[ad_1]

Up to date on September twenty fifth, 2023 by Aristofanis Papadatos

Silver shares function in a extremely cyclical trade. Income for mining corporations are reliant on excessive treasured metals costs. Throughout instances of rising treasured metals costs, this ends in a large windfall.

However the reverse can also be true–decrease treasured metals costs may cause mining corporations to submit losses. Consequently, revenue traders searching for secure money stream and dependable dividends have to tread fastidiously.

With this in thoughts, we created an inventory of silver shares with essential monetary ratios akin to price-to-earnings ratios and dividend payout ratios.

You may obtain our full listing of silver shares by clicking on the hyperlink beneath:

Along with the Excel spreadsheet above, this text covers our high 5 silver shares at the moment. The businesses analyzed primarily give attention to silver, however are additionally engaged in mining of different metals akin to gold or zinc.

We rank these 5 corporations by a qualitative mixture of asset high quality, steadiness sheet power, future development prospects, and dividend security.

Desk of Contents

The value of silver plunged to a 10-year low in early 2020 because of the influence of the pandemic on the worldwide demand for silver however it has recovered strongly since then. It’s presently hovering round a 10-year excessive degree because of rising demand for silver in industrial and electrical functions, akin to catalysts and high-capacity batteries in addition to rising demand for jewellery and silverware.

General, the present enterprise setting is favorable for silver producers.

Silver Inventory #5: Hecla Mining Firm (HL)

Hecla Mining Firm has been in enterprise since 1891. The corporate, together with its subsidiaries, develops, produces, markets and explores for each treasured and base metals all over the world.

The corporate sells unrefined gold and silver to merchants within the treasured metallic markets. Hecla additionally gives lead, zinc and bulk concentrates to smelters. Hecla has pursuits in Alaska, Colorado, Idaho, Montana, Canada, and Mexico.

In keeping with Hecla, the corporate produces 45% of U.S. silver and is on observe to turn out to be the most important silver producer in Canada subsequent 12 months.

Supply: Investor Presentation

Hecla’s enterprise efficiency is on the mercy of the markets for its treasured and base metals. The corporate does have some benefits. To make sure, Hecla is the most important silver producer within the U.S., the lowest-cost silver producer because of high-quality belongings and the third largest producer of lead and zinc.

The corporate additionally focuses on mines with a protracted reserve life. Its core properties have an estimated reserve lifetime of between 11 and 15 years.

Hecla pays a quarterly dividend of $0.0063 per share, for a present yield of 0.6%.

Hecla maintains a bullish long-term view of silver, due largely to favorable supply-and-demand financial components. The corporate believes that by 2030, silver demand will attain greater than 1,100 million ounces if demand stays on the present pattern. This compares to 2019 provide of 1,023 million ounces and demand of 1,074 million ounces.

Due to this fact, the supply-demand imbalance would require extra provide as a way to meet projected demand. This might result in promising long-term development for Hecla. We anticipate 12% development of earnings per share over the subsequent 5 years, from $0.07 this 12 months to $0.12 in 2028.

The inventory is presently buying and selling at a ahead price-to-earnings ratio of 56.9. We assume a good earnings a number of of 15.0 for this inventory. If it trades at its honest valuation degree in 5 years, it is going to incur a -23.4% annualized valuation drag, which is able to offset the robust earnings development.

Given additionally 12.0% annual earnings development and the 0.6% dividend, the inventory may provide a -12.6% common annual complete return over the subsequent 5 years. It’s thus evident that the market has already priced a terrific portion of future development within the inventory.

Silver Inventory #4: Pan American Silver Company (PAAS)

Pan American Silver Company explores, acquires, develops and refines silver produced from its mines. The corporate has a market cap of $5.5 billion.

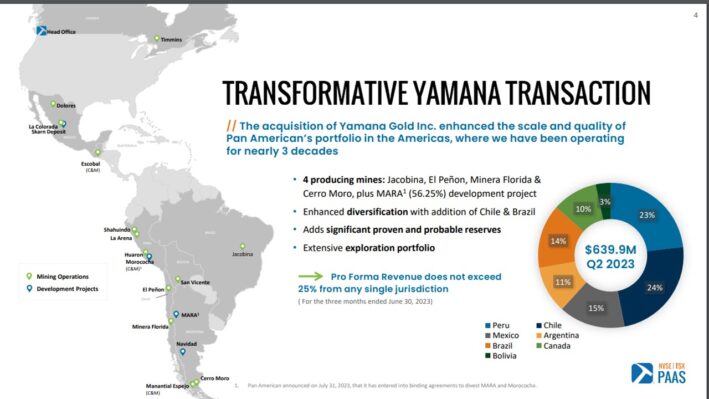

The corporate has operations in each North and South America. It additionally just lately acquired Yamana Gold in a cash-and-stock deal.

Supply: Investor Presentation

This acquisition has drastically enhanced the size and high quality of the asset portfolio of Pan American.

Pan American operates silver mines within the U.S., Canada, Peru, Mexico and Argentina. The corporate has used acquisitions to assist gasoline future development, such because the acquisition of Canadian treasured metallic mining firm Tahoe Sources in 2019 and the current acquisition of Yamana Gold.

The corporate generates greater than half of its income from gold, greater than 1 / 4 from silver, and the rest from copper, zinc, and lead.

Pan American is a powerful money stream generator, with over $1.6 billion in free money stream generated since 2010. With its free money stream, the corporate invests in development, pays its debt, and returns money to shareholders. It has an funding grade score of BBB- from S&P.

Pan American has paid a dividend yearly since 2008, although the corporate reduce its dividend in each 2015 and 2016. During the last three years, nevertheless, Pan American’s dividend has grown at a excessive charge.

The corporate has a novel dividend coverage, which is to pay a base dividend of $0.10 per widespread share every quarter with a variable dividend, paid quarterly, that’s linked to the online money on the steadiness sheet for the earlier quarter. Pan American has a present yield of two.6%.

The corporate is predicted to earn roughly $0.45 per share this 12 months. Nevertheless, we anticipate it to develop its earnings per share by 15% per 12 months on common because of the most important acquisition of Yamana Gold and a good outlook for silver and gold.

The inventory is presently buying and selling at a ahead price-to-earnings ratio of 33.8. We assume a good earnings a number of of 12.0 for this inventory. If it trades at its honest valuation degree in 5 years, it is going to incur a -18.7% annualized valuation drag, which is able to offset the robust earnings development.

Given additionally 15.0% annual earnings development and the two.6% dividend, the inventory may provide a -2.8% common annual complete return over the subsequent 5 years. Due to this fact, the market appears to have already priced a good portion of future development within the inventory.

Silver Inventory #3: Wheaton Valuable Metals (WPM)

Previously referred to as Wheaton Silver, Wheaton Valuable Metals was began in 1994. The corporate has a market capitalization of $20 billion.

Wheaton is the most important metallic streaming firm on the earth. Streaming implies that the corporate purchases the correct to purchase silver and gold at a low fastened price as a substitute of outright mine possession. It has 19 working mines and one other 13 improvement tasks all over the world.

Wheaton’s earnings-per-share efficiency has been fairly risky during the last decade. Attributable to its enterprise mannequin, Wheaton doesn’t management how a lot gold or silver is mined from a particular location nor does the corporate have management over the market costs for the dear metals.

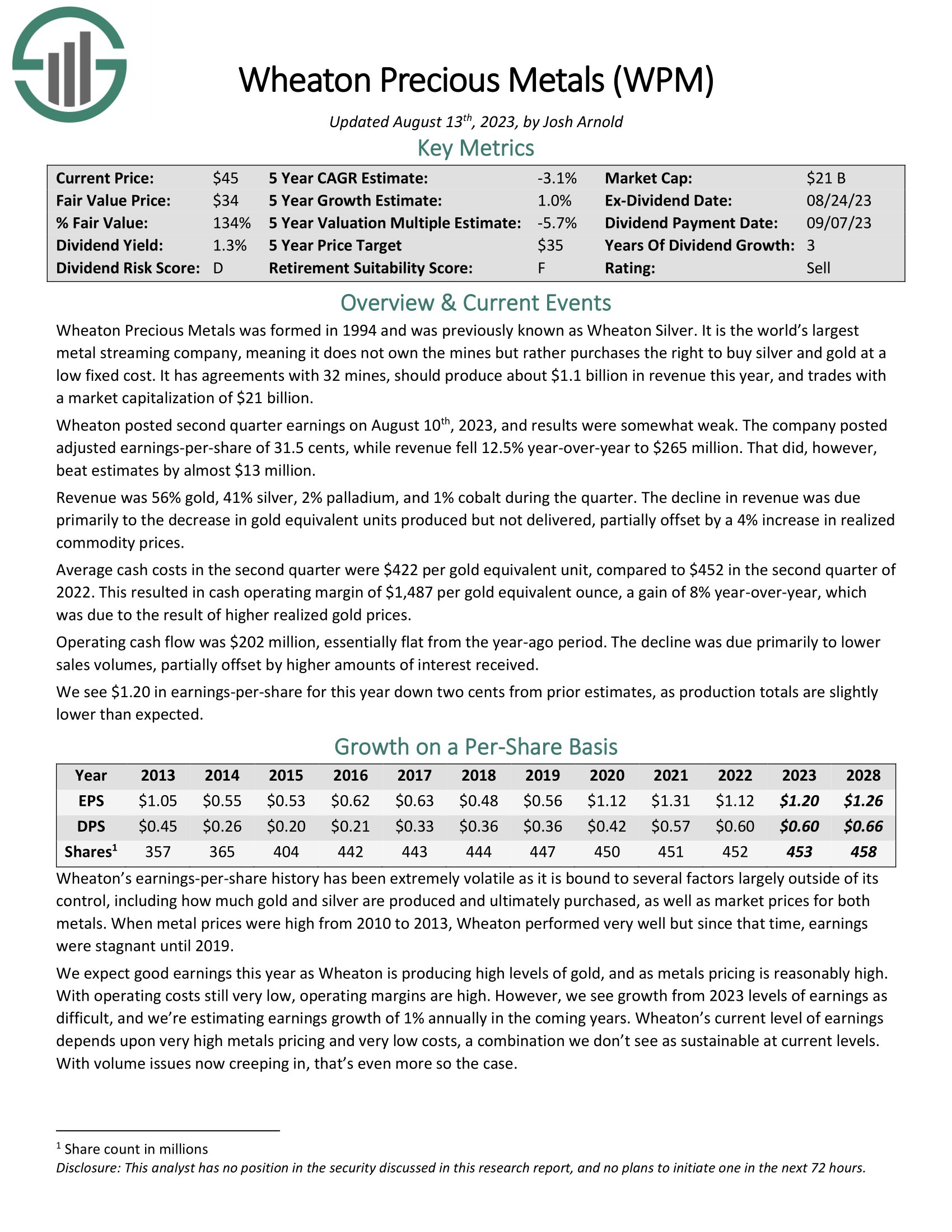

Wheaton reported second quarter earnings on August tenth, 2023, and outcomes had been considerably weak. The corporate posted adjusted earnings-per-share of $0.31, which decreased 6% over the prior 12 months’s quarter, although they exceeded the analysts’ consensus by $0.04. Income fell 12.5% year-over-year, to $265 million, however it exceeded the analysts’ estimates by nearly $13 million. The decline in income resulted primarily from a lower within the common worth of gold.

Common money prices within the second quarter had been $422 per gold equal unit, in comparison with $452 within the second quarter of 2022. This resulted in money working margin of $1,487 per gold equal ounce, a achieve of 8% year-over-year.

Based mostly on the annualized dividend of $0.60, the inventory yields 1.4%. We anticipate 5% development of earnings per share over the subsequent 5 years, from $1.20 this 12 months to $1.26 in 2028.

The inventory is presently buying and selling at a ahead price-to-earnings ratio of 36.1. We assume a good earnings a number of of 28.0 for this inventory. If it trades at its honest valuation degree in 5 years, it is going to incur a -4.9% annualized valuation drag. Given additionally 1.0% annual earnings development and the 1.4% dividend, the inventory may provide a -2.3% common annual complete return over the subsequent 5 years. It thus seems unattractive round its present worth.

Click on right here to obtain our most up-to-date Positive Evaluation report on WPM (preview of web page 1 of three proven beneath):

Silver Inventory #2: Fresnillo Plc (FNLPF)

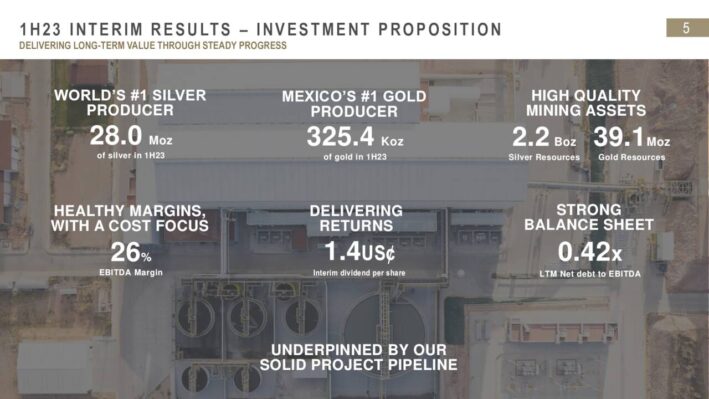

Fresnillo is the world’s main producer of silver and the most important producer of gold in Mexico. The corporate’s shares are listed on the London inventory trade. Moreover silver and gold, Fresnillo explores for lead and zinc concentrates.

The corporate additionally leases mining tools, provides semi-pure alloys of gold and silver and gives administrative companies. Fresnillo has a market capitalization of $5.2 billion.

Fresnillo is a diversified firm, with high-quality belongings, wholesome working margins and a rock-solid steadiness sheet.

Supply: Investor Presentation

Like many corporations on this listing, Fresnillo has skilled broad variance in earnings outcomes. The corporate has incurred losses a number of instances during the last decade.

Fresnillo’s coverage is to pay out 33% to 50% of revenue after tax within the type of dividends. The corporate pays out one-third of the dividend in September whereas the remaining two-thirds of the dividend is paid in June.

As a result of revenue adjustments from year-to-year and forex trade impacts what quantity U.S. traders are paid, the dividend has different through the years. Traders ought to notice that the corporate has paid a dividend for at the least 10 consecutive years, the longest streak of any firm on this listing.

Based mostly on the trailing two semi-annual funds, the inventory yields 2.1%. We anticipate 15% development of earnings per share over the subsequent 5 years, from $0.30 this 12 months to $0.60 in 2028.

The inventory is presently buying and selling at a ahead price-to-earnings ratio of 23.1. We assume a good earnings a number of of 15.0 for this inventory. If it trades at its honest valuation degree in 5 years, it is going to incur an -8.3% annualized valuation drag, which is able to partly offset the robust earnings development. Given additionally 15.0% annual earnings development and the two.1% dividend, the inventory may provide an 8.1% common annual complete return over the subsequent 5 years.

Silver Inventory #1: Glencore plc (GLCNF)

Glencore was based in 1974 and is without doubt one of the main corporations within the mining sector. Glencore plc was the results of merging Glencore with Xstrata in 2013. The corporate smelts, refines, mines, processes and shops silver, copper, zinc, aluminum, nickel, cobalt, iron ore and different metals.

Glencore, which is the most important firm in Switzerland, additionally has an vitality and agricultural merchandise section. This makes the corporate essentially the most diversified on this listing. Diversification is particularly invaluable when contemplating silver shares, contemplating the volatility of treasured metals costs.

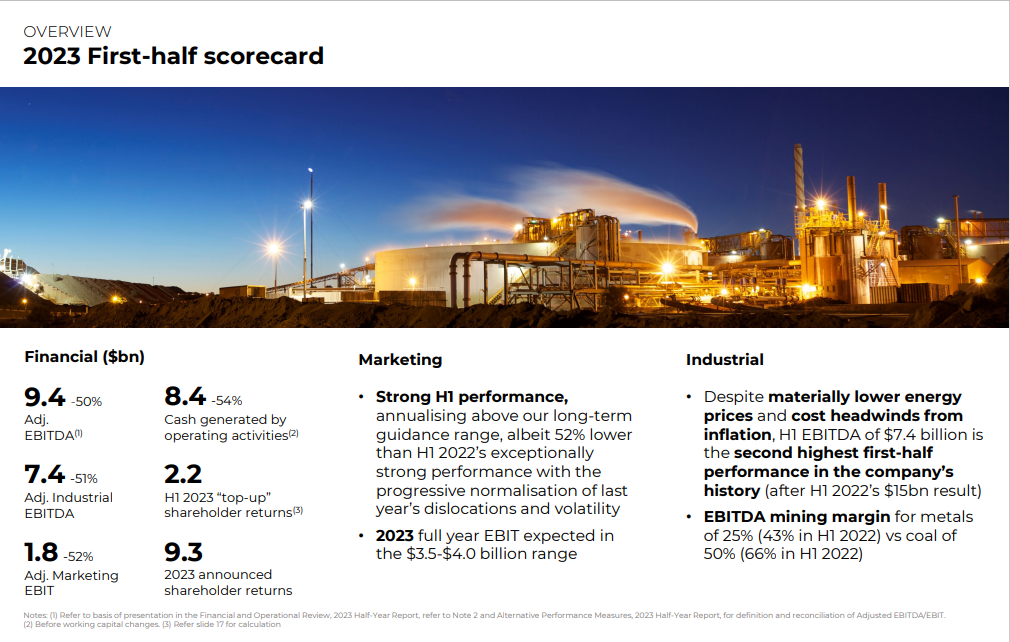

You may see an outline of Glencore’s 2023 first-half efficiency within the picture beneath:

Supply: Investor Presentation

Earnings decreased 50% over the prior 12 months’s interval as a consequence of exceptionally excessive commodity costs within the prior 12 months’s interval amid a powerful restoration from the pandemic and provide chain disruptions. However, earnings remained above common.

Whereas silver is the corporate’s largest metallic produced, Glencore can also be a frontrunner in a number of different areas. Glencore is a worldwide chief within the manufacturing of copper, cobalt, zinc, nickel and seaborne vitality coal.

Glencore is the most important title in its sector, which ought to gasoline continued development within the years forward. We additionally discover the diversified enterprise mannequin away from treasured metals to be enticing as nicely. However, given the cyclicality of commodity costs, we anticipate 4% common annual development of earnings per share over the subsequent 5 years.

Glencore pays a separate dividend each semester, relying on its earnings. Due to favorable commodity costs, the inventory is presently providing an annual dividend of $1.04, which corresponds to a 9.4% yield. This renders Glencore a excessive dividend inventory.

We anticipate Glencore to submit earnings per share of $0.92 this 12 months. The inventory is buying and selling at a price-to-earnings ratio of 12.1, which is simply marginally greater than our assumed honest earnings a number of of 12.0 for this inventory. If Glencore trades at its honest valuation degree in 5 years, it is going to incur a marginal -0.1% annualized valuation drag.

Given additionally 4.0% annual earnings development and the 9.4% dividend, the inventory may provide a ten.5% common annual complete return over the subsequent 5 years. It thus seems enticing round its present worth.

Remaining Ideas

Investing in silver shares is finest left to these with greater danger tolerances. The businesses on this listing have every struggled throughout numerous parts of the previous decade. Some corporations have hardly ever recorded a revenue from 12 months to 12 months.

Furthermore, many silver shares don’t pay dividends, and even those who do can’t be counted on to take care of their dividends throughout a recession, or in periods of declining silver costs.

That mentioned, if traders are inquisitive about silver shares, we imagine that Glencore and Fresnillo are the most effective choices.

Additional Studying

If you’re inquisitive about discovering high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases can be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link