[ad_1]

By Egon von Greyerz

The monetary system is terminally damaged, toast, kaput!

Anybody who doesn’t see what is going on will quickly lose a serious a part of their property both by means of financial institution failure, foreign money debasement or the collapse of all bubble property like shares, property and bonds by 75-100%. Many bonds will turn into nugatory.

Wealth preservation in bodily gold is now completely important. Clearly it should be saved exterior a damaged monetary system. Extra later on this article.

The solidity of the banking system relies on confidence. With the fractional banking system, extremely leveraged banks solely have a fraction of the cash out there if all depositors ask for his or her a refund. So when confidence evaporates, so do the steadiness sheets of the banks and depositors realise that the entire system is only a black gap.

And that is precisely what’s about to occur.

For anybody who believes that that is only a downside with a number of smaller US banks and one huge one (Credit score Suisse), they need to suppose once more.

RE CREDIT SUISSE SEE ‘STOP PRESS’ AT THE END OF THE ARTICLE.

THE BANKS ARE FALLING LIKE DOMINOS, INCLUDING CREDIT SUISSE TONIGHT

Sure, Silicon Valley Financial institution (sixteenth greatest US financial institution) is gone after an idiotic and irresponsible coverage to speculate brief time period buyer deposits in long run US Treasuries on the backside of the rate of interest cycle. Even worse, they then valued the bonds at maturity fairly than market, to keep away from taking a loss. Clearly a administration that didn’t have a clue about threat. SVB’s demise is the second greatest failure of a US financial institution.

Sure, Signature Financial institution (29th greatest) is gone because of a run on deposits.

And sure, First Republic Financial institution needed to be supported by US lenders and the Fed by a $30 billion mortgage because of a run on deposits. However this received’t cease the rot as depositors assault the subsequent financial institution and the subsequent one and the subsequent one……….

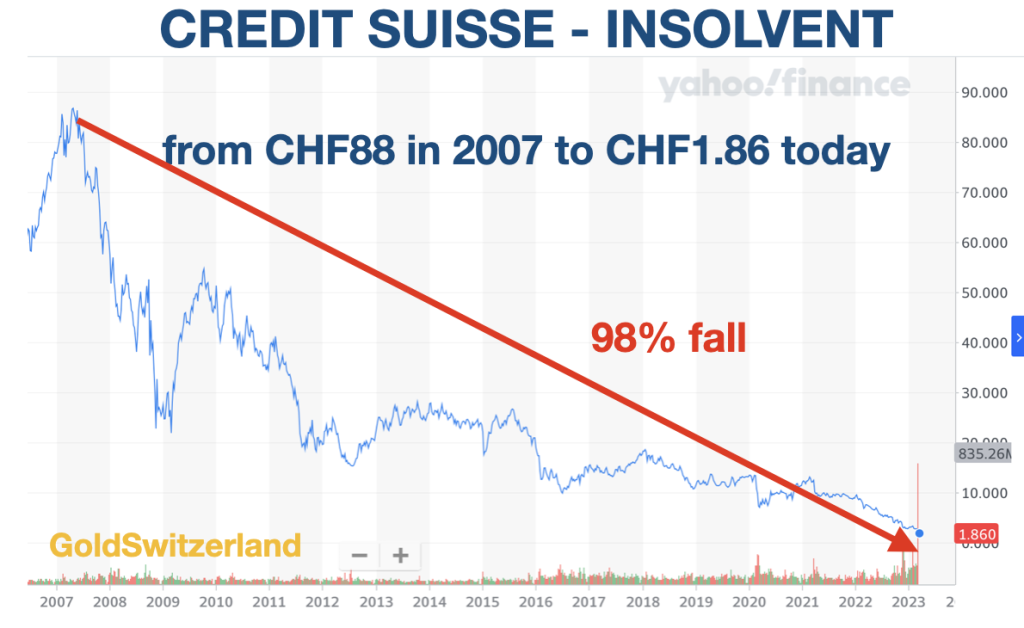

And sure, the Swiss second largest financial institution Credit score Suisse (CS) is terminally sick after a variety of poor investments through the years mixed with poor administration that has come and gone just about yearly.. I wrote an essential article concerning the coming demise of CS 2 years in the past right here: “ARCHEGOS & CREDIT SUISSE – TIP OF THE ICEBERG.”

The scenario at CS is so dire {that a} resolution must be discovered earlier than Monday’s (March 20) opening. The financial institution can not survive in its current kind. A failure for Credit score Suisse wouldn’t simply rock the Swiss monetary system however have extreme international repercussions. A merger with UBS is one resolution. However UBS needed to be bailed out in 2008 and doesn’t wish to be weakened once more by Credit score Suisse with out state ensures and assist from the Swiss Nationwide Financial institution (SNB). The SNB injected CHF50 billion into CS final week however the share worth nonetheless went to a brand new low.

Nobody ought to consider {that a} state subsidised takeover of Credit score Suisse by UBS will remedy the issue. No, it can simply be rearranging the deck chairs on the titanic and making the issue greater fairly than smaller. So fairly than a lifebuoy, UBS can have a large lead weight to hold which can assure its demise because the banking system collapses. And the Swiss authorities will tackle property which can be unrealisable.

Nonetheless, it’s probably that by the top of the current weekend a deal can be introduced with UBS being supplied a deal they will’t refuse by taking up the nice property and the SNB/Authorities nurturing the unhealthy property of Credit score Suisse in a rescue automobile.

The SNB is in fact in a multitude itself, having misplaced $143 billion in 2022. The SNB steadiness sheet is larger than Swiss GDP and consists of foreign money hypothesis and US tech shares. This central financial institution is the world’s greatest hedge fund and the least profitable.

Simply to place a balanced view on Switzerland. It has the most effective political system on this planet with direct democracy. It additionally has low Federal debt and usually no funds deficits. It is usually the most secure nation on this planet.

SWISS BANKING SYSTEM TOO BIG TO SAVE

However the Swiss banking system could be very unsound, similar to the remainder of the world’s. A central financial institution which is larger than the nation’s GDP is extraordinarily unsound. And a banking system which is 5x Swiss GDP makes it too huge to avoid wasting.

Though the Fed and ECB are a lot smaller in relation to their international locations’ GDP than the SNB, these two central banks will quickly uncover that their property of round $8 trillion every are grossly overvalued.

With a worldwide banking system on the verge of a systemic failure, Central Bankers and bankers have been working across the clock this weekend to briefly keep away from the inevitable collapse of the bankrupt monetary system.

BIGGEST MONEY PRINTING IN HISTORY COMING

As I identified above, the primary Central Banks would even be bankrupt in the event that they valued their property truthfully. However they’ve an exquisite supply of cash that they are going to faucet to avoid wasting the system.

Sure, I’m in fact speaking about cash printing.

We’ll in coming months and years see probably the most large avalanche of cash printing that has ever hit the world.

For anybody who believes that we’re simply seeing one other financial institution run that can rapidly evaporate, they might want to take a bathe in ice chilly Alpine water.

What we’re witnessing isn’t just a short lived drama that can be sorted out by “the all highly effective and resourceful” central banks.

THE DEATH OF MONEY

No, as an alternative what we’re seeing is the top section of this monetary period which began with the formation of the Fed in 1913 and within the subsequent few years, or a lot sooner, will finish with the dying of cash.

However the Dying of Cash doesn’t simply imply that the greenback (and most currencies) will make their last transfer to ZERO, having already declined 98% since 1971.

Forex debasement will not be the trigger however the impact of the banking Cabal taking management of the cash for their very own profit. As Mayer Amschel Rothschild mentioned within the late 1700s: “Let me challenge and management a nation’s cash and I care not who makes the legal guidelines”.

Sadly, as this Cassandra (me) has written about because the starting of the century, the Dying of Cash isn’t just all currencies going to ZERO as they’ve all through historical past.

No, the Dying of Cash means a complete and last collapse of this monetary system.

Cassandra was a priestess in Greek mythology who was given the present of predicting main occasions precisely but in addition given the curse that nobody would consider her predictions.

No depositor should consider that the FDIC (Federal Deposit Insurance coverage Corp) within the US or related autos in different international locations will save their deposits. All these organisations are massively undercapitalised and ultimately it is going to be the governments in all international locations which step in.

We all know in fact, that the federal government has no cash. They simply print no matter they want. That leaves atypical individuals taking the ultimate burden of all this cash printing.

However atypical individuals can have no cash both. Sure a number of wealthy individuals can be taxed closely to cowl financial institution deficits and losses. Nonetheless, that can be a drop within the ocean. As a substitute atypical individuals can be impoverished with little revenue, no authorities handouts, no pension and cash which is nugatory.

The above is unfortunately the cycle that each one financial eras undergo. The problem this time is that the issue is international and of a magnitude by no means seen earlier than in historical past.

Regrettably a rotten and bankrupt monetary system must undergo a cleaning interval which the world will now expertise. There can’t be sound development and sound values till the present corrupt and debt infested system implodes. Solely then can the world develop soundly once more.

The transition will sadly be dramatic with numerous struggling for most individuals. However there is no such thing as a different method. We received’t simply see poverty, famine but in addition many human tragedies. The chance of social unrest or civil struggle could be very excessive plus the chance of a worldwide struggle.

Central banks had in fact hoped that their Digital Currencies (CBDC) could be prepared to avoid wasting them (however not the world) from the current debacle by completely controlling individuals’s spending. However for my part they are going to be too late. And since CBDCs are simply one other type of Fiat cash, it might simply exacerbate the issue with an much more extreme final result on the finish. Nonetheless, it received’t forestall them from making an attempt.

MARKET VALUE OF US BANKING ASSETS $2 TRILLION LOWER THAN BOOK VALUE

A paper issued by 4 US lecturers in finance, illustrates the $2 trillion black gap within the US banking system:

“Financial Tightening and U.S. Financial institution Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?”

March 13, 2023

Erica Jiang, Gregor Matvos, Tomasz Piskorski, and Amit Seru

CONCLUSION

“We offer a easy evaluation of U.S. banks’ asset publicity to a latest rise within the rates of interest with implications for monetary stability. The U.S. banking system’s market worth of property is $2 trillion decrease than advised by their e book worth of property. We present that these losses, mixed with a big share of uninsured deposits at some U.S. banks can impair their stability. Even when solely half of uninsured depositors resolve to withdraw, nearly 190 banks are at a possible threat of impairment to even insured depositors, with doubtlessly $300 billion of insured deposits in danger. If uninsured deposit withdrawals trigger even small hearth gross sales, considerably extra banks are in danger. Total, these calculations recommend that latest declines in financial institution asset values considerably elevated the fragility of the US banking system to uninsured depositors runs.”

What’s essential to know is that the $2 trillion “loss” is just because of increased rates of interest. When the US economic system comes underneath stress, the mortgage books of the banks will deteriorate dramatically and unhealthy money owed improve exponentially. With complete property of US business banks at $23 trillion, I’d be shocked if 50% is repaid or recoverable within the coming disaster.

The above dangers are only for the US monetary system. The worldwide system can be no higher with the EU underneath large stress partly because of US led sanctions of Russia. Nearly each main economic system on this planet is in a dire place.

Let’s simply take a look at the debt pyramid which I’ve mentioned in lots of articles.

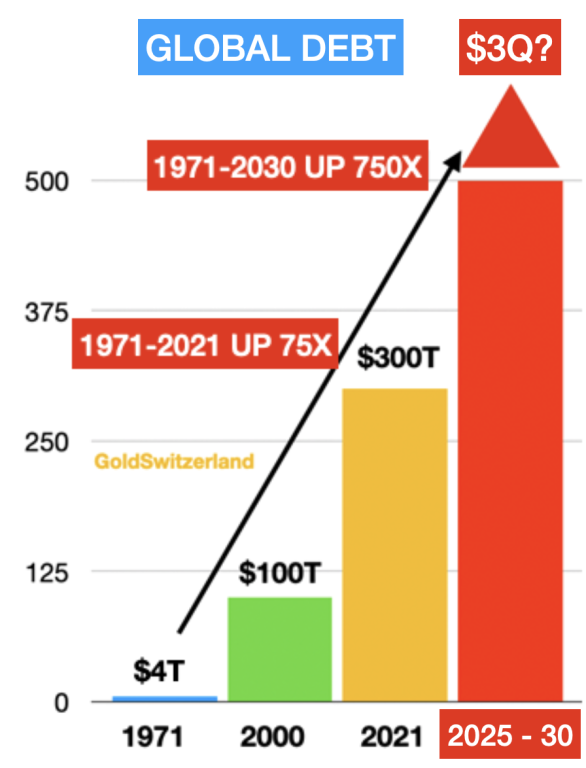

In 1971, when Nixon closed the gold window, international debt was $4 trillion. With gold backing no foreign money, this turned a free for all to print limitless quantities of cash. And thus by 2000 debt had grown 25x to $100t. In 2006, when the Nice Monetary Disaster began, international debt was $120 trillion. By 2021 it had grown 75x from 1971 to $300 trillion.

The pink column exhibits international debt at $3 quadrillion someday between 2025 and 2030.

This assumes that the shadow banking system plus excellent derivatives of presently most likely round $2 quadrillion will must be saved by central banks in a cash printing bonanza. This can clearly result in hyperinflation and thereafter to a depressionary implosion.

I do know this sounds sensational however nonetheless a really probably state of affairs on the finish of the most important credit score bubble in historical past.

GOLD – CRITICAL WEALTH PRESERVATION

I’ve been standing on a soapbox for over 20 years, warning the world concerning the coming monetary disaster and the significance of bodily gold for wealth preservation functions. In 2002 we invested essential funds into bodily gold with the aim of holding it for the foreseeable future.

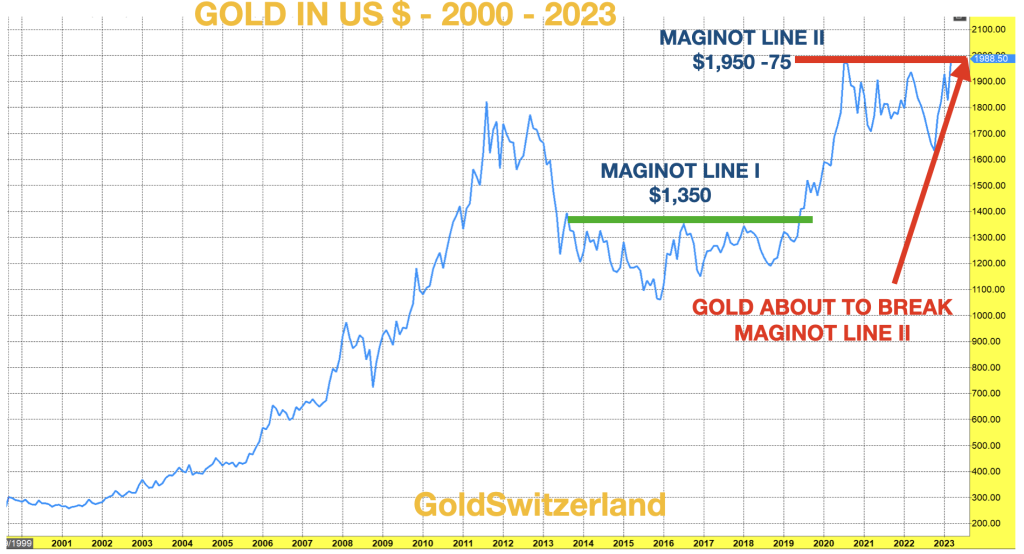

Between 2002 and 2011 gold went from $300 to $1,900. Since then gold corrected after which went sideways as shares and the asset markets surged backed by large credit score enlargement.

With gold presently round $1990, there may be not a lot achieve since 2011. Nonetheless since 2002 gold is up 7x. Because of the briefly stronger greenback, gold’s positive factors measured in {dollars} are a lot smaller than in Euros, Kilos or Yen. However that can quickly change.

Within the last part of the article “WILL NUCLEAR WAR, DEBT COLLAPSE OR ENERGY DEPLETION FINISH THE WORLD?”, I outlined the significance of proudly owning bodily gold to retailer it in a protected jurisdiction away from kleptocratic governments.

“2023 is more likely to be the 12 months of gold. Each essentially and technically gold seems like it can make main up strikes this 12 months.”

And on the finish of this text, I clarify the significance of how and the place gold must be held:“PREPARE FOR 10 YEARS OF GLOBAL DESTRUCTION.”

“So my very own choice could be to personal bodily gold and silver that solely I’ve direct management of and might withdraw or promote with very brief discover.

It is usually essential to take care of an organization that may transfer your metals at very brief discover if the safety or geopolitical scenario would necessitate it.”

In February 2019 I wrote about what I known as the Gold Maginot Line which had held for six years under $1,350. That is typical for gold. Having gone from $250 in 1999 to $1,900 in 2011, it then spent 8 years in a correction. On the time I forecast that the Maginot Line would quickly break which it did and swiftly moved to $2,000 by August 2020. We have now now had one other interval of consolidation since then and the subsequent transfer above $2,000 and in direction of $3,000 is imminent.

Simply to remind ourselves what occurs to your cash and gold throughout a hyperinflationary interval, right here is a photograph from China’s hyperinflation in 1949 as individuals attempt to get their 40 grammes (simply over one ounce) that they had been allotted by the federal government. Sooner or later within the subsequent few years, there can be a panic within the West to purchase gold at any worth.

In order I’ve been urging buyers for over 20 years, please get your gold NOW whereas it’s nonetheless out there.

STOP PRESS

Intense discussions are proper now occurring right here in Switzerland between UBS, Credit score Suisse, the regulator FINMA, the Swiss Nationwide Financial institution – SNB – and the Swiss Authorities. The Fed, the Financial institution of England and the ECB are additionally concerned.

The newest hearsay is that UBS will purchase Credit score Suisse for CHF900 million ($1 billion). The shares of CS closed at a market cap of CHF8 billion on Friday. The deal would clearly contain backing from the SNB and the Swiss authorities which must tackle main liabilities.

The December 2022 e book worth of CS was CHF42 billion, as with all banks massively overstated.

The deal isn’t completed at this level, 5.30pm Swiss time, however the entire banking world is aware of that and not using a deal, there can be international contagion beginning tomorrow Monday the 20th.

Even when a provisional deal can be completed by Monday’s open, the monetary system has now been completely injured with an open wound which received’t heal.

The issue will simply transfer on to the subsequent financial institution, and the subsequent and the subsequent….

Maintain on to your seats however purchase gold first.

[ad_2]

Source link