In 2021 and 2022 we referred to as the Federal Reserve “tardy” on a number of events as they doggedly held to their “transitory” inflation stance lengthy after affordable individuals (utilizing the fitting indicators) would have given up on such a notion. In Might 2, 2022 we famous that that they had lastly began to maneuver; too late.

Just lately, Fed Governor Lael Brainard mentioned the Fed may begin lowering its steadiness sheet as quickly as Might at “a speedy tempo”.

A speedy tempo? Why that sounds a little bit determined. Nearly as if the large brains on the Fed had issued a collective “RUH ROH!!” as the ultimate vestiges of their “transitory inflation” fantasy had slipped away into the ether and all of sudden they realized one thing drastic needed to be completed.

The Fed’s steadiness sheet, you ask? Effectively, it’s not a fairly sight because the Fed of right this moment continues to cobble away at attempting to repair the grossest distortion up to now in its inflationary financial coverage. The 2008 spike, which appeared excessive on the time, is nothing in comparison with what went on in 2020.

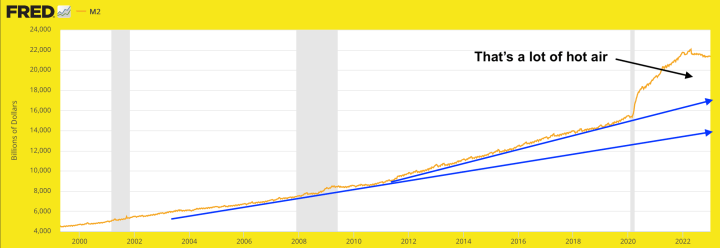

However it isn’t simply the steadiness sheet that was put in an excessive situation. The M2 mixture of cash provide additionally makes the earlier gross panic of 2008 appear like a little bit blip (it wasn’t). M2 was blown out of earlier developments and it’s a good wager that footage like these are what the desperately hawkish Fed has been attempting to handle since final spring.

There have to be penalties to one thing as vital (to a Keynesian financial system) as gross distortions born of extra and beforehand free license to inflate the system at each deflationary flip (e.g. This autumn, 2008 & Q1, 2020). It’s not magic in any case, a lot although the Fed has through the years tried to work it as such (efficiently till the present cycle).

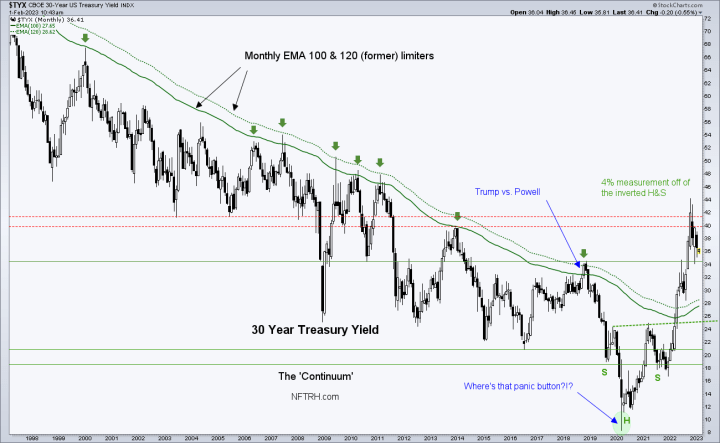

We knew one thing was very incorrect when the “Continuum”, AKA , AKA an NFTRH software used to measure the Fed’s capability to inflate the system at each flip towards a deflation scare because the Eighties, broke its a long time previous pattern of disinflationary signaling. Boy did it bust it, however good!

The bullish Inverted Head & Shoulders sample proven on the yield is the mirror of the bearish H&S that confirmed up on the lengthy bond. A hysterical bond bear market spiked yields up and thru the beforehand limiting transferring averages and nicely Dorothy, we’re not in Kansas anymore.

Right here on Fed day I’m not going to enter the main points of what all of it could imply. There are too many particulars and chances, which will probably be left for NFTRH and its ahead methods to interpret.

What I wished as an instance above, as a panel of eggheads readies its “resolution”, is that the macro we knew for many years isn’t the macro forward… and the Fed is aware of it. So in case you are considering logically and in linear vogue per the previous couple of a long time you would possibly wish to hit refresh on that. The above are stark footage of 1 factor (right this moment’s macro) that’s not in any respect like the opposite factor (yesterday’s macro).