Latest market volatility sparked panic promoting, with many buyers echoing considerations about an impending collapse. Nevertheless, emotional reactions typically result in impulsive selections and important monetary losses.

In contrast to tangible belongings, monetary devices derive worth from their future potential. Whereas short-term market fluctuations might be unsettling, a long-term perspective is essential for profitable investing.

Simply as a sale on clothes does not essentially point out poor product high quality, a inventory value decline does not at all times sign an organization’s failure. In actual fact, market downturns can current distinctive shopping for alternatives for these with a disciplined funding strategy.

With that in thoughts, let’s delve into some promising funding alternatives which have emerged exterior of the US following final week’s market selloff.

Learn how to Take Benefit of the Alternatives within the European Market

European firms provide compelling alternatives proper now, buying and selling at decrease multiples in comparison with their U.S. counterparts. The index has gained 8.69% over the previous 12 months, a stark distinction to the S&P 500’s 19.72% rise.

Nevertheless, impulsive promoting pushed by feelings can result in important losses, simply as hasty shopping for with out strategic planning might be detrimental.

On this unstable surroundings, deal with high quality shares with sturdy fundamentals able to weathering unsure macroeconomic circumstances. Search for firms out there at a reduction relative to their truthful worth to maximise potential returns.

Key Parameters to Bear in mind

In right this moment’s unstable market, deal with high quality shares that may stand up to unsure macroeconomic circumstances and can be found at a reduction. Search for shares with:

- Sturdy market capitalization and monetary well being

- Engaging dividend yields

- Constant free money stream

- Honest worth that signifies undervaluation

- Analysts’ targets above the present value

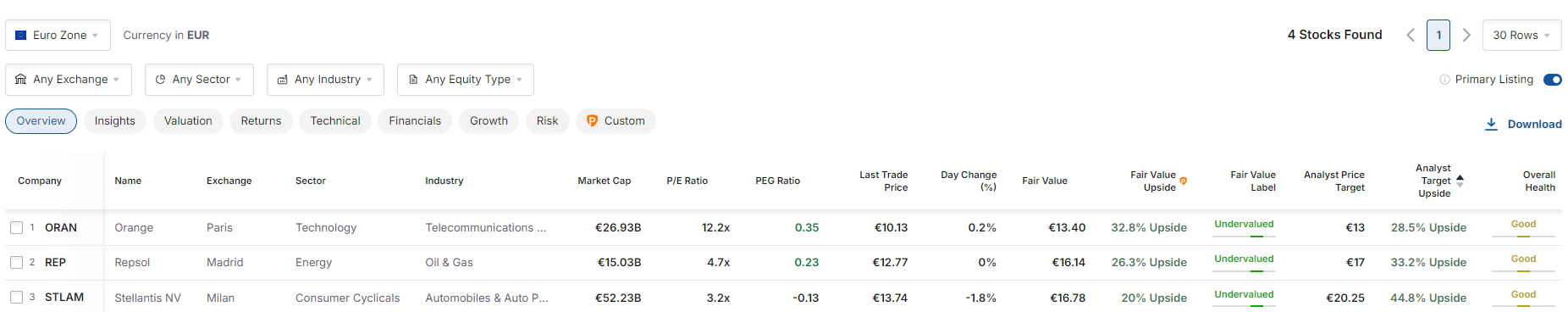

For the factors, I chosen large-cap shares with market capitalizations between €9 billion and €100 billion, good monetary well being, excessive dividend yields (higher than 5%), constructive money stream, and truthful worth with an upside of 18% to 50%.

Supply: Investing.com

Moreover, I filtered for shares with a adverse value change over the previous two weeks to capitalize on reductions.

Prime European Picks

The display screen revealed 4 shares, all buying and selling at a reduction, with dividend yields above 5%, strong monetary information, and progress potential. Listed here are the highest three:

Supply: Investing.com

Let’s analyze them in additional element:

1. Orange

Orange (NYSE:), a serious French telecommunications agency, operates throughout France, Spain, Europe, Africa, the Center East, and extra. The inventory affords a dividend yield of seven.1% and a possible upside of round 30%.

Supply: InvestingPro

2. Repsol

Repsol SA (OTC:), a Spanish multinational power firm, spans 29 nations with pursuits in oil, gasoline, and renewable power. The inventory is undervalued with a 26.3% potential upside and affords a dividend yield of 5.8%.

Supply: InvestingPro

3. Stellantis

Stellantis (NYSE:), the automaker led by CEO Carlos Tavares, combines a number of historic manufacturers beneath one umbrella. The inventory has an estimated upside of twenty-two% from its present value and boasts a powerful dividend yield of 11%.

Supply: InvestingPro

***

This summer season, get unique reductions on our subscriptions, together with annual plans for lower than $8 a month.

Strive InvestingPro right this moment and take your investing sport to the subsequent degree.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or suggestion to speculate and isn’t supposed to incentivize asset purchases in any method. I want to remind you that any sort of asset is evaluated from a number of views and is very dangerous; subsequently, any funding choice and related threat stays with the investor.