Updated on May 10th, 2022 by Bob Ciura

At Sure Dividend, we often steer income investors toward the Dividend Aristocrats. Investors looking for high-quality dividend stocks to buy and hold for the long-run, can find many attractive stocks on this prestigious list.

The Dividend Aristocrats are a select group of 65 stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases.

You can download an Excel spreadsheet of all 65 Dividend Aristocrats (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

We typically rank stocks based on their five-year expected annual returns, as stated in the Sure Analysis Research Database.

But for investors primarily interested in income, it is also useful to rank the Dividend Aristocrats according to their dividend yields.

This article will rank the 20 highest-yielding Dividend Aristocrats today.

Table of Contents

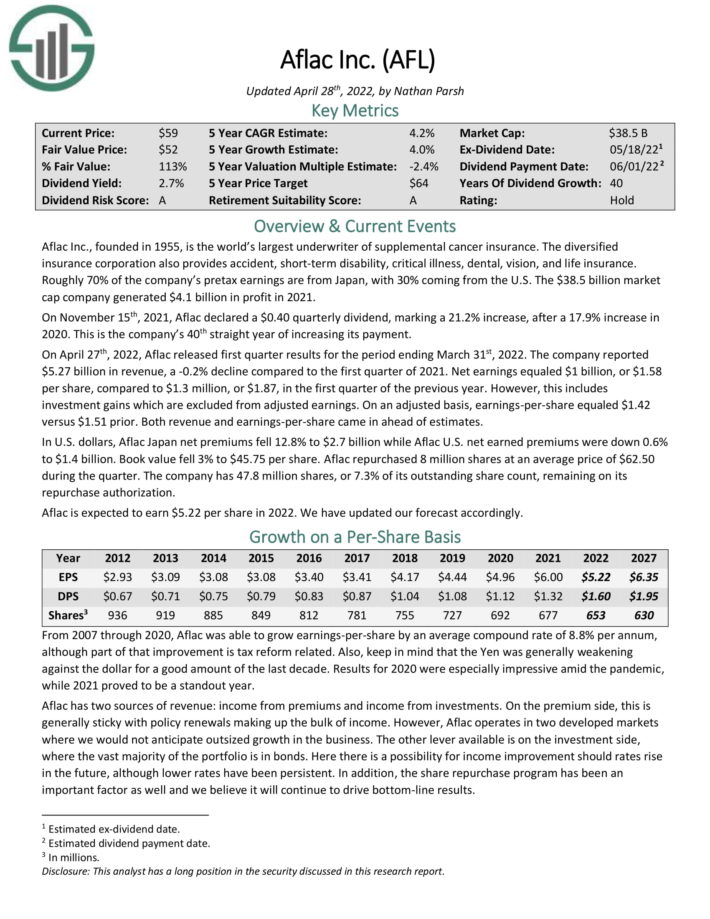

High Yield Dividend Aristocrat #20: Aflac Inc. (AFL)

Aflac Inc., founded in 1955, is the world’s largest underwriter of supplemental cancer insurance. The diversified insurance corporation also provides accident, short-term disability, critical illness, dental, vision, and life insurance.

Roughly 70% of the company’s pretax earnings are from Japan, with 30% coming from the U.S. The company hedges its international currency exposure.

Source: Investor Presentation

On April 27th, 2022, Aflac released first quarter results for the period ending March 31st, 2022. The company reported $5.27 billion in revenue, a -0.2% decline compared to the first quarter of 2021. Net earnings equaled $1 billion, or $1.58 per share, compared to $1.3 million, or $1.87, in the first quarter of the previous year. However, this includes investment gains which are excluded from adjusted earnings. On an adjusted basis, earnings-per-share equaled $1.42 versus $1.51 prior. Both revenue and earnings-per-share came in ahead of estimates.

In U.S. dollars, Aflac Japan net premiums fell 12.8% to $2.7 billion while Aflac U.S. net earned premiums were down 0.6% to $1.4 billion. Book value fell 3% to $45.75 per share. Aflac repurchased 8 million shares at an average price of $62.50 during the quarter. The company has 47.8 million shares, or 7.3% of its outstanding share count, remaining on its repurchase authorization.

Click here to download our most recent Sure Analysis report on Aflac (preview of page 1 of 3 shown below):

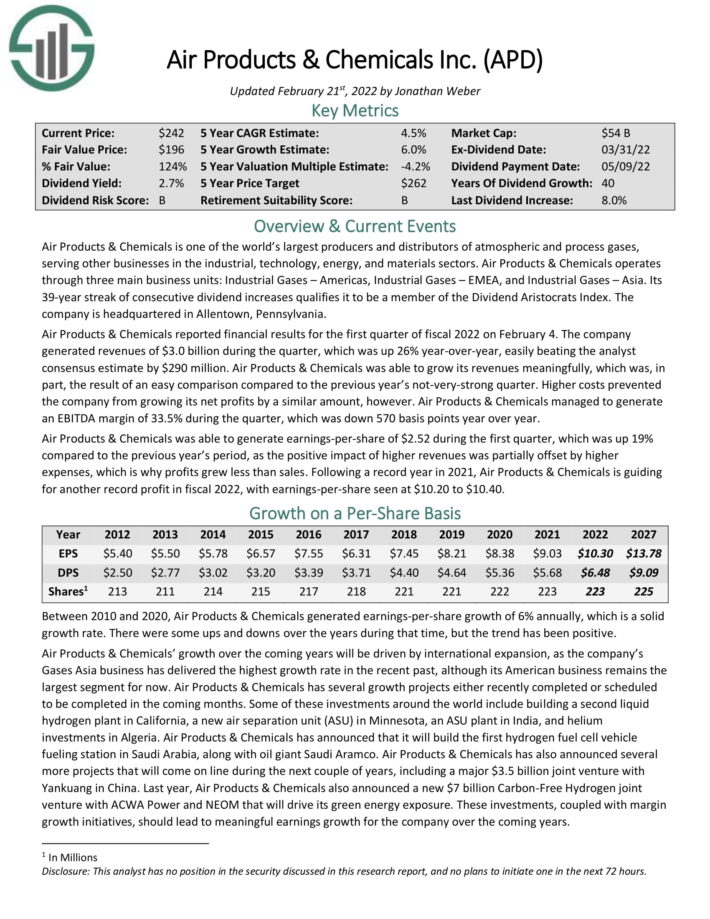

High Yield Dividend Aristocrat #19: Air Products & Chemicals (APD)

Air Products & Chemicals is one of the world’s largest producers and distributors of atmospheric and process gases, serving other businesses in the industrial, technology, energy, and materials sectors. Air Products & Chemicals operates through three main business units: Industrial Gases – Americas, Industrial Gases – EMEA, and Industrial Gases – Asia.

The company has a 40-year streak of annual dividend increases.

Source: Investor Presentation

Air Products & Chemicals reported financial results for the first quarter of fiscal 2022 on February 4. The company generated revenues of $3.0 billion during the quarter, which was up 26% year-over-year, easily beating the analyst consensus estimate by $290 million.

Air Products & Chemicals was able to generate earnings-per-share of $2.52 during the first quarter, which was up 19% compared to the previous year’s period, as the positive impact of higher revenues was partially offset by higher expenses, which is why profits grew less than sales.

Following a record year in 2021, Air Products & Chemicals is guiding for another record profit in fiscal 2022, with earnings-per-share seen at $10.20 to $10.40.

Click here to download our most recent Sure Analysis report on APD (preview of page 1 of 3 shown below):

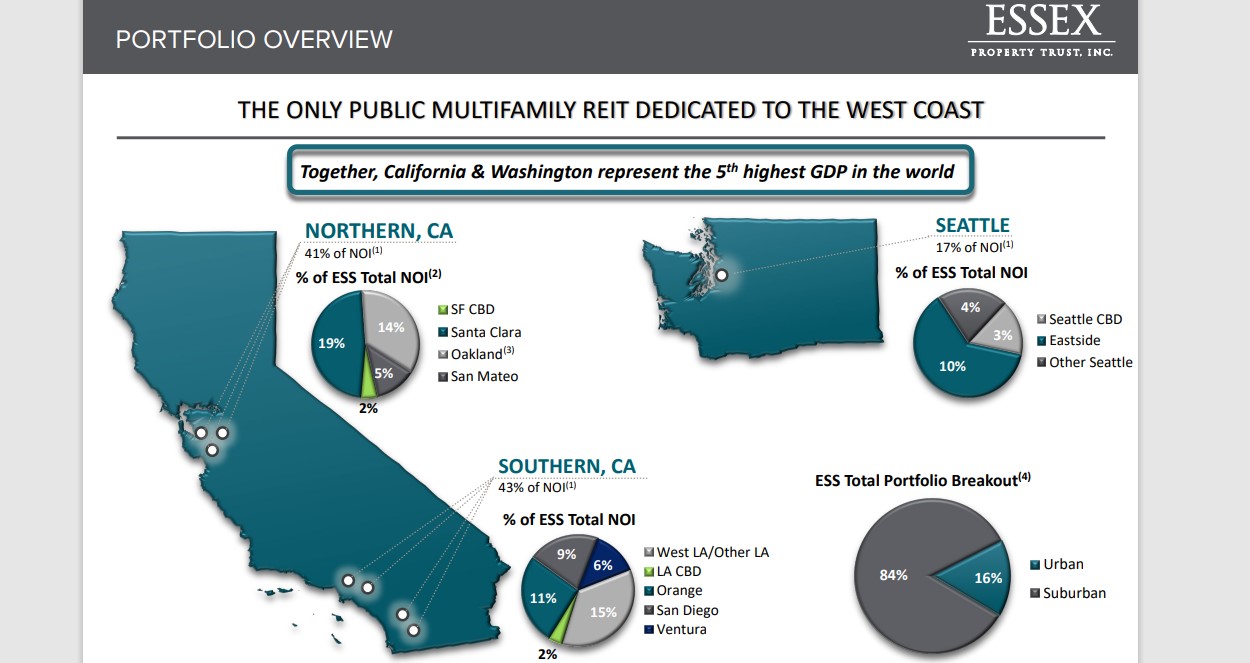

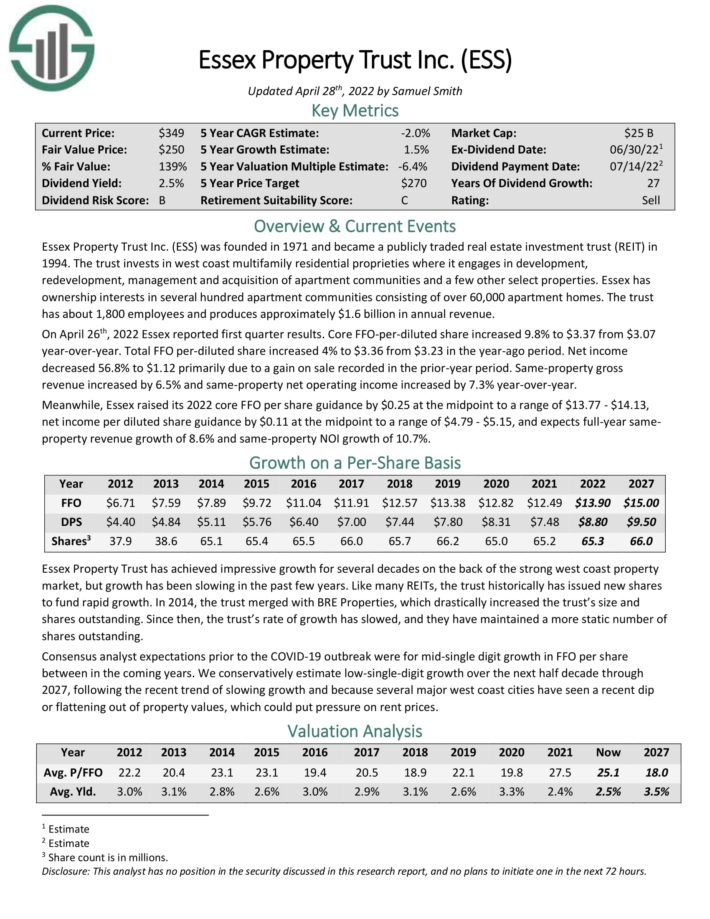

High Yield Dividend Aristocrat #18: Essex Property Trust (ESS)

Essex Property Trust was founded in 1971. The trust invests in west coast multifamily residential proprieties where it engages in development, redevelopment, management and acquisition of apartment communities and a few other select properties. Essex has ownership interests in several hundred apartment communities consisting of over 60,000 apartment homes. The trust has about 1,800 employees and produces approximately $1.6 billion in annual revenue.

Source: Investor Presentation

On April 26th, 2022 Essex reported first quarter results. Core FFO-per-diluted share increased 9.8% to $3.37 from $3.07 year-over-year. Total FFO per-diluted share increased 4% to $3.36 from $3.23 in the year-ago period. Net income decreased 56.8% to $1.12 primarily due to a gain on sale recorded in the prior-year period. Same-property gross revenue increased by 6.5% and same-property net operating income increased by 7.3% year-over-year.

Meanwhile, Essex raised its 2022 core FFO per share guidance by $0.25 at the midpoint to a range of $13.77 – $14.13, net income per diluted share guidance by $0.11 at the midpoint to a range of $4.79 – $5.15, and expects full-year sameproperty revenue growth of 8.6% and same-property NOI growth of 10.7%.

Click here to download our most recent Sure Analysis report on ESS (preview of page 1 of 3 shown below):

High Yield Dividend Aristocrat #17: The Clorox Company (CLX)

The Clorox Company is a manufacturer and marketer of consumer and professional products, spanning a wide array of categories from charcoal to cleaning supplies to salad dressing. More than 80% of its revenue comes from products that are #1 or #2 in their categories across the globe, helping Clorox produce more than $7 billion in annual revenue.

Source: Investor Presentation

Clorox reported second quarter earnings on February 3rd, 2022, and results were very weak, and the stock fell more than 14% on the release. Total sales declined 8% to $1.7 billion, but the quarter followed a 27% year-over-year increase in the comparable period a year ago.

Clorox pointed out sales on a two-year basis were up 19% as a result. Volumes declined 10%, partially offset by a 2% gain from favorable price mix. Forex translation had no impact on sales, so organic sales were down 8%. Gross margin plummeted 1240 basis points to 33% of revenue. This was driven primarily by higher manufacturing, logistics, and commodity costs. Adjusted EPS fell 67% to 66 cents.

Click here to download our most recent Sure Analysis report on Clorox (preview of page 1 of 3 shown below):

High Yield Dividend Aristocrat #16: Chevron Corporation (CVX)

Chevron is the third–largest oil major in the world. In 2021, Chevron generated 84% of its earnings from its upstream segment.

The company has increased its dividend for over 40 consecutive years.

Source: Investor Presentation

In late April, Chevron reported (4/29/22) financial results for the first quarter of fiscal 2022. It cut its production by -2% over last year’s quarter but greatly benefited from the rally of oil and gas prices to 13-year highs, which resulted from the sanctions of western countries on Russia for its invasion in Ukraine. As a result, the oil major grew its adjusted earnings-per-share 31% sequentially, from $2.56 to $3.36, a nearly all-time high.

As we do not expect sanctions to be withdrawn anytime soon, we expect oil and gas prices to remain excessive this year and thus we have raised our forecast for the annual earnings-per-share of Chevron from $9.90 (our forecast before the war) to $16.40.

Click here to download our most recent Sure Analysis report on CVX (preview of page 1 of 3 shown below):

High Yield Dividend Aristocrat #15: Consolidated Edison (ED)

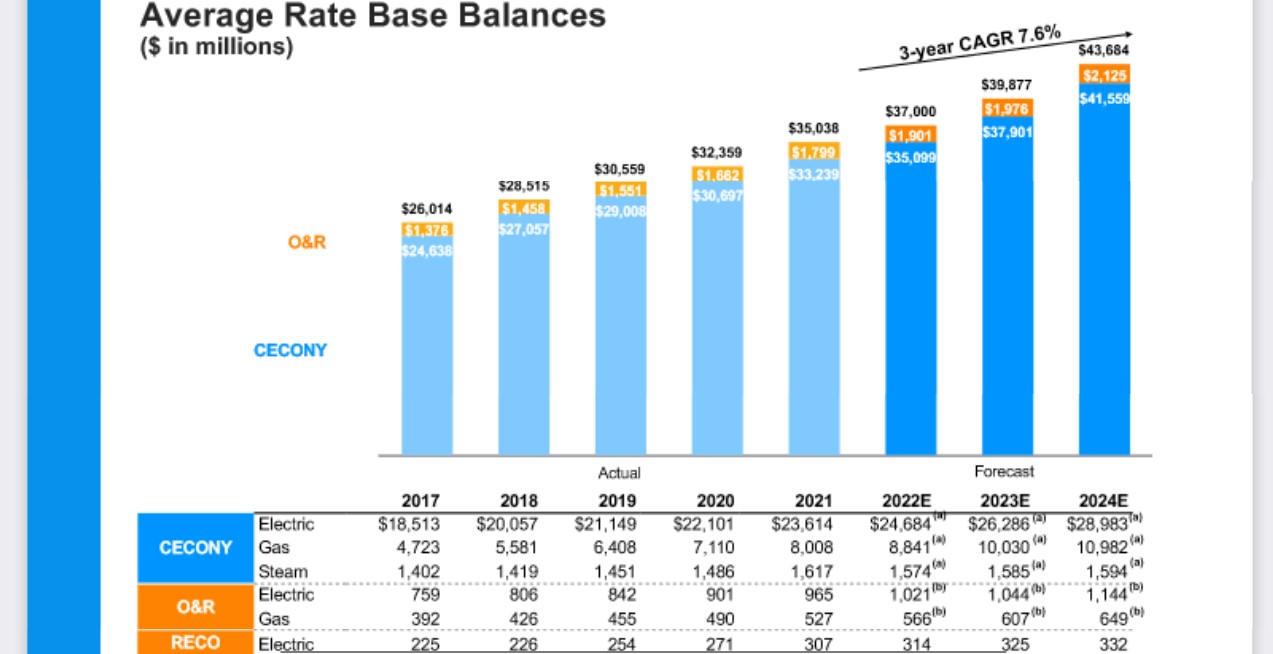

Consolidated Edison is a holding company that delivers electricity, natural gas, and steam to its customers in New York City and Westchester County. It has annual revenues of nearly $13 billion.

Consolidated Edison announced fourth quarter and full year earnings results on 2/17/2022. Revenue grew 15.5% to $3.4 billion, beating expectations by $510 million. Adjusted earnings of $355 million, or $1.00 per share, compared to adjusted earnings of $253 million, or $0.75 per share, in the previous year.

Adjusted EPS beat estimates by $0.14. For the year, revenue grew 11.8% to $13.7 while adjusted earnings of $1.5 billion, or $4.39 per share, compared to adjusted earnings of $1.4 billion, or $4.18, in 2020.

Rate increases are a major driver of Consolidated Edison’s growth.

Source: Investor Presentation

Higher rate bases for gas and electric customers added $0.06 to the company’s New York operations, though this was more than offset by higher costs related to healthcare and storm-related events. The pandemic impact on this business reduced earnings by $0.05. Higher revenues in company’s clean energy business added $0.13 to results.

The company reaffirmed prior guidance of adjusted earnings–per–share in a range of $4.15 to $4.35 for 2021, which would be a 1.7% increase at the midpoint from the previous year.

Click here to download our most recent Sure Analysis report on ConEd (preview of page 1 of 3 shown below):

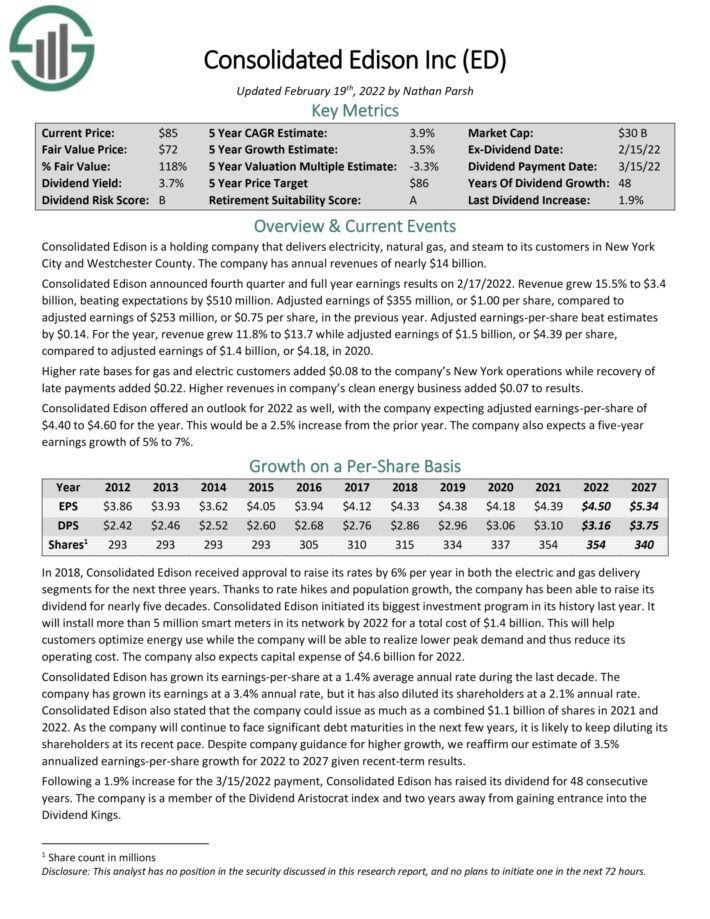

High Yield Dividend Aristocrat #14: Cardinal Health (CAH)

Cardinal Health is one of the “Big 3” drug distribution companies along with McKesson (MKC) and AmerisourceBergen (ABC). Cardinal Health serves over 24,000 United States pharmacies and more than 85% of the country’s hospitals. The company has operations in more than 30 countries with approximately 44,000 employees.

Cardinal Health released Q3 fiscal 2022 results for the period ending March 31st, 2022 (Cardinal Health’s fiscal year ends June 30th). For the quarter, the company’s revenue grew 14.1% to $44.8 billion, which was $1.64 billion higher than expected. On an adjusted basis, the company posted earnings of $545 million, or $1.45 per share, compared to $689 million, or $1.53 per share, in the year ago period. Adjusted earnings-per-share was $0.07 below estimates.

Pharmaceutical sales of $41.4 billion was a 17% increase year-over-year, while segment profit if $487 million was down 5%. Revenue for the Medical segment decreased 7% to $3.9 billion while segment profit decreased 66% to

$59 million. A divestiture was the main headwind to top-line decline. Inflationary pressures and supply chain constraints were a drag on profits. The Pharmaceutical segment makes up the lion’s share of revenues, but the Medical segment remains important due to its higher margins and growth potential.

Cardinal Health again updated its fiscal 2022 outlook, now anticipating $5.15 to $5.25 in adjusted EPS.

Click here to download our most recent Sure Analysis report on Cardinal Health (preview of page 1 of 3 shown below):

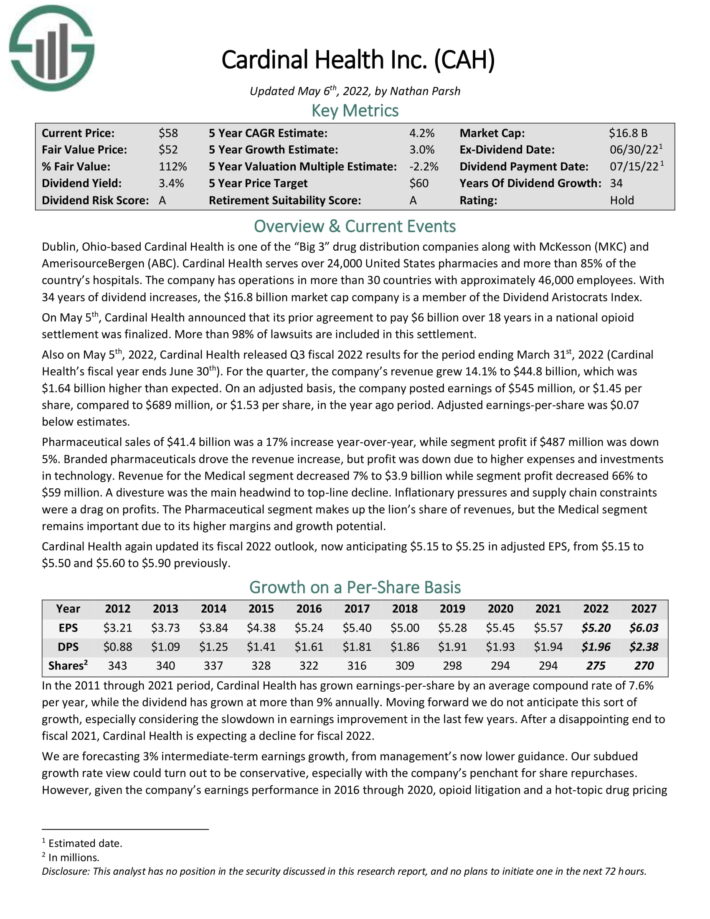

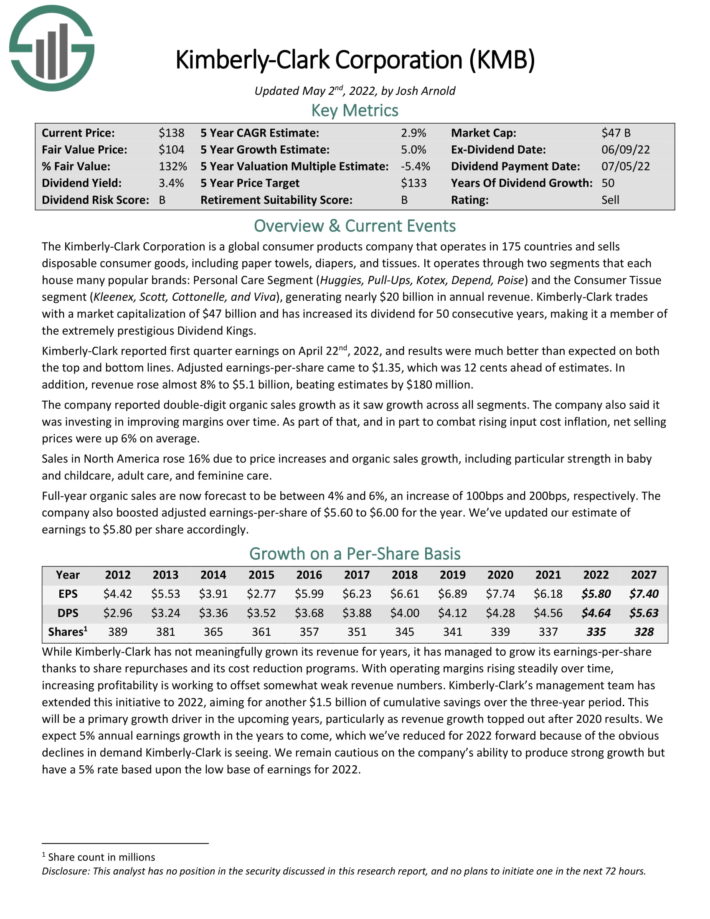

High Yield Dividend Aristocrat #13: Kimberly-Clark (KMB)

Kimberly-Clark is a global consumer products company that operates in 175 countries and sells disposable consumer goods, including paper towels, diapers, and tissues.

It operates through two segments that each house many popular brands: Personal Care Segment (Huggies, Pull-Ups, Kotex, Depend, Poise) and the Consumer Tissue segment (Kleenex, Scott, Cottonelle, and Viva), generating nearly $20 billion in annual revenue.

Source: Investor Presentation

Kimberly-Clark reported first quarter earnings on April 22nd, 2022, and results were much better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $1.35, which was 12 cents ahead of estimates. In addition, revenue rose almost 8% to $5.1 billion, beating estimates by $180 million. The company reported double-digit organic sales growth as it saw growth across all segments.

The company also said it was investing in improving margins over time. As part of that, and in part to combat rising input cost inflation, net selling prices were up 6% on average. Sales in North America rose 16% due to price increases and organic sales growth, including particular strength in baby and childcare, adult care, and feminine care. Full-year organic sales are now forecast to be between 4% and 6%, an increase of 100bps and 200bps, respectively.

Click here to download our most recent Sure Analysis report on Kimberly-Clark (preview of page 1 of 3 shown below):

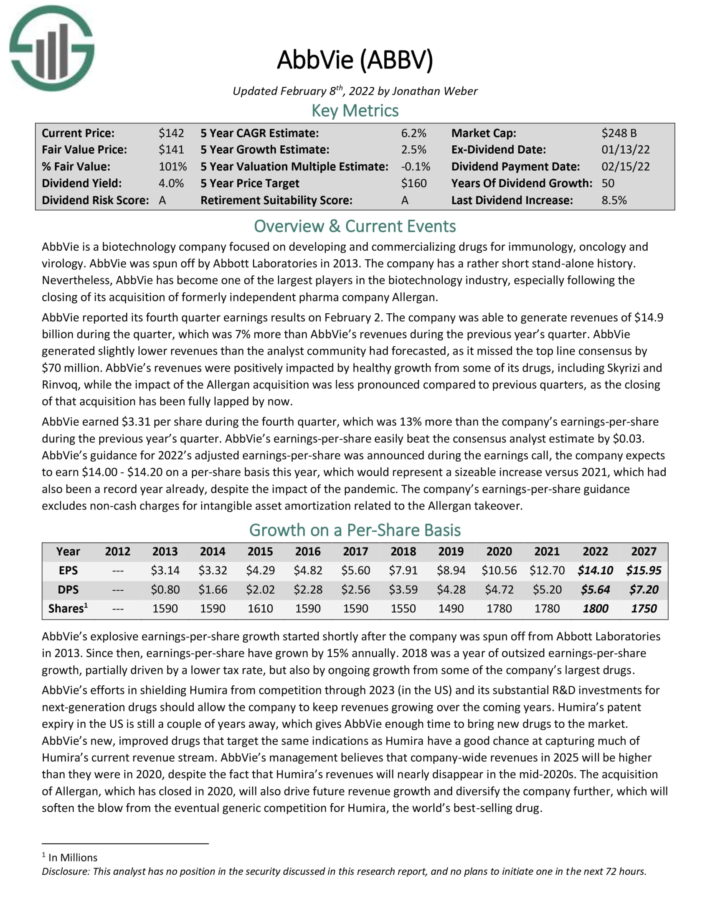

High Yield Dividend Aristocrat #12: AbbVie Inc. (ABBV)

AbbVie Inc. is a pharmaceutical company spun off by Abbott Laboratories (ABT) in 2013. Its most important product is Humira, which is now facing biosimilar competition in Europe, which has had a noticeable impact on the company. Humira will lose patent protection in the U.S. in 2023.

Even so, AbbVie remains a giant in the healthcare sector, with a large and diversified product portfolio.

AbbVie reported its fourth quarter earnings results on February 2. Revenues of $14.9 billion rose 7% from the previous year’s quarter. Revenues were positively impacted by healthy growth from some of its drugs, including Skyrizi and Rinvoq. AbbVie earned $3.31 per share during the fourth quarter, which was up 13% year-over-year.

Click here to download our most recent Sure Analysis report on AbbVie (preview of page 1 of 3 shown below):

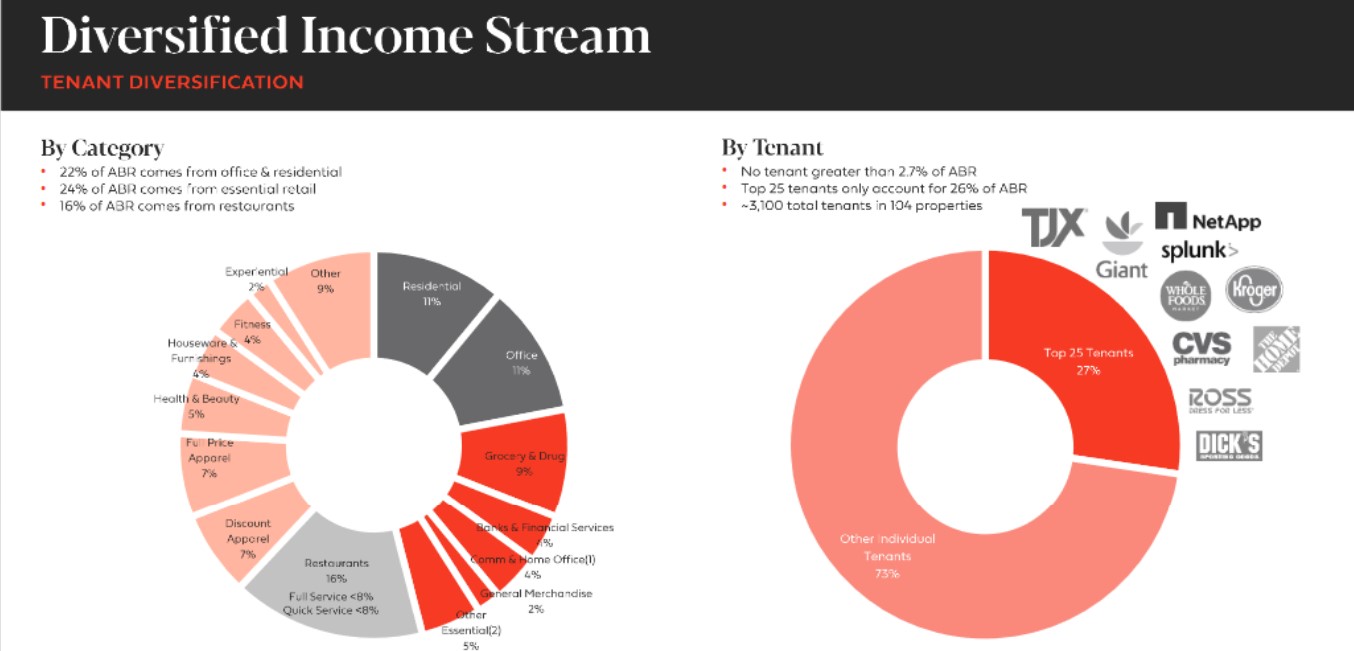

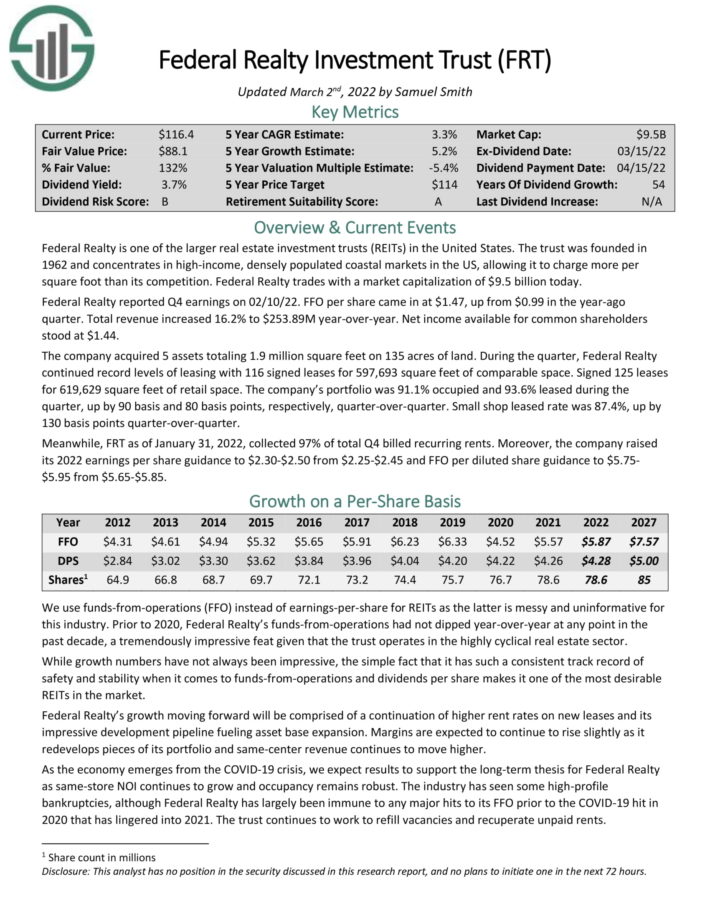

High Yield Dividend Aristocrat #11: Federal Realty Investment Trust (FRT)

Federal Realty was founded in 1962. As a Real Estate Investment Trust, Federal Realty’s business model is to own and rent out real estate properties. It uses a significant portion of its rental income, as well as external financing, to acquire new properties. This helps create a “snow-ball” effect of rising income over time.

Federal Realty primarily owns shopping centers. However, it also operates in redevelopment of multi-purpose properties including retail, apartments, and condominiums. The portfolio is highly diversified in terms of tenant base.

Source: Investor Presentation

Federal Realty reported Q4 earnings on 02/10/22. FFO per share came in at $1.47, up from $0.99 in the year-ago quarter. Total revenue increased 16.2% year–over–year. The company acquired 5 assets totaling 1.9 million square feet on 135 acres of land.

The company’s portfolio was 91.1% occupied and 93.6% leased during the quarter. Meanwhile, FRT as of January 31, 2022, collected 97% of total Q4 billed recurring rents.

Click here to download our most recent Sure Analysis report on Federal Realty (preview of page 1 of 3 shown below):

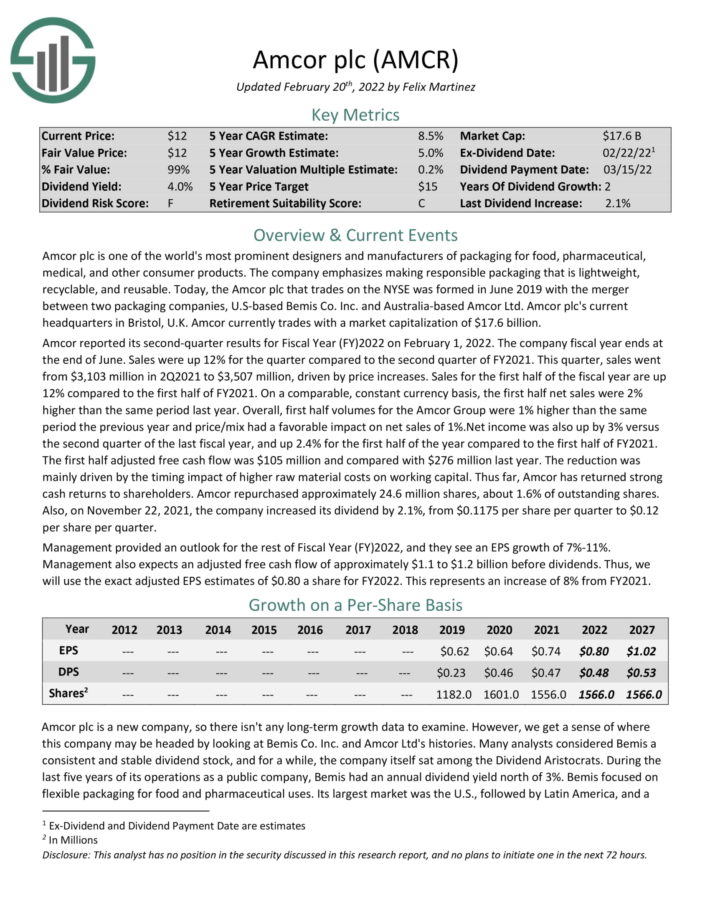

High Yield Dividend Aristocrat #10: Amcor plc (AMCR)

Amcor is one of the world’s most prominent designers and manufacturers of packaging for food, pharmaceutical, medical, and other consumer products. The company is headquartered in the U.K.

Amcor reported its second–quarter results for Fiscal Year 2022 on February 1, 2022. Sales were up 12% for the quarter compared to the second quarter of FY 2021, driven by price increases.

Sales for the first half of the fiscal year are up 12% compared to the first half of FY 2021. On a comparable, constant currency basis, the first half net sales were 2% higher than the same period last year.

Click here to download our most recent Sure Analysis report on Amcor (preview of page 1 of 3 shown below):

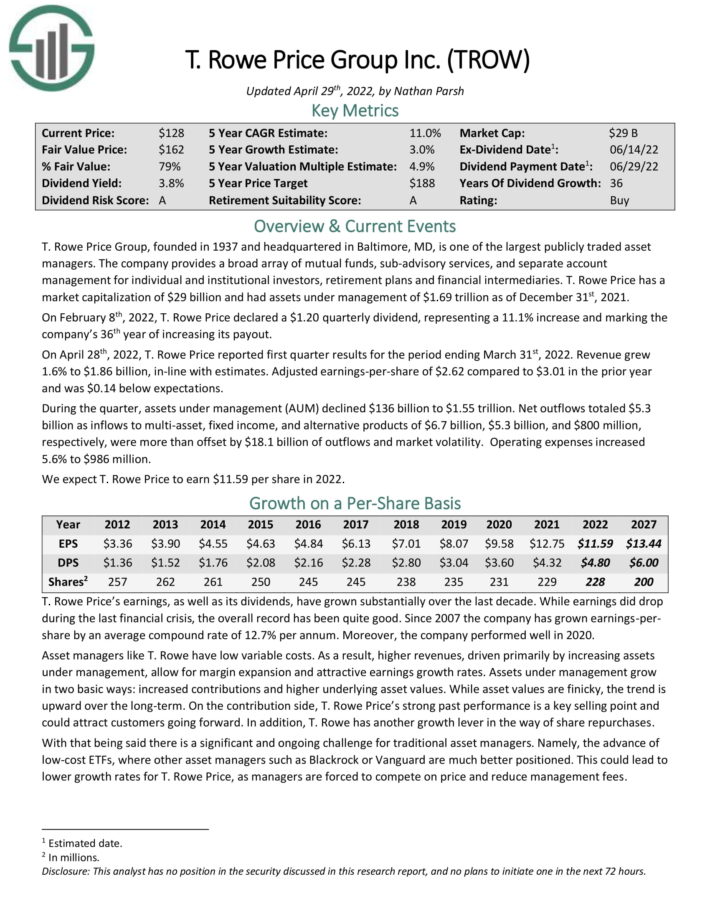

High Yield Dividend Aristocrat #9: T. Rowe Price Group (TROW)

T. Rowe Price Group is one of the largest publicly traded asset managers. The company provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans and financial intermediaries. T. Rowe Price had assets under management of $1.69 trillion as of December 31st, 2021.

On February 9th, 2021, T. Rowe Price declared a $1.08 quarterly dividend, representing a 20.0% increase and marking the company’s 35th year of increasing its payout.

On April 28th, 2022, T. Rowe Price reported first quarter results for the period ending March 31st, 2022. Revenue grew 1.6% to $1.86 billion, in-line with estimates. Adjusted earnings-per-share of $2.62 compared to $3.01 in the prior year and was $0.14 below expectations.

During the quarter, assets under management (AUM) declined $136 billion to $1.55 trillion. Net outflows totaled $5.3 billion as inflows to multi-asset, fixed income, and alternative products of $6.7 billion, $5.3 billion, and $800 million, respectively, were more than offset by $18.1 billion of outflows and market volatility. Operating expenses increased 5.6% to $986 million.

Click here to download our most recent Sure Analysis report on T. Rowe Price (preview of page 1 of 3 shown below):

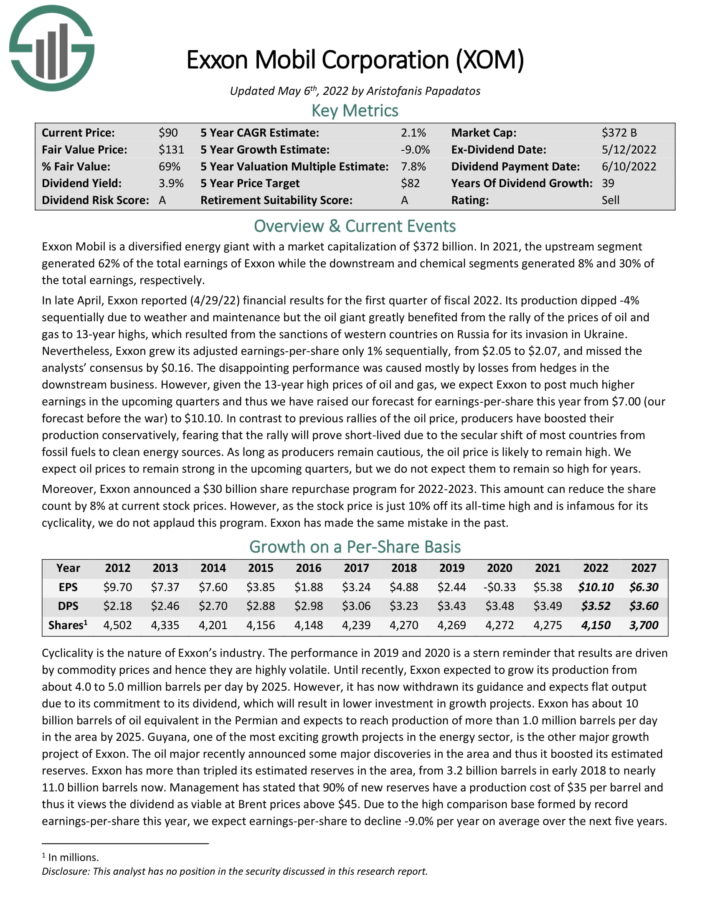

High Yield Dividend Aristocrat #8: ExxonMobil Corporation (XOM)

Exxon Mobil is a diversified energy giant with a market capitalization above $300 billion. In 2021, the upstream segment generated 62% of the total earnings of Exxon while the downstream and chemical segments generated 8% and 30% of the total earnings, respectively.

In late April, Exxon reported (4/29/22) financial results for the first quarter of fiscal 2022. Its production dipped -4% sequentially due to weather and maintenance but the oil giant greatly benefited from the rally of the prices of oil and gas to 13-year highs, which resulted from the sanctions of western countries on Russia for its invasion in Ukraine.

Nevertheless, Exxon grew its adjusted earnings-per-share only 1% sequentially, from $2.05 to $2.07, and missed the analysts’ consensus by $0.16. The disappointing performance was caused mostly by losses from hedges in the downstream business. However, given the 13-year high prices of oil and gas, we expect Exxon to post much higher earnings in the upcoming quarters and thus we have raised our forecast for earnings-per-share this year from $7.00 (our forecast before the war) to $10.10.

Moreover, Exxon announced a $30 billion share repurchase program for 2022-2023.

Click here to download our most recent Sure Analysis report on Exxon Mobil (preview of page 1 of 3 shown below):

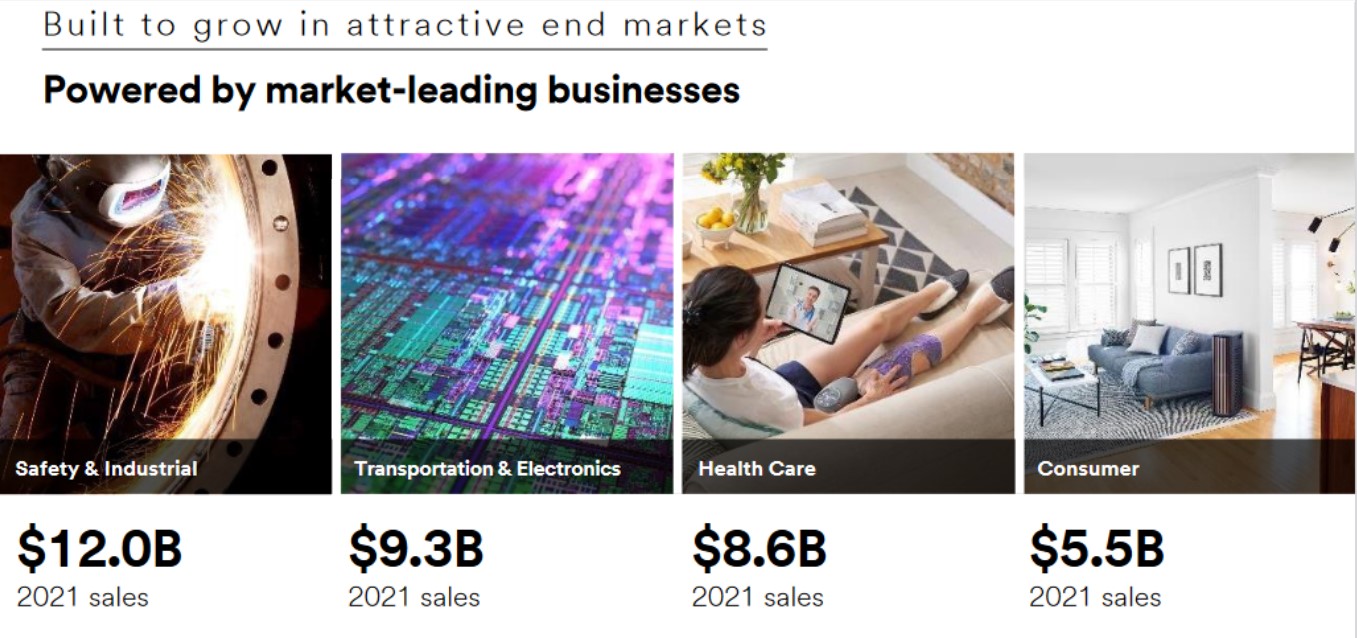

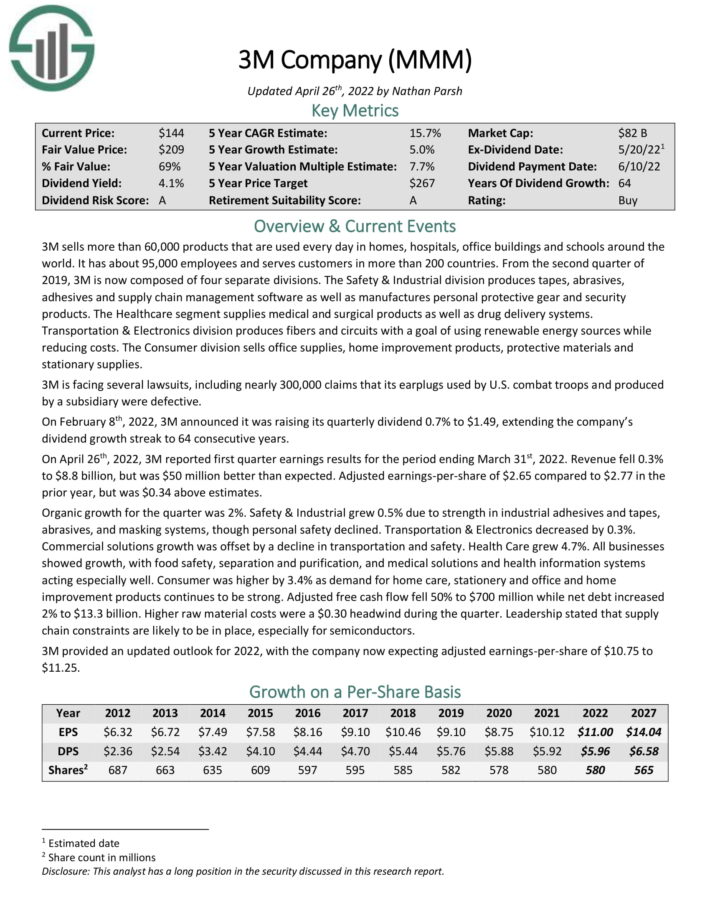

High Yield Dividend Aristocrat #7: 3M Company (MMM)

3M sells more than 60,000 products that are used every day in homes, hospitals, office buildings and schools around the world. It has about 95,000 employees and serves customers in more than 200 countries.

Source: Investor Presentation

3M is now composed of four separate divisions. The Safety & Industrial division produces tapes, abrasives, adhesives and supply chain management software as well as manufactures personal protective gear and security products.

The Healthcare segment supplies medical and surgical products as well as drug delivery systems. Transportation & Electronics division produces fibers and circuits with a goal of using renewable energy sources while reducing costs. The Consumer division sells office supplies, home improvement products, protective materials and stationary supplies.

On April 26th, 2022, 3M reported first quarter earnings results for the period ending March 31st, 2022. Revenue fell 0.3% to $8.8 billion, but was $50 million better than expected. Adjusted earnings-per-share of $2.65 compared to $2.77 in the prior year, but was $0.34 above estimates. Organic growth for the quarter was 2%.

Safety & Industrial grew 0.5% due to strength in industrial adhesives and tapes, abrasives, and masking systems, though personal safety declined. Transportation & Electronics decreased by 0.3%. Commercial solutions growth was offset by a decline in transportation and safety. Health Care grew 4.7%. Consumer was higher by 3.4% as demand for home care, stationery and office and home improvement products continues to be strong.

3M provided an updated outlook for 2022, with the company now expecting adjusted earnings-per-share of $10.75 to $11.25.

Click here to download our most recent Sure Analysis report on 3M (preview of page 1 of 3 shown below):

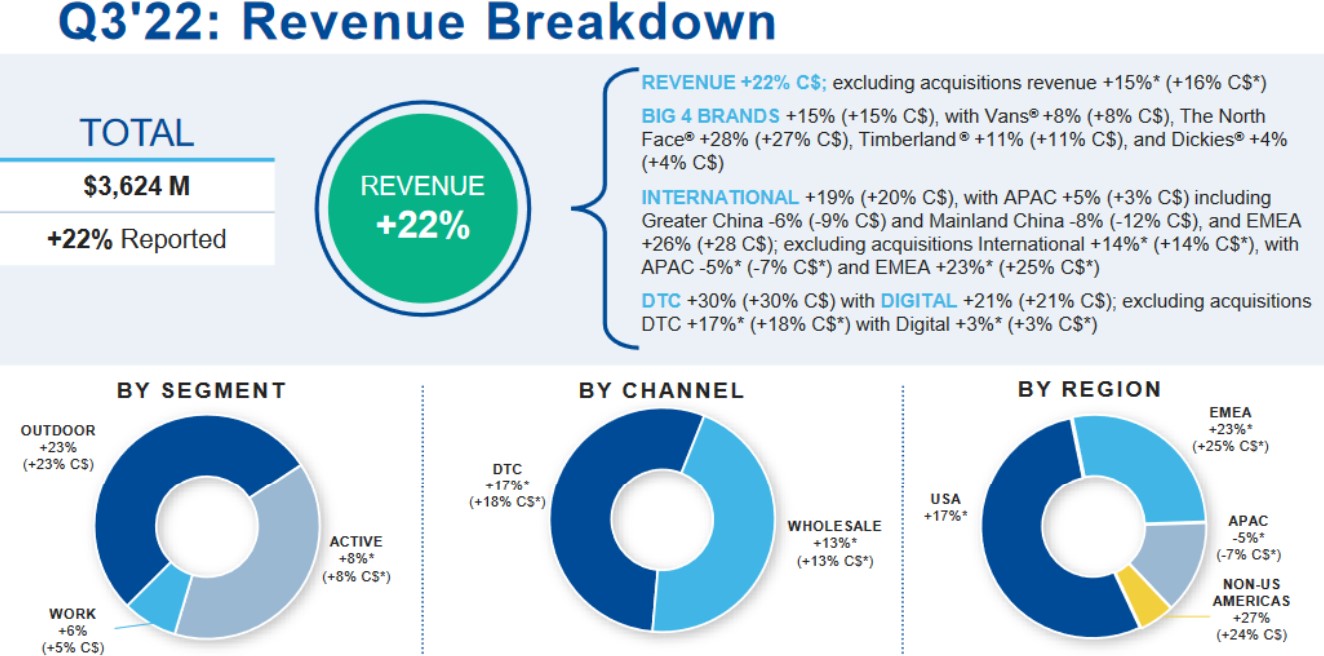

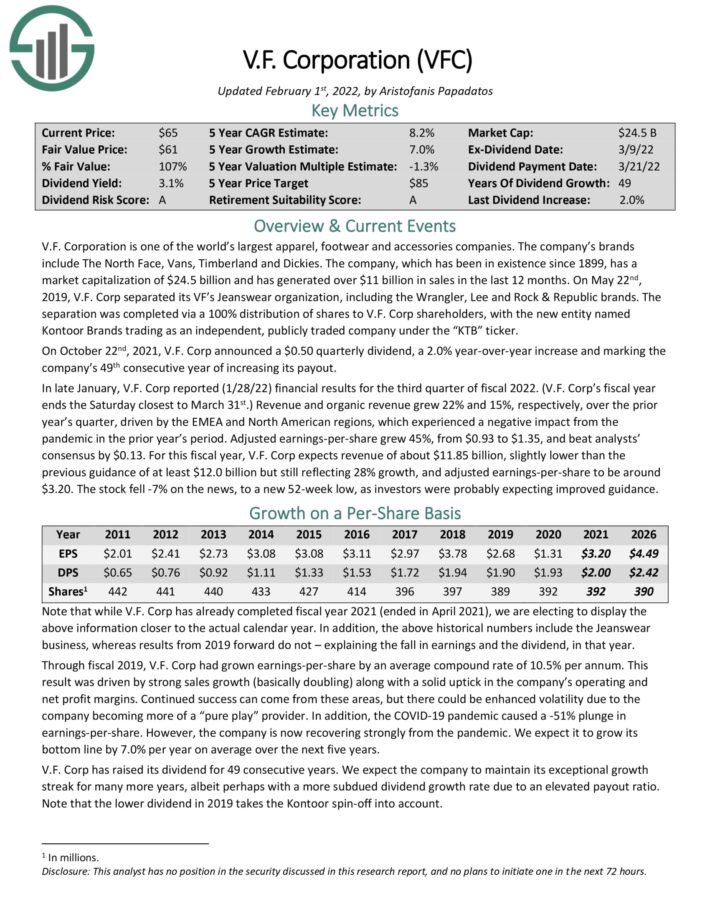

High Yield Dividend Aristocrat #6: V.F. Corp. (VFC)

V.F. Corporation is one of the world’s largest apparel, footwear and accessories companies. The company’s brands include The North Face, Vans, Timberland and Dickies. The company, which has been in existence since 1899, generated over $11 billion in sales in the last 12 months.

In late January, V.F. Corp reported (1/28/22) financial results for the third quarter of fiscal 2022. Revenue and organic revenue grew 22% and 15%, respectively, over the prior year’s quarter, driven by the EMEA and North American regions, which experienced a negative impact from the pandemic in the prior year’s period.

Source: Investor Presentation

Adjusted EPS grew 45%, from $0.93 to $1.35, and beat analysts’ consensus by $0.13.

For this fiscal year, V.F. Corp expects revenue of about $11.85 billion, slightly lower than the previous guidance of at least $12.0 billion but still reflecting 28% growth, and adjusted EPS to be around $3.20.

Click here to download our most recent Sure Analysis report on V.F. Corp. (preview of page 1 of 3 shown below):

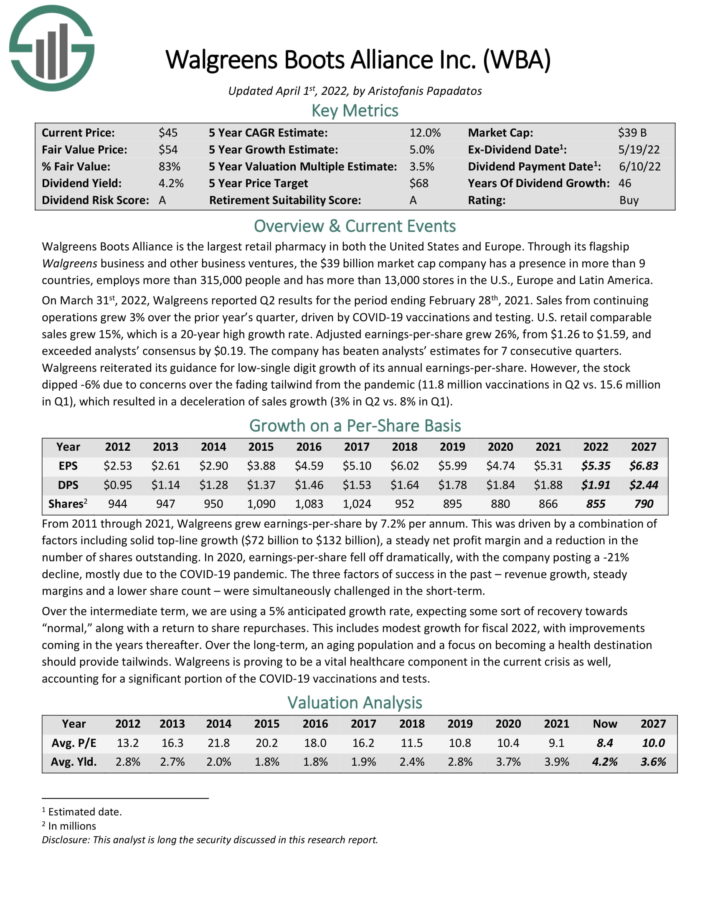

High Yield Dividend Aristocrat #5: Walgreens-Boots Alliance (WBA)

Walgreens Boots Alliance is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures, the company employs more than 325,000 people and has more than 13,000 stores.

On March 31st, 2022, Walgreens reported Q2 results for the period ending February 28th, 2021. Sales from continuing operations grew 3% over the prior year’s quarter, driven by COVID-19 vaccinations and testing. U.S. retail comparable sales grew 15%, which is a 20-year high growth rate. Adjusted earnings-per-share grew 26%, from $1.26 to $1.59, and exceeded analysts’ consensus by $0.19. The company has beaten analysts’ estimates for 7 consecutive quarters.

Walgreens reiterated its guidance for low-single digit growth of its annual earnings-per-share.

Click here to download our most recent Sure Analysis report on Walgreens (preview of page 1 of 3 shown below):

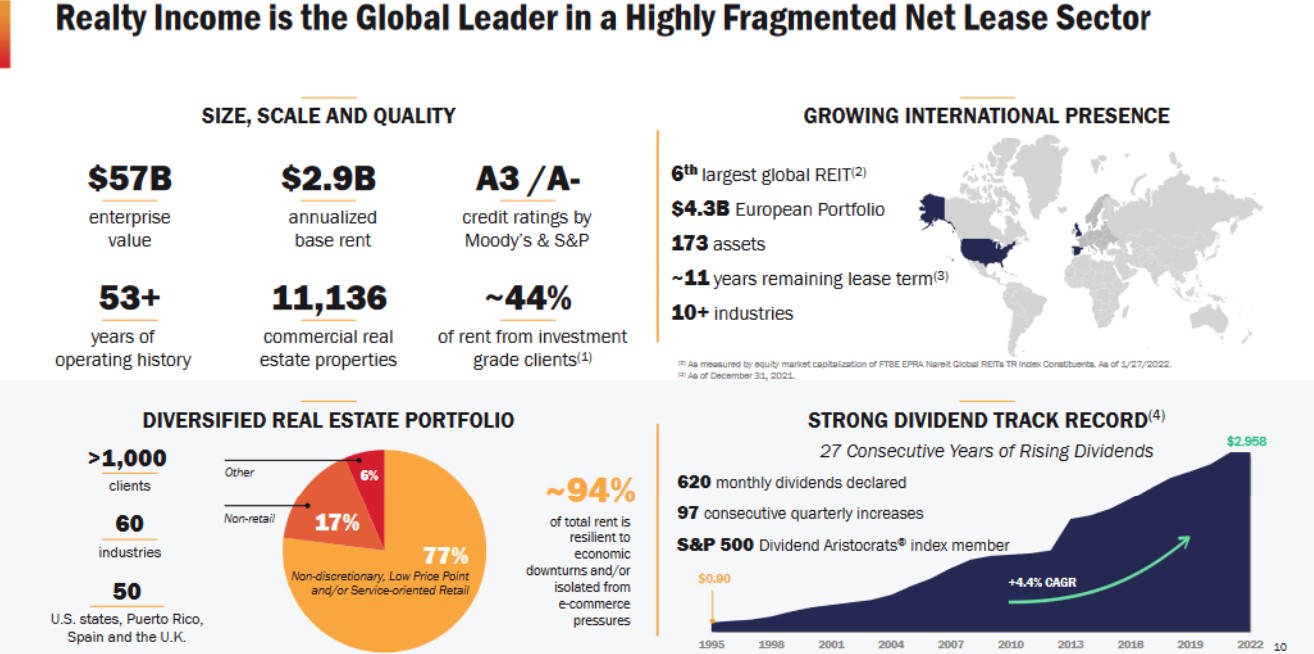

High Yield Dividend Aristocrat #4: Realty Income (O)

Realty Income is a retail-focused REIT that owns more than 6,500 properties. It owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties.

This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

Source: Investor Presentation

The company’s long history of dividend payments and increases is due to its high-quality business model and diversified property portfolio.

Realty Income announced its fourth quarter earnings results on February 22. Revenues of $685 million during the quarter rose 64% from the previous year’s quarter. Investments in new properties and its acquisition of VEREIT accounted for most of the growth. Funds from operation rose substantially versus the prior year’s quarter, although AFFO-per-share growth was lower, due to share issuance.

Click here to download our most recent Sure Analysis report on Realty Income (preview of page 1 of 3 shown below):

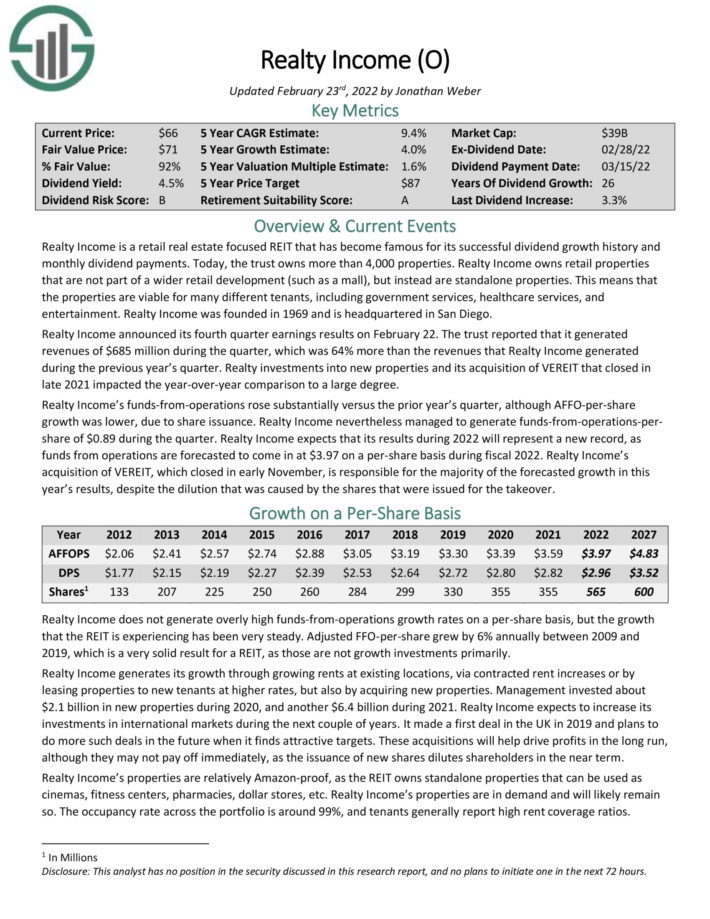

High Yield Dividend Aristocrat #3: Leggett & Platt (LEG)

Leggett & Platt is an engineered products manufacturer. The company’s products include furniture, bedding components, store fixtures, die castings, and industrial products. Leggett & Platt has 14 business units and more than 20,000 employees. The company qualifies for the Dividend Kings as it has 50 years of consecutive dividend increases.

Leggett & Platt reported its fourth quarter earnings results on February 7th. The company reported revenues of $1.33 billion for the quarter, which represents a 13% increase compared to the prior year’s quarter. EPS of $0.77 during the fourth quarter was $0.02 lower than the previous year’s third quarter.

Management has introduced its revenue guidance for the current fiscal year. The company is forecasting revenues of $5.3 billion to $5.6 billion, implying growth of 4% to 10%. The EPS guidance range has been set at $2.70 to $3.00 for 2022.

Click here to download our most recent Sure Analysis report on Leggett & Platt (preview of page 1 of 3 shown below):

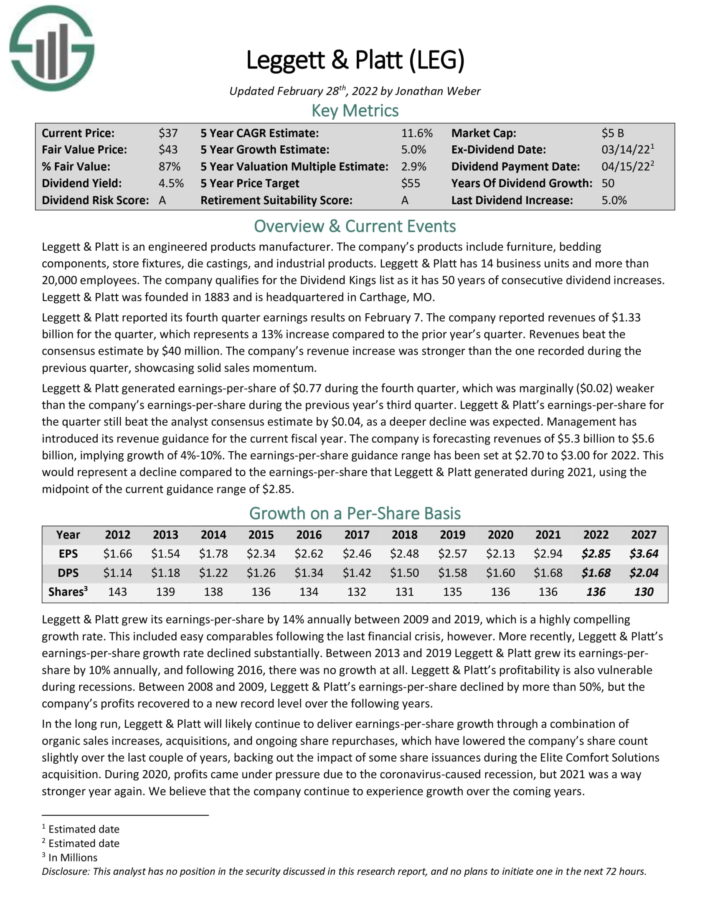

High Yield Dividend Aristocrat #2: Franklin Resources (BEN)

Franklin Resources is a global asset manager with a long and successful history. The company offers investment management (which makes up the bulk of fees the company collects) and related services to its customers, including sales, distribution, and shareholder servicing.

On December 14th, 2021, Franklin Resources announced a $0.29 quarterly dividend, marking a 3.6% year-over-year increase and the company’s 42nd consecutive year of increasing its payment.

On February 1st, 2022, Franklin Resources reported Q1 fiscal year 2022 results for the period ending December 31st, 2021. (Franklin Resources’ fiscal year ends September 30th.)

Total assets under management equaled $1.578 trillion, up $48.0 billion compared to last quarter, as a result of $24.1 billion in long-term net inflows, $10.4 billion of positive market change, and other items. For the quarter, operating revenue totaled $2.224 billion.

This represents 0.143% of average AUM or ~57 basis points annualized. On an adjusted basis, net income equaled $553.6 million or $1.08 per share compared to $644.6 million or $1.26 per share in Q1 2021.

Click here to download our most recent Sure Analysis report on Franklin Resources (preview of page 1 of 3 shown below):

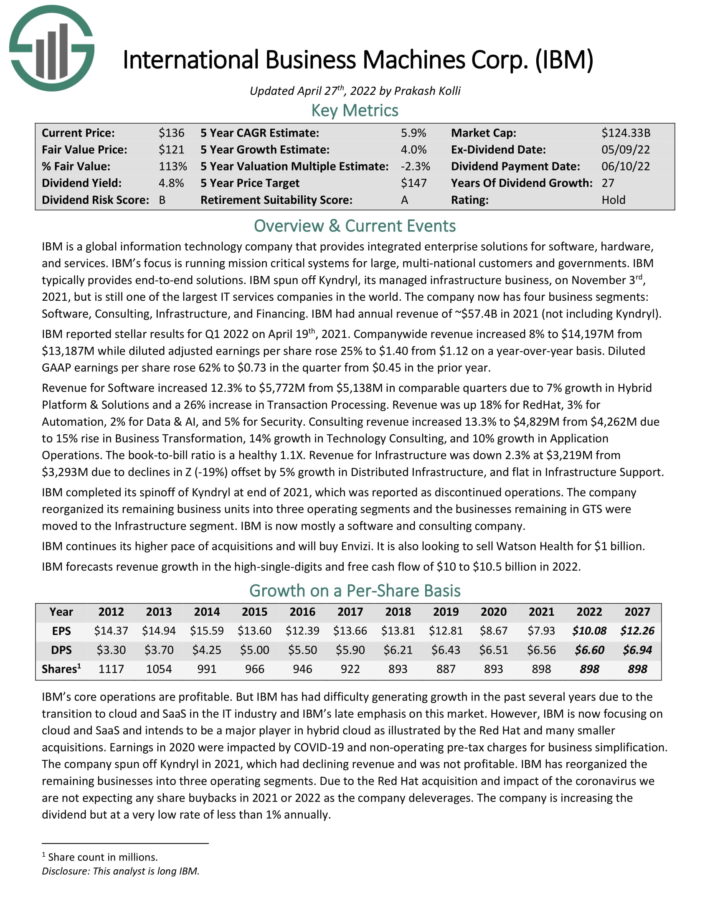

High Yield Dividend Aristocrat #1: International Business Machines (IBM)

IBM is the highest-yielding Dividend Aristocrat.

IBM is a global information technology company that provides integrated enterprise solutions for software, hardware, and services. IBM’s focus is running mission critical systems for large, multi-national customers and governments. IBM typically provides end-to-end solutions.

The company now has four business segments: Software, Consulting, Infrastructure, and Financing. IBM had annual revenue of ~$57.4B in 2021 (not including Kyndryl).

IBM reported stellar results for Q1 2022 on April 19th, 2021. Company-wide revenue increased 8% to $14,197M from $13,187M while diluted adjusted earnings per share rose 25% to $1.40 from $1.12 on a year-over-year basis. Diluted GAAP earnings per share rose 62% to $0.73 in the quarter from $0.45 in the prior year.

Revenue for Software increased 12.3% to $5,772M from $5,138M in comparable quarters due to 7% growth in Hybrid Platform & Solutions and a 26% increase in Transaction Processing. Revenue was up 18% for RedHat, 3% for Automation, 2% for Data & AI, and 5% for Security. Consulting revenue increased 13.3% to $4,829M from $4,262M due to 15% rise in Business Transformation, 14% growth in Technology Consulting, and 10% growth in Application Operations.

The book-to-bill ratio is a healthy 1.1X. Revenue for Infrastructure was down 2.3% at $3,219M from $3,293M due to declines in Z (-19%) offset by 5% growth in Distributed Infrastructure, and flat in Infrastructure Support.

Click here to download our most recent Sure Analysis report on IBM (preview of page 1 of 3 shown below):

Final Thoughts

High dividend yields are hard to find in today’s investing climate. The average dividend yield of the S&P 500 Index has steadily fallen over the past decade, and is now just 1.4%.

Investors can find significantly higher yields, but many extreme high-yield stocks have questionable business fundamentals. Investors should be wary of stocks with yields above 10%.

Fortunately, investors do not have to sacrifice quality in the search for yield. These 20 Dividend Aristocrats have market-beating dividend yields. But they also have high-quality business models, durable competitive advantages, and long-term growth potential.

You may also be looking to invest in dividend growth stocks with high probabilities of continuing to raise their dividends each year into the future.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].