[ad_1]

The US Greenback was -3.32% down from 102.86 ultimately Thursday’s near 99.45 at yesterday’s settlement. That is how far the USD basket in opposition to six different majors (USDX) has fallen within the final 5 periods build up on some very optimistic information within the US, whereas on each the patron and producer costs aspect information have been falling steadily and quickly in addition to on the labour market aspect.

It was primarily the sell-offs in opposition to the Japanese forex that originally caught the attention because of the USDJPY‘s fast descent from 145 to the present 138.05 (-4.8%) and the following breaking of varied helps together with the psychological one at 140; however the reality is that GBP, EUR and CHF (+3.34%, +3.39% and +4.40% respectively from 06/07 open) have additionally been advancing steadily in opposition to the Dollar for days now whereas different currencies such because the antipodeans and a few EMs have solely performed catch-up in latest days. Let’s check out a roundup of some of those latter ones, a few of that are much less below the radar.

USDZAR

The South African Rand has been weak for a very long time resulting from a tough nationwide financial image in a number of respects however has currently regained traction. This week there was one other clear break of the development at 18.28 and presently the value trades slightly below the MM200 at 17.97. Notice the energy of the earlier bearish leg that started in June. A continuation of the transfer ought to simply have room as much as 17.68 though a pause could be due proper now.

USDHUF

The Hungarian Florint is an EM forex (CEEMEA to be correct) that has been appreciating for a while (since October 2022) in opposition to the USD and has accelerated this course of once more within the final week (-6.03% because the 06/07 settlement worth). It’s inside a transparent long-term descending channel and appears to have additional room to fall, with the decrease finish of the channel passing close to 320 at current (334.30 worth). It’s buying and selling under its MM50 and MM200, each of that are negatively inclined. There’s long-term congestion within the 327 space. An attention-grabbing one to observe.

USDMXN

The Mexican Peso is one other rising forex with a long-standing optimistic development, because the cross reached a excessive close to 25.75 in April 2020. It presently stands at 16.89. Features since 06/07 have additionally been extra reasonable, -2.37%, resulting from this continued energy. On this weekly chart we see that it’s under the assist zone at 18.45 and, if it closes on the present worth, it might achieve this under an vital long-term trendline. The subsequent assist space is 16.32.

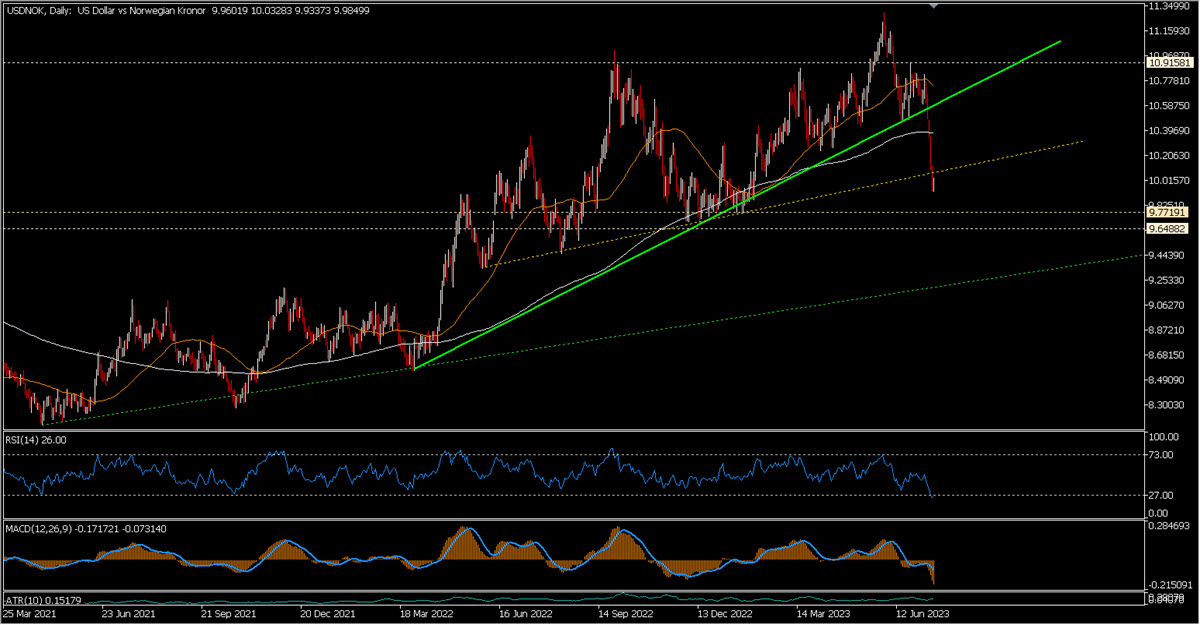

USDNOK

The motion of this cross was very robust and clear, which, additionally in mild of the Norwegian ”buying and selling combine”, may be very delicate to the value of oil, which has been rising in latest days. The break of the trendline at $10.57 was very clear and from there the motion accelerated downwards to the present $10.03 (-5.01%). The motion is now a bit stretched however a continuation might attain $9.77 first after which $9.65. One other attention-grabbing one to watch.

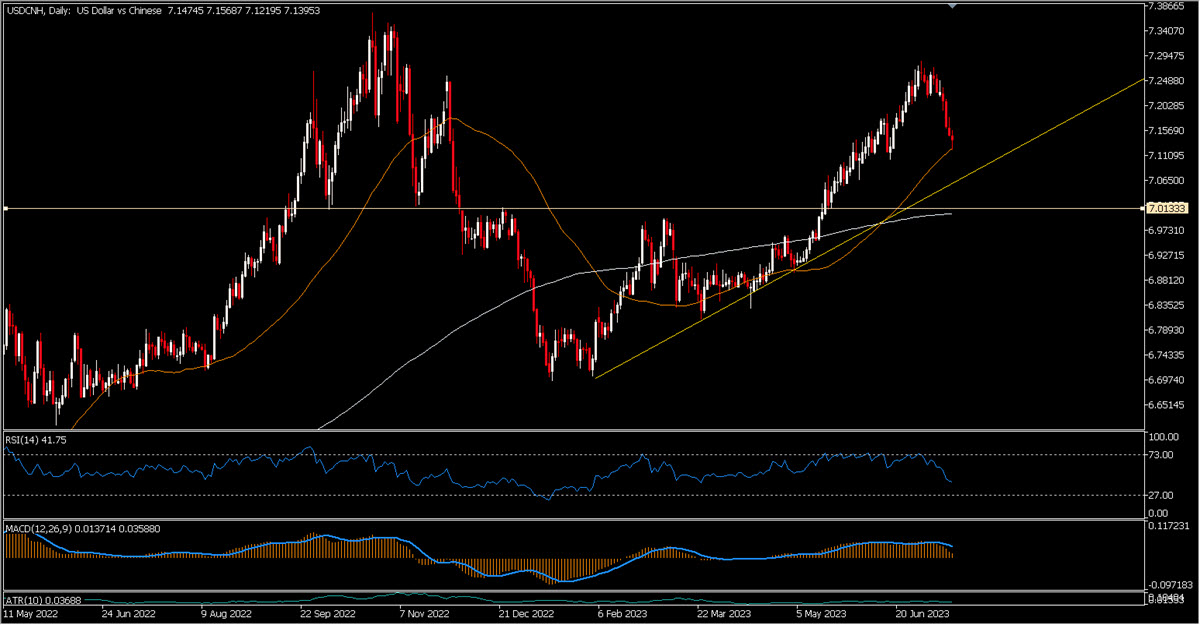

USDCNH

The all-important cross in opposition to the Chinese language Yuan has taken a breather after touching 7.28 and is presently at 7.1356 (-1.94%), sitting simply above the MM50. The mix of information from the US plus expectations of extra stimulus within the Asian nation might prolong the transfer all the way down to 7.06 -where the primary trendline passes whereas the MM200 is within the 7 space now.

USD Index

Following the CPI launch the USD Index has brutally damaged downwards by means of the 101.15-100.50 zone and is presently pausing barely and attempting to gradual its fall to 99.26. In case the motion – nonetheless stretched – continues downwards instantly there’s 98.75 to watch, 97.62 being the following actually vital stage. Firstly of 2021 the USDX was buying and selling within the 90 space. Amid all this, the FED’s hawk Bullard has resigned and can go away workplace in August.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a basic advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link