[ad_1]

by Michael

It amazes me that so many individuals nonetheless can’t perceive what is occurring. 2022 was supposedly going to be a yr when America entered a brand new golden age of prosperity, however that didn’t occur. As an alternative, it was a whole and utter catastrophe. Inventory costs fell by probably the most that now we have seen since 2008, the cryptocurrency trade got here aside on the seams, inflation soared to absurd heights, and residential gross sales simply saved declining all all year long. Undoubtedly, 2022 represented a significant turning level. People have already collectively misplaced trillions of {dollars}, and plenty of consultants are telling us that 2023 will probably be even worse.

We warned again and again that the occasion on Wall Road would finally come to a really bitter finish, however most individuals didn’t wish to hear.

Properly, the occasion has now ended, and the inventory market losses that now we have witnessed over the previous 12 months have been completely staggering…

As of closing time on Friday night, the Dow Jones Industrial Common fell by practically 3,500 factors for the reason that begin of the yr, a 9.4 p.c drop.

The S&P 500 was additionally down by 957 factors this yr, with the tech-heavy index falling by virtually 20 p.c, capping off a brutal yr for the tech trade.

In the meantime, the Nasdaq sunk by greater than 5,600 factors, a practically 34 p.c decline in 2022.

Greater than a 3rd of your complete worth of the Nasdaq is already gone.

Simply take into consideration that.

After all some shares have been hit a lot more durable than others.

Tesla is down about 70 p.c from the height, and Elon Musk “has turn into the primary particular person ever to lose $200 billion from his internet price”…

Tesla CEO and Chief Twit Elon Musk has turn into the primary particular person ever to lose $200 billion from his internet price, in line with a Bloomberg report.

Musk, 51, beforehand turned the second particular person ever to amass a fortune of greater than $200 billion in January 2021, after Amazon founder Jeff Bezos. Musk has now seen his wealth drop to $137 billion following a latest drop in Tesla shares.

Musk noticed his fortune peak in November 2021, hitting $340 billion, and held the title of the world’s richest particular person up till final month. Musk was in the end toppled off the throne by Bernard Arnault, the CEO of French luxurious large LVMH.

It’s a must to give him credit score for holding up so effectively beneath the circumstances.

200 billion {dollars} is an sum of money that’s so massive that it’s virtually unimaginable.

Fb additionally received monkey-hammered over the course of 2022. At this level, Fb inventory has fallen over 64 p.c from the place it was final January…

On the final day of buying and selling this yr, Meta’s inventory was down greater than 64 p.c in comparison with January, with costs sinking from over $338-per-share to now $120-per-share.

The corporate has misplaced greater than $600 billion in valuation because it spend billions to make its controversial leap to digital actuality with its Metaverse, with the efforts persevering with to return up brief.

Maybe Fb shouldn’t have put a lot effort into banning and censoring hundreds of thousands of their finest customers.

What an extremely silly factor to do.

Once I go on Fb today, it simply feels so extremely useless.

There are nonetheless a couple of diehard customers hanging round, however total it’s only a pathetic hole shell of a social media platform at this level.

Talking of implosions, 2022 was an absolute catastrophe for the cryptocurrency trade. The next abstract of what we witnessed over the previous 12 months comes from Zero Hedge…

Amongst all of the chaos and downfall of many crypto exchanges and main enterprise capital companies, the largest losers are crypto buyers. If the burn of the bear market was not sufficient, hundreds of thousands of crypto buyers who had their funds on FTX misplaced their life financial savings in a single day.

Terra was as soon as a $40 billion ecosystem. Its native token, LUNA — now often known as Terra Basic (LUNC) — was one of many prime 5 greatest cryptocurrencies by market capitalization. With hundreds of thousands of shoppers invested within the ecosystem, the collapse introduced their funding to zero inside hours. After the Terra collapse, crypto buyers misplaced their funds on a sequence of centralized exchanges and staking platforms like Celsius, BlockFi and Hodlnaut. Crypto buyers additionally misplaced considerably within the nonfungible token market, with the value of many well-liked collections down by 70%. General, crypto buyers are among the many greatest losers of the yr.

The whole worth of all cryptocurrencies exceeded 3 trillion {dollars} on the peak of the market.

Now the entire worth of all cryptocurrencies has fallen to lower than 1 trillion {dollars}.

Hopefully you bought out earlier than the crash occurred.

2022 was additionally a yr once we skilled very painful inflation.

Meals costs, vitality costs and automobile costs all went fully nuts, and plenty of in contrast what we have been going by means of to the Jimmy Carter period of the Seventies.

However this shouldn’t have been a shock to any of us. Beginning in 2020, our leaders completely flooded the system with new money and the dimensions of the cash provide completely exploded.

Rising the dimensions of the cash provide so dramatically was inevitably going to trigger costs to go haywire, and anybody that thought in any other case was simply not being rational.

In a determined try and struggle the inflation monster that they helped to create, officers on the Federal Reserve aggressively raised rates of interest all through a lot of 2022.

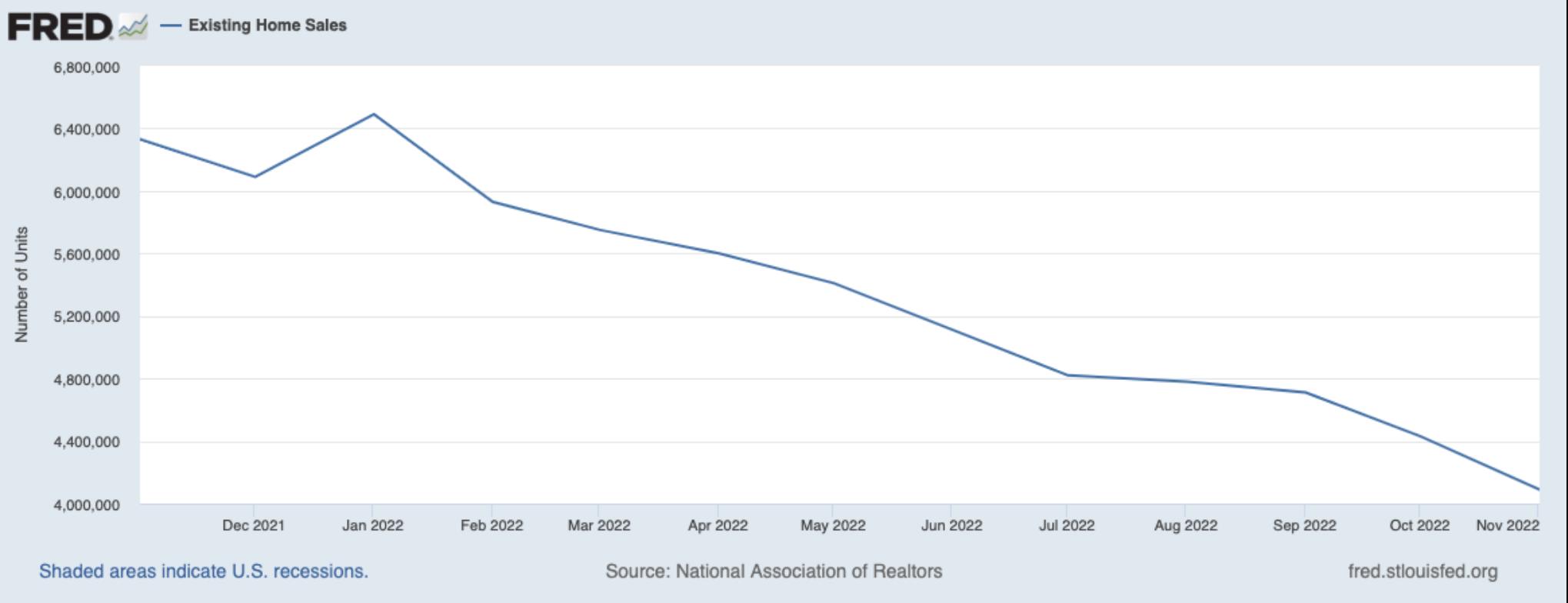

Consequently, we now discover ourselves within the midst of one other horrifying housing crash. Dwelling values are actually steadily receding everywhere in the nation, and residential gross sales have been falling month after month.

Dwelling gross sales have already fallen by greater than a 3rd.

How a lot decrease can they presumably go?

I don’t know, however we’re being warned to brace ourselves for extra onerous occasions forward.

In actual fact, even the IMF is publicly admitting that “the worst is but to return”…

“The worst is but to return, and for many individuals 2023 will really feel like a recession,” the IMF stated in October, noting the slowdown “will probably be broad-based” and should “reopen financial wounds that have been solely partially healed post-pandemic.”

If solely they knew.

We aren’t simply heading into a short lived financial downturn. Finally, your complete system is beginning to collapse throughout us, and the years forward are going to be extremely difficult.

Our leaders have been making mistake after mistake for many years, and now we get to pay the value.

So buckle up and maintain on tight, as a result of 2023 shouldn’t be going to be nice in any respect.

[ad_2]

Source link