Printed on Might fifteenth, 2023 by Felix Martinez

Traders seeking to generate increased earnings ranges from their funding portfolios ought to have a look at Actual Property Funding Trusts or REITs. These firms personal actual property properties and lease them to tenants or put money into actual estate-backed loans, which generate a gradual earnings stream.

The majority of their earnings is then handed on to shareholders by means of dividends. You may see all 200+ REITs right here.

You may obtain our full checklist of REITs, together with essential metrics resembling dividend yields and market capitalizations, by clicking on the hyperlink under:

Actual Property Funding Trusts (REITs) are an ideal alternative for earnings buyers as they need to pay out 90% of their taxable earnings to shareholders within the type of dividends. This allows REITs to keep away from paying company taxes. With over 200 REITs to select from, many supply excessive dividend yields.

Nonetheless, not all high-yielding shares are value investing in. It’s important for buyers to completely assess the basics to make sure that excessive yields are sustainable. Some high-yield securities have a major threat of a dividend discount and/or deteriorating enterprise outcomes.

To assist buyers make knowledgeable selections, an inventory of protected REITs and corporations that personal information facilities with robust enterprise fashions and property portfolios was created. These firms have extra sustainable dividends than most REITs and needs to be thought-about as a safer choice for earnings buyers.

Desk of Contents

You may immediately bounce to any particular part of the article by utilizing the hyperlinks under:

Information Middle REIT No. 8: Keppel REIT (KREVF)

Keppel REIT is an actual property funding belief (REIT) listed on the Singapore Inventory Change. The corporate was established in November 2005 and is managed by Keppel REIT Administration Restricted, a subsidiary of Keppel Capital Holdings.

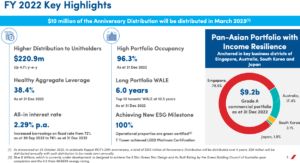

Keppel REIT’s portfolio includes a diversified combine of economic properties, together with workplace, retail areas, and information facilities, situated primarily in Singapore’s central enterprise district. As of December 2022, the corporate’s whole belongings underneath administration had been valued at roughly $9.2 billion.

The corporate’s funding technique focuses on buying high-quality, income-generating properties with robust progress potential. Keppel REIT goals to supply steady and rising distributions to its unitholders by maximizing the worth of its belongings by means of lively asset administration and strategic divestments.

Supply: Investor Presentation

Information Middle REIT No. 7: DigitalBridge Group, Inc. (DBRG)

DigitalBridge Group, Inc. is a number one world digital infrastructure funding agency headquartered in Boca Raton, Florida. Previously often called Colony Capital Inc., the corporate underwent a serious rebranding in 2021 and altered its title to DigitalBridge to raised mirror its concentrate on digital infrastructure investments.

DigitalBridge Group has a various portfolio of investments that features digital towers, fiber networks, information facilities, small cells, and edge information facilities. These belongings are crucial elements of contemporary communication networks, that are experiencing exponential progress as a result of rising demand for digital companies and applied sciences. DigitalBridge Group is well-positioned to capitalize on this development as a world chief within the digital infrastructure funding area.

Supply: Investor Presentation

On Might third, 2023, the corporate reported first-quarter outcomes. Whole income was up from $232 million within the first quarter of 2022 to $250 million final quarter. This is a rise of seven.4% yr over yr. Nonetheless, bills had been up year-over-year by 12.3%. General, the corporate had a web earnings lack of $(1.34) per share in comparison with $(1.84).

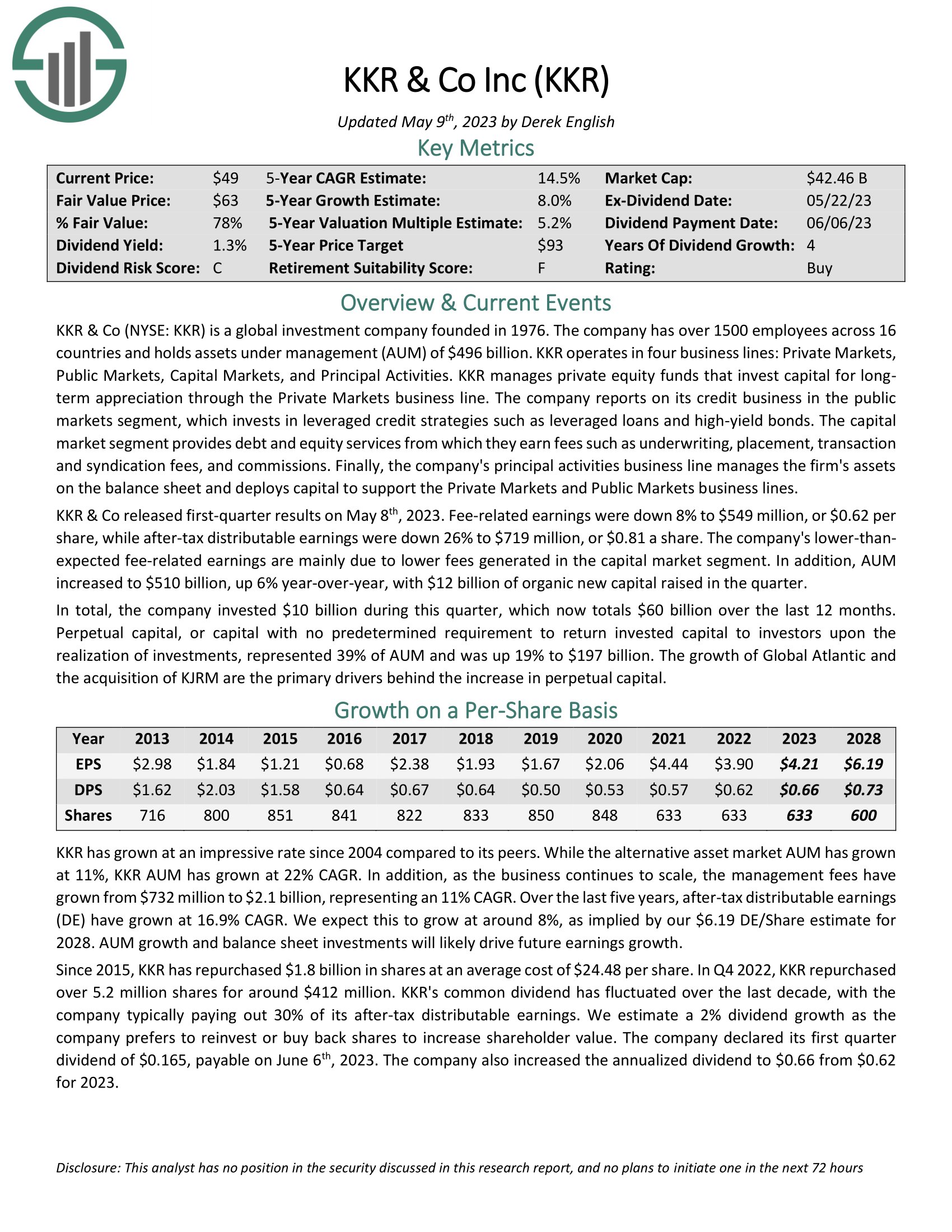

Information Middle REIT No. 6: KKR & Co Inc (KKR)

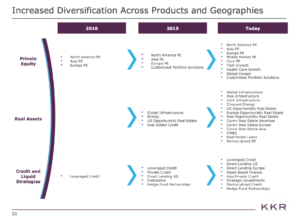

KKR & Co (NYSE: KKR) is a outstanding world funding agency established in 1976. The agency has a workforce of greater than 1500 staff working throughout 16 nations, managing belongings value $496 billion. KKR operates in 4 enterprise traces: Personal Markets, Public Markets, Capital Markets, and Principal Actions.

Personal Markets make investments capital for long-term appreciation, whereas the Public Markets phase studies on KKR’s credit score enterprise, investing in leveraged credit score methods resembling leveraged loans and high-yield bonds. The Capital Market phase provides debt and fairness companies, producing underwriting, placement, transaction, syndication charges, and commissions charges. Lastly, the Principal Actions enterprise line manages the corporate’s belongings on the stability sheet and allocates capital to help the Personal Markets and Public Markets enterprise traces.

Supply: Investor Presentation

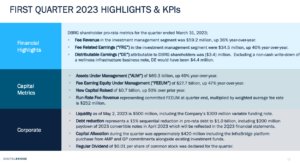

On Might eighth, 2023, KKR & Co launched its first-quarter outcomes, revealing that its fee-related earnings had been down 8% to $549 million, or $0.62 per share, whereas after-tax distributable earnings had been down 26% to $719 million, or $0.81 per share. The corporate’s lower-than-expected fee-related earnings had been primarily as a result of decrease charges generated within the Capital Market phase. Moreover, AUM elevated to $510 billion, up 6% year-over-year, and the agency raised $12 billion of natural new capital within the quarter.

KKR invested $10 billion through the quarter, bringing its whole investments to $60 billion over the previous 12 months. Perpetual capital, which represents capital with no predetermined requirement to return invested capital to buyers upon the belief of investments, made up 39% of AUM and elevated by 19% to $197 billion. The expansion of International Atlantic and the acquisition of KJRM are the first drivers behind the rise in perpetual capital.

Click on right here to obtain our most up-to-date Positive Evaluation report on KKR & Co Inc (KKR) (preview of web page 1 of three proven under):

Information Middle REIT No. 5: Blackstone Group Inc. (BX)

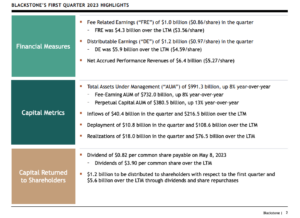

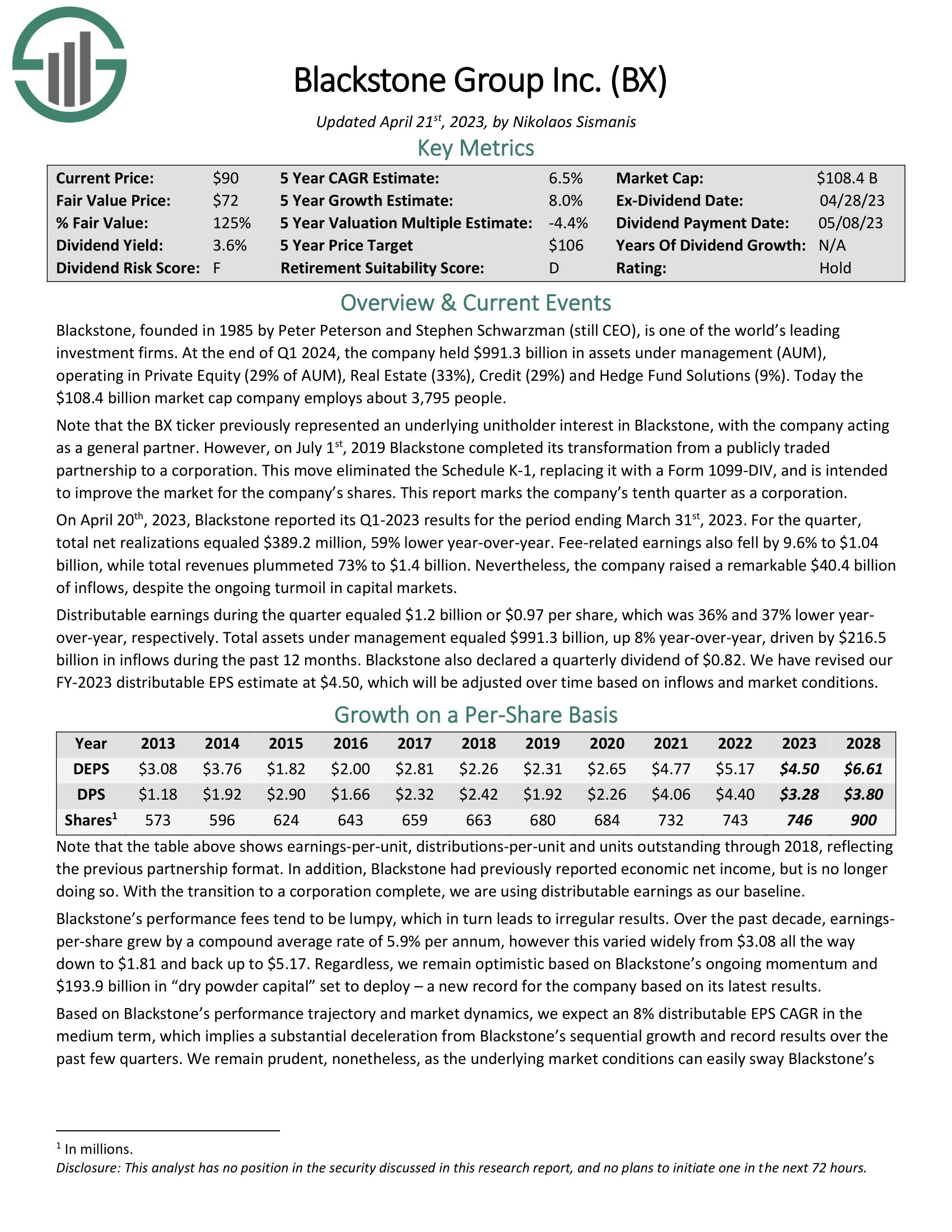

Blackstone is a serious funding agency based in 1985 by Peter Peterson and Stephen Schwarzman, who continues to be the CEO. As of the tip of the primary quarter of 2024, the corporate had a large $991.3 billion in belongings underneath administration (AUM). Blackstone operates in 4 essential areas, together with Personal Fairness (29% of AUM), Actual Property (33%), Credit score (29%), and Hedge Fund Options (9%). The corporate has a market cap of $108.4 billion and employs round 3,795 folks.

Supply: Investor Presentation

Blackstone was a publicly traded partnership, however the firm turned a company on July 1st, 2019. This transformation eradicated Schedule Ok-1 and changed it with Type 1099-DIV. This transfer was meant to enhance the marketplace for the corporate’s shares. Blackstone has now been a company for ten quarters.

On April twentieth, 2023, Blackstone reported its Q1-2023 outcomes for March thirty first, 2023. Through the quarter, the corporate had whole web realizations of $389.2 million, 59% decrease year-over-year. Payment-related earnings additionally fell 9.6% to $1.04 billion, whereas whole revenues plummeted 73% to $1.4 billion. Regardless of the continuing turmoil in capital markets, the corporate raised a exceptional $40.4 billion in inflows.

Through the quarter, distributable earnings equaled $1.2 billion or $0.97 per share, 36% and 37% decrease year-over-year, respectively. Nonetheless, whole belongings underneath administration elevated by 8% year-over-year to $991.3 billion, pushed by $216.5 billion in inflows through the previous 12 months. Blackstone additionally declared a quarterly dividend of $0.82. The corporate’s FY-2023 distributable EPS estimate was revised to $4.50, which can be adjusted over time based mostly on inflows and market circumstances.

Click on right here to obtain our most up-to-date Positive Evaluation report on Blackstone Group Inc. (BX) (preview of web page 1 of three proven under):

Information Middle REIT No. 4: Iron Mountain (IRM)

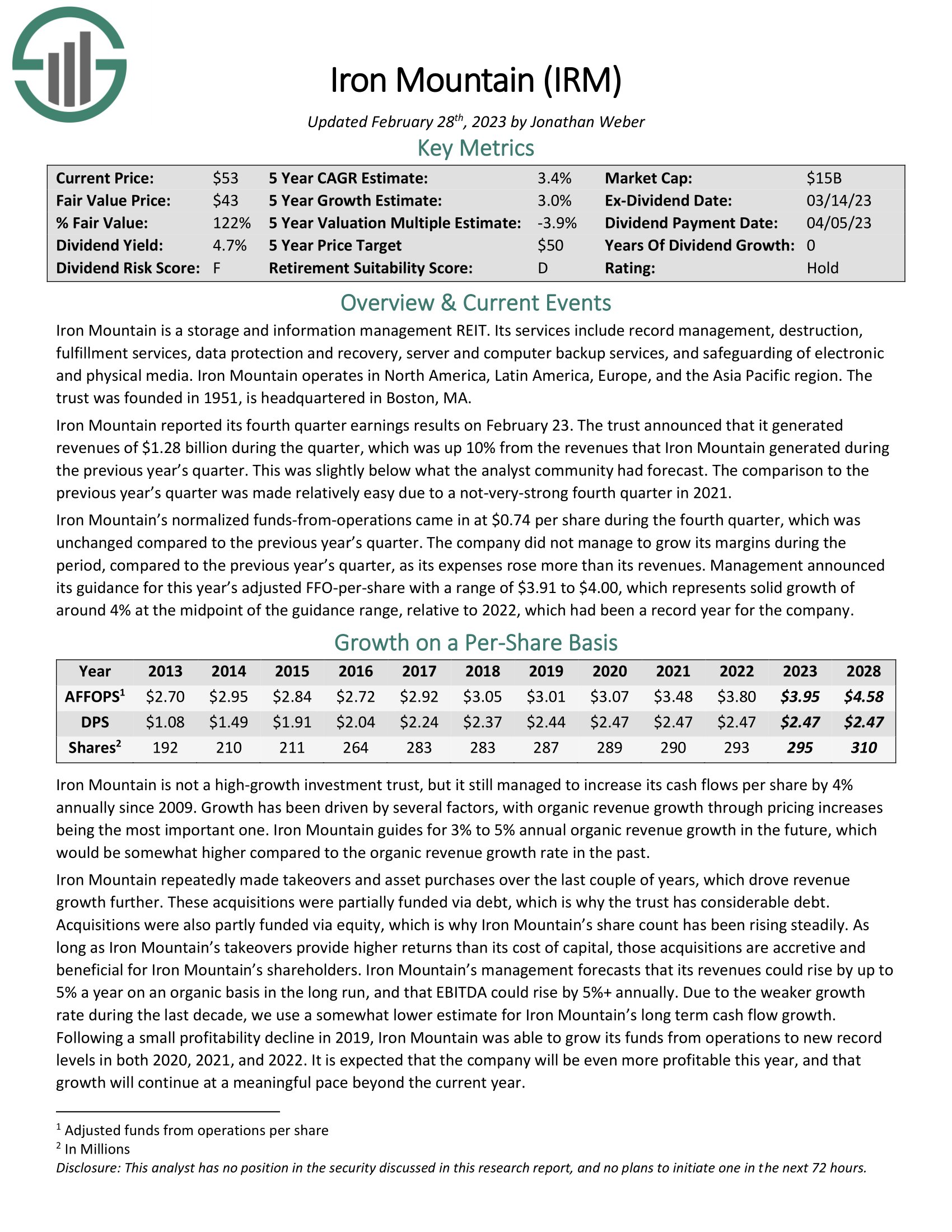

Iron Mountain is a Actual Property Funding Belief (REIT) that gives storage and knowledge administration companies. Its companies embody file administration, destruction, information safety and restoration, and pc backup companies. The belief operates in North America, Latin America, Europe, and the Asia Pacific space. Iron Mountain was based in 1951 and relies in Boston, MA.

Supply: Investor Presentation

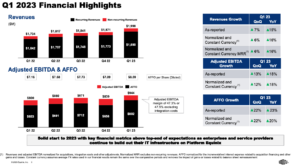

In its first-quarter earnings report launched on Might 4th, 2023, Iron Mountain introduced that it generated revenues of $1.31 billion through the quarter, a 5% enhance from the earlier yr. This was barely under what analysts had anticipated however nonetheless improved over the not-very-strong first quarter of 2021.

Through the first quarter, Iron Mountain’s normalized funds-from-operations elevated to $0.97 per share in comparison with the earlier yr. Additionally, the corporate was in a position to enhance its margins through the interval.

Administration supplied steerage for adjusted FFO-per-share for the present yr, with a spread of $3.91 to $4.00, representing strong progress of round 4% on the midpoint of the steerage vary, relative to 2022, which was a file yr for the corporate.

Click on right here to obtain our most up-to-date Positive Evaluation report on Iron Mountain (IRM) (preview of web page 1 of three proven under):

Information Middle REIT No. 3: Equinix (EQIX)

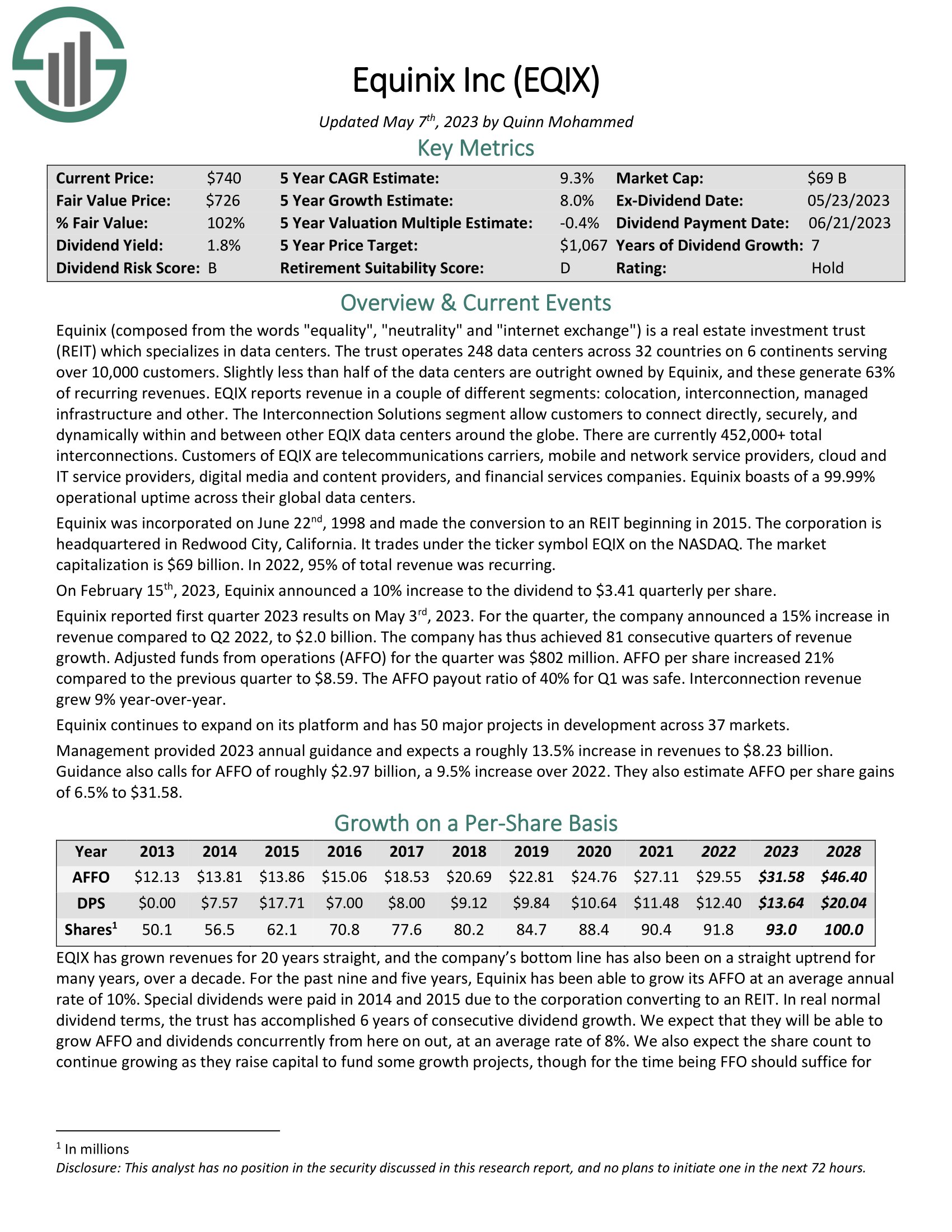

Equinix, a world chief in information facilities and web trade companies, made vital bulletins relating to its monetary efficiency in early 2023. On February fifteenth, 2023, the corporate declared a rise of 10% to its dividend, making it $3.41 per share each quarter. This enhance signifies the corporate’s dedication to rewarding its buyers.

Supply: Investor Presentation

The primary-quarter monetary outcomes had been introduced on Might third, 2023. The corporate achieved a 15% enhance in income in comparison with the identical quarter of the earlier yr, reaching $2.0 billion. This achievement marked Equinix’s 81st consecutive quarter of income progress, which is a formidable accomplishment. The adjusted funds from operations (AFFO) for the quarter was $802 million, and the AFFO per share elevated by 21% in comparison with the earlier quarter, reaching $8.59. Equinix maintained a protected payout ratio of 40% for Q1, indicating its means to pay dividends. Moreover, the interconnection income grew by 9% year-over-year, indicating the corporate’s continued progress.

Equinix is an organization that’s actively increasing its platform and has 50 main tasks in improvement throughout 37 totally different markets. Administration supplied the 2023 annual steerage and expects a roughly 13.5% enhance in revenues, reaching $8.23 billion. The steerage additionally requires an AFFO of roughly $2.97 billion, a 9.5% enhance from 2022 and an estimated AFFO per share acquire of 6.5% to $31.58. Equinix’s administration continues to work in direction of increasing the corporate’s attain and diversifying its choices.

Click on right here to obtain our most up-to-date Positive Evaluation report on Equinix (EQIX) (preview of web page 1 of three proven under):

Information Middle REIT No. 2: American Tower Corp (AMT)

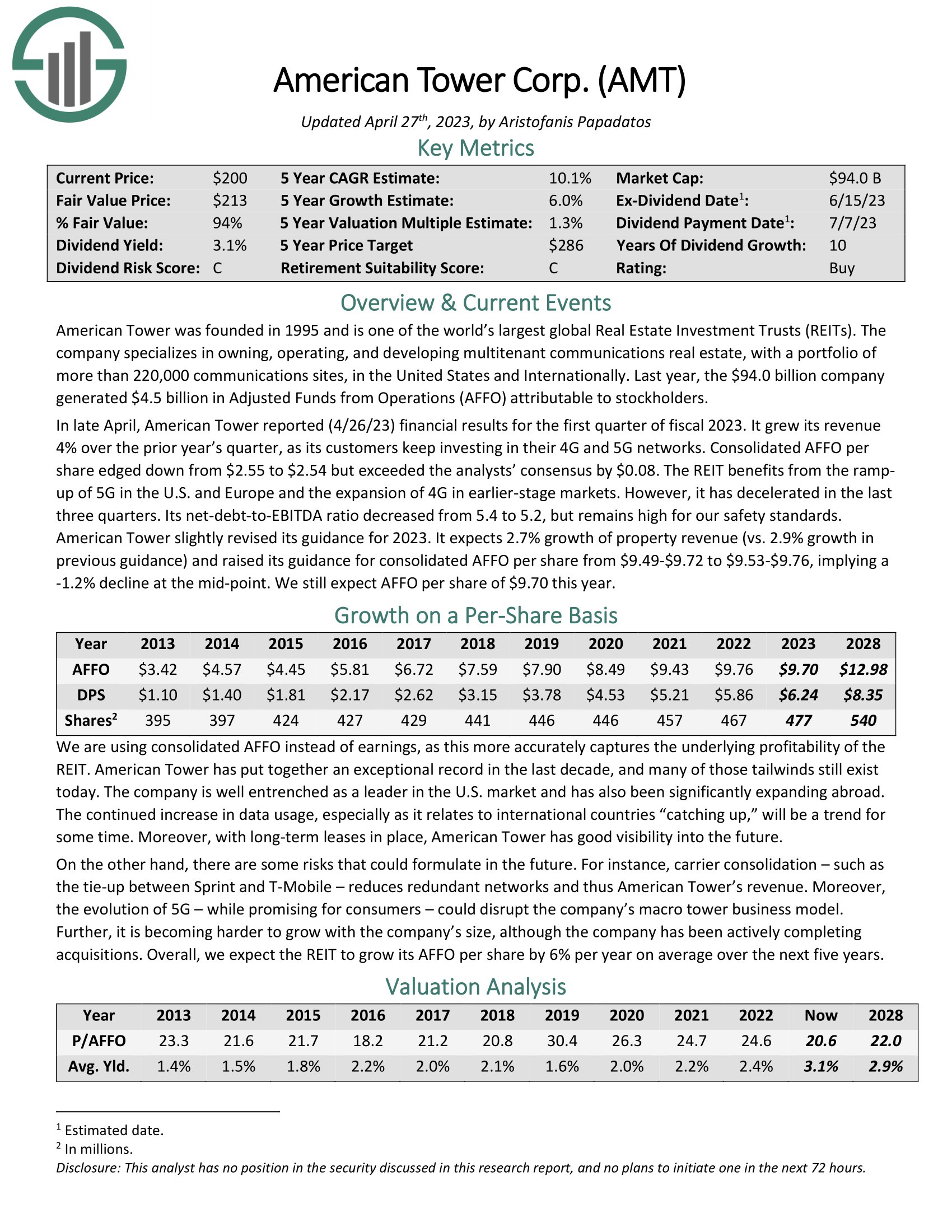

American Tower is a big Actual Property Funding Belief (REIT) specializing in the possession, operation, and improvement of communication actual property. With over 220,000 communication websites worldwide, the corporate generated $4.5 billion in Adjusted Funds from Operations (AFFO) for stockholders in 2022.

Supply: Investor Presentation

In April 2023, American Tower reported its monetary outcomes for Q1 of fiscal 2023, saying a 4% enhance in income in comparison with the earlier yr’s quarter. This progress was attributed to the corporate’s prospects’ continued investments in 4G and 5G networks. Regardless of a slight lower in Consolidated AFFO per share from $2.55 to $2.54, American Tower exceeded analysts’ consensus by $0.08.

Nonetheless, American Tower’s net-debt-to-EBITDA ratio stays excessive by security requirements, and is down from 5.4 to five.2. The corporate expects a 2.7% progress in property income in 2023, down from its earlier estimate of two.9%. It additionally revised its consolidated AFFO per share steerage to $9.53-$9.76, a mid-point decline of -1.2%. Nonetheless, this yr’s $9.70 AFFO per share continues to be projected, indicating the corporate’s continued success within the communication actual property market.

Click on right here to obtain our most up-to-date Positive Evaluation report on American Tower Corp (AMT) (preview of web page 1 of three proven under):

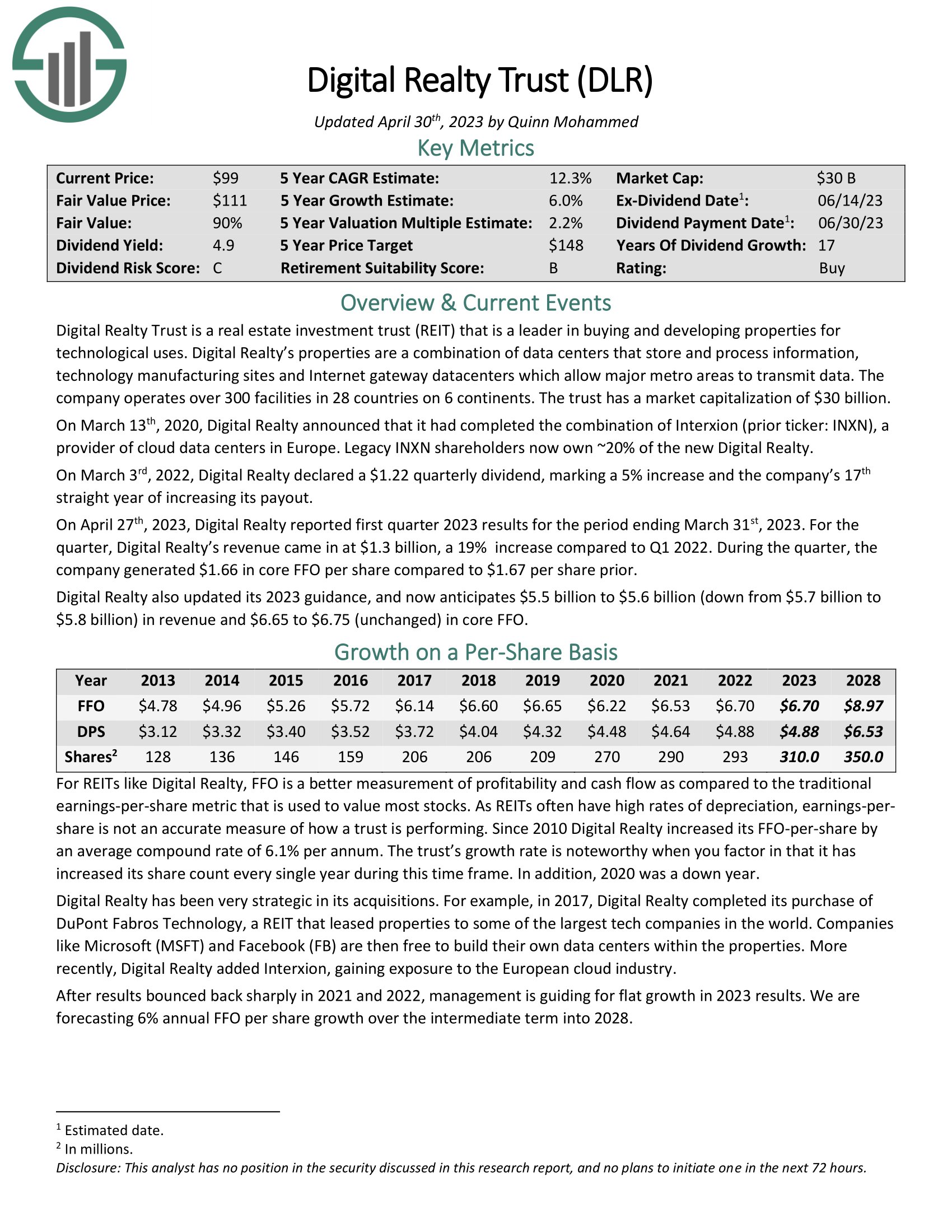

Information Middle REIT No. 1: Digital Realty Belief (DLR)

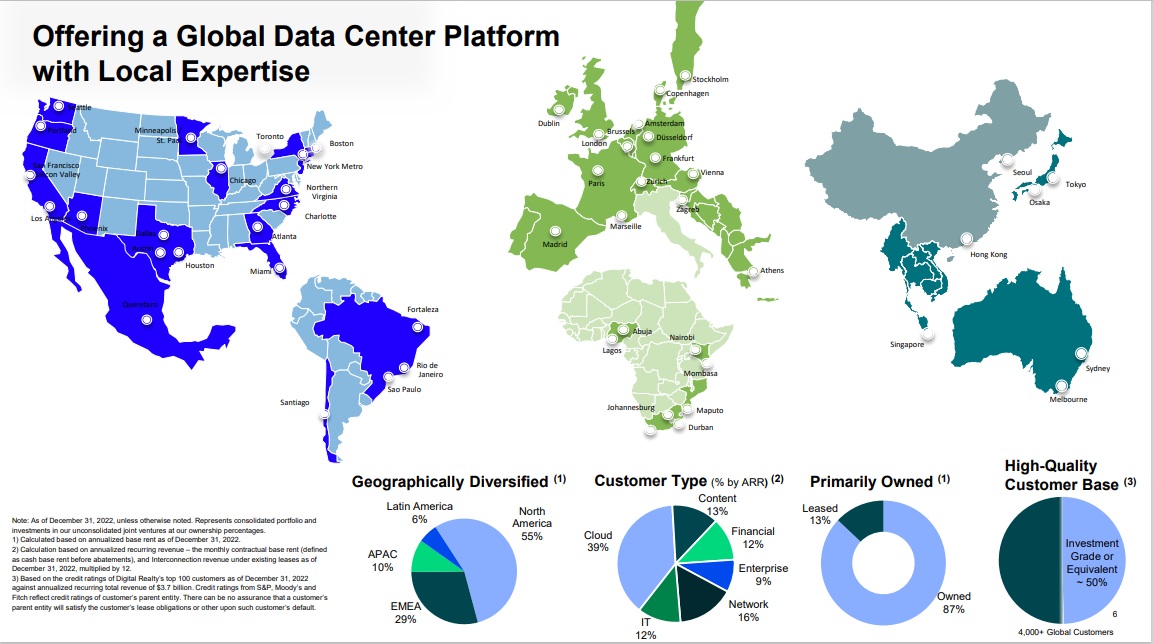

Digital Realty Belief is a REIT that may be a chief in shopping for and creating properties for technological makes use of. Digital Realty’s properties are a mixture of information facilities that retailer and course of info, expertise manufacturing websites, and Web gateway information facilities that enable main metro areas to transmit information. The corporate operates over 300 amenities in 28 nations on six continents.

Supply: Investor Presentation

On March third, 2022, Digital Realty declared a $1.22 quarterly dividend, marking a 5% enhance and the corporate’s seventeenth straight yr of accelerating its payout. On February sixteenth, 2023, Digital Realty reported This fall 2022 outcomes for the interval ending December thirty first, 2022.

Digital Realty’s income got here in at $1.2 billion for the quarter, a 3% enhance in comparison with This fall 2021. Through the quarter, the corporate generated $1.65 in core FFO per share in comparison with $1.67 per share prior. Digital Realty additionally initiated 2023 steerage, anticipating $5.7 billion to $5.8 billion in income and $6.65 to $6.75 in core FFO.

Digital Realty is exclusive amongst protected REITs in providing publicity to the expertise sector.

Click on right here to obtain our most up-to-date Positive Evaluation report on Digital Realty (preview of web page 1 of three proven under):

Ultimate Ideas

Traders looking for earnings might discover REITs interesting as a result of their usually excessive dividend yields. Nonetheless, it’s advisable to decide on protected REITs that may proceed paying dividends within the occasion of an financial downturn inside the following yr. To this finish, the next eight REITs are thought-about protected choices: they’ve affordable debt ranges, ample money movement to maintain dividend funds, and supply excessive yields.

If you’re focused on discovering high-quality dividend progress shares and/or different high-yield securities and earnings securities, the next Positive Dividend assets can be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].