[ad_1]

Revealed on March twenty second, 2023 by Bob Ciura

The Russell 2000 Index is arguably the world’s best-known benchmark for small-cap U.S. shares.

Small-cap shares have traditionally outperformed their bigger counterparts.

Accordingly, the Russell 2000 Index may be an intriguing place to search for new funding alternatives.

You possibly can obtain your free Excel listing of Russell 2000 shares, together with related monetary metrics like dividend yields and P/E ratios, by clicking on the hyperlink beneath:

We usually rank shares primarily based on their five-year anticipated annual returns, as said within the Positive Evaluation Analysis Database.

However for traders primarily interested by revenue, it’s also helpful to rank small-cap shares in line with their dividend yields.

This text will rank the 20 highest-yielding small cap shares in our protection universe (excluding REITs, MLPs, BDCs, and royalty trusts).

Desk of Contents

Why Make investments In Small-Cap Shares?

The Russell 2000 Index incorporates the home U.S. shares that rank 1,001 via 3,000 by descending market capitalization.

The Russell 2000 is a wonderful benchmark for small-cap shares. The common market capitalization inside the Russell 2000 is ~presently $2.9 billion.

Why does this matter? There are an a variety of benefits to investing in small-cap shares, which we discover within the following video:

Small-cap shares have traditionally outperformed large-cap shares for 2 causes.

Firstly, small-cap shares are likely to develop extra rapidly than their bigger counterparts. There’s merely much less competitors and extra room to develop when your market capitalization is, say, $1 billion when in comparison with mega-cap shares with market caps above $200 billion.

Secondly, many small-cap securities are outdoors the funding universes of some bigger institutional funding managers. This creates much less demand for shares, which reduces their costs and creates higher shopping for alternatives.

Because of this, there are usually extra mis-priced funding alternatives in a small-cap index just like the Russell 2000 than a large-cap inventory index just like the S&P 500.

The next part ranks the 20 highest-yielding small-cap shares within the U.S. which can be coated within the Positive Evaluation Analysis Database. The shares are ranked so as of lowest dividend yield to highest.

Excessive Yield Small Cap #20: Group Belief Bancorp (CTBI)

Group Belief Bancorp is a regional financial institution with 84 department areas in 35 counties in Kentucky, Tennessee, and West Virginia. It’s Kentucky’s second-largest financial institution holding firm, with a $5.5 billion stability sheet. It has raised its dividend for 42 consecutive years.

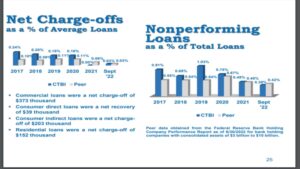

The important thing aggressive benefit of Group Belief Bancorp is its disciplined and conservative administration. The financial institution has reported common web mortgage charge-offs of solely 0.03% within the final 4 quarters.

Supply: Investor Presentation

Because of the current sell-off, the inventory is providing a virtually 10-year excessive dividend yield of 4.5%. Given its strong payout ratio of 39% and its defensive enterprise mannequin, the corporate is prone to proceed elevating its dividend for a lot of extra years.

Furthermore, Group Belief Bancorp has grown its earnings per share at a 6.4% common annual price over the past decade and at a 9.5% common annual price over the past 5 years. The economic system has recovered from the pandemic, and the Fed has raised rates of interest aggressively in current quarters. Larger rates of interest have enhanced the web curiosity margin of the financial institution, however they’ve triggered deceleration of the economic system, as supposed.

Click on right here to obtain our most up-to-date Positive Evaluation report on Group Belief Bancorp (CTBI) (preview of web page 1 of three proven beneath):

Excessive Yield Small Cap #19: Auburn Nationwide Bancorporation (AUBN)

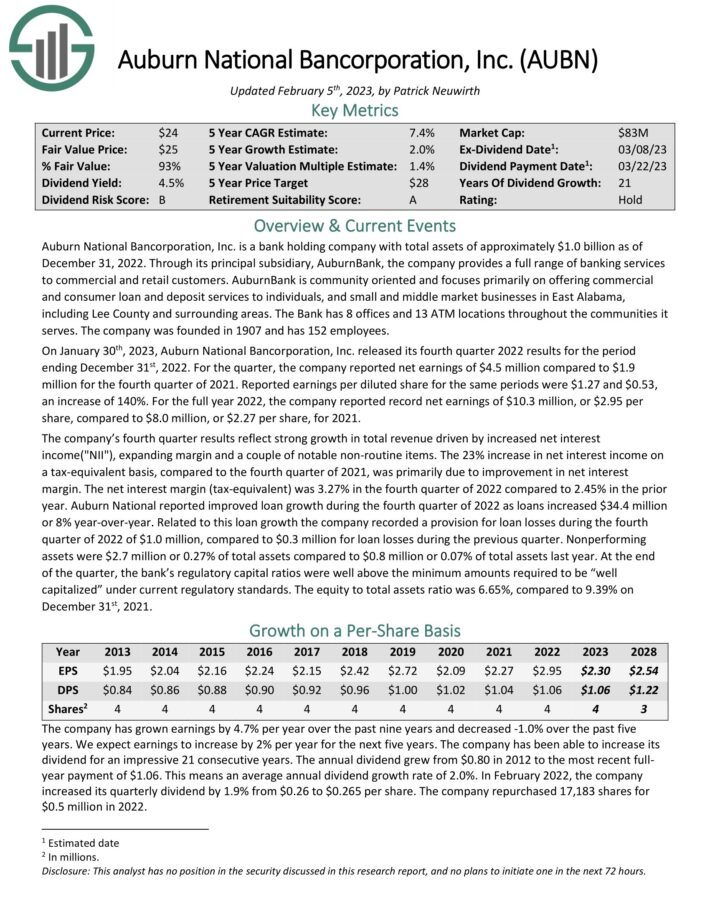

Auburn Nationwide Bancorporation, Inc. is a financial institution holding firm with whole property of roughly $1.0 billion as of December 31, 2022. By way of its principal subsidiary, AuburnBank, the corporate supplies a full vary of banking providers to business and retail prospects.

AuburnBank is group oriented and focuses totally on providing business and shopper mortgage and deposit providers to people, and small and center market companies in East Alabama, together with Lee County and surrounding areas. The Financial institution has 8 workplaces and 13 ATM areas all through the communities it serves. The corporate was based in 1907 and has 152 workers.

On January thirtieth, 2023, Auburn Nationwide Bancorporation, Inc. launched its fourth quarter 2022 outcomes for the interval ending December thirty first, 2022. For the quarter, the corporate reported web earnings of $4.5 million in comparison with $1.9 million for the fourth quarter of 2021. Reported earnings per diluted share for a similar durations have been $1.27 and $0.53, a rise of 140%. For the complete yr 2022, the corporate reported document web earnings of $10.3 million, or $2.95 per share, in comparison with $8.0 million, or $2.27 per share, for 2021.

The corporate’s fourth quarter outcomes replicate sturdy development in whole income pushed by elevated web curiosity revenue(“NII”), increasing margin and a few notable non-routine gadgets. The 23% improve in web curiosity revenue on a tax-equivalent foundation, in comparison with the fourth quarter of 2021, was primarily attributable to enchancment in web curiosity margin. The online curiosity margin (tax-equivalent) was 3.27% within the fourth quarter of 2022 in comparison with 2.45% within the prior yr. Auburn Nationwide reported improved mortgage development throughout the fourth quarter of 2022 as loans elevated $34.4 million or 8% year-over-year.

Click on right here to obtain our most up-to-date Positive Evaluation report on AUBN (preview of web page 1 of three proven beneath):

Excessive Yield Small Cap #18: Ennis Inc. (EBF)

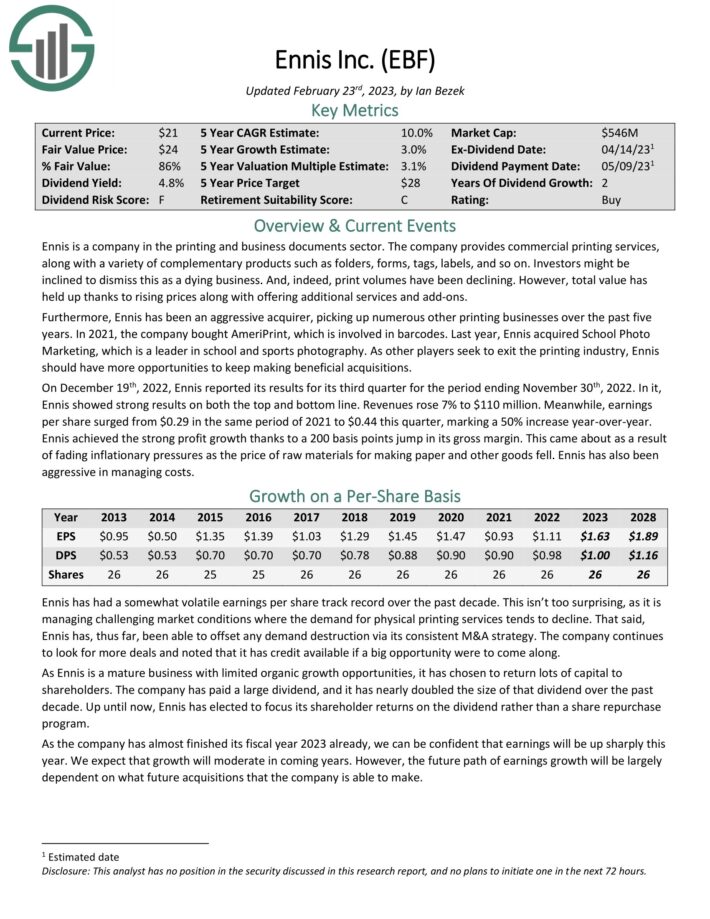

Ennis is an organization within the printing and enterprise paperwork sector. The corporate supplies business printing providers, together with a wide range of complementary merchandise corresponding to folders, varieties, tags, labels, and so forth. Traders may be inclined to dismiss this as a dying enterprise. And, certainly, print volumes have been declining. Nonetheless, whole worth has held up because of rising costs together with providing extra providers and add-ons.

Moreover, Ennis has been an aggressive acquirer, choosing up quite a few different printing companies over the previous 5 years. In 2021, the corporate purchased AmeriPrint, which is concerned in barcodes. Final yr, Ennis acquired College Photograph Advertising, which is a frontrunner in class and sports activities pictures. As different gamers search to exit the printing trade, Ennis ought to have extra alternatives to maintain making useful acquisitions.

On December nineteenth, 2022, Ennis reported its outcomes for its third quarter for the interval ending November thirtieth, 2022. In it, Ennis confirmed sturdy outcomes on each the highest and backside line. Revenues rose 7% to $110 million. In the meantime, earnings per share surged from $0.29 in the identical interval of 2021 to $0.44 this quarter, marking a 50% improve year-over-year. Ennis achieved the sturdy revenue development because of a 200 foundation factors soar in its gross margin.

Click on right here to obtain our most up-to-date Positive Evaluation report on Ennis (preview of web page 1 of three proven beneath):

Excessive Yield Small Cap #17: Kaiser Aluminum (KALU)

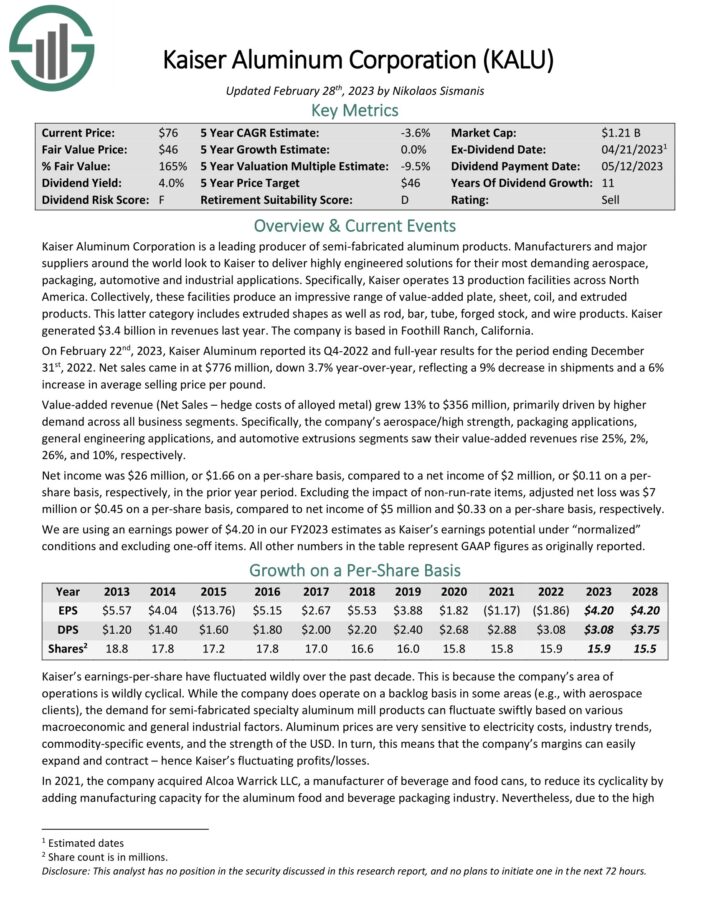

Kaiser Aluminum Company is a number one producer of semi-fabricated aluminum merchandise. Producers and main suppliers around the globe look to Kaiser to ship extremely engineered options for his or her most demanding aerospace, packaging, automotive and industrial purposes.

Particularly, Kaiser operates 13 manufacturing amenities throughout North America. Collectively, these amenities produce a formidable vary of value-added plate, sheet, coil, and extruded merchandise. This latter class consists of extruded shapes in addition to rod, bar, tube, solid inventory, and wire merchandise. Kaiser generated $3.4 billion in revenues final yr.

Supply: Investor Presentation

On February twenty second, 2023, Kaiser Aluminum reported its This fall-2022 and full-year outcomes for the interval ending December thirty first, 2022. Internet gross sales got here in at $776 million, down 3.7% year-over-year, reflecting a 9% lower in shipments and a 6% improve in common promoting value per pound.

Worth-added income (Internet Gross sales – hedge prices of alloyed steel) grew 13% to $356 million, primarily pushed by larger demand throughout all enterprise segments. Particularly, the corporate’s aerospace/excessive energy, packaging purposes, normal engineering purposes, and automotive extrusions segments noticed their value-added revenues rise 25%, 2%, 26%, and 10%, respectively.

Internet revenue was $26 million, or $1.66 on a per-share foundation, in comparison with a web revenue of $2 million, or $0.11 on a per share foundation, respectively, within the prior yr interval. Excluding the influence of non-run-rate gadgets, adjusted web loss was $7 million or $0.45 on a per-share foundation, in comparison with web revenue of $5 million and $0.33 on a per-share foundation, respectively.

Click on right here to obtain our most up-to-date Positive Evaluation report on KALU (preview of web page 1 of three proven beneath):

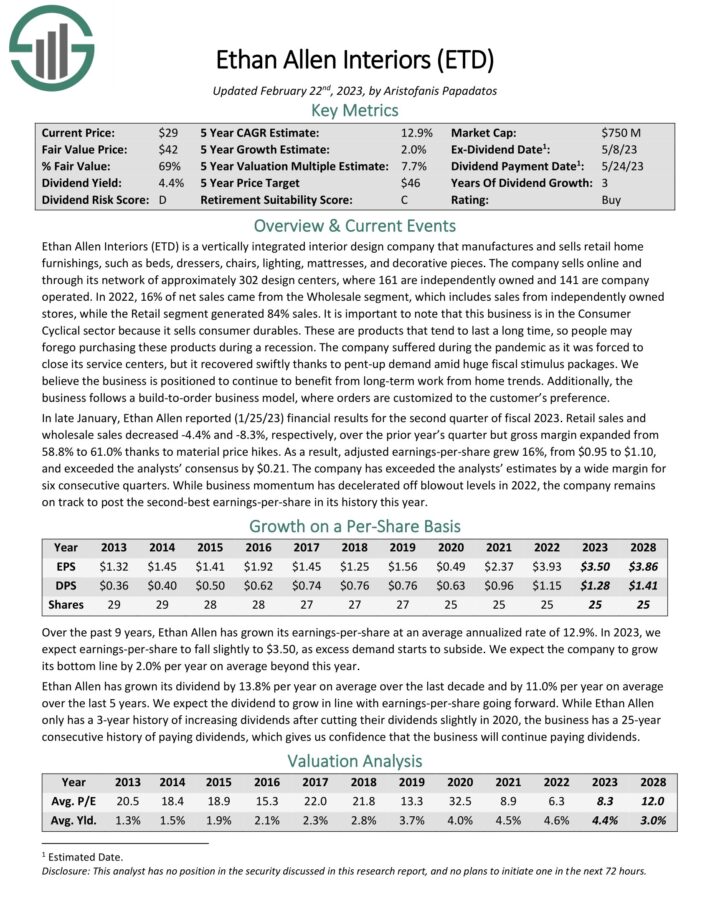

Excessive Yield Small Cap #16: Ethan Allen Interiors (ETD)

Ethan Allen Interiors is a vertically built-in inside design firm that manufactures and sells retail residence furnishings, corresponding to beds, dressers, chairs, lighting, mattresses, and ornamental items. The corporate sells on-line and thru its community of roughly 302 design facilities, the place 161 are independently owned and 141 are firm operated.

In 2022, 16% of web gross sales got here from the Wholesale phase, which incorporates gross sales from independently owned shops, whereas the Retail phase generated 84% gross sales. We imagine the enterprise is positioned to proceed to learn from long-term work at home tendencies. Moreover, the enterprise follows a build-to-order enterprise mannequin, the place orders are custom-made to the shopper’s choice.

In late January, Ethan Allen reported (1/25/23) monetary outcomes for the second quarter of fiscal 2023. Retail gross sales and wholesale gross sales decreased -4.4% and -8.3%, respectively, over the prior yr’s quarter however gross margin expanded from 58.8% to 61.0% because of materials value hikes.

In consequence, adjusted earnings-per-share grew 16%, from $0.95 to $1.10, and exceeded the analysts’ consensus by $0.21. The corporate has exceeded the analysts’ estimates by a large margin for six consecutive quarters.

Click on right here to obtain our most up-to-date Positive Evaluation report on Ethan Allen (preview of web page 1 of three proven beneath):

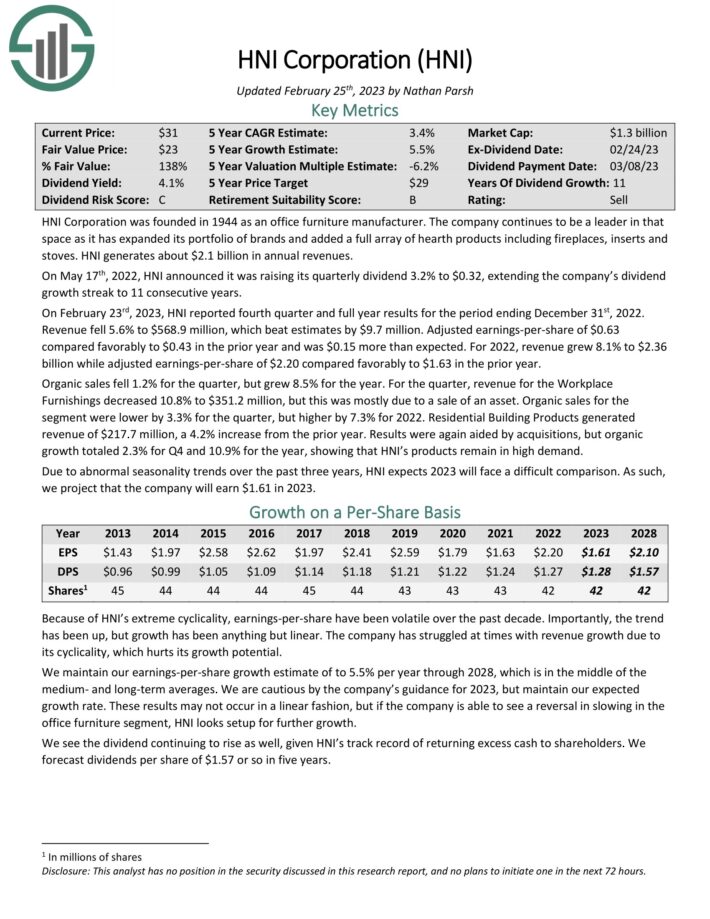

Excessive Yield Small Cap #15: HNI Company (HNI)

HNI Company was based in 1944 as an workplace furnishings producer. The corporate continues to be a frontrunner in that house because it has expanded its portfolio of manufacturers and added a full array of fireside merchandise together with fireplaces, inserts and stoves. HNI generates about $2.1 billion in annual revenues.

The corporate lately introduced the acquisition of Kimball Worldwide for about $485 million, with a complete

enterprise worth of roughly $531 million.

Supply: Investor Presentation

On February twenty third, 2023, HNI reported fourth quarter and full yr outcomes for the interval ending December thirty first, 2022. Income fell 5.6% to $568.9 million, which beat estimates by $9.7 million. Adjusted earnings-per-share of $0.63 in contrast favorably to $0.43 within the prior yr and was $0.15 greater than anticipated.

For 2022, income grew 8.1% to $2.36 billion whereas adjusted earnings-per-share of $2.20 in contrast favorably to $1.63 within the prior yr. Natural gross sales fell 1.2% for the quarter, however grew 8.5% for the yr.

For the quarter, income for the Office Furnishings decreased 10.8% to $351.2 million, however this was largely attributable to a sale of an asset. Natural gross sales for the phase have been decrease by 3.3% for the quarter, however larger by 7.3% for 2022. Residential Constructing Merchandise generated income of $217.7 million, a 4.2% improve from the prior yr.

Outcomes have been once more aided by acquisitions, however natural development totaled 2.3% for This fall and 10.9% for the yr, displaying that HNI’s merchandise stay in excessive demand.

Click on right here to obtain our most up-to-date Positive Evaluation report on HNI (preview of web page 1 of three proven beneath):

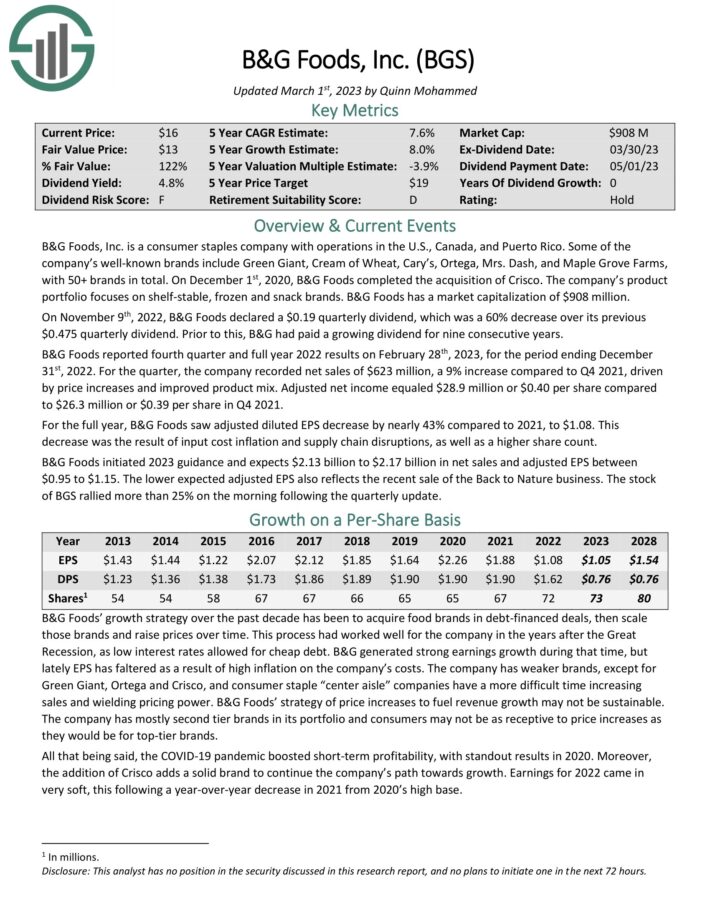

Excessive Yield Small Cap #14: B&G Meals (BGS)

B&G Meals was created within the late Nineties with the preliminary goal of buying Bloch & Guggenheimer, who offered pickles, relish, and condiments. Bloch itself was based in 1889. The frequent inventory we all know right this moment below the ticker BGS has traded on the NYSE since 2007. B&G Meals has a market capitalization of $992 million.

A number of the firm’s well-known manufacturers embody Inexperienced Large, Ortega, Cream of Wheat, Mrs. Sprint, and Again to Nature, with over 50 manufacturers in whole. The corporate’s newest main acquisition was Crisco in early December 2020. The corporate’s product portfolio focuses on shelf-stable, frozen and snack manufacturers.

The corporate operates in the US, Canada, and Puerto Rico. Whereas the corporate possesses some main manufacturers, corresponding to Inexperienced Large, Ortega, and Crisco, a lot of their manufacturers may be thought-about second-tier.

B&G Meals reported fourth quarter and full yr 2022 outcomes on February twenty eighth, 2023. For the quarter, the corporate recorded web gross sales of $623 million, a 9% improve in comparison with This fall 2021, pushed by value will increase and improved product combine. Adjusted web revenue equaled $28.9 million or $0.40 per share in comparison with $26.3 million or $0.39 per share in This fall 2021.

For the complete yr, B&G Meals noticed adjusted diluted EPS lower by practically 43% in comparison with 2021, to $1.08. This lower was the results of enter value inflation and provide chain disruptions, in addition to the next share rely. B&G Meals initiated 2023 steerage and expects $2.13 billion to $2.17 billion in web gross sales and adjusted EPS between $0.95 to $1.15. The decrease anticipated adjusted EPS additionally displays the current sale of the Again to Nature enterprise.

Click on right here to obtain our most up-to-date Positive Evaluation report on BGS (preview of web page 1 of three proven beneath):

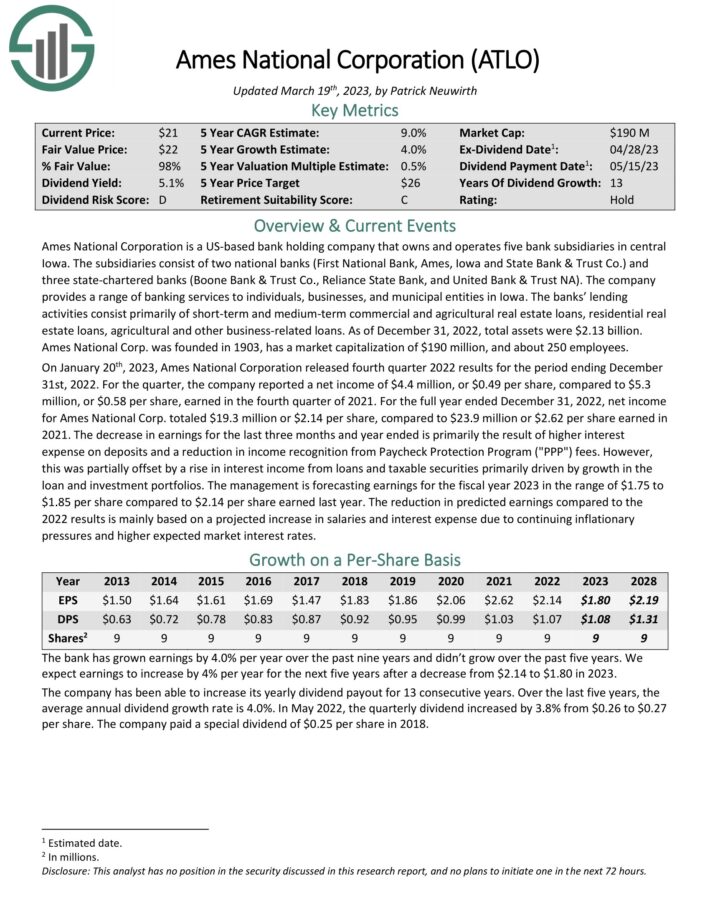

Excessive Yield Small Cap #13: Ames Nationwide Company (ATLO)

Ames Nationwide Company is a US-based financial institution holding firm that owns and operates 5 financial institution subsidiaries in central Iowa. The subsidiaries encompass two nationwide banks (First Nationwide Financial institution, Ames, Iowa and State Financial institution & Belief Co.) and three state-chartered banks (Boone Financial institution & Belief Co., Reliance State Financial institution, and United Financial institution & Belief NA). The corporate supplies a spread of banking providers to people, companies, and municipal entities in Iowa.

Lending actions consist primarily of short-term and medium-term business and agricultural actual property loans, residential actual property loans, agricultural and different business-related loans. As of December 31, 2022, whole property have been $2.13 billion.

On January twentieth, 2023, Ames Nationwide Company launched fourth quarter 2022 outcomes for the interval ending December thirty first, 2022. For the quarter, the corporate reported a web revenue of $4.4 million, or $0.49 per share, in comparison with $5.3 million, or $0.58 per share, earned within the fourth quarter of 2021.

For the complete yr ended December 31, 2022, web revenue for Ames Nationwide Corp. totaled $19.3 million or $2.14 per share, in comparison with $23.9 million or $2.62 per share earned in 2021. The lower in earnings for the final three months and yr ended was primarily the results of larger curiosity expense on deposits and a discount in revenue recognition from Paycheck Safety Program (“PPP”) charges.

Nonetheless, this was partially offset by an increase in curiosity revenue from loans and taxable securities primarily pushed by development within the mortgage and funding portfolios. Administration is forecasting earnings for the fiscal yr 2023 within the vary of $1.75 to $1.85 per share in comparison with $2.14 per share earned final yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on ATLO (preview of web page 1 of three proven beneath):

Excessive Yield Small Cap #12: Compass Diversified Holdings (CODI)

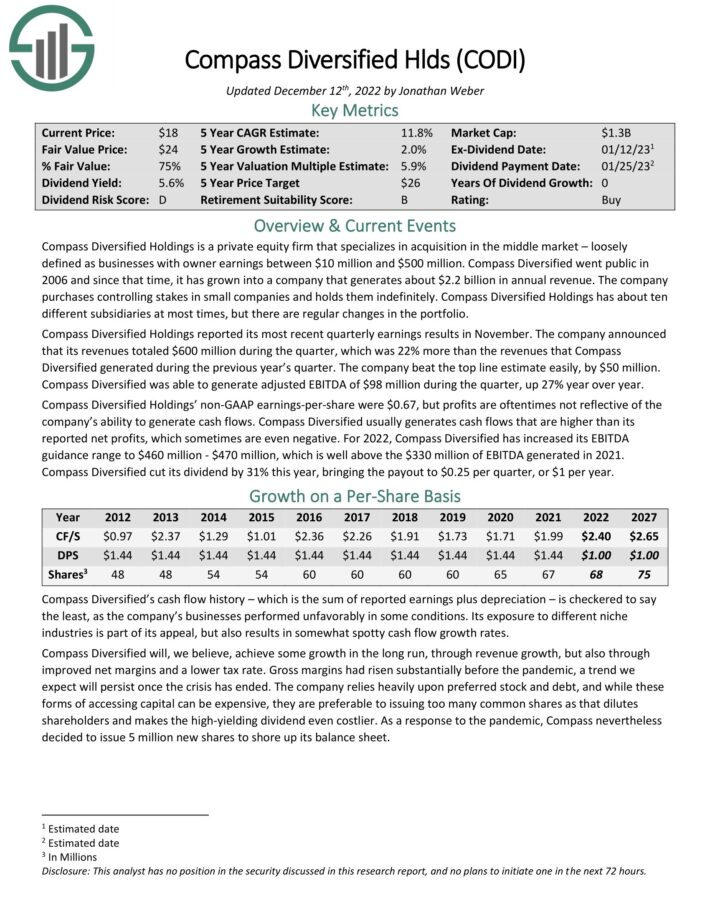

Compass Diversified Holdings is a non-public fairness agency that makes a speciality of acquisition within the center market. The center market is loosely outlined as companies with proprietor earnings between $10 million and $500 million. Compass Diversified Holdings has about 10 totally different subsidiaries at most occasions, however there are common modifications within the portfolio.

Compass Diversified Holdings reported its most up-to-date quarterly earnings ends in November. The corporate introduced that its revenues totaled $600 million throughout the quarter, up 22% year-over-year. The corporate beat the highest line estimate simply, by $50 million. Compass Diversified was in a position to generate adjusted EBITDA of $98 million throughout the quarter, up 27% yr over yr.

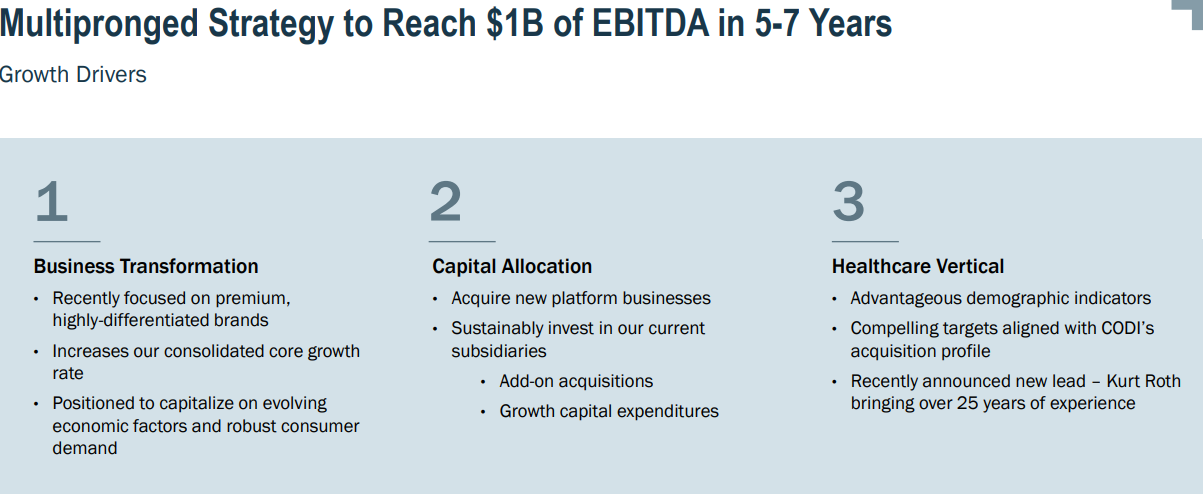

Compass Diversified’s development technique is targeted on producing $1 billion of EBITDA in 5-7 years from now. It has three major development drivers to attain that aim.

Supply: Investor Presentation

First, it plans to proceed reworking and bettering the companies inside its present portfolio to drive rising EBITDA organically. Second, it plans to proceed buying new companies that match inside its present platforms, with a continued concentrate on premium, extremely differentiated manufacturers. Lastly, it’s taking the start steps in direction of launching a extra defensive healthcare vertical.

Click on right here to obtain our most up-to-date Positive Evaluation report on CODI (preview of web page 1 of three proven beneath):

Excessive Yield Small Cap #11: First of Lengthy Island Corp. (FLIC)

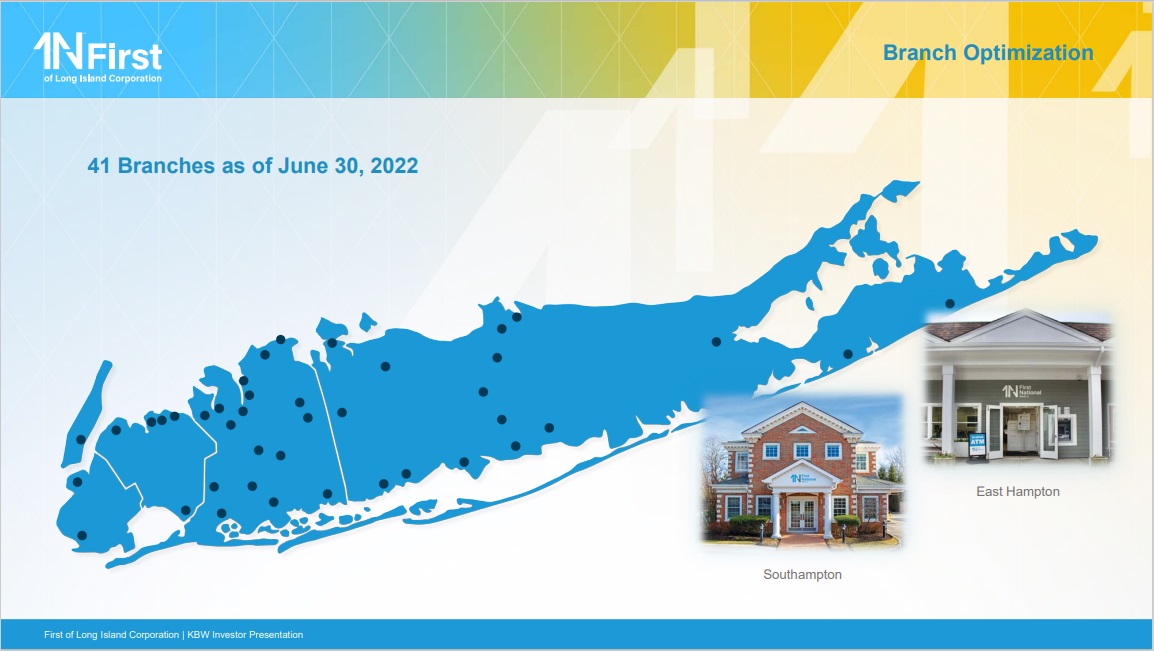

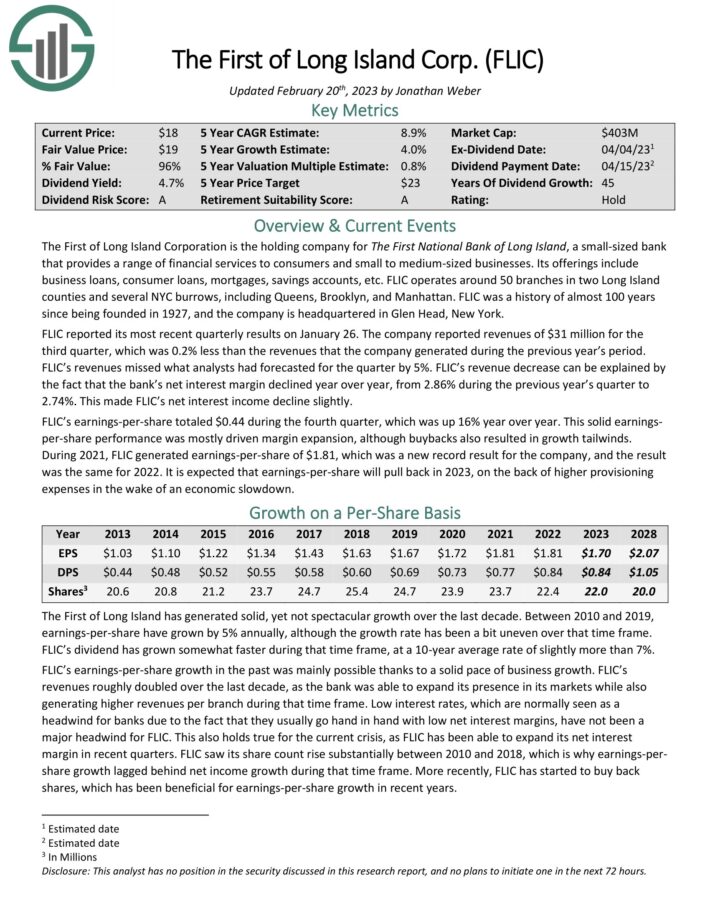

The First of Lengthy Island Company is the holding firm for The First Nationwide Financial institution of Lengthy Island. This small-sized financial institution supplies a spread of monetary providers to shoppers and small to medium-sized companies. Its choices embody enterprise loans, shopper loans, mortgages, financial savings accounts, and so forth.

FLIC operates over 40 branches in two Lengthy Island counties and several other NYC burrows, together with Queens, Brooklyn, and Manhattan.

Supply: Investor Presentation

FLIC reported its most up-to-date quarterly outcomes on January 26. The corporate reported revenues of $31 million for the third quarter, which was 0.2% lower than the revenues that the corporate generated throughout the earlier yr’s interval. FLIC’s revenues missed what analysts had forecasted for the quarter by 5%. The income lower may be defined by the truth that the financial institution’s web curiosity margin declined yr over yr, from 2.86% throughout the earlier yr’s quarter to 2.74%. This made FLIC’s web curiosity revenue decline barely.

FLIC’s earnings-per-share totaled $0.44 throughout the fourth quarter, which was up 16% yr over yr. This strong earnings-per-share efficiency was largely pushed margin enlargement, though buybacks additionally resulted in development tailwinds. Throughout 2021, FLIC generated earnings-per-share of $1.81, which was a brand new document end result for the corporate, and the end result was the identical for 2022.

Click on right here to obtain our most up-to-date Positive Evaluation report on FLIC (preview of web page 1 of three proven beneath):

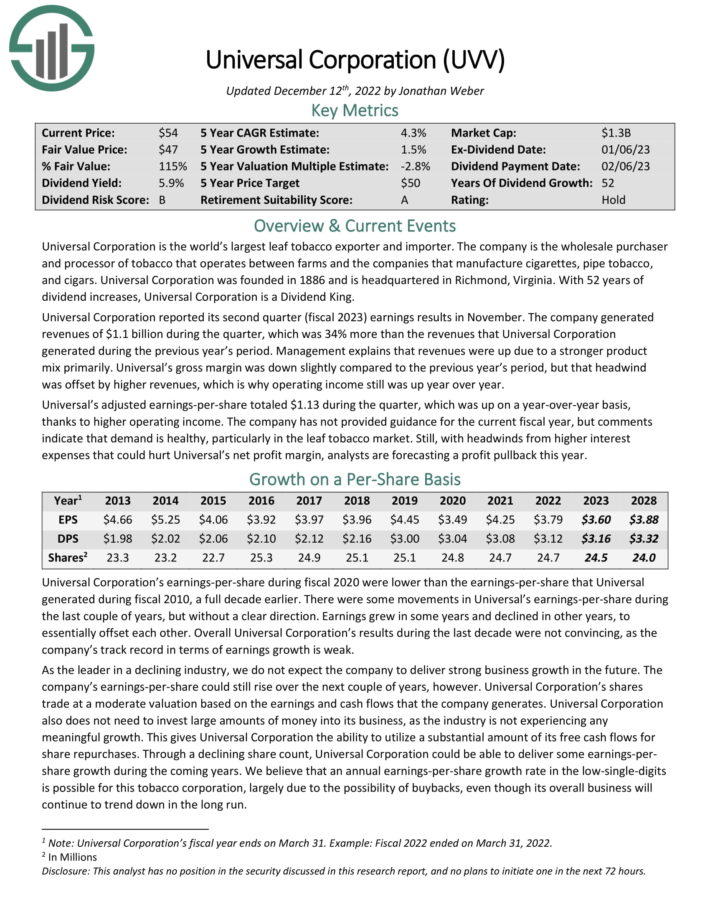

Excessive Yield Small Cap #10: Common Company (UVV)

Common Company is a tobacco inventory. It’s the world’s largest leaf tobacco exporter and importer. The corporate is the wholesale purchaser and processor of tobacco that operates as an middleman between tobacco farms and the businesses that manufacture cigarettes, pipe tobacco, and cigars. Common additionally has an components enterprise that’s separate from the core leaf phase.

Common Company reported its second quarter (fiscal 2023) earnings ends in November. The corporate generated

revenues of $1.1 billion throughout the quarter, which was 34% greater than the revenues that Common Company generated throughout the earlier yr’s interval. Administration explains that revenues have been up attributable to a stronger product combine primarily.

Common’s gross margin was down barely in comparison with the earlier yr’s interval, however that headwind was offset by larger revenues, which is why working revenue nonetheless was up yr over yr. Common’s adjusted earnings-per-share totaled $1.13 throughout the quarter, which was up on a year-over-year foundation, because of larger working revenue.

Because the chief in a declining trade, we don’t anticipate the corporate to ship sturdy development sooner or later. The corporate’s earnings-per-share might nonetheless rise over the subsequent couple of years, nonetheless. Common’s shares commerce at a reasonable valuation primarily based on the earnings and money flows that the corporate generates.

Common additionally doesn’t want to speculate giant quantities of cash into its enterprise, which provides it the power to make the most of a considerable quantity of its free money flows for share repurchases and dividends.

With a dividend payout of ~79% for the present fiscal yr, we view Common’s dividend as reasonably protected, with the caveat that the corporate faces headwinds as a result of regular decline of the tobacco trade.

Click on right here to obtain our most up-to-date Positive Evaluation report on Common (preview of web page 1 of three proven beneath):

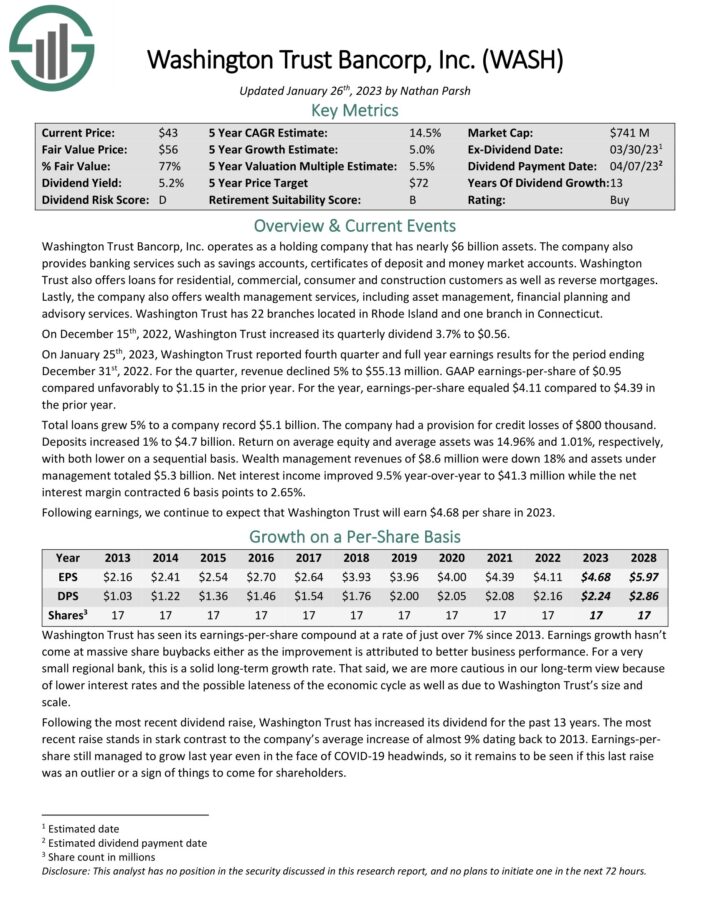

Excessive Yield Small Cap #9: Washington Belief Bancorp (WASH)

Washington Belief Bancorp, Inc. operates as a holding firm that has practically $6 billion property. The corporate additionally supplies banking providers corresponding to financial savings accounts, certificates of deposit and cash market accounts.

Washington Belief additionally gives loans for residential, business, shopper and building prospects in addition to reverse mortgages. Lastly, the corporate additionally gives wealth administration providers, together with asset administration, monetary planning and advisory providers. Washington Belief has 22 branches situated in Rhode Island and one department in Connecticut.

On December fifteenth, 2022, Washington Belief elevated its quarterly dividend 3.7% to $0.56. On January twenty fifth, 2023, Washington Belief reported fourth quarter and full yr earnings outcomes for the interval ending December thirty first, 2022. For the quarter, income declined 5% to $55.13 million. GAAP earnings-per-share of $0.95 in contrast unfavorably to $1.15 within the prior yr. For the yr, earnings-per-share equaled $4.11 in comparison with $4.39 within the prior yr.

Whole loans grew 5% to an organization document $5.1 billion. The corporate had a provision for credit score losses of $800 thousand. Deposits elevated 1% to $4.7 billion. Return on common fairness and common property was 14.96% and 1.01%, respectively, with each decrease on a sequential foundation.

Wealth administration revenues of $8.6 million have been down 18% and property below administration totaled $5.3 billion. Internet curiosity revenue improved 9.5% year-over-year to $41.3 million whereas the web curiosity margin contracted 6 foundation factors to 2.65%. Following earnings, we proceed to anticipate that Washington Belief will earn $4.68 per share in 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on WASH (preview of web page 1 of three proven beneath):

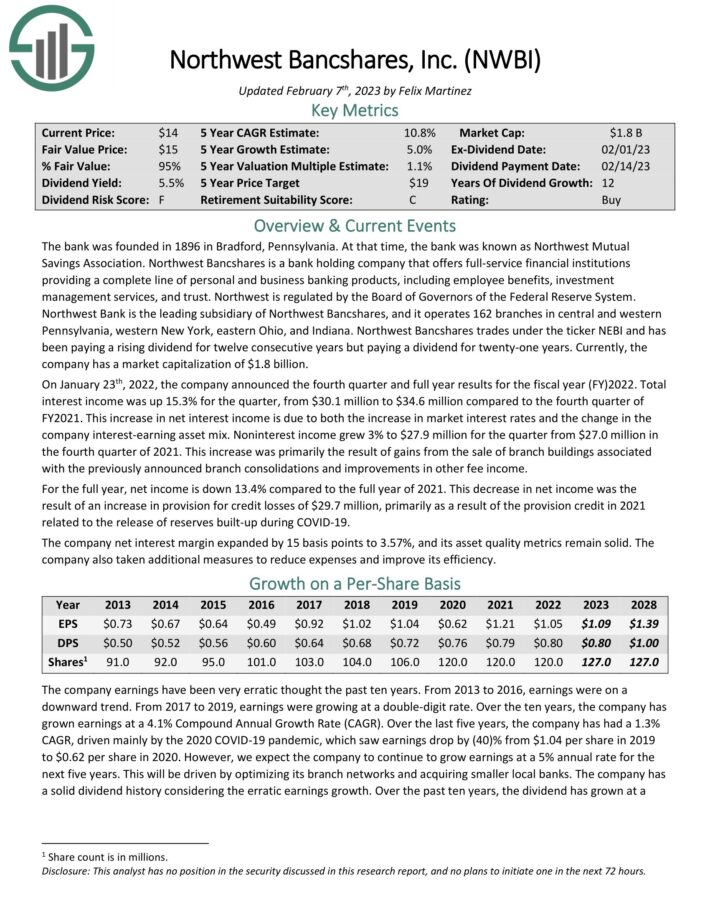

Excessive Yield Small Cap #8: Northwest Bancshares (NWBI)

Northwest Bancshares is a financial institution holding firm that gives full-service monetary establishments offering an entire line of non-public and enterprise banking merchandise, together with worker advantages, funding administration providers, and belief.

Northwest Financial institution is the main subsidiary of Northwest Bancshares, and it operates 162 branches in central and western Pennsylvania, western New York, jap Ohio, and Indiana.

On January 23th, 2022, the corporate introduced the fourth quarter and full yr outcomes for the fiscal yr (FY) 2022. Whole curiosity revenue was up 15.3% for the quarter, from $30.1 million to $34.6 million in comparison with the fourth quarter of FY2021. This improve in web curiosity revenue is because of each the rise in market rates of interest and the change within the firm interest-earning asset combine.

Noninterest revenue grew 3% to $27.9 million for the quarter from $27.0 million within the fourth quarter of 2021. This improve was primarily the results of positive factors from the sale of department buildings related to the beforehand introduced department consolidations and enhancements in different charge revenue. For the complete yr, web revenue is down 13.4% in comparison with the complete yr of 2021.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWBI (preview of web page 1 of three proven beneath):

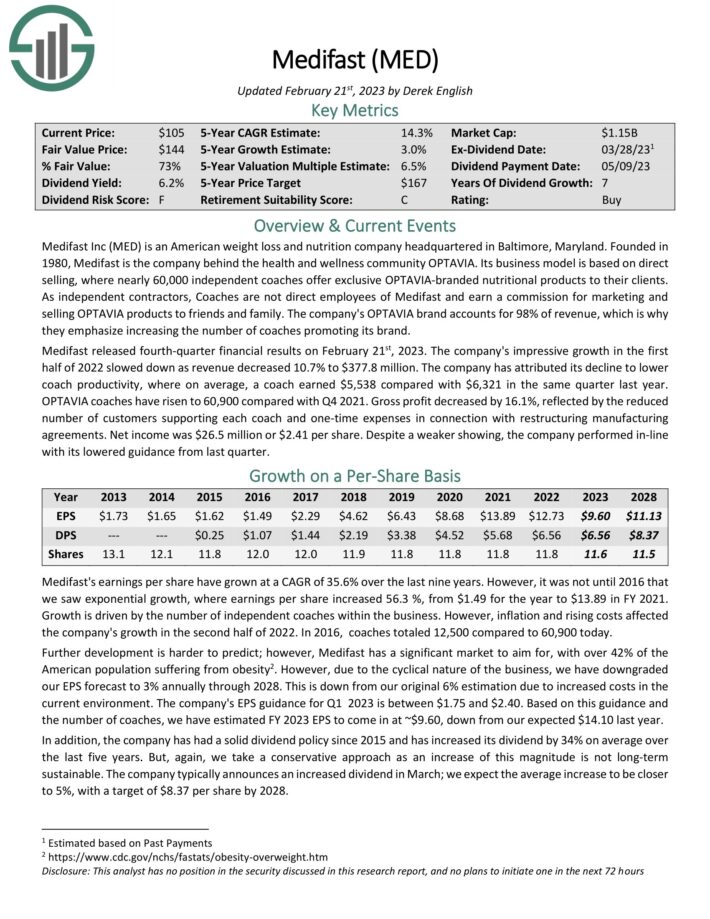

Excessive Yield Small Cap #7: Medifast Inc. (MED)

Medifast is an organization that primarily manufactures and distributes weight reduction, weight administration, and different consumable well being and vitamin merchandise within the US.

The corporate gives all kinds of bars, cereal, drinks, oatmeal, smoothies, and extra below three model banners: OPTAVIA, Optimum Well being by Take Form for Life, and Flavors of House. Medifast sells its merchandise on to shoppers by way of its digital properties and thru retail factors of distribution via its distributors.

The corporate was based in 1980 and generates about $1.6 billion in annual income.

Supply: Investor Presentation

Medifast operates in a really aggressive house, with quite a few entrants and aggressive benefits being derived largely from branding. Given that customers could wrestle to grasp the variations in numerous dietary merchandise – if there are any materials variations – Medifast employs a commissioned gross sales power to maneuver its merchandise.

The present payout ratio is below 50% of earnings, and given the corporate has no interest-bearing debt and continues to publish excessive ranges of earnings, we expect the payout is protected.

Click on right here to obtain our most up-to-date Positive Evaluation report on Medifast (preview of web page 1 of three proven beneath):

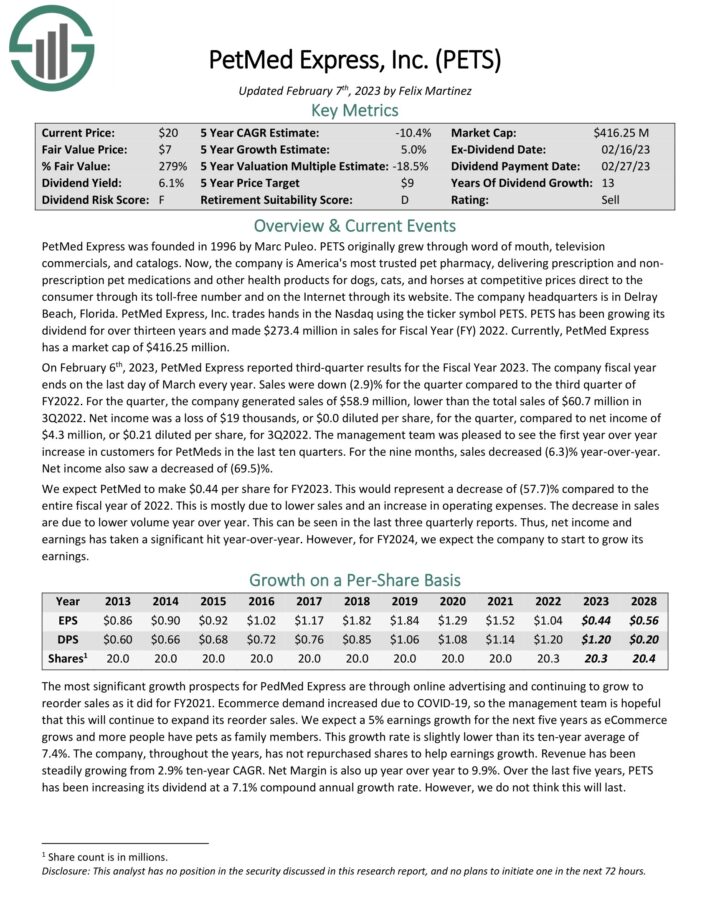

Excessive Yield Small Cap #6: PetMed Categorical (PETS)

PetMed Categorical is a pet pharmacy enterprise that’s primarily based within the US. The corporate supplies prescription and non-prescription therapies and medicines, well being merchandise, nutritional vitamins and dietary supplements, meals, and different merchandise for canines, cats, and horses. As well as, it sells onerous items corresponding to beds, crates, and different associated merchandise. The corporate was based in 1996, generates about $270 million in annual income, and trades with a market cap of $374 million.

Supply: Investor presentation

On February sixth, 2023, PetMed Categorical reported third-quarter outcomes for the Fiscal 12 months 2023. The corporate fiscal yr ends on the final day of March yearly. Gross sales have been down (2.9)% for the quarter in comparison with the third quarter of FY2022. For the quarter, the corporate generated gross sales of $58.9 million, decrease than the overall gross sales of $60.7 million in 3Q2022.

Internet revenue was a lack of $19 hundreds, or $0.0 diluted per share, for the quarter, in comparison with web revenue of $4.3 million, or $0.21 diluted per share, for 3Q2022. The administration group was happy to see the primary yr over yr improve in prospects for PetMeds within the final ten quarters.

For the 9 months, gross sales decreased (6.3)% year-over-year. Internet revenue additionally noticed a decreased of (69.5)%.

Click on right here to obtain our most up-to-date Positive Evaluation report on PetMed Categorical (preview of web page 1 of three proven beneath):

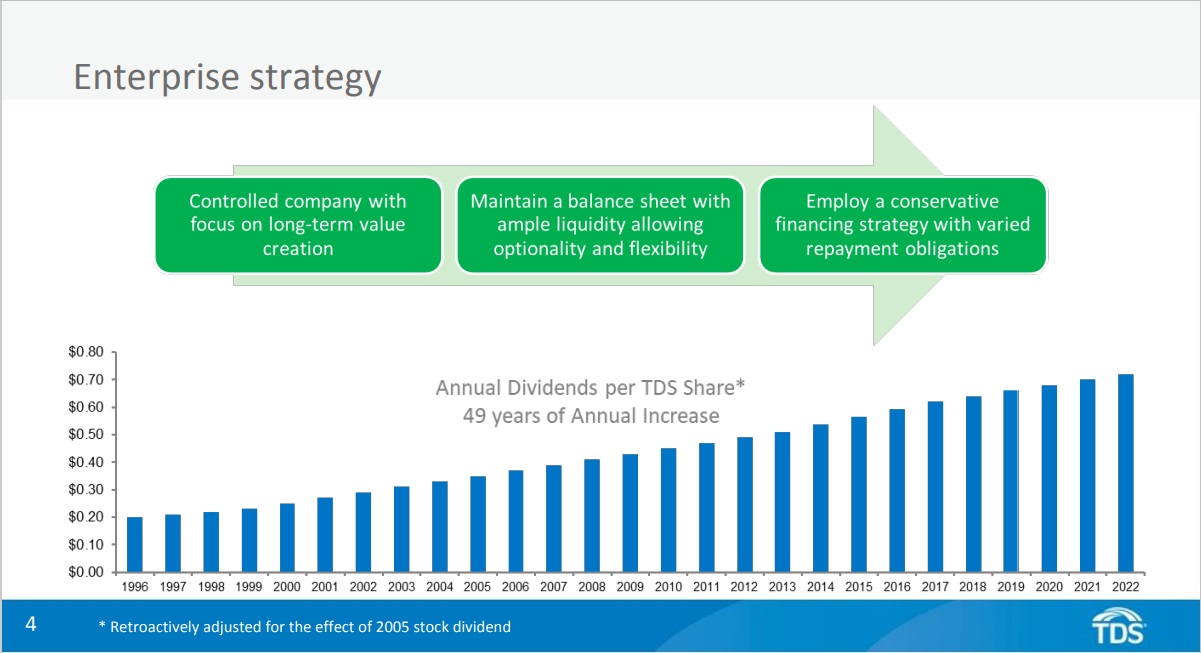

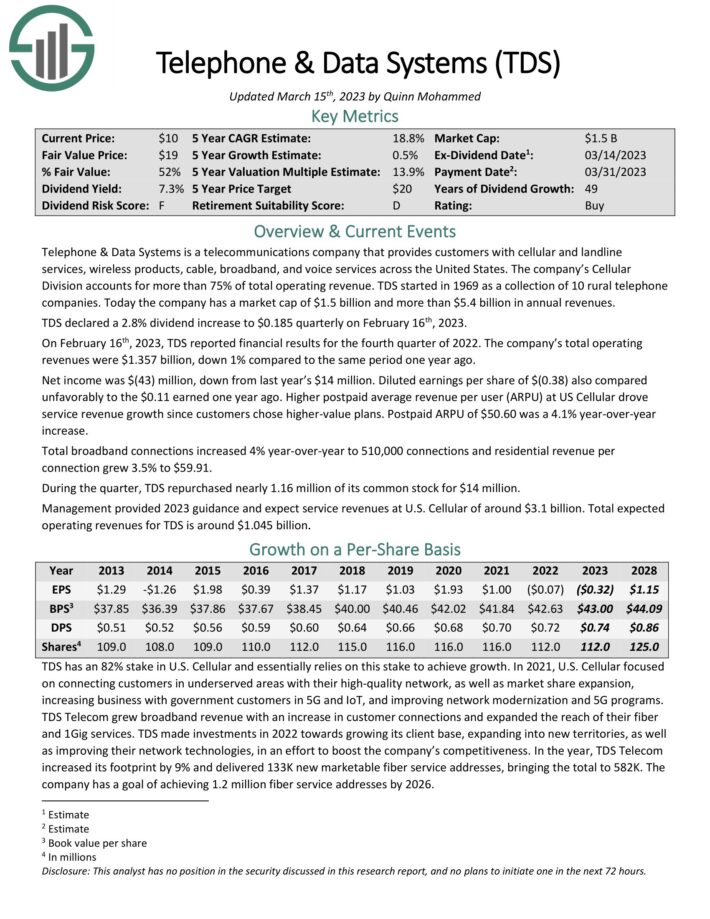

Excessive Yield Small Cap #5: Phone and Information Programs (TDS)

Phone & Information Programs is a telecommunications firm that gives prospects with mobile and landline providers, wi-fi merchandise, cable, broadband, and voice providers throughout the US. The corporate’s Mobile Division accounts for greater than 75% of whole working income. TDS began in 1969 as a set of 10 rural phone corporations.

The corporate has elevated its dividend for 49 consecutive years.

Supply: Investor Presentation

TDS declared a 2.8% dividend improve to $0.185 quarterly on February sixteenth, 2023. In the newest quarter, whole working revenues have been $1.357 billion, down 1% in comparison with the identical interval one yr in the past. Internet revenue was $(43) million, down from final yr’s $14 million.

Diluted earnings per share of $(0.38) additionally in contrast unfavorably to the $0.11 earned one yr in the past. Larger postpaid common income per person (ARPU) at US Mobile drove service income development since prospects selected higher-value plans. Postpaid ARPU of $50.60 was a 4.1% year-over-year improve.

Whole broadband connections elevated 4% year-over-year to 510,000 connections and residential income per connection grew 3.5% to $59.91. Throughout the quarter, TDS repurchased practically 1.16 million of its frequent inventory for $14 million. Administration supplied 2023 steerage and anticipate service revenues at U.S. Mobile of round $3.1 billion. Whole anticipated working revenues for TDS is round $1.045 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on TDS (preview of web page 1 of three proven beneath):

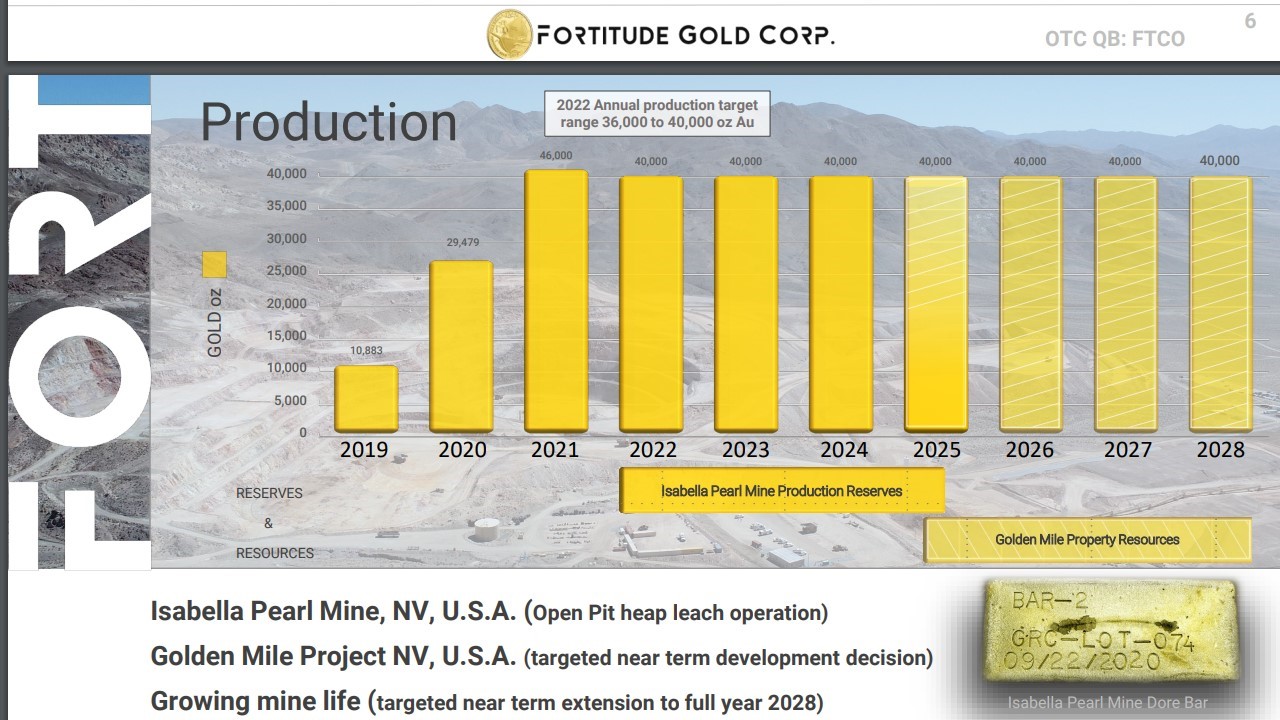

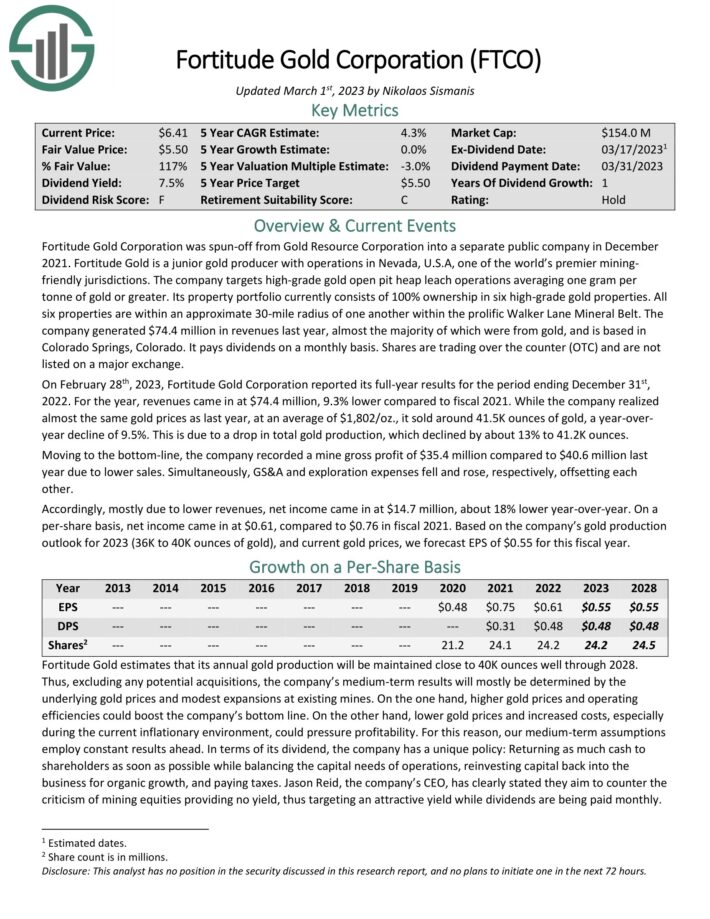

Excessive Yield Small Cap #4: Fortitude Gold Company (FTCO)

Fortitude Gold is a gold producer, which is predicated within the U.S., generates 99% of its income from gold and targets tasks with low working prices, excessive returns on capital and extensive margins.

Its Nevada Mining Unit consists of 5 high-grade gold properties situated within the Walker Lane Mineral Belt. Nevada is likely one of the friendliest jurisdictions to miners on the earth.

Fortitude Gold has grown its manufacturing at a quick tempo in every of the final two years, primarily because of the main development venture of Isabella Pearl Mine.

Supply: Investor Presentation

As proven within the above chart, the reserves of Isabella Pearl Mine will final till roughly 2025 after which they are going to most likely be replenished by the extra reserves of the Golden Mile Challenge.

The chart depicts basically flat manufacturing within the upcoming years. In consequence, the earnings of Fortitude Gold shall be basically decided by the prevailing value of gold.

Revenue traders ought to keep away from gold shares in precept as a result of excessive cyclicality that outcomes from the swings of the value of gold.

However, Fortitude Gold has some engaging options for dividend traders. It’s providing a month-to-month dividend of $0.04, which corresponds to an annualized dividend yield of seven.3%.

Click on right here to obtain our most up-to-date Positive Evaluation report on FTCO (preview of web page 1 of three proven beneath):

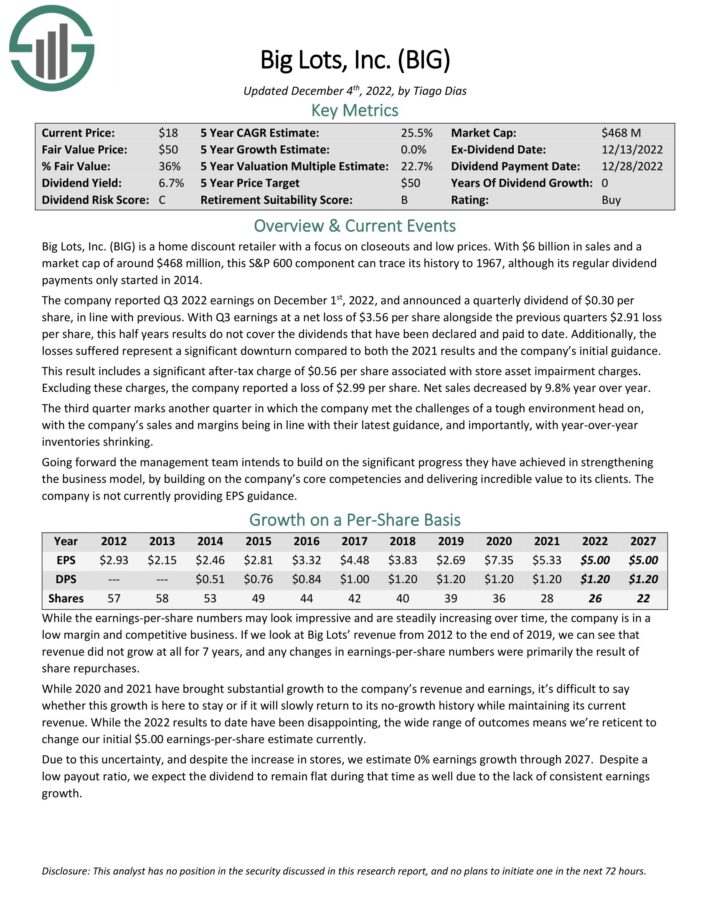

Excessive Yield Small Cap #3: Huge Tons (BIG)

Huge Tons, Inc. is a house low cost retailer with a concentrate on closeouts and low costs. With $6 billion in gross sales and a market cap of round $468 million, this S&P 600 part can hint its historical past to 1967, though its common dividend funds solely began in 2014. The corporate reported Q3 2022 earnings on December 1st, 2022, and introduced a quarterly dividend of $0.30 per share, consistent with earlier.

With Q3 earnings at a web lack of $3.56 per share alongside the earlier quarters $2.91 loss per share, this half years outcomes don’t cowl the dividends which have been declared and paid up to now.

Moreover, the losses suffered characterize a big downturn in comparison with each the 2021 outcomes and the corporate’s preliminary steerage. This end result features a important after-tax cost of $0.56 per share related to retailer asset impairment fees. Excluding these fees, the corporate reported a lack of $2.99 per share.

Internet gross sales decreased by 9.8% yr over yr. The third quarter marks one other quarter by which the corporate met the challenges of a tricky surroundings head on, with the corporate’s gross sales and margins being consistent with their newest steerage, and importantly, with year-over-year inventories shrinking.

Click on right here to obtain our most up-to-date Positive Evaluation report on BIG (preview of web page 1 of three proven beneath):

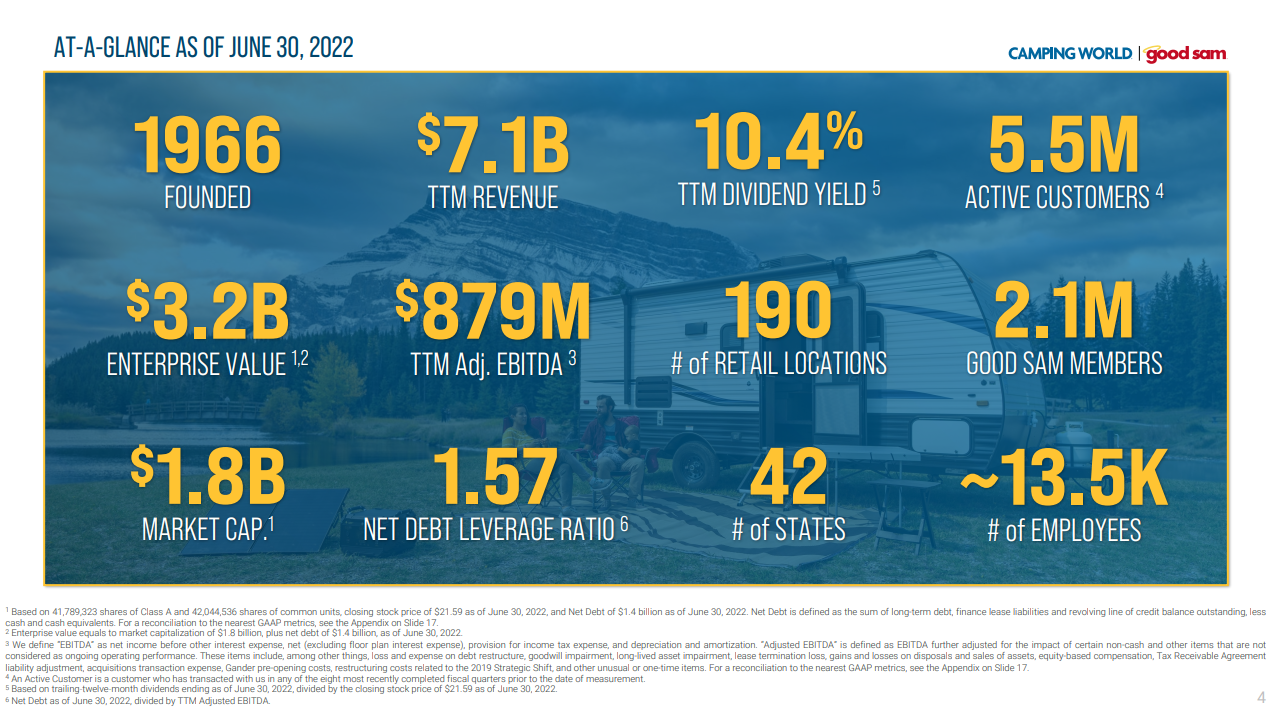

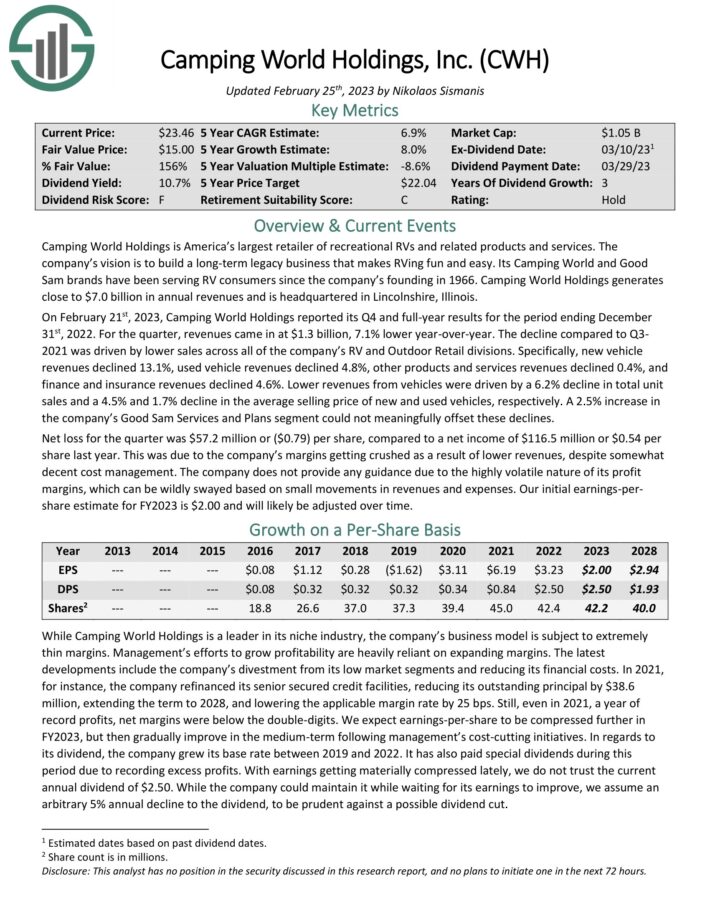

Excessive Yield Small Cap #2: Tenting World Holdings (CWH)

Tenting World is a retailer of leisure autos, associated merchandise, and numerous RV providers. It operates in two segments: Good Sam Providers and Plans, and RV and Outside Retail. By way of these segments, the corporate gives a deep and extensive portfolio of providers, safety plans, and different assets associated to RVs.

As well as it gives merchandise like car service contracts, roadside help, insurance coverage applications, magazines, and naturally, new and used RV car gross sales. Tenting World has a community of sellers and retail areas in 40 states within the U.S.

The corporate generates about $7 billion in annual income, and traces its roots to 1966.

Supply: Investor presentation

The corporate boasts over 2 million members in its Good Sam enterprise, which offer high-margin, recurring income to assist praise its extra cyclical RV enterprise.

On February twenty first, 2023, Tenting World Holdings reported its This fall and full-year outcomes. For the quarter, revenues got here in at $1.3 billion, 7.1% decrease year-over-year. The decline in comparison with Q3-2021 was pushed by decrease gross sales throughout all the firm’s RV and Outside Retail divisions.

Particularly, new car revenues declined 13.1%, used car revenues declined 4.8%, different services revenues declined 0.4%, and finance and insurance coverage revenues declined 4.6%. Decrease revenues from autos have been pushed by a 6.2% decline in whole unit gross sales and a 4.5% and 1.7% decline within the common promoting value of latest and used autos, respectively.

A 2.5% improve within the firm’s Good Sam Providers and Plans phase couldn’t meaningfully offset these declines. Internet loss for the quarter was $57.2 million or ($0.79) per share, in comparison with a web revenue of $116.5 million or $0.54 per share final yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on CWH (preview of web page 1 of three proven beneath):

Excessive Yield Small Cap #1: By way of Renewables (VIA)

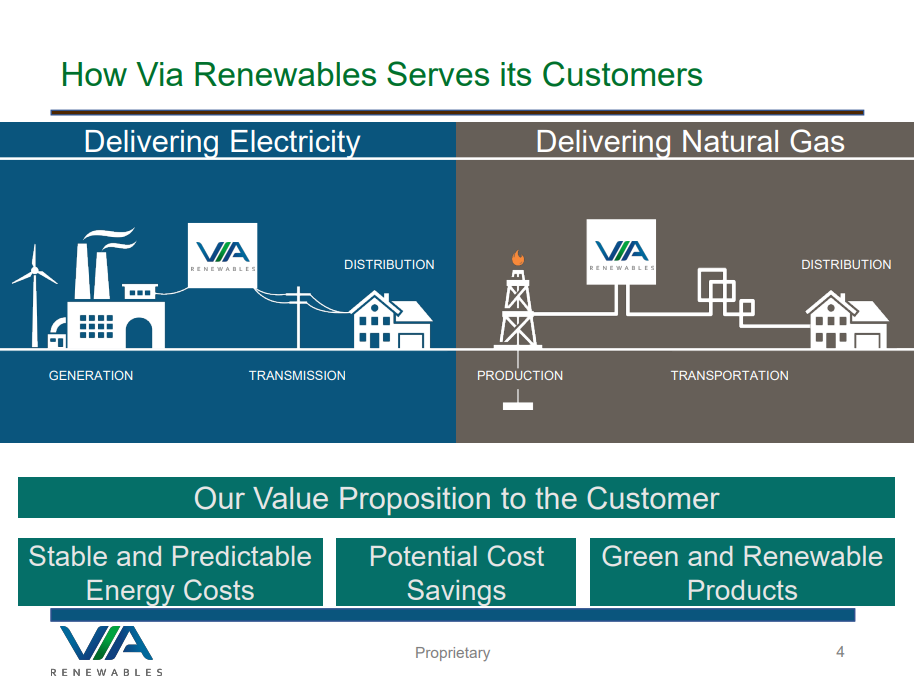

By way of Renewables is a small, Houston-based retail power providers firm with a long-standing historical past courting again to 1999. Working throughout 19 states and the District of Columbia, it serves each residential and business prospects via its distinctive asset-light mannequin. This strategy allows the corporate to supply aggressive costs as they supply energy and pure fuel to fulfill the calls for of their prospects.

Nonetheless, VIA Renewables isn’t your typical retail power firm because it doesn’t produce power by itself. As a substitute, it manages threat and trades power, which can lead to its outcomes being extraordinarily unstable.

Supply: Investor Presentation

In early November, By way of Renewables reported (11/2/22) monetary outcomes for the third quarter of fiscal 2022. It switched from earnings of $34.7 million within the prior yr’s quarter to a web lack of -$4.9 million, largely attributable to hefty losses in its value hedges. Adjusted EBITDA decreased -31%, largely attributable to larger spending on buyer acquisition and a tax profit in final yr’s interval. On the intense aspect, the corporate expects to learn within the present surroundings of excessive utility charges, which render By way of Renewables extra aggressive than its bigger friends.

Click on right here to obtain our most up-to-date Positive Evaluation report on VIA (preview of web page 1 of three proven beneath):

Ultimate Ideas

Excessive yield dividend shares have apparent attraction to revenue traders. The S&P 500 Index yields simply ~1.7% proper now on common, making excessive yield shares much more engaging by comparability.

As well as, small-cap shares might have stronger development potential than bigger rivals of their respective sectors.

After all, traders ought to at all times do their analysis earlier than shopping for particular person shares.

That stated, the 20 shares on this listing have yields at the least double the S&P 500 Index common, going all the way in which as much as 13%. In consequence, revenue traders could discover these 20 dividend shares engaging.

Additional Studying

In case you are interested by discovering high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases shall be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link