[ad_1]

The Fed advised markets what they did not need to hear. Charges would should be increased than beforehand thought, and with that, charges throughout the curve and the are shifting increased. Each charges and the greenback might have a lot additional to climb earlier than all is claimed and carried out.

This might particularly be the case if in a single day charges are heading above 5%, which is what the Fed Funds Futures are at present suggesting, and which means the fee will most likely head in direction of 5%, and all the curve will likely be taken increased with it.

Charges Additional To Climb

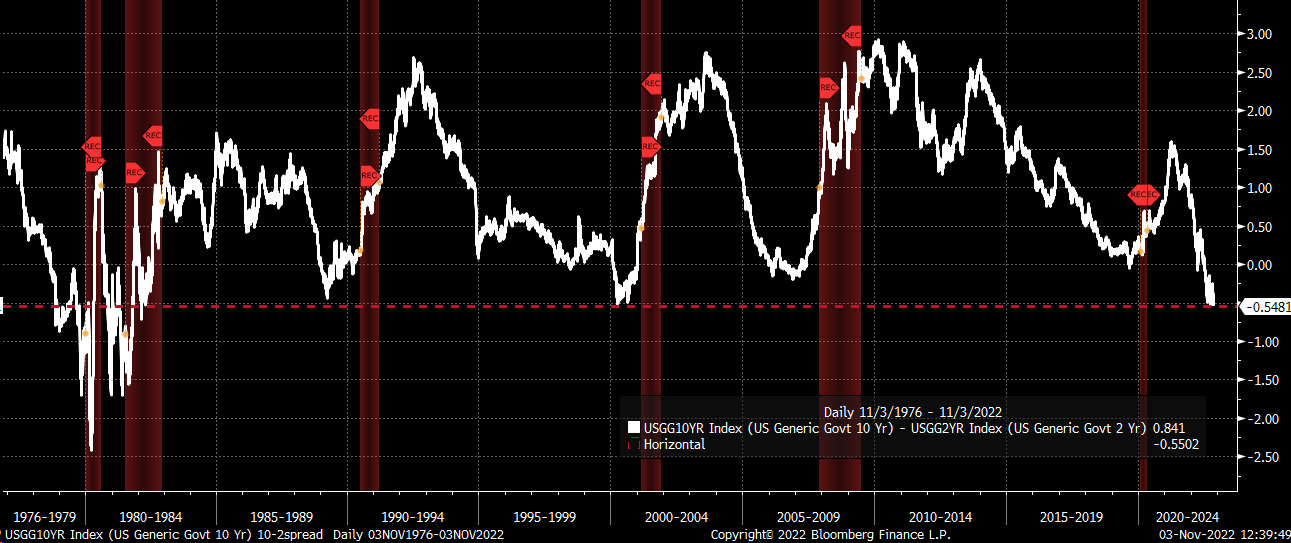

Until the Treasury curve goes to invert even additional, it appears probably that because the 2-year rises in direction of that 5% stage, the charges ought to rise together with it. On condition that the present unfold between the two and 10-year charges is round 55 bps, one would assume the US 10-year might rise to about 4.5% sooner or later.

The unfold between the 2 yields has reached practically the bottom level in 40 years. It was solely decrease within the late Nineteen Seventies and early Eighties. A minimum of, in more moderen occasions, when the unfold inverted, it tended to flatten out for a while earlier than ultimately turning increased. So, a 2-year heading to five% and a 10-year pushing as much as 4.5% may very well be potential given how markets are positioned at present.

Greenback Energy

Moreover, the extra charges rise within the US, and the spreads with different nations widen, the extra the greenback ought to strengthen. The unfold at present between US and German charges seems to be heading increased and is getting very near breaking out to a brand new excessive. Additionally, the gap between the US and Japanese charges is already very excessive. The larger the spreads get, the stronger the greenback ought to develop into.

Moreover, a weak financial system in China ought to permit the greenback to proceed to strengthen versus the . The yuan has already weakened materially to the greenback in latest weeks.

A stronger greenback and better charges ought to proceed to weigh on commodity costs as they have already got. However as the 2 push even increased, that can apply a downward pressure on commodities like , , and even . Oil costs have fallen considerably not too long ago, and one can not help however assume how a lot increased oil could be if not for the robust greenback. This could even be a damaging for inventory costs, and a powerful greenback lowers earnings and gross sales estimates, and better charges drive valuations decrease. A brand new excessive in charges and the greenback might ship shares to new lows.

With the Fed far more hawkish than the market anticipated and signaling that charges nonetheless have a lot additional to climb, the impacts ought to consequence within the greenback and yields pushing increased from their present ranges.

Disclaimer: This report accommodates impartial commentary for use for informational and academic functions solely. Michael Kramer is a member and funding adviser consultant with Mott Capital Administration. Mr. Kramer shouldn’t be affiliated with this firm and doesn’t serve on the board of any associated firm that issued this inventory. All opinions and analyses introduced by Michael Kramer on this evaluation or market report are solely Michael Kramer’s views. Readers shouldn’t deal with any opinion, viewpoint, or prediction expressed by Michael Kramer as a particular solicitation or suggestion to purchase or promote a specific safety or observe a specific technique. Michael Kramer’s analyses are primarily based upon data and impartial analysis that he considers dependable, however neither Michael Kramer nor Mott Capital Administration ensures its completeness or accuracy, and it shouldn’t be relied upon as such. Michael Kramer shouldn’t be beneath any obligation to replace or right any data introduced in his analyses. Mr. Kramer’s statements, steering, and opinions are topic to vary with out discover.

[ad_2]

Source link