Caner CIFTCI

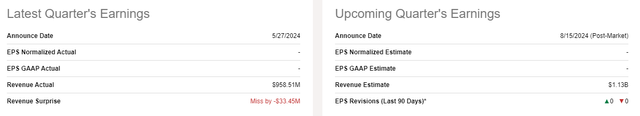

I’m updating my ongoing evaluation on Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC) prematurely of Q2 2024 earnings, which shall be launched post-market on August fifteenth.

I beforehand rated Turkcell a maintain for the next causes:

- Inflation had began ticking up once more placing margin in danger

- Value administration and pricing levers had largely been pulled

- DCF generated worth goal of $6.20-$6.70 urged inventory was pretty priced with balanced upside potential and draw back danger

Since then, Turkcell has returned 20%, whereas the S&P 500 has returned 1%, largely resulting from improved inflation information.

TKC Worth Development (TrendSpider)

Turkcell is anticipated to announce Q2 earnings according to steerage, and inflation in Turkey is easing, which reduces strain on the corporate. Nonetheless, from April to August, the market has already rewarded Turkcell, leading to one-year progress of greater than 60% on the inventory worth. As well as, inflation, whereas easing, is nonetheless up at historic highs close to 60%.

Between the run-up in worth and concern that margin levers have been pulled by means of the hyperinflationary atmosphere, I’m involved that the market has now pushed Turkcell past truthful worth. With a worth goal of $7.00 I decrease my score from maintain to promote prematurely of Q2 earnings.

Q2 Earnings Preview

Turkcell is anticipated to announce income of $1.13 billion, which is up 18% sequentially and double digits year-over-year, pacing Turkcell according to steerage regardless of the miss in Q1.

Q2 Earnings Abstract (Looking for Alpha)

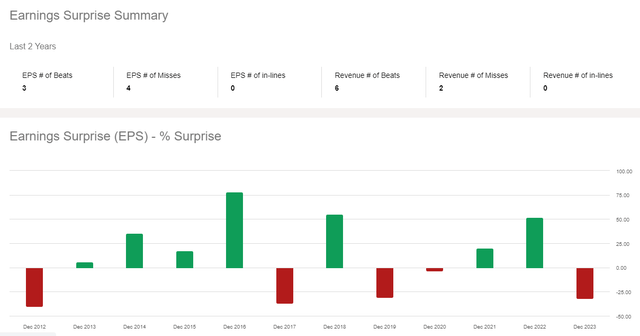

Turkcell has a combined historical past of delivering consensus on EPS and a extra favorable historical past of delivering income. This is sensible given the inflationary atmosphere and the problem of calculating forecasts, particularly relating to value. Nonetheless, this implies it’s troublesome to have any expectations for the way earnings will are available.

TKC Earnings Shock (Looking for Alpha)

As I discussed earlier than, assuming efficiency near consensus, Turkcell is pacing nicely in the direction of their 2024 steerage, if not barely above, particularly as inflation and the IAS29 impression are lowered.

2024 Steering (TKC Investor Relations)

As earnings are launched, my major focus shall be on ARPU traits and price traits. I need to perceive if Turkcell’s pricing energy continues to outpace value progress. Throughout my final evaluation, labor prices particularly have been a degree of concern, so this can impression my ideas on the long run valuation.

Valuation

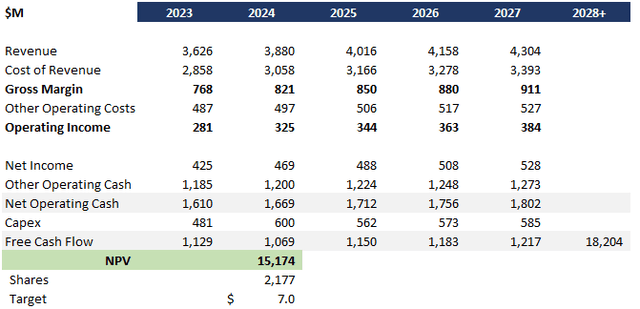

I up to date my ongoing DCF evaluation, incorporating current traits and modifications in inflation. I made the next general assumptions:

- Administration steerage for income delivered in 2024 at excessive single digits (7% assumed based mostly on 2023 exit trajectory).

- 2025+ income at 3.5% based mostly on Turkish telecom CAGR.

- Lengthy-run progress at 2.5% based mostly on Turkish telecom CAGR and hedged down for value base and declining returns at scale.

- 9.6% low cost fee utilizing estimated WACC.

- Fixed forex and inflation as of Q1 2024 earnings.

This DCF yields a worth goal of $7.00, 10% draw back from immediately’s costs.

Turkcell DCF (Knowledge: SA; Evaluation: Mike Dion)

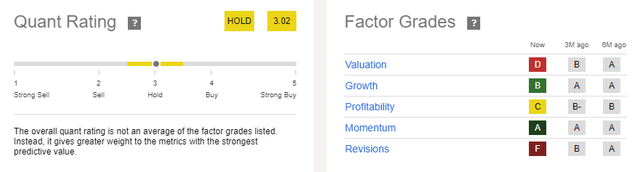

The quant score indicators a maintain, with valuation and profitability pulling the score down. Understand that the expansion score just isn’t cleanly inflation-adjusted, so the quant is probably going giving Turkcell a bit an excessive amount of credit score right here.

TKC Quant Score (Looking for Alpha)

Macro Elements Are A Robust Headwind For Turkcell

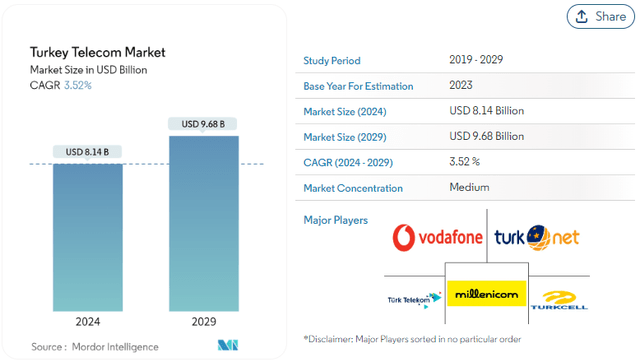

The strongest headwind for Turkcell is the Turkish telecom market general. The market is comparatively mature and progress is anticipated to be 3.52% by means of 2029. Based mostly on DCF evaluation, low single-digit progress in income doesn’t help the present share worth, not to mention upside past that.

Turkey Telecom CAGR (Mordor Intelligence)

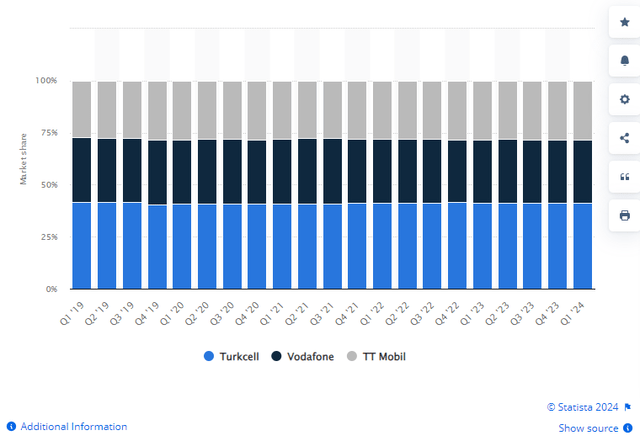

Turkcell can also be the biggest participant (41% share) in a triopoly, and their scale and market dynamics imply that oversized market share progress is unlikely.

Turkey Market Share (Statista)

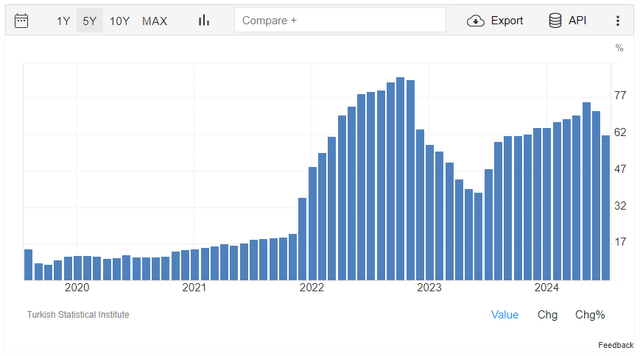

Past market situations, inflation, whereas easing, continues to be at historic highs. This can proceed to strain the associated fee base whereas customers tire of worth will increase, placing margin in danger.

Turkey Inflation Development (Turkish Statistical Institute)

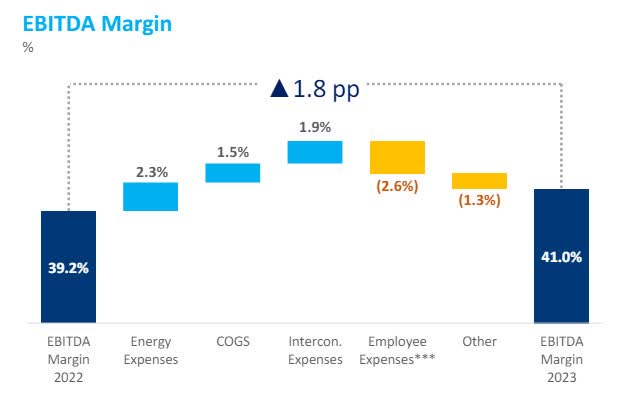

I additionally famous in Q1 that margin enchancment was pushed by power bills, COGS, and interconnection bills. Whereas Turkcell can affect COGS and, to a lesser extent, interconnection, they’ve restricted skill to affect power prices, which is very regarding as geopolitical danger rises. Continued inflation at these ranges actually dangers margin.

EBITDA Margin COC (TKS Investor Relations)

Upside Potential

The upside potential for Turkcell requires two of the next three issues to go very proper.

- Inflation quickly declines

- Pricing continues to develop sooner than the market

- Digital enterprise accelerates quickly

Any considered one of these would seemingly help the present worth, however not upside potential.

If inflation declines quickly, Turkcell may carry the pricing and quantity momentum/rollover to broaden margins whereas the associated fee base progress slows.

If pricing continues to outpace the market, Turkcell may broaden margins and overcome the lag that’s to be anticipated in the associated fee base.

The digital companies are the true progress enterprise, as they will let Turkcell broaden sooner than the general telecom market, which primarily represents a 3.5% ceiling on progress over the long run. Development in these companies decelerated under inflation in Q1, so sustained acceleration would current upside.

Verdict

Turkcell is a strong and well-run enterprise and I anticipate sturdy efficiency to proceed. Nonetheless, the market has rewarded this efficiency with a 60% run-up over the previous yr. Following the run-up, macro elements now signify an excessive amount of draw back potential and place a ceiling on progress prospects.

Whereas there’s upside potential if all the things goes proper for Turkcell, that is far outweighed by present traits and macro elements. With a DCF-generated worth goal of $7.00, up from my earlier vary of $6.20-$6.70 however down 10% from immediately’s pricing, I decrease my score on Turkcell from maintain to promote.