[ad_1]

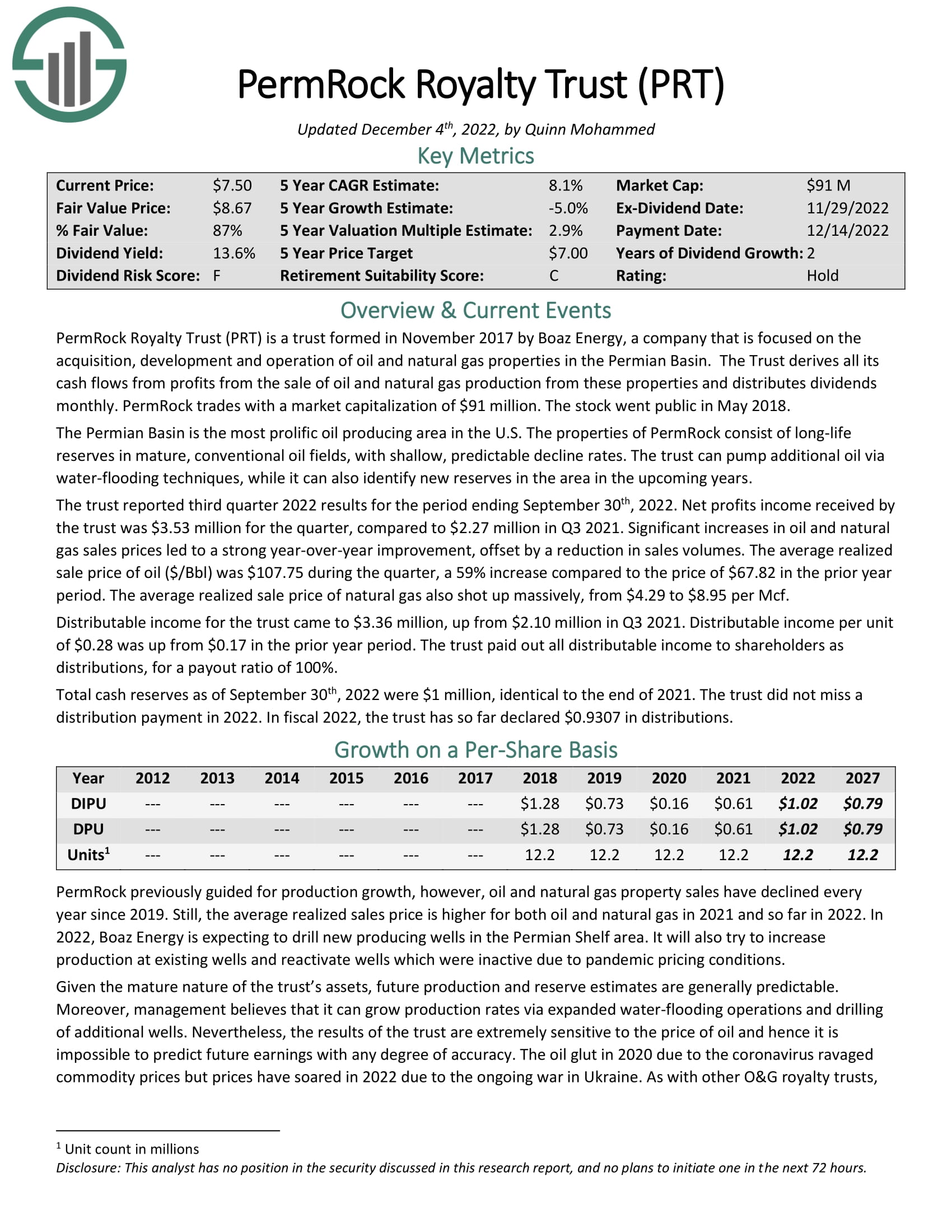

PermRock Royalty Belief is a belief shaped in November 2017 by Boaz Vitality, an organization whose experience is in buying, growing, and working oil and pure fuel properties within the Permian Basin.

The belief owns properties within the Permian Basin. It receives 80% of the online earnings from the sale of oil and pure fuel produced in its properties and distributes all these web earnings in month-to-month dividends.

In keeping with the EIA, Permian Basin is probably the most prolific oil-producing space within the U.S. This space extends over 75,000 sq. miles in West Texas and Southeastern New Mexico. Since its discovery in 1921, it has produced greater than 30 billion barrels of oil and greater than 75 Tcf of pure fuel.

Supply: Investor Relations

Royalty trusts like PermRock are basically a guess on commodity costs. Regardless of the belief earns primarily based on the royalties acquired, which is in flip decided by the underlying oil and pure fuel costs, is to be distributed out to shareholders. In 2022, the belief paid a complete of $0.86 per share in dividends leading to a double-digit yield for the yr. This was because of the value of oil rallying to a 13-year excessive this yr, primarily because of the invasion of Russia in Ukraine and the resultant sanctions of western international locations on Russia.

Nonetheless, we be aware that it’s prudent to not depend on PermRock to maintain or develop its distribution shifting ahead. Buyers ought to count on extremely variable payouts that may be swayed both means primarily based on the underlying costs of oil and fuel. In fiscal 2020, as an illustration, commodity costs in power plunged on account of the COVID-19 pandemic. Accordingly, PermRock noticed its distributable earnings per unit, and thus distribution-per-share, decline to $0.16, in comparison with $0.73 in fiscal 2019.

Given the extremely unstable earnings and distributions of PermRock, it’s vital for buyers to think about the inventory’s P/E ratio and dividend yield inside a broader context. In any case, this isn’t a inventory for conservative, income-oriented buyers that search predictable payouts.

Click on right here to obtain our most up-to-date Positive Evaluation report on PRT (preview of web page 1 of three proven beneath):

Low-cost Month-to-month Dividend Inventory #7: Banco Bradesco S.A. (BBD)

- Ahead P/E: 6.5

- Dividend Yield: 1.6%

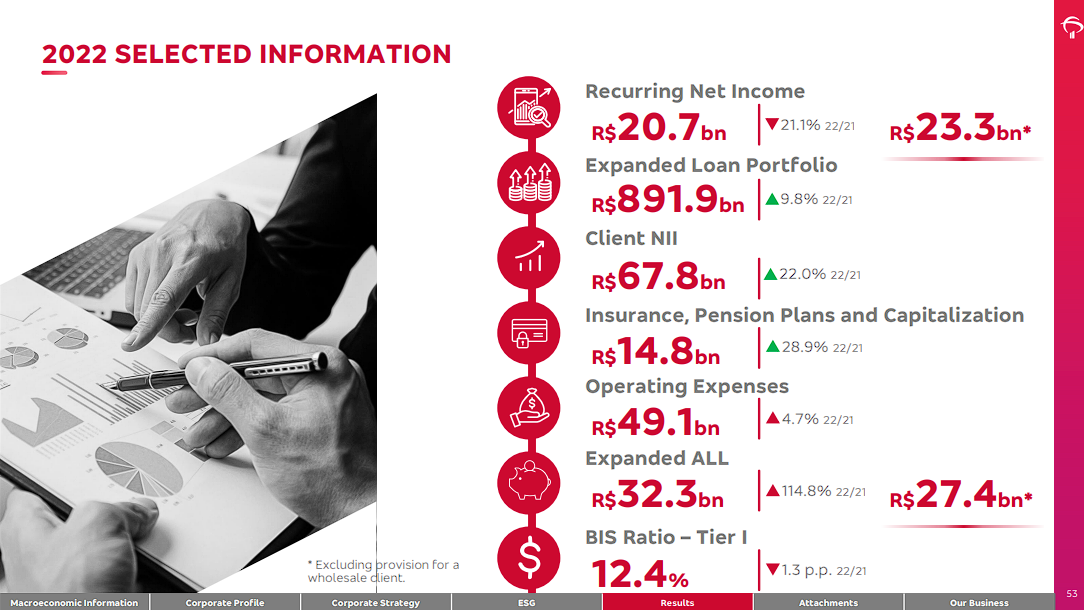

Banco Bradesco is a monetary companies firm primarily based in Brazil. It provides numerous banking merchandise and monetary companies to people, firms, and companies in Brazil and internationally. The corporate’s two fundamental segments are banking and insurance coverage, together with checking and financial savings accounts, demand deposits, and time deposits, in addition to accident and property insurance coverage merchandise and funding merchandise.

The 2020 COVID-19 pandemic yr was very troublesome for Banco Bradesco, as the worldwide financial system was negatively impacted by the coronavirus pandemic. Happily, the corporate has recovered notably throughout the previous two years.

In FY2022, the corporate reported it expanded its mortgage portfolio to R$891.9 billion ($171 billion), a 9.8% development year-over-year, or 1.5% quarter-over-quarter. Moreover, its consumer base in its AGORA digital funding brokerage app grew by 19.2% to 886.2K, with $13.2 billion of invested funds.

Supply: Investor Presentation

Whereas we might usually value in optimistic development within the firm’s EPS outcomes primarily based on its steady product growth, such development could possibly be wiped as soon as once more by FX modifications. This has been a constant theme for the corporate. Its EPS has been bettering regularly in fixed foreign money, however it’s proven as flat or diminished through the years when transformed into USD because of the BRL’s depreciation towards the USD.

The corporate often pays round $0.0036 per share every month, accompanied by one or two particular dividends per yr, which outline the ultimate quantity. It’s value noting that the corporate had consecutively grown its dividend yearly from 2012 to 2019, however once more, FX modifications have distorted that quantity. The annual dividend needs to be larger than Banco Bradesco’s $0.04 annualized month-to-month dividend, because it solely contains the bottom payouts. The corporate has a historical past of paying particular dividends as effectively. Nonetheless, it’s nearly unattainable to forecast their worth, particularly given the FX elements concerned.

- Ahead P/E: 6.4

- Dividend Yield: 15.7%

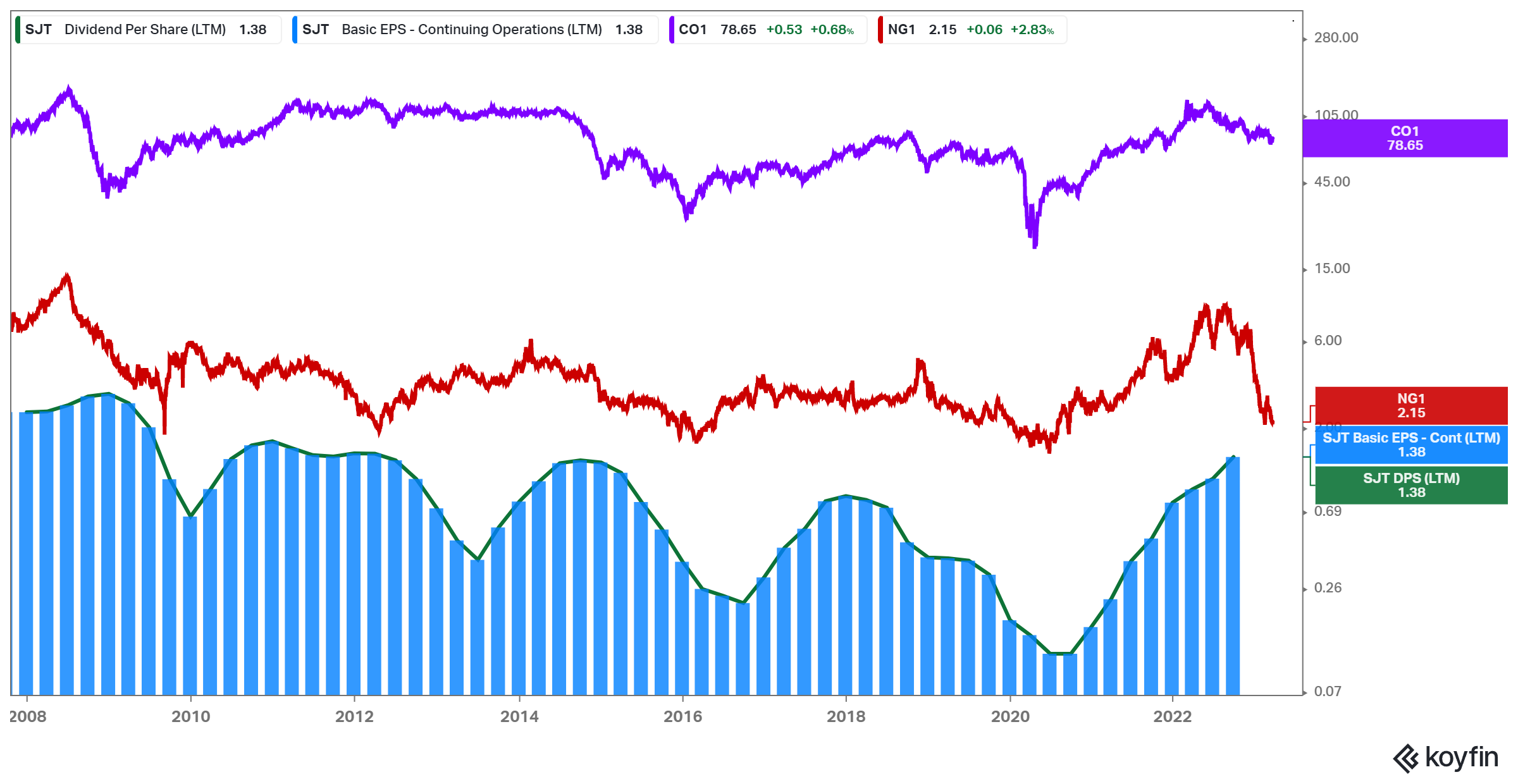

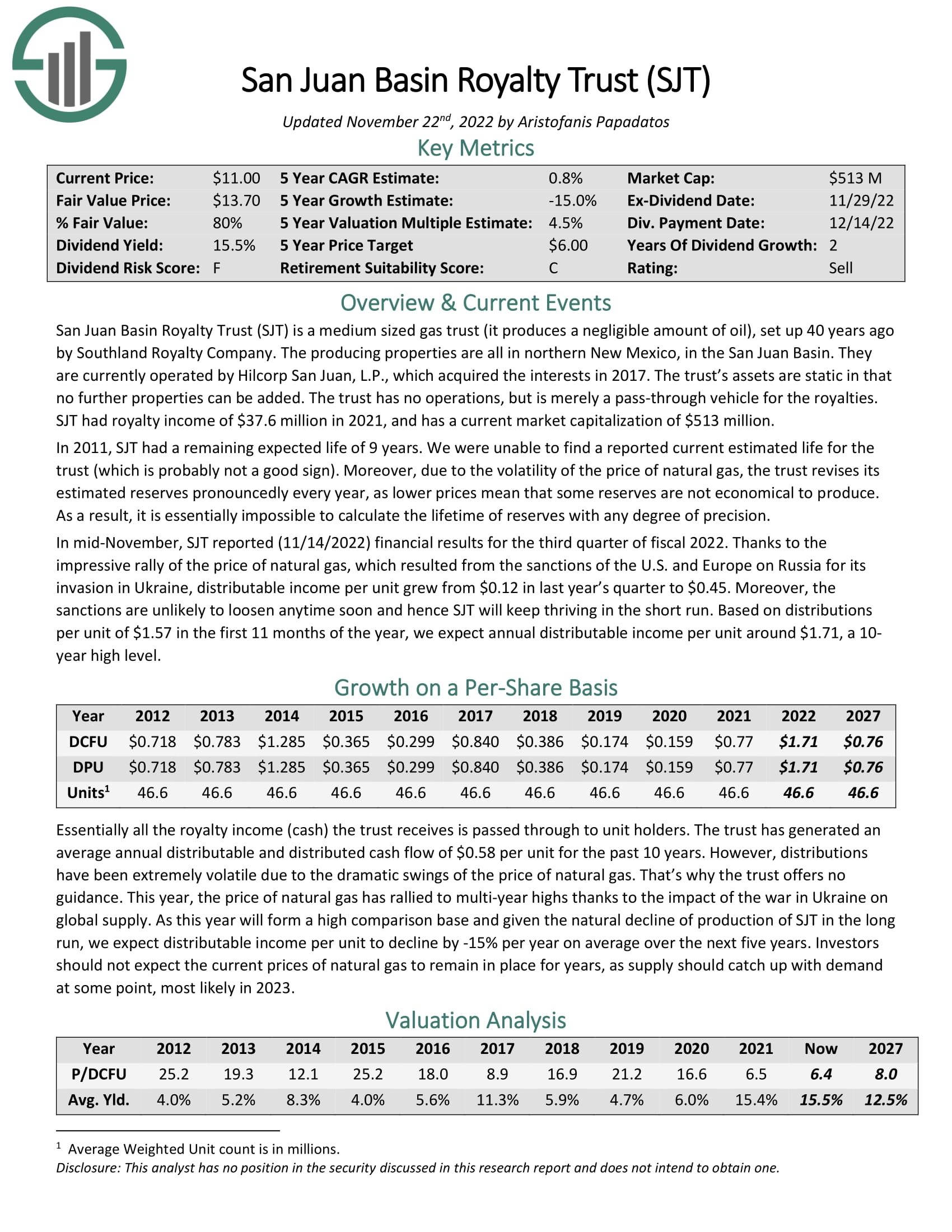

San Juan Basin is a royalty belief established in November 1980. The belief is entitled to a 75% royalty curiosity in numerous oil and fuel properties throughout over 150,000 gross acres within the San Juan Basin of northwestern New Mexico.

On July thirty first, 2017, Hilcorp San Juan LP accomplished its buy of San Juan Basin belongings from Burlington Sources Oil & Gasoline Firm LP, a subsidiary of ConocoPhillips (COP).

Greater than 90% of the belief’s manufacturing is comprised of fuel, with the rest consisting of oil. The belief doesn’t have a specified termination date. It would terminate if royalty earnings falls beneath $1,000,000 yearly over a consecutive two-year interval.

As we talked about with regard to PermRock Royalty Belief, San Juan Basin’s earnings and distributions are fully decided by the underlying costs of oil and fuel. San Juan Basin confronted a collection of challenges between 2018 and 2020, primarily pushed by the decline in oil and fuel costs. Because the coronavirus pandemic hit in 2020, costs have been additional pushed down, exacerbating an already troublesome scenario. Nonetheless, earnings and distributions have rebounded significantly since, consistent with the underlying rally in commodity costs. The chart beneath illustrates the corporate’s earnings (blue) and distributions (inexperienced) relation to grease costs (purple) and pure fuel costs (pink).

Supply: Koyfin

Much like PermRock, buyers ought to train warning when counting on San Juan Basin to maintain or enhance its distribution sooner or later. Because of the unstable nature of the oil and fuel market, payouts are topic to vital fluctuations in both route. The inventory’s P/E ratio and dividend yield ought to equally be assessed inside a broader context because of this. Conservative, income-oriented buyers searching for predictable payouts could need to take into account various choices.

Click on right here to obtain our most up-to-date Positive Evaluation report on SJT (preview of web page 1 of three proven beneath):

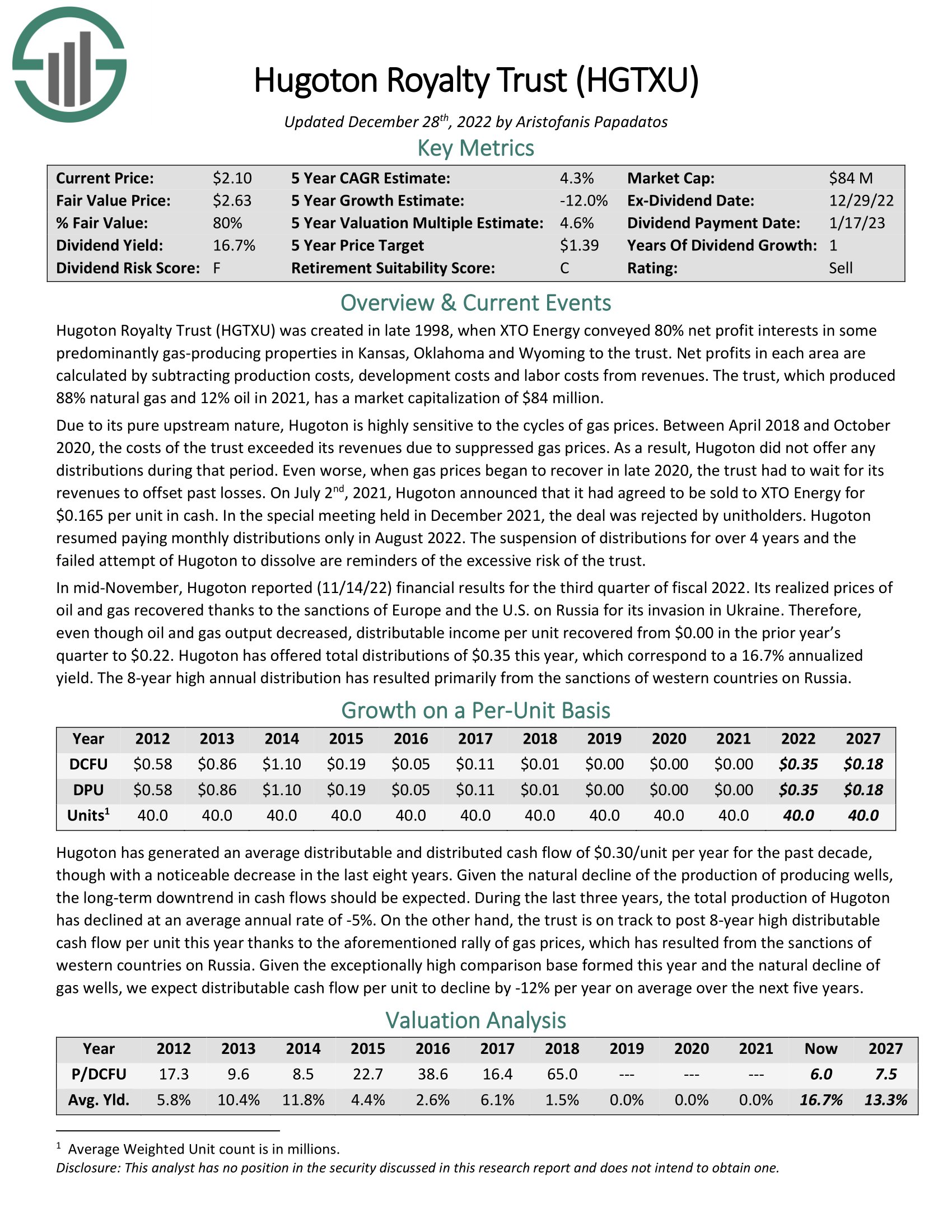

Low-cost Month-to-month Dividend Inventory #5: Hugoton Royalty Belief (HGTXU)

- Ahead P/E: 6.3

- Dividend Yield: 15.9%

Hugoton Royalty Belief was shaped on December 1, 1998, when XTO Vitality conveyed 80% web earnings pursuits in particular predominantly gas-producing properties in Kansas, Oklahoma, and Wyoming to the belief. Web earnings are calculated by subtracting revenues from manufacturing, improvement, and labor prices.

Hugoton has a key distinction from different well-known oil and fuel trusts, akin to PermRock Royalty Belief (PRM) and San Juan Basin Royalty Belief (SJT), as its pursuits are primarily tied to the manufacturing of pure fuel. In 2021, fuel comprised 88% of the manufacturing of Hugoton, whereas oil comprised the remaining 12%. Within the first 9 months of 2022, fuel comprised 86% of the manufacturing of Hugoton, whereas oil comprised the remaining 14%. Consequently, Hugoton is extraordinarily delicate to the gyrations of the worth of pure fuel.

In truth, with pure fuel costs remaining at depressed ranges between 2018 and 2021, the corporate paid no distributions, as its distributable money flows have been $0. That mentioned, the belief is on monitor to publish an 8-year excessive distributable money circulation per unit this yr because of the pure fuel costs hovering in 2022, which resulted from the sanctions of western international locations on Russia. Therefore, its distributions have already resumed. The chart beneath illustrates the corporate’s earnings (blue) and distributions (inexperienced) relation to pure fuel costs (purple).

Supply: Koyfin

Like PermRock and San Juan Basin, Hugoton Royalty Belief’s distributions can’t be relied upon by buyers. The volatility of pure fuel costs implies that payouts can fluctuate wildly and even be suspended fully. In gentle of this, it’s vital to guage the inventory’s P/E ratio and dividend yield in a wider context. Conservative buyers who prioritize predictable payouts could need to discover different funding alternatives.

Click on right here to obtain our most up-to-date Positive Evaluation report on HGTXU (preview of web page 1 of three proven beneath):

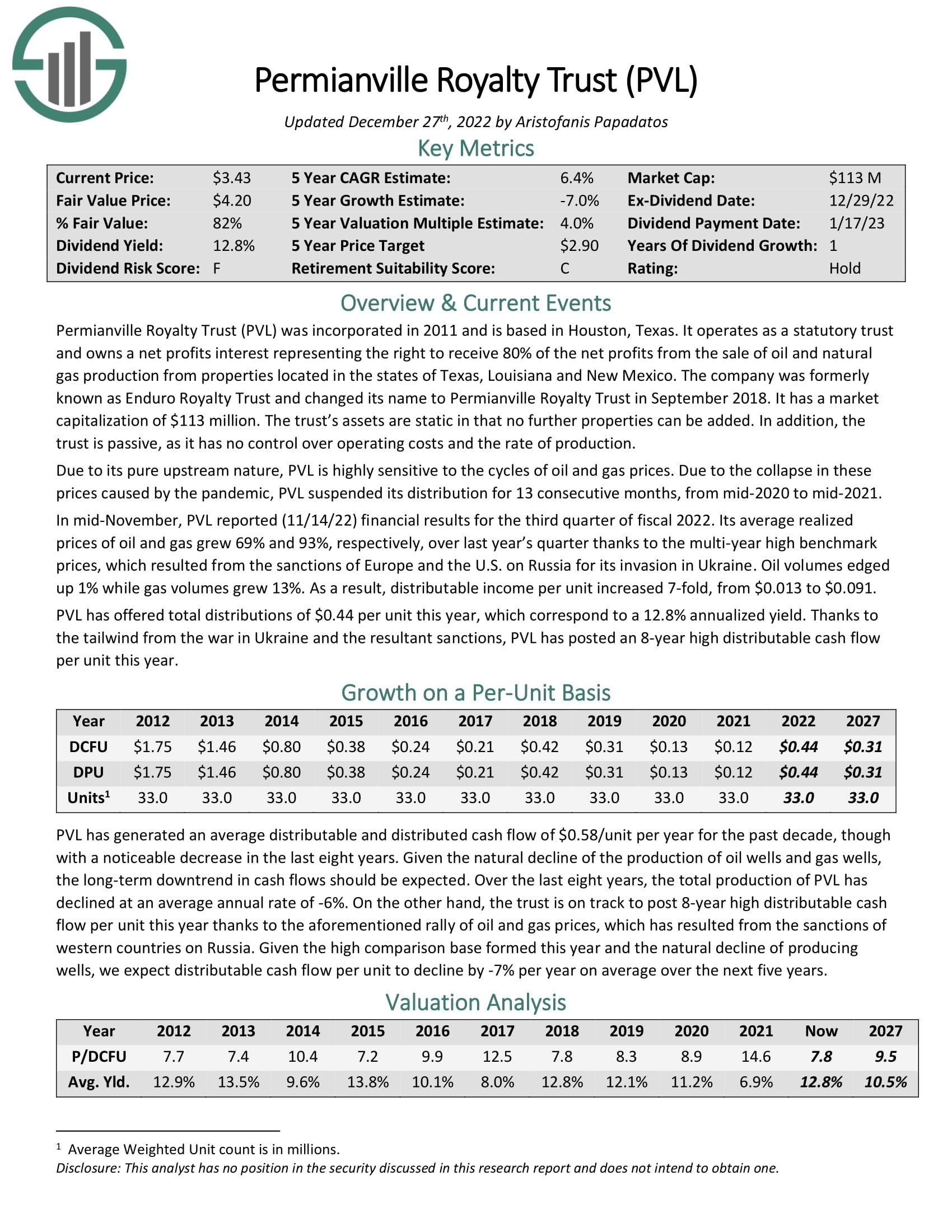

Low-cost Month-to-month Dividend Inventory #4: Permianville Royalty Belief (PVL)

- Ahead P/E: 5.2

- Dividend Yield: 19.2%

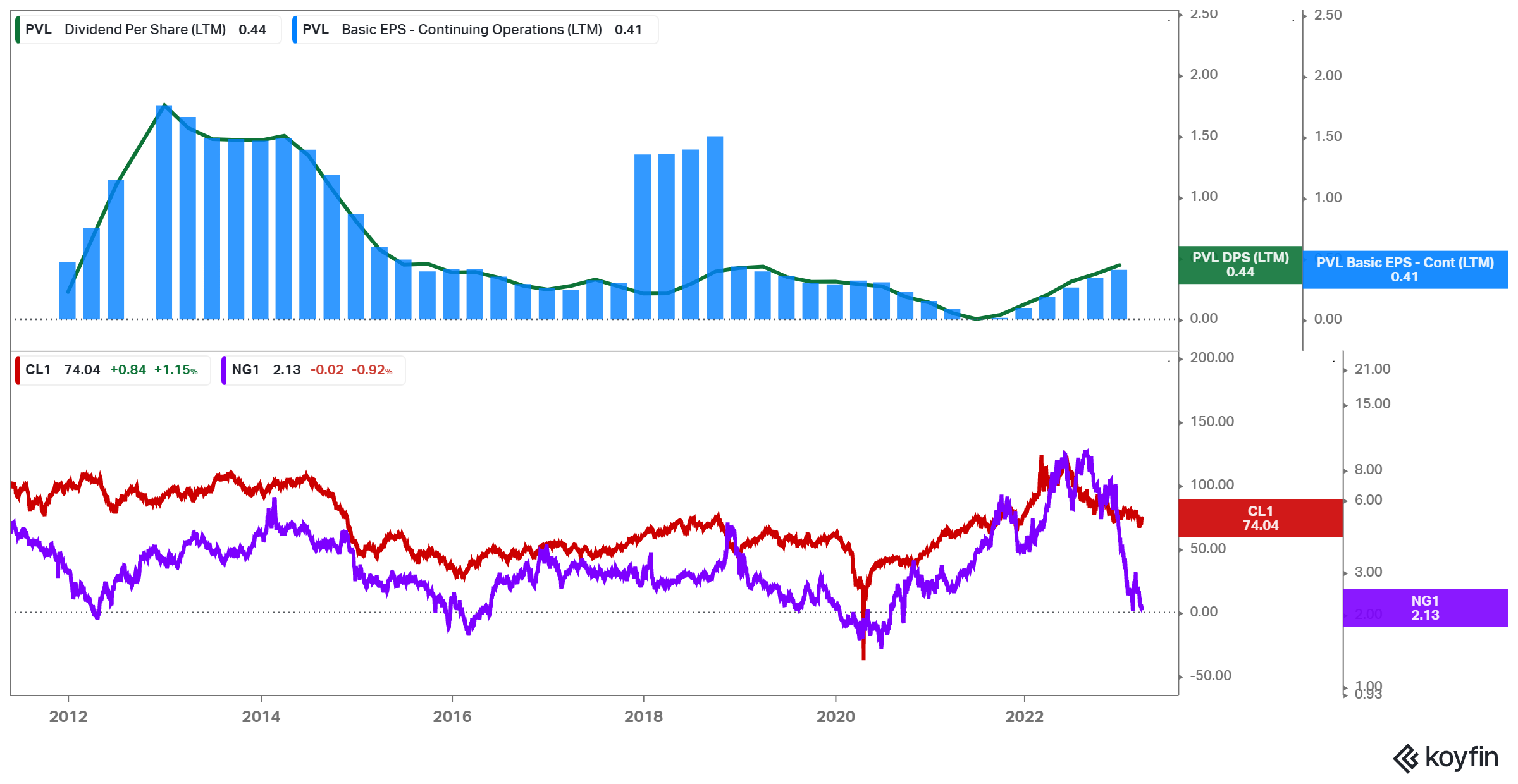

Permianville Royalty Belief is a statutory belief that was shaped in 2011 to personal a web earnings curiosity representing the fitting to obtain 80% of the online earnings from the sale of oil and pure fuel manufacturing from properties in Texas, Louisiana, and New Mexico in addition to the Permian and Haynesville basins.

The belief has the fitting to obtain 80% of the online earnings from the sale of oil and pure fuel manufacturing from its properties. Every month, in spite of everything obligations and bills are paid, unitholders obtain the remaining proceeds. The belief just isn’t topic to any preset termination provisions.

Nonetheless, the belief may dissolve if a minimum of 75% of excellent models vote in favor of dissolution or the annual money proceeds acquired by the belief are lower than $2 million for every of any two consecutive years. The corporate’s enterprise mannequin and its efficiency’s correlation with the underlying costs of oil and fuel observe the identical rationale we’ve seen within the aforementioned royalty trusts. The chart beneath illustrates the corporate’s earnings (blue) and distributions (inexperienced) relation to grease (pink) and pure fuel costs (purple).

Supply: Koyfin

Identical to the royalty charts we’ve already offered, buyers can not depend upon Permianville’s distributions because of the unpredictability of commodity costs. Consequently, it’s essential to evaluate the inventory’s P/E ratio and dividend yield inside a broader framework. Those that worth constant payouts and train warning could want to discover various funding choices.

Click on right here to obtain our most up-to-date Positive Evaluation report on PVL (preview of web page 1 of three proven beneath):

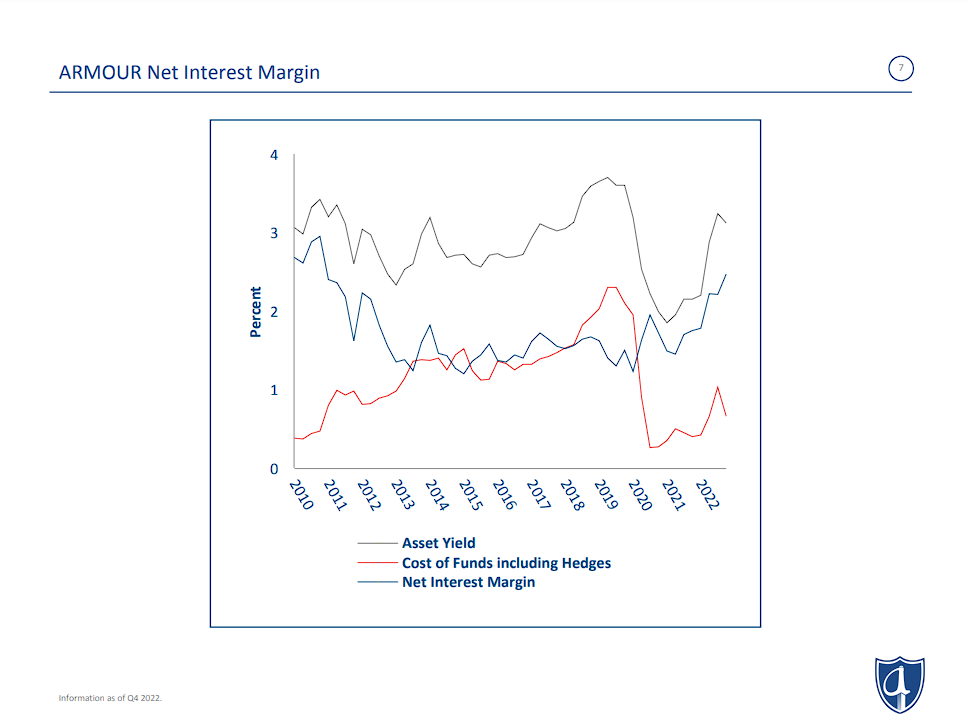

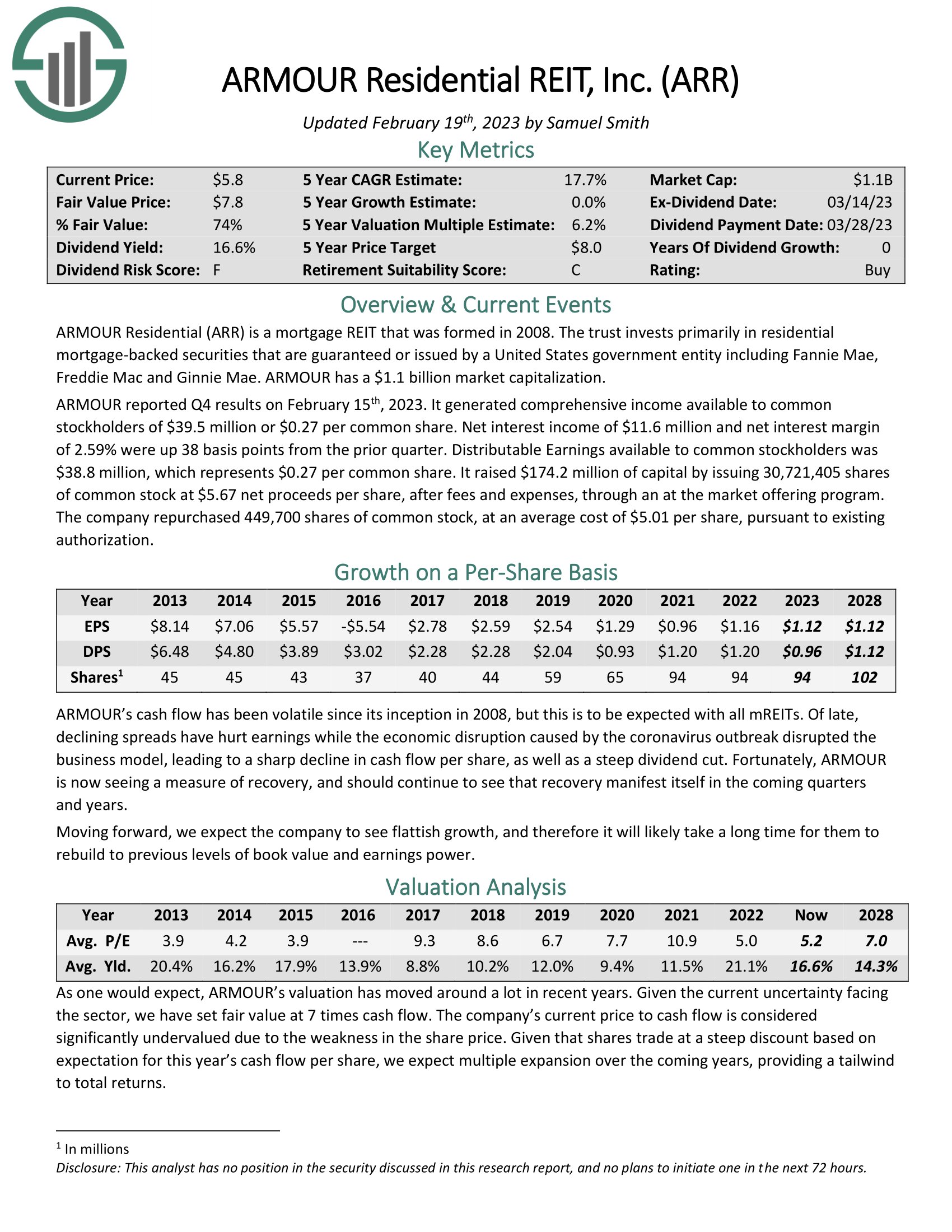

Low-cost Month-to-month Dividend Inventory #3: ARMOUR Residential REIT, Inc. (ARR)

- Ahead P/E: 4.6

- Dividend Yield: 18.7%

As an mREIT, ARMOUR Residential invests in residential mortgage-backed securities that embrace U.S. Authorities-sponsored entities (GSE) akin to Fannie Mae and Freddie Mac. It additionally contains Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate house loans.

Different kinds of investments embrace unsecured notes and bonds issued by the GSE and the US treasuries, cash market devices, in addition to non-GSE or authorities agency-backed securities.

The belief makes cash by elevating capital by way of issuing debt in addition to most popular and customary fairness after which reinvesting the proceeds into higher-yielding debt devices. The unfold (i.e., the distinction between the price of capital and the return on capital) is then largely returned to widespread shareholders by way of dividend funds, although the belief usually retains a little bit little bit of the earnings to reinvest within the enterprise.

ARMOUR’s money circulation has been unstable since its inception in 2008, however that is to be anticipated with all mREITs. Of late, declining spreads have harm earnings whereas the financial disruption attributable to the coronavirus outbreak disrupted the enterprise mannequin, resulting in a pointy decline in money circulation per share, in addition to a steep dividend lower in 2020.

Supply: Investor Presentation

Happily, ARMOUR is now seeing a measure of restoration and may proceed to see that restoration present itself within the coming quarters and years. Transferring ahead, we count on the corporate to develop slowly, although it is going to seemingly take a very long time for them to rebuild to earlier ranges of guide worth and earnings energy.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARR (preview of web page 1 of three proven beneath):

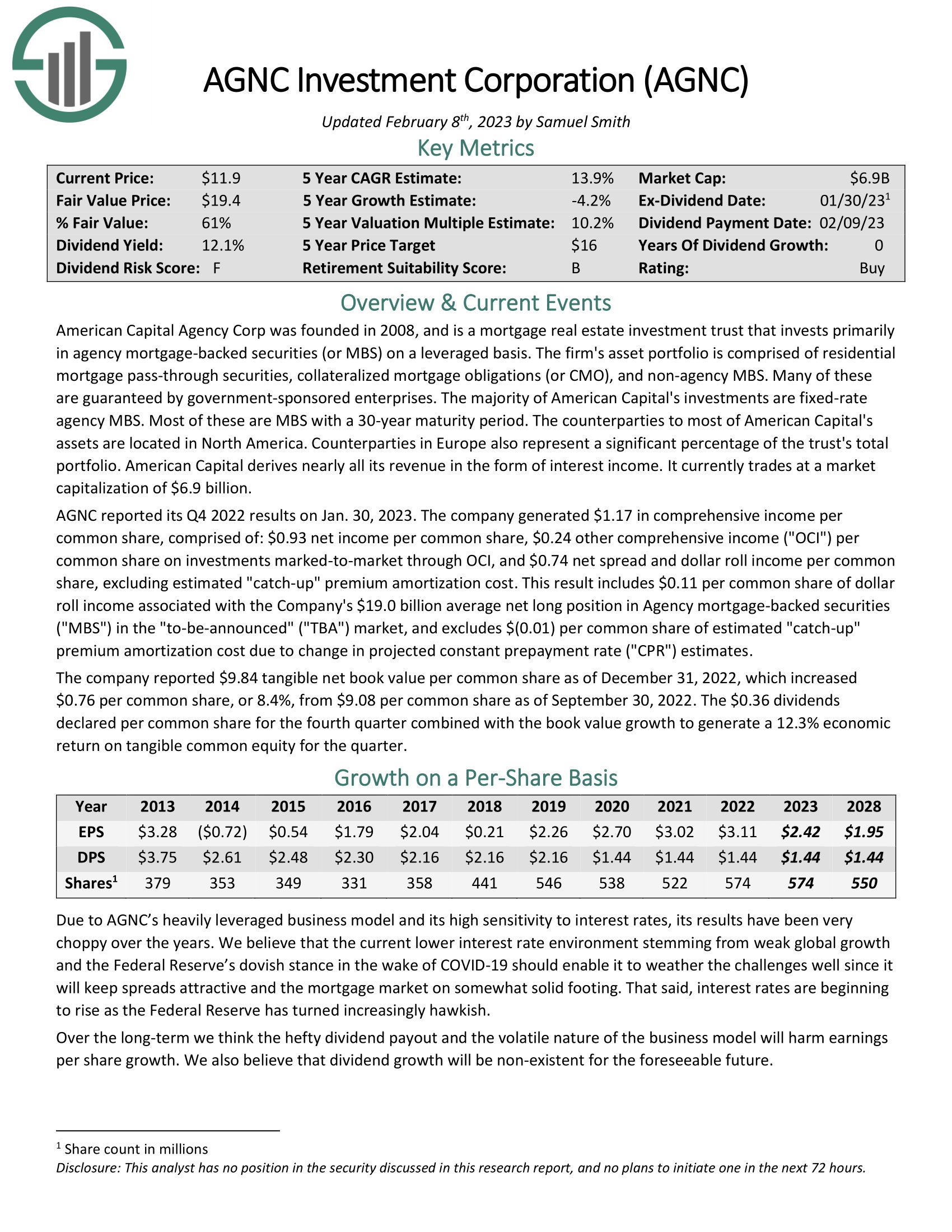

Low-cost Month-to-month Dividend Inventory #2: AGNC Funding Corp. (AGNC)

- Ahead P/E: 4.1

- Dividend Yield: 14.6%

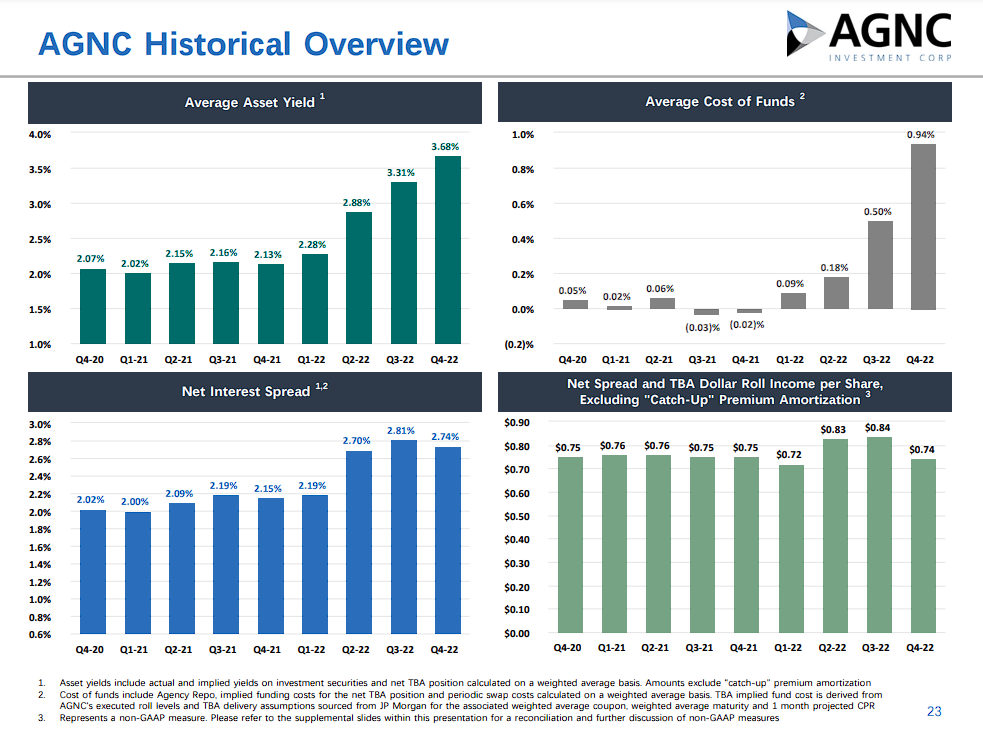

AGNC was based in 2008 and is an internally-managed REIT. Whereas most REITs personal bodily properties which are leased to tenants, AGNC has a distinct enterprise mannequin. It operates in a distinct segment of the REIT market: mortgage securities.

AGNC invests in company mortgage-backed securities. It generates earnings by amassing curiosity on its invested belongings minus borrowing prices. It additionally information good points or losses from its investments and hedging practices. Company securities are those who have principal and curiosity funds assured by both a government-sponsored entity or the federal government itself. They theoretically carry much less threat than personal mortgages.

The key disadvantage to mortgage REITs is that the enterprise mannequin is negatively impacted by rising rates of interest. AGNC makes cash by borrowing at short-term charges, lending at long-term charges, and pocketing the distinction. To amplify returns, mortgage REITs are additionally extremely leveraged. Regardless of this, AGNC has managed to increase its web curiosity spreads, as its common yield on belongings has expanded at a quicker tempo in comparison with its common value of funds.

Supply: Investor Presentation

Following a dividend lower in 2020, AGNC has declared month-to-month dividends of $0.12 per share since April 2020. This interprets to an annualized payout of $1.44 per share, bringing AGNC’s dividend yield to an infinite 14.6% on the inventory’s present value.

Such a excessive yield generally is a signal of elevated threat. Certainly, AGNC’s dividend does carry vital threat. AGNC has diminished its dividend a number of instances over the previous decade, together with as not too long ago as two years in the past. Whereas we don’t see a dividend lower as an imminent threat at this level, provided that the payout ratio has considerably improved, we don’t exclude the potential of one if AGNC’s funding outcomes have been to take a sudden hit.

Click on right here to obtain our most up-to-date Positive Evaluation report on AGNC (preview of web page 1 of three proven beneath):

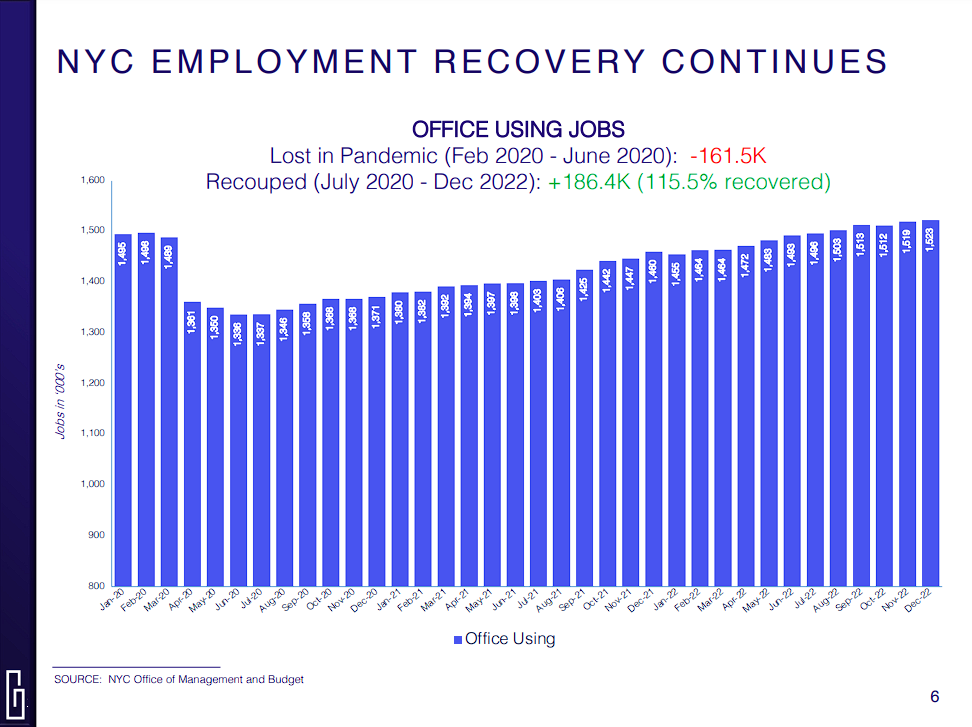

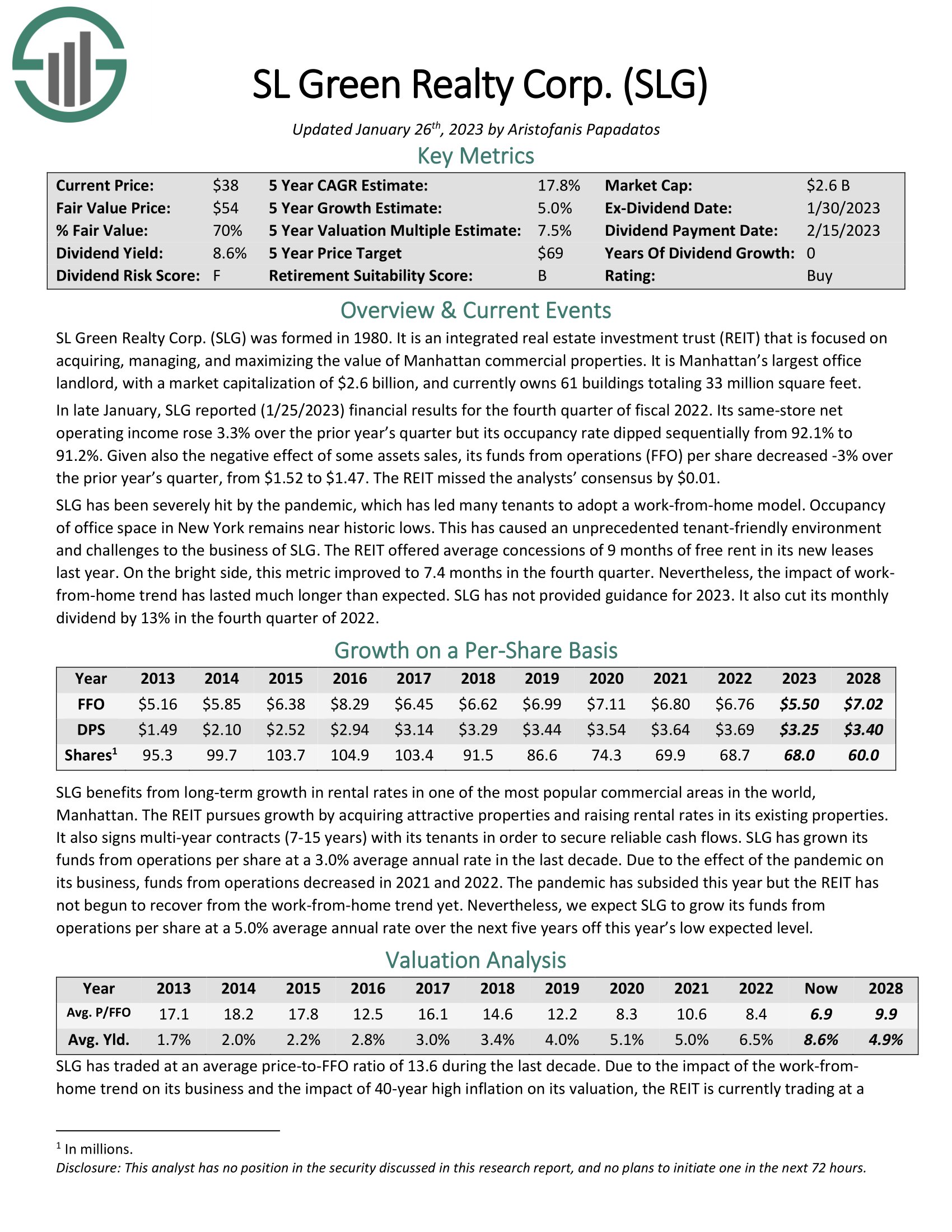

Low-cost Month-to-month Dividend Inventory #1: SL Inexperienced Realty Corp. (SLG)

- Ahead P/E: 3.7

- Dividend Yield: 16.0%

SL Inexperienced is a self-managed REIT that manages, acquires, develops, and leases workplace properties within the New York Metropolis Metropolitan space. In truth, the belief is the most important proprietor of workplace actual property in New York Metropolis, with the vast majority of properties in midtown Manhattan. The belief has a market capitalization of $2.2 billion and is Manhattan’s largest workplace landlord, with greater than 40 buildings totaling near 30 million sq. ft.

The situation of properties advantages the belief as extra know-how and monetary firms want centrally positioned actual property within the space. Whereas many consider San Francisco because the know-how hub within the U.S., New York Metropolis can be one of many largest employers within the sector. This could enable SL Inexperienced a chance to capitalize on this rising discipline with its strategically positioned properties.

SL Inexperienced has been considerably affected by the coronavirus disaster, which has harm a number of firms which are tenants of SLG. Occupancy of workplace house in New York is close to historic lows as demand has waned, a minimum of to some extent, as a result of elevated working from house. Nonetheless, with employment charges in New York Metropolis repeatedly recovering, the corporate expects demand for workplace house to rise shifting ahead.

Supply: Investor Presentation

Additional, SL Inexperienced advantages from its trophy belongings, akin to 450 Park Avenue and 245 Park Avenue, the place the corporate can demand excessive rents from tenants and the place demand continues to be excessive. The corporate’s common asset gross sales of non-core belongings search to strengthen the portfolio additional, which ought to assist with demand and, thus, occupancy charges in the long term.

SL Inexperienced diminished its dividend by 12.9% in December 2022 to a month-to-month fee of $0.2708. Regardless of ongoing challenges from rates of interest, the present payout seems to be manageable. In truth, we anticipate that SL Inexperienced will generate $5.40 in FFO-per-share in 2023, leading to a projected dividend payout ratio of 60%.

Click on right here to obtain our most up-to-date Positive Evaluation report on SLG (preview of web page 1 of three proven beneath):

Remaining Ideas

To sum up, though month-to-month dividend shares could seem interesting for producing a gradual earnings stream, it’s essential to keep in mind that not all dividend shares are created equal. Every inventory carries its personal set of dangers, and the larger the danger, the extra possible it’s that shares will seem undervalued. The month-to-month dividend shares featured on this article mirror this reasoning. Though they could appear cheap at first look, their earnings have been fairly shaky traditionally, and all of them have beforehand diminished their dividends.

Whether or not it’s a dangerous mortgage REIT or a royalty belief with unpredictable outcomes and distributions, buyers ought to scrutinize a budget valuation of month-to-month dividend shares and comprehend the dangers concerned in every circumstance. Nonetheless, our checklist can function a superb place to begin for buyers searching for potential alternatives for undervalued investments within the realm of month-to-month dividend shares.

In case you are enthusiastic about discovering extra high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases shall be helpful:

The key home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

[ad_2]

Source link