin to battle between Israel and Hamas and between Ukraine and Russia have pushed traders in direction of safe-haven belongings like gold. The Ukraine’s assaults on the Russia’s oil infrastructures and issues that the battle between Israel and Hamas might widen preserve haven flows increased.

With geopolitical tensions unresolved and conventional protected havens just like the Yen displaying weak spot, gold stays a most well-liked selection for traders in search of refuge.

Quarterly Outlook:

Wanting forward, the prospect of decrease US rates of interest, sustained Chinese language demand, and geopolitical uncertainties are anticipated to proceed bolstering gold costs. Rapid Resistance ranges for gold stay at newest report excessive, at $2,365 barrier, whereas a break above that degree might entice extra bulls into the market in direction of the psychological threshold of $2,500 which represents the 161.8% Fibonacci extension degree of the August 2023 rebound.

For the gold rally to ease and even reversed, elementary shifts akin to development of the Chinese language economic system, ease of geopolitical conflicts, or a reversal in Fed fee reduce expectations could be obligatory. Nevertheless, such modifications appear unlikely within the close to future, suggesting continued help for the continued gold rally.

In the long run in the meantime, Financial institution of America predicts that gold costs might hit $3,000 by 2025, citing the continuation of its record-breaking rally fueled by speculative buying and selling. Moreover, Citi has raised its higher worth targets for the following 6 to 12 months, setting them at $3,000 per ounce for gold as nicely and $32 per ounce for silver.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a basic advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link