Revealed on July twenty ninth, 2025 by Bob Ciura

Earnings traders keen to look exterior the U.S. ought to take into account worldwide dividend shares.

Including worldwide dividend shares brings geographical diversification. As well as, many worldwide dividend shares are providing greater yields, and decrease valuations, than their U.S.-based friends.

After all, there are dangers to buying worldwide shares, similar to forex danger. Nonetheless, there are various high quality worldwide shares which have elevated their dividends a few years.

We take into account shares which have elevated their dividends for over 10 consecutive years to be blue-chip shares.

You may obtain our full record of over 500 blue-chip shares by clicking on the hyperlink under:

This text will focus on the highest 10 worldwide dividend shares. All of the shares on the record have elevated their dividends for at the very least 10 years.

Moreover, they’ve Dividend Threat Scores of ‘C’ or higher within the Certain Evaluation Analysis Database, signifying they’ve safe payouts.

Consequently, these 10 worldwide dividend development shares could possibly be engaging for dividend development traders, in search of worldwide diversification.

Desk of Contents

The desk of contents under permits for straightforward navigation. The shares are listed by 5-year annual anticipated returns, in ascending order.

Worldwide Dividend Inventory #10: Canadian Nationwide Railway (CNI)

- Annual Anticipated Returns: 10.2%

Canadian Nationwide Railway is the most important railway operator in Canada. The corporate has a community of roughly 20,000 route miles and connects three coasts: the Atlantic, the Pacific and the Gulf of Mexico.

It handles over $200 billion price of products yearly and carries over 300 million tons of cargo.

On Might 1st, 2025, Canadian Nationwide Railway reported first quarter outcomes. For the quarter, income grew 2.3% to $3.18 billion, which was $25 million greater than anticipated.

Adjusted earnings-per share of $1.40 in contrast favorably to $1.26 within the prior 12 months and was $0.12 above estimates.

For the quarter, Canadian Nationwide Railway’s working ratio improved 20 foundation factors to 63.4%. Income ton miles improved 1% from the prior 12 months whereas carloads declined 2.2%.

Income outcomes had been blended for many of the firm’s particular person product classes. Utilizing fixed forex, Coal (+9%), Grain and Fertilizers (+7%), and Petroleum and Chemical substances (+3%) had been all greater for the interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on CNI (preview of web page 1 of three proven under):

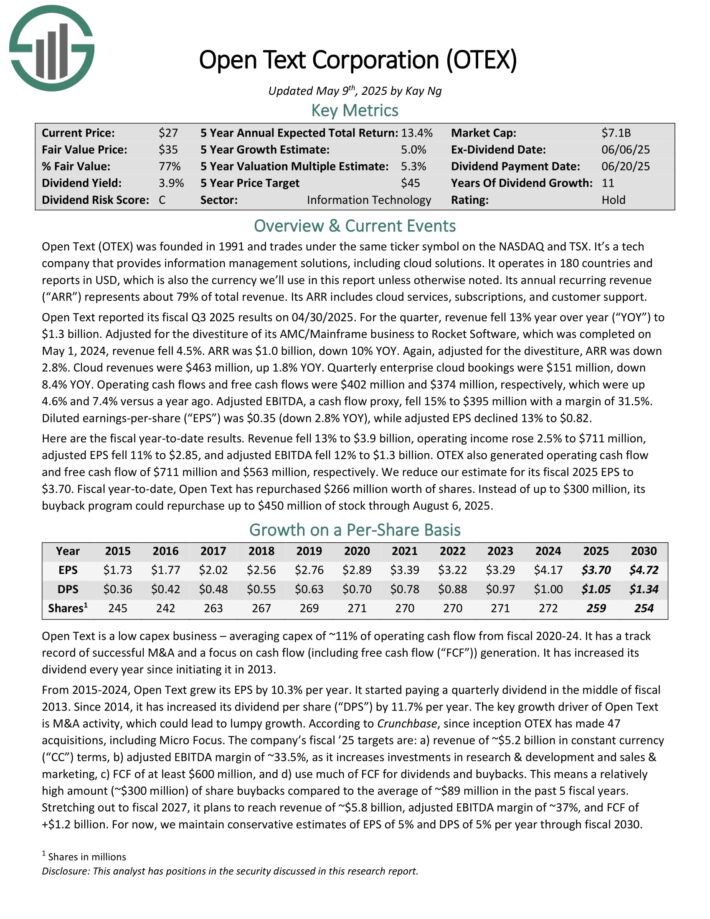

Worldwide Dividend Inventory #9: Open Textual content Corp. (OTEX)

- Annual Anticipated Returns: 11.0%

Open Textual content was based in 1991. It offers info administration options, together with cloud options. It operates in 180 international locations and its annual recurring income (“ARR”) represents about 79% of complete income.

Its ARR contains cloud providers, subscriptions, and buyer assist. Open Textual content reported its fiscal Q3 2025 outcomes on 04/30/2025. For the quarter, income fell 13% year-over-year to $1.3 billion. Adjusted for the divestiture of its AMC/Mainframe enterprise to Rocket Software program, which was accomplished on Might 1, 2024, income fell 4.5%.

ARR was $1.0 billion, down 10% year-over-year. Once more, adjusted for the divestiture, ARR was down 2.8%. Cloud revenues had been $463 million, up 1.8% year-over-year.

Working money flows and free money flows had been $402 million and $374 million, respectively, which had been up 4.6% and seven.4% versus a 12 months in the past. Adjusted EBITDA, a money movement proxy, fell 15% to $395 million with a margin of 31.5%.

OTEX additionally generated working money movement and free money movement of $711 million and $563 million, respectively.

Click on right here to obtain our most up-to-date Certain Evaluation report on OTEX (preview of web page 1 of three proven under):

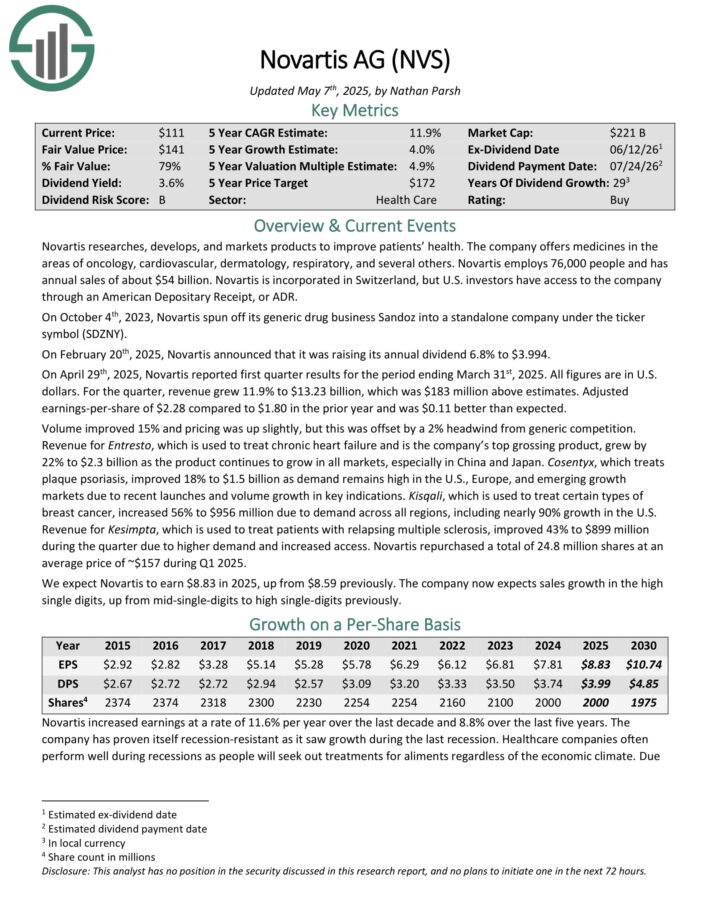

Worldwide Dividend Inventory #8: Novartis AG (NVS)

- Annual Anticipated Returns: 11.3%

Novartis researches, develops, and markets merchandise to enhance sufferers’ well being. The corporate presents medicines within the areas of oncology, cardiovascular, dermatology, respiratory, and several other others. Novartis employs 76,000 individuals and has annual gross sales of about $54 billion.

Novartis is integrated in Switzerland, however U.S. traders have entry to the corporate by means of an American Depositary Receipt, or ADR.

On April twenty ninth, 2025, Novartis reported first quarter outcomes. All figures are in U.S. {dollars}. For the quarter, income grew 11.9% to $13.23 billion, which was $183 million above estimates. Adjusted earnings-per-share of $2.28 in comparison with $1.80 within the prior 12 months and was $0.11 higher than anticipated.

Quantity improved 15% and pricing was up barely, however this was offset by a 2% headwind from generic competitors. Income for Entresto, which is used to deal with persistent coronary heart failure and is the corporate’s prime grossing product, grew by 22% to $2.3 billion because the product continues to develop in all markets, particularly in China and Japan.

Cosentyx, which treats plaque psoriasis, improved 18% to $1.5 billion as demand stays excessive within the U.S., Europe, and rising development markets resulting from current launches and quantity development in key indications.

Click on right here to obtain our most up-to-date Certain Evaluation report on NVS (preview of web page 1 of three proven under):

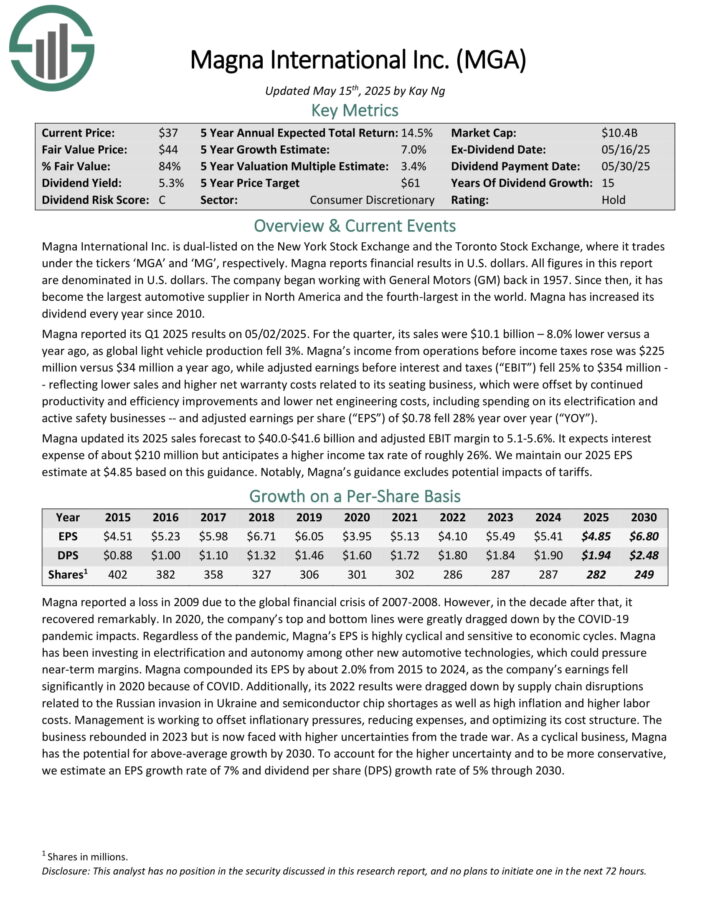

Worldwide Dividend Inventory #7: Magna Worldwide (MGA)

- Annual Anticipated Returns: 11.4%

Magna Worldwide Inc. is dual-listed on the New York Inventory Trade and the Toronto Inventory Trade, the place it trades underneath the tickers ‘MGA’ and ‘MG’, respectively.

It has change into the most important automotive provider in North America and the fourth-largest on the planet. Magna has elevated its dividend yearly since 2010.

Magna reported its Q1 2025 outcomes on 05/02/2025. For the quarter, its gross sales had been $10.1 billion – 8.0% decrease versus a 12 months in the past, as world gentle car manufacturing fell 3%. Magna’s revenue from operations earlier than revenue taxes rose was $225 million versus $34 million a 12 months in the past.

Adjusted earnings earlier than curiosity and taxes (“EBIT”) fell 25% to $354 million — reflecting decrease gross sales and better web guarantee prices associated to its seating enterprise, which had been offset by continued productiveness and effectivity enhancements and decrease web engineering prices, together with spending on its electrification and lively security companies.

Adjusted earnings per share of $0.78 fell 28% year-over-year. Magna up to date its 2025 gross sales forecast to $40.0-$41.6 billion and adjusted EBIT margin to five.1-5.6%.

Click on right here to obtain our most up-to-date Certain Evaluation report on MGA (preview of web page 1 of three proven under):

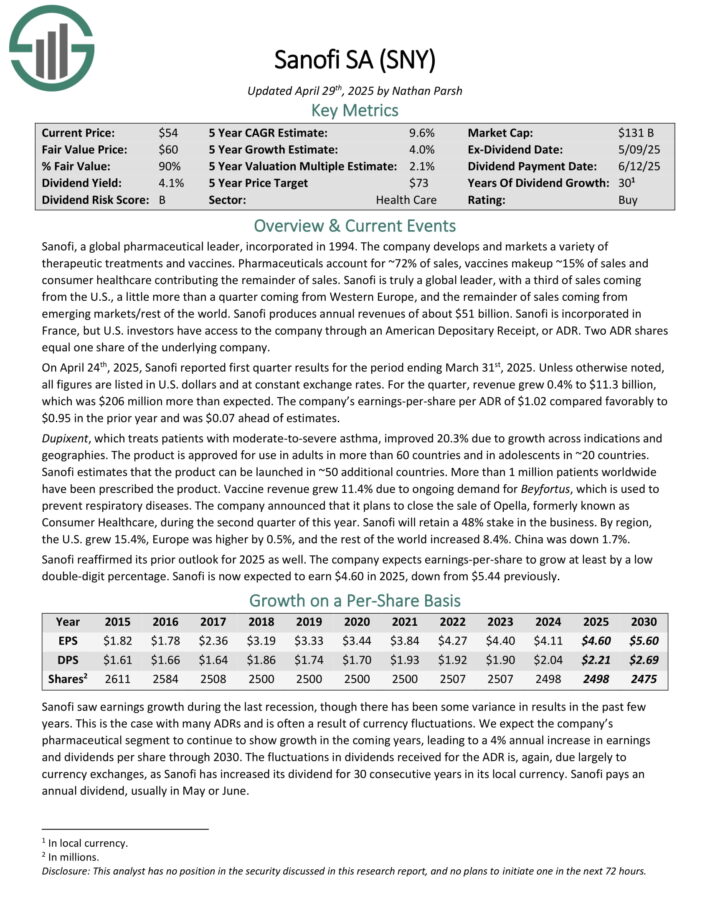

Worldwide Dividend Inventory #6: Sanofi (SNY)

- Annual Anticipated Returns: 11.6%

Sanofi is a worldwide pharmaceutical firm that develops and markets a wide range of therapeutic remedies and vaccines. Prescription drugs account for ~72% of gross sales, vaccines make-up ~15% of gross sales and client healthcare contributing the rest of gross sales.

Sanofi produces annual revenues of about $51 billion. It’s integrated in France, however U.S. traders have entry to the corporate by means of an American Depositary Receipt, or ADR. Two ADR shares equal one share of the underlying firm.

On April twenty fourth, 2025, Sanofi reported first quarter outcomes for the interval ending March thirty first, 2025. Except in any other case famous, all figures are listed in U.S. {dollars} and at fixed alternate charges.

For the quarter, income grew 0.4% to $11.3 billion, which was $206 million greater than anticipated. The corporate’s earnings-per-share per ADR of $1.02 in contrast favorably to $0.95 within the prior 12 months and was $0.07 forward of estimates.

Dupixent, which treats sufferers with moderate-to-severe bronchial asthma, improved 20.3% resulting from development throughout indications and geographies. The product is authorized to be used in adults in additional than 60 international locations and in adolescents in ~20 international locations. Sanofi estimates that the product may be launched in ~50 further international locations.

Vaccine income grew 11.4% resulting from ongoing demand for Beyfortus, which is used to stop respiratory illnesses.

Click on right here to obtain our most up-to-date Certain Evaluation report on SNY (preview of web page 1 of three proven under):

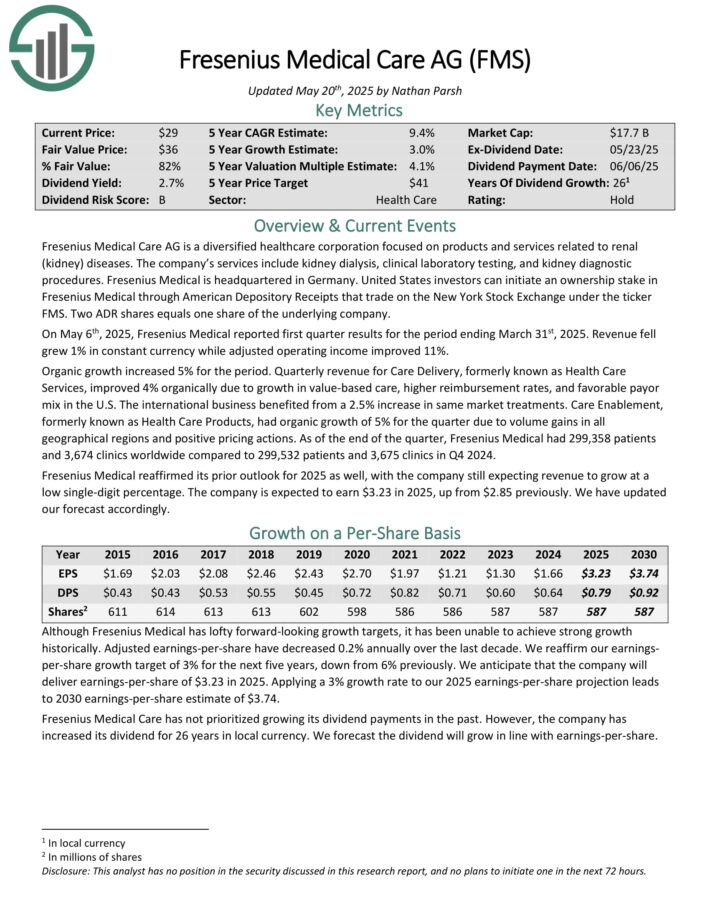

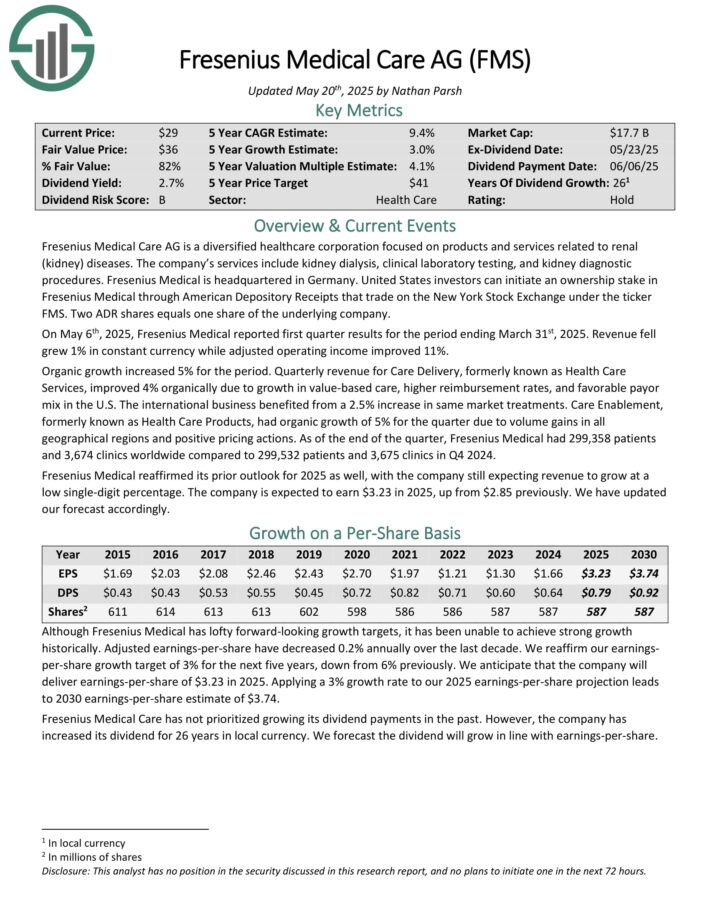

Worldwide Dividend Inventory #5: Fresenius-Medical Care AG (FMS)

- Annual Anticipated Returns: 12.3%

Fresenius Medical Care AG is a diversified healthcare company targeted on services and products associated to renal (kidney) illnesses.

The corporate’s providers embrace kidney dialysis, medical laboratory testing, and kidney diagnostic procedures. Fresenius Medical is headquartered in Germany.

On Might sixth, 2025, Fresenius Medical reported first quarter outcomes for the interval ending March thirty first, 2025. Income fell grew 1% in fixed forex whereas adjusted working revenue improved 11%.

Natural development elevated 5% for the interval. Quarterly income for Care Supply, previously often known as Well being Care Providers, improved 4% organically resulting from development in value-based care, greater reimbursement charges, and favorable payor combine within the U.S. The worldwide enterprise benefited from a 2.5% enhance in identical market remedies.

Care Enablement, previously often known as Well being Care Merchandise, had natural development of 5% for the quarter resulting from quantity features in all geographical areas and optimistic pricing actions.

Fresenius Medical reaffirmed its prior outlook for 2025 as effectively, with the corporate nonetheless anticipating income to develop at a low single-digit proportion. The corporate is predicted to earn $3.23 in 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on FMS (preview of web page 1 of three proven under):

Worldwide Dividend Inventory #4: TFI Worldwide (TFII)

- Annual Anticipated Returns: 12.6%

TFI Worldwide Inc. is a number one North American transportation and logistics firm. The Canada-based firm’s 95-plus working corporations and over 26,000 workers present a wide range of transportation and logistics providers to prospects.

TFII’s prospects function principally within the retail, manufactured items, automotive, constructing supplies, meals and beverage, metals and mining, and providers industries.

Roughly two-thirds of the corporate’s income is generated within the U.S., with the remaining third of income being derived in Canada.

TFII is organized into the next three working segments. The Much less-Than-Truckload phase offers over-the-road and asset-light intermodal LTL providers. Via the primary half of 2025, LTL accounted for the plurality (~41%) of the corporate’s $3.5 billion in complete income earlier than gas surcharges.

The Truckload phase presents flatbed, tank, and container providers to prospects. The phase additionally carries full masses from the shopper to the vacation spot utilizing a closed van or specialised gear.

Lastly, the Logistics phase offers asset-light logistics providers, similar to freight forwarding, transportation administration, and small package deal parcel supply.

On July twenty eighth, TFII shared its earnings report for the second quarter ended June thirtieth, 2025. The corporate’s complete income decreased by 10% over the year-ago interval to $2.04 billion within the quarter. This was resulting from decreased volumes stemming from weaker end-market demand throughout the quarter.

TFII’s adjusted diluted EPS dropped by 21.6% year-over-year to $1.34 for the quarter. That beat the analyst consensus by $0.11 per share.

Click on right here to obtain our most up-to-date Certain Evaluation report on TFII (preview of web page 1 of three proven under):

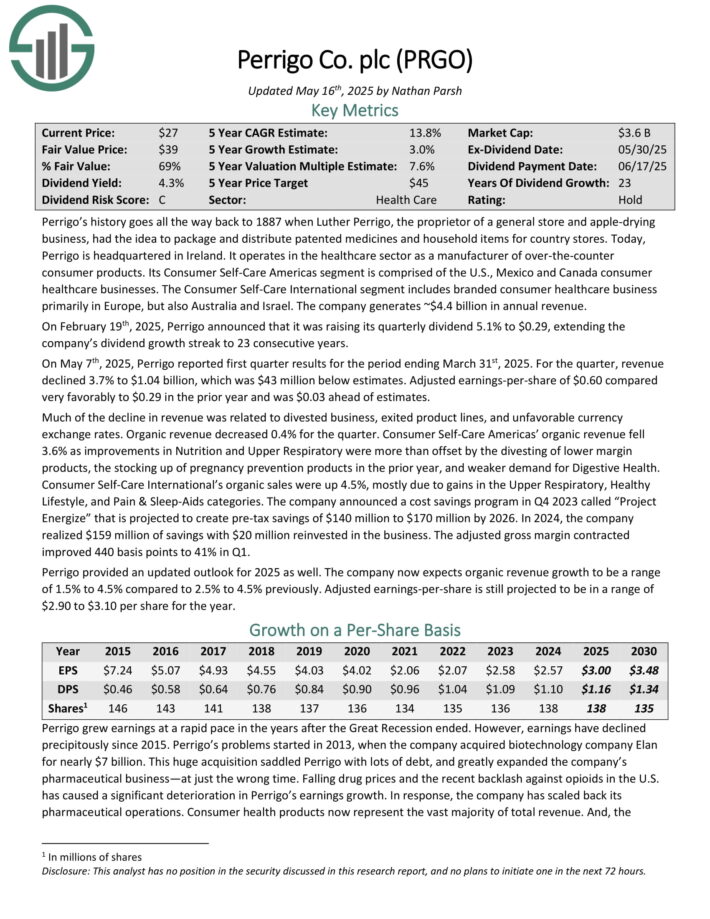

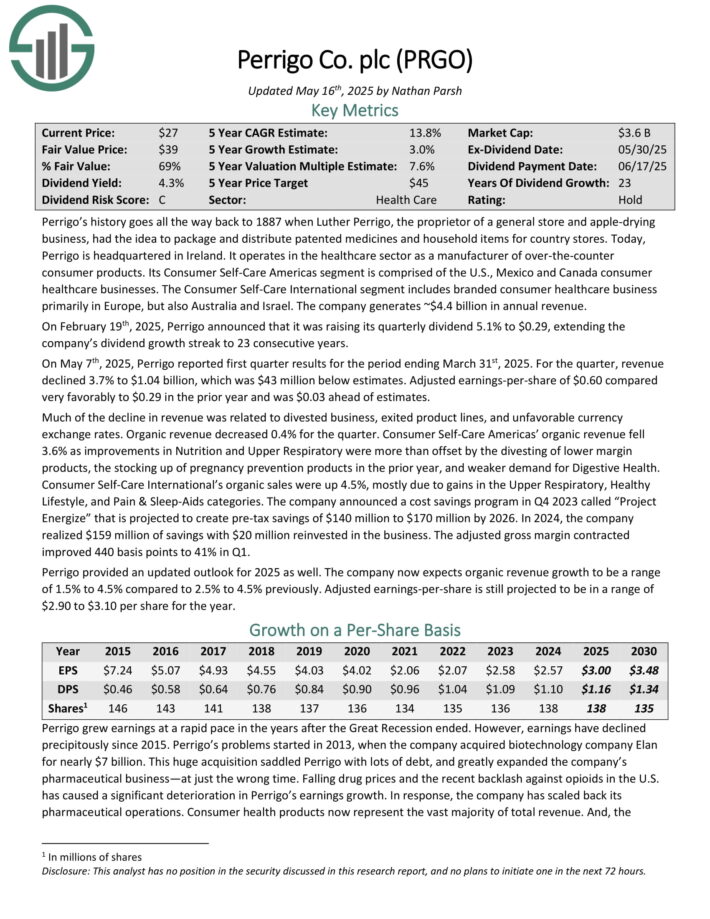

Worldwide Dividend Inventory #3: Perrigo Firm plc (PRGO)

- Annual Anticipated Returns: 12.9%

Perrigo operates within the healthcare sector as a producer of over-the-counter client merchandise. Its Client Self-Care Americas phase is comprised of the U.S., Mexico and Canada client healthcare companies.

The Client Self-Care Worldwide phase contains branded client healthcare enterprise primarily in Europe, but additionally Australia and Israel. The corporate generates ~$4.4 billion in annual income.

On Might seventh, 2025, Perrigo reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income declined 3.7% to $1.04 billion, which was $43 million under estimates. Adjusted earnings-per-share of $0.60 in contrast very favorably to $0.29 within the prior 12 months and was $0.03 forward of estimates.

A lot of the decline in income was associated to divested enterprise, exited product strains, and unfavorable forex alternate charges. Natural income decreased 0.4% for the quarter.

Client Self-Care Americas’ natural income fell 3.6% as enhancements in Vitamin and Higher Respiratory had been greater than offset by the divesting of decrease margin merchandise, the stocking up of being pregnant prevention merchandise within the prior 12 months, and weaker demand for Digestive Well being.

Click on right here to obtain our most up-to-date Certain Evaluation report on PRGO (preview of web page 1 of three proven under):

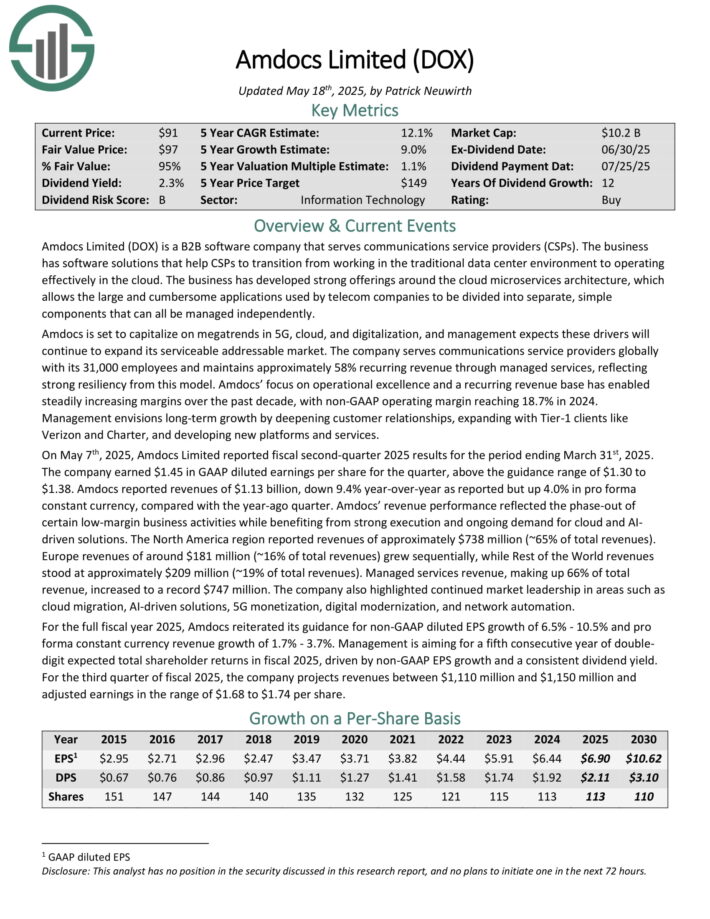

Worldwide Dividend Inventory #2: Amdocs Ltd. (DOX)

- Annual Anticipated Returns: 13.3%

Amdocs Restricted is a B2B software program firm that serves communications service suppliers (CSPs). Its software program options that assist CSPs to transition from working within the conventional knowledge heart surroundings to working successfully within the cloud.

The enterprise has developed sturdy choices across the cloud microservices structure, which permits the massive and cumbersome functions utilized by telecom corporations to be divided into separate, easy elements that may all be managed independently.

Amdocs is ready to capitalize on megatrends in 5G, cloud, and digitalization, and administration expects these drivers will proceed to increase its serviceable addressable market.

The corporate serves communications service suppliers globally with its 31,000 workers and maintains roughly 58% recurring income by means of managed providers.

Administration envisions long-term development by deepening buyer relationships, increasing with Tier-1 shoppers like Verizon and Constitution, and creating new platforms and providers.

On Might seventh, 2025, Amdocs Restricted reported fiscal second-quarter 2025 outcomes for the interval ending March thirty first, 2025.

The corporate earned $1.45 in GAAP diluted earnings per share for the quarter, above the steerage vary of $1.30 to $1.38. Amdocs reported revenues of $1.13 billion, down 9.4% year-over-year as reported however up 4.0% in professional forma fixed forex, in contrast with the year-ago quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on DOX (preview of web page 1 of three proven under):

Worldwide Dividend Inventory #1: Novo Nordisk (NVO)

- Annual Anticipated Returns: 18.4%

Novo Nordisk A/S ADR is a big world pharmaceutical firm headquartered in Denmark. The corporate focuses on two core enterprise segments: Diabetes & Weight problems Care and Uncommon Illnesses.

The Diabetes & Weight problems Care phase manufactures insulin, associated supply methods, oral anti-diabetic merchandise, and merchandise to deal with weight problems. The Uncommon Illnesses phase manufactures merchandise for hemophilia and different persistent illnesses. Novo Nordisk derives ~92% of income from diabetes and weight problems.

Novo Nordisk reported glorious Q1 2025 outcomes on Might seventh, 2025. Firm-wide gross sales had been up 19% in Danish kroner to and diluted earnings per share (“EPS”) rose 15% on a year-over-year foundation.

Diabetes & Weight problems gross sales elevated 21% pushed by will increase in Ozempic and Rybelsus (GLP-1), Wegovy (weight problems), long-acting insulin, and fast-acting insulin, offset by decrease gross sales for premix insulin, Saxenda (weight problems), Victoza (GLP-1), and flat human insulin.

The Uncommon Illness phase gross sales rose 5% brought on by rising uncommon blood and endocrine problems medicine. The agency is increasing its blockbuster GLP-1 and weight problems medicine to different indications and dosing sizes.

The corporate lowered its outlook to 13 – 21% gross sales development and 16%- 24% working revenue development in 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on NVO (preview of web page 1 of three proven under):

Further Studying

The next Certain Dividend databases comprise probably the most dependable dividend growers in our funding universe:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].